“Yuh Ready for Carnival?”

Commentary

Every January, when most countries are still shaking off the inertia of the holiday season, Trinidad and Tobago (T&T) quietly shifts into overdrive. The nights grow louder, anticipation thickens the air, and in every conversation, the question inevitably emerges: “Yuh ready for Carnival?” To many, it is simply a cultural reflex. To an economist, it is the first signal that one of the country’s most powerful, predictable annual economic cycles has begun.

Carnival is best known for its music, masquerade and freedom. Less visible is the organisation and economic activity that builds quietly behind the scenes. Long before the first fete, production ramps up across the economy. Costume houses move into full-scale manufacturing mode. Event promoters lock in calendars months ahead. Artistes and DJs enter their peak earning period, while supporting services including caterers, tailors, photographers, transport providers and security firms experience a sharp rise in demand. Hotels see bookings soar, airlines add capacity, and retailers benefit from higher foot traffic as visitors and locals alike prepare for the season.

In macroeconomic terms, Carnival functions as a seasonal stimulus. It activates labour, accelerates spending, boosts foreign exchange inflows, and temporarily lifts services output. The real issue is not whether Carnival matters economically, but how far its seasonal momentum carries into measurable gains across the wider economy.

Carnival 2024 Review

The clearest way to quantify Carnival’s macroeconomic relevance is through visitor arrivals and expenditure, a combined proxy for tourism exports in a small, open economy such as T&T. In simple terms, every arriving visitor represents growing external demand, converting cultural participation into foreign exchange inflows, domestic income generation, and higher services output.

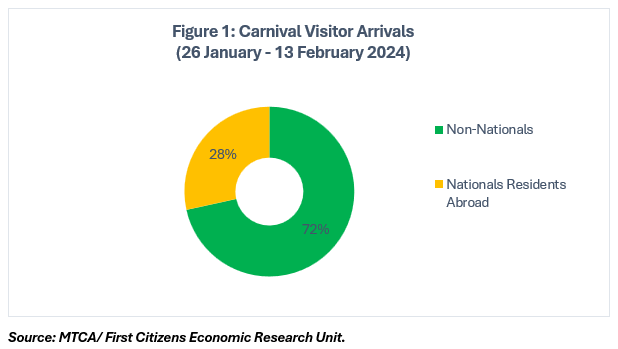

During the Carnival period in 2024, between 26 January and 13 February, the Ministry of Tourism, Culture and the Arts (MTCA) estimated that 41,444 visitors arrived by air (Figure 1). The majority of these were non-nationals (29,651), alongside a significant share of nationals resident abroad (11,793) emphasizing Carnival’s dual appeal as both an international tourism product and a powerful diaspora draw.

Spending data reinforce this impact. According to the Central Statistical Office (CSO), visitors stayed an average of 13 days and spent USD2,251/TTD15,313 per person, across accommodation, food, entertainment, transport, and related services. These patterns translated into an estimated USD93.3mn/TTD634mn in visitor expenditure over Carnival alone.

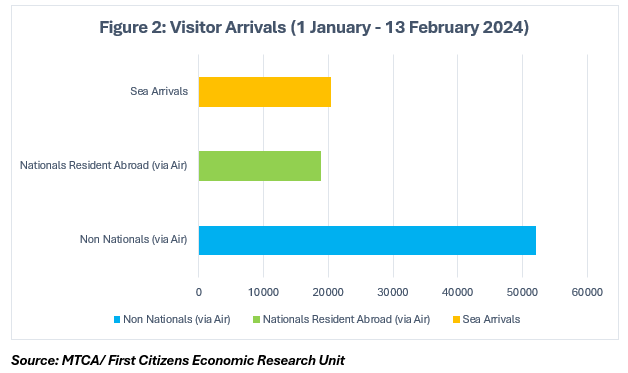

When the assessment window expands to include arrivals from 1 January, total air arrivals rise to 71,010 (Figure 2). Including cruise arrivals, total Carnival-related visitor expenditure in 2024 is conservatively estimated at USD94.2mn/TTD640mn.

Carnival 2025 Visitor Arrivals and Spending

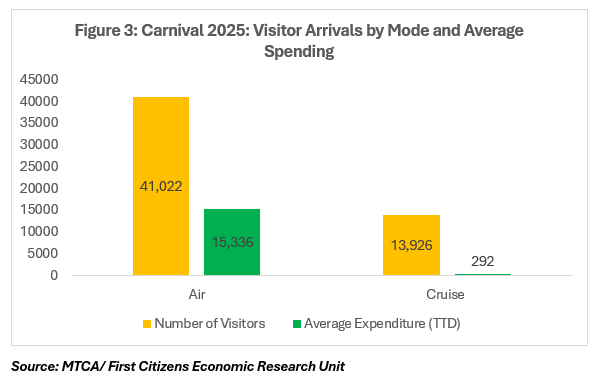

Preliminary indicators for Carnival 2025 suggest that this momentum has continued. Air arrivals were estimated at 41,022 (Figure 3), averaging over 2,100 arrivals/day, peaking the week before Carnival. The composition of arrivals remained broadly stable, with non-nationals accounting for the majority, while average expenditure per visitor edged slightly higher to an estimated USD2,306/TTD15,336. Cruise activity also expanded, with arrivals split between Port of Spain and Tobago estimated at 13,926, helping to widen the geographic distribution of Carnival-related spending. On this basis, total visitor expenditure for the 2025 Carnival season was estimated at around USD100.45mn/TTD668mn.

These trends confirm that Carnival generates a short but noticeable seasonal boost to services exports. Instead of a post-Christmas lull, Carnival adds to the T&T economy by injecting foreign exchange, lifting domestic demand and supporting activity across tourism, entertainment, transport and the creative economy. The consistency of arrivals and per-visitor spending suggests that Carnival’s economic contribution is a structural feature of T&T’s annual economic cadence.

Carnival and Services Receipts

The macroeconomic relevance of Carnival-related inflows becomes even clearer when viewed through the balance of payments, particularly the services account. According to the Central Bank of Trinidad and Tobago (CBTT), the term ‘services receipts’ captures exports of services to non-residents. In this framework, Carnival-related tourism spending is recorded directly as services exports, translating cultural participation into measurable external inflows that support the country’s foreign exchange position.

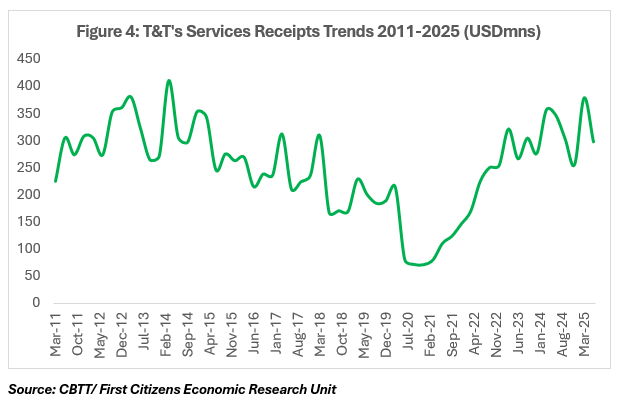

CBTT data reveal a clear and recurring seasonal pattern concentrated in the first quarter (Q1). Services receipts in T&T have tended to strengthen in Q1, coinciding closely with the Carnival period. In Q1 2024, services receipts amounted to USD355.5mn, rising further to USD377.6mn in Q1 2025. When placed against the historical profile of quarterly data, Q1 outturns are consistently stronger than surrounding quarters, pointing to a seasonal uplift in external services demand early in the year.

To place the seasonal uplift in context, Q1 services receipts also represent a meaningful share of T&T’s external earnings. In Q1 2025, services receipts of USD377.6mn accounted for approximately 14.1% of total exports (USD2686.7mn) for the quarter. While energy exports (USD2,252.8mn) remained dominant, services receipts represented a smaller but identifiable share of external earnings.

The economic significance of Carnival becomes even more apparent by its absence in the pandemic years. In 2021, when Carnival was cancelled entirely due to the COVID-19 pandemic, Q1 services receipts fell sharply to USD80.1mn, marking one of the weakest Q1 performances on record. In 2022, when festivities resumed in a drastically scaled-down format (“A Taste of Carnival”), constrained by public-health restrictions, services receipts recovered to USD169.8mn (Figure 4), but represented the weakest quarterly reading for that year.

These deviations are instructive. The absence of a full Carnival season coincided with a pronounced contraction in services exports, while the partial return of festivities generated only a partial recovery in receipts. By contrast, the restoration of full Carnival celebrations in 2024 and 2025 aligns with a return to materially stronger Q1 services inflows. The pattern reinforces a causal relationship between Carnival activity and external services performance.

This suggests that Carnival functions as a seasonal anchor for service exports, providing a predictable boost to foreign exchange inflows at a time when external demand would otherwise be moderating following the holiday season. While energy exports continue to dominate T&T’s balance of payments, the consistency of Carnival-related services receipts highlights the growing importance of non-energy foreign exchange sources in stabilising external flows.

Given the importance of Carnival to T&T’s service exports, the question moving forward is not whether Carnival matters for the balance of payments, but how effectively this recurring seasonal inflow can be leveraged to build more sustained services-export capacity throughout the year.

Leveraging Carnival as a Services Export Platform

The evidence confirms that Carnival already functions as a reliable services-export driver, generating foreign exchange inflows, supporting employment, and stabilising early-year economic activity. The challenge, therefore, is not to justify Carnival’s economic relevance, but to extend its value beyond a narrow seasonal window.

Recent commentary from the Trinidad and Tobago Coalition of Services Industries (TTCSI), reinforces this point. Carnival is estimated to support 15,000 temporary jobs across music, event production, costume design, catering, logistics, and related creative services, with activity concentrated within small and medium-sized enterprises. While informal and seasonal, this employment provides a meaningful income boost and demand impulse at the start of the year.

However, structural leakages limit the net foreign exchange impact. A significant share of costume inputs is imported, largely from China, reflecting cost pressures, labour shortages, and limited domestic manufacturing capacity. As a result, part of Carnival-related inflows is offset by higher imports, weakening value retention within the local economy. Skills attrition among artisans, SMEs capacity constraints, tight production timelines further restrict the scaling of local inputs use and the sustainability of output beyond the season.

From a policy perspective, Carnival expenditure should therefore be treated less as cultural spending and more as strategic investment in services capacity. Improved data collection on employment, earnings, and firm-level activity would improve measurement of economic returns, while targeted support for skills development, SME financing, and local supply-chain deepening could reduce import dependence and improve foreign exchange retention. Such measures would help transform Carnival from a seasonal boost into a more durable contributor to services-led growth and external stability.

Conclusion

Given the above, question is not about “if yuh ready for Carnival.” The T&T economy clearly is. Each year, Carnival lifts spending, draws in visitors, and puts thousands to work at a time when activity would otherwise be easing. It is organised, repeatable, and economically meaningful. What remains more difficult is sustaining that momentum throughout the year. Once the Carnival season ends, value leaks through imports, skills shortages, and capacity limits, and much of the economic energy dissipates. Carnival, in that sense, is not an exception but a demonstration of what the services economy can deliver when demand, creativity, and coordination align. If T&T can mobilise so effectively for a few weeks each year, then the challenge is not about making Carnival bigger, but making its lessons last. Turning a seasonal surge into steady services growth may be the difference between celebrating economic potential and capturing it sustainably.

DISCLAIMER

First Citizens Bank Limited (hereinafter “the Bank”) has prepared this report which is provided for informational purposes only and without any obligation, whether contractual or otherwise. The content of the report is subject to change without any prior notice. All opinions and estimates in the report constitute the author’s own judgment as at the date of the report. All information contained in the report that has been obtained or arrived at from sources which the Bank believes to be reliable in good faith but the Bank disclaims any warranty, express or implied, as to the accuracy, timeliness, completeness of the information given or the assessments made in the report and opinions expressed in the report may change without notice. The Bank disclaims any and all warranties, express or implied, including without limitation warranties of satisfactory quality and fitness for a particular purpose with respect to the information contained in the report. This report does not constitute nor is it intended as a solicitation, an offer, a recommendation to buy, hold, or sell any securities, products, service, investment, or a recommendation to participate in any particular trading scheme discussed herein. The securities discussed in this report may not be suitable to all investors, therefore Investors wishing to purchase any of the securities mentioned should consult an investment adviser. The information in this report is not intended, in part or in whole, as financial advice. The information in this report shall not be used as part of any prospectus, offering memorandum or other disclosure ascribable to any issuer of securities. The use of the information in this report for the purpose of or with the effect of incorporating any such information into any disclosure intended for any investor or potential investor is not authorized.

DISCLOSURE

We, First Citizens Bank Limited hereby state that (1) the views expressed in this Research report reflect our personal view about any or all of the subject securities or issuers referred to in this Research report, (2) we are a beneficial owner of securities of the issuer (3) no part of our compensation was, is or will be directly or indirectly related to the specific recommendations or views expressed in this Research report (4) we have acted as underwriter in the distribution of securities referred to in this Research report in the three years immediately preceding and (5) we do have a direct or indirect financial or other interest in the subject securities or issuers referred to in this Research report.