Understanding the U.S. Government Shutdown

Commentary

The Hidden Economic Toll of Repeated U.S. Government Shutdowns

On October 1, 2025, large parts of Washington effectively went dark. Agencies closed, workers were furloughed and what should have been a routine political standoff swiftly expanded into the longest shutdown in U.S. history. Its duration turned a domestic political dispute into a global market event, exposing that political risks can exist even in advanced economies, and demonstrating how fragile investor confidence becomes when critical government data is no longer available.

What is the U.S. Shut Down, How it happens?

A U.S. government shutdown occurs when Congress and the President cannot agree on the budget needed to fund government operations for the year. Without this agreement, federal agencies lose the authority to spend money to pay staff and deliver services. As a result, non-essential government work is put on hold until funding is approved. Essential services, such as national security, public safety, and emergency response continue, but activities like processing permits, loans, and some social programs are temporarily paused.

To emphasize, this is not just a routine dispute. When government funding runs out, the consequences ripple quickly through the real economy. Millions of federal workers may go unpaid, forcing families to cut spending or borrow money to cover basic expenses. The impact also reaches those who rely on government support programs, such as food assistance and health care aid, where delays in payments can leave vulnerable households struggling to afford essentials.

Businesses feel the strain as well, especially small and mid-sized firms. With federal agencies unable to process permits, loans, or contracts, companies can lose access to critical financing, face delays in operations, and in some cases, be forced to lay off workers. For example, when the Small Business Administration stops approving loans, billions of dollars in potential business activity can be put on hold.

The deeper risk is psychological – a prolonged shutdown undermines economic confidence, both at home and abroad. Investors begin pricing not only the lost output but also the political dysfunction behind it, raising the risk premium on U.S. assets. In a highly financialized economy where expectations drive valuations, a shutdown becomes more than a funding gap, it becomes a signal of uncertainty.

How it Impacts Investors

One of the most overlooked costs of a shutdown is its impact on investors. The repeated failures by the Congress to pass short-term funding means that key government agencies are unable to do their jobs. The Bureau of Labor Statistics (BLS) and parts of the Commerce Department, such as the Census Bureau and the Bureau of Economic Analysis, are unable to publish vital economic reports as scheduled during a U.S. government shutdown because their funding is suspended and most of their staff are legally required to stop working. Data collection and analysis activities are considered non-essential, therefore as the shutdown lingers on, surveys, data entry, and the preparation of official reports are put on pause.

Consequently, key economic statistics such as employment numbers, inflation data, and economic growth reports are halted because federal law prohibits government agencies from incurring new expenses during a lapse in appropriations. Without the staff to collect, process, and verify data, and without legal authority to operate normally, the agencies cannot update or publish their scheduled releases until funding is restored. This creates data gaps for policymakers, investors, and businesses, leaving critical decisions to be made without up-to-date official information.

A shutdown also creates costly uncertainty for individuals and small organizations. Even for individuals and small organizations, a government shutdown creates confusion and pushes up their costs. Contractors waiting for federal decisions, businesses applying for permits or grants, and families expecting routine approvals all end up stuck, with no certainty about when their issues will be resolved.

This uncertainty, sometimes called “information asymmetry”, forces everyone involved to be more cautious: businesses delay hiring, families put off big purchases and vital projects are shelved. Economists describe these shutdowns as “timing shocks” because they largely freeze activity that would have otherwise happened. When the government eventually reopens, much of the delayed work and spending does bounce back, especially once federal employees receive back pay and agencies restart operations.

Impact on U.S Stock markets and Volatility

In past shutdowns, equity markets usually adopted a cautious “wait and see” approach, with U.S stocks initially falling at the beginning of the shutdown and reversing once government operations resumed. Volatility, as measured by the CBOE Volatility Index (VIX), a barometer of market fear, also tends to pick up modestly at the beginning of the shutdown, peaks in the first few days after the shutdown begins and normalizes as negotiations progress and a resolution appears likely.

The 2018 shutdown, sparked by disagreements over border wall funding, lasted 35 days (December 22, 2018, to January 25, 2019) and was the longest shutdown on record until 2025 surpassed it. Similar to historical trends, just before and after the 2018-2019 shutdown began, the S&P 500 dropped sharply by about 16.45%. The decline was short-lived as the S&P 500 recovered by more than 10% as investors began to expect a more supportive stance from the Federal Reserve.

In the days leading up to the shutdown, the VIX Index jumped to 30.41, well above the 25 level often associated with rising stress. This surge captured the heightened uncertainty created by political conflict and the freeze in government operations. As progress was made with negotiations and the equity market rebounded, the VIX slipped back below 25, signalling that investors were becoming less fearful and more confident that the situation would be resolved.

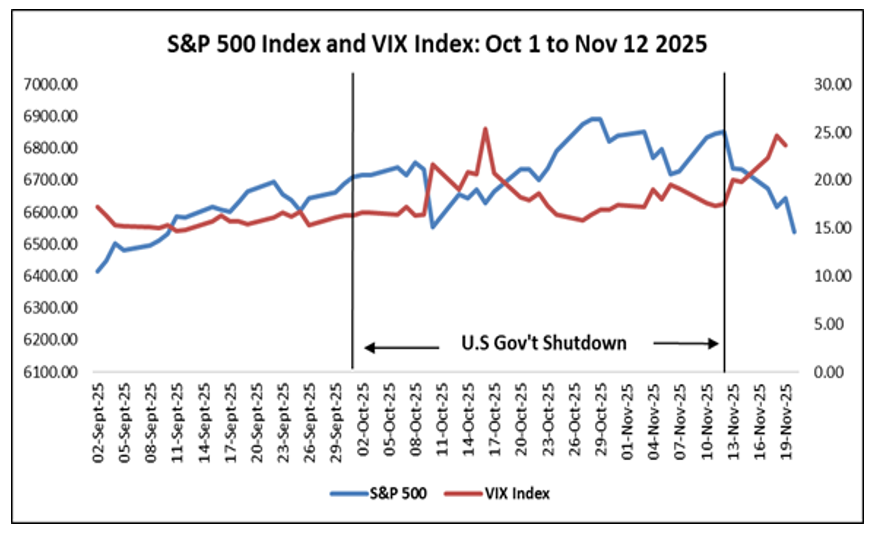

Compared with history, the 2025 shutdown has produced even milder equity moves and a more subdued volatility response than many prior episodes, despite being the longest on record. The S&P 500 index was rallying prior to the shutdown and reached several new highs as the event began. In the first days following the shutdown’s start, the S&P 500 dropped by roughly 3% in two days, reflecting short-term uncertainty. Through the shutdown, the S&P 500 rose only slightly, posting gains of around 5% up until November 12, 2025. Since then, the index has been on a sustained pullback.

During the shutdown, the VIX index spiked to a local high, which is a short-term peak, of 27.8 on October 16 2025, its highest level since April 2025, indicating a significant rise in investor anxiety and anticipation of market swings. It fell steadily thereafter to 15.79 at the end of October and remained below the market stress level.

Figure 1: S&P 500 & VIX Index: 2018-2019

Figure 2: S&P 500 & VIX Index: 2025

The Fed’s Dilemma and Why Guidance Mattered So Much

Central banks are responsible not only for controlling inflation but also for managing financial risks. For the Federal Reserve, the shutdown made that job harder by cutting off access to key economic data, such as inflation and employment figures. Without these regular reports, policymakers had to rely more on forecasts, alternative indicators, and judgment about how much of the slowdown was temporary. Investors, in turn, analyzed every statement from Fed officials closely, trying to understand whether the lack of data would delay any policy changes and whether the Fed viewed the shutdown as a short-term disruption or a meaningful drag on growth.

With fewer data points and greater reliance on speeches and guidance, clear communication became even more important. Even slight shifts in tone from the Fed had an outsized effect on bond yields and investor sentiment because there were no hard numbers to anchor expectations. This created a “guidance-driven” market environment, one that lasts until the regular flow of economic data resumes.

The Takeaway: Resilience Isn’t Invulnerability

The 2025 shutdown highlighted two key points. First, the U.S. economy and financial system remain highly resilient, markets did not unravel simply because funding stalled. But second, resilience is not the same as immunity. When the flow of reliable economic information is interrupted, uncertainty rises, risk-taking becomes more cautious, and decision-making becomes harder. Even if much of the lost activity eventually returns, the disruption itself carries real costs.

What ultimately matters is how long a shutdown lasts and the broader environment in which it occurs. A brief shutdown is barely felt; a prolonged one can shape economic sentiment and policy expectations. In late 2025, with high interest rates and global tensions already in play, the shutdown did not change the overall economic direction, but it did underscore how crucial effective governance is to market stability. For future U.S government shutdowns, investors should proceed carefully, relying on the data that is available, allowing for wider safety margins and avoiding hasty reactions in uncertain conditions.

DISCLAIMER

First Citizens Bank Limited (hereinafter “the Bank”) has prepared this report which is provided for informational purposes only and without any obligation, whether contractual or otherwise. The content of the report is subject to change without any prior notice. All opinions and estimates in the report constitute the author’s own judgment as at the date of the report. All information contained in the report that has been obtained or arrived at from sources which the Bank believes to be reliable in good faith but the Bank disclaims any warranty, express or implied, as to the accuracy, timeliness, completeness of the information given or the assessments made in the report and opinions expressed in the report may change without notice. The Bank disclaims any and all warranties, express or implied, including without limitation warranties of satisfactory quality and fitness for a particular purpose with respect to the information contained in the report. This report does not constitute nor is it intended as a solicitation, an offer, a recommendation to buy, hold, or sell any securities, products, service, investment, or a recommendation to participate in any particular trading scheme discussed herein. The securities discussed in this report may not be suitable to all investors, therefore Investors wishing to purchase any of the securities mentioned should consult an investment adviser. The information in this report is not intended, in part or in whole, as financial advice. The information in this report shall not be used as part of any prospectus, offering memorandum or other disclosure ascribable to any issuer of securities. The use of the information in this report for the purpose of or with the effect of incorporating any such information into any disclosure intended for any investor or potential investor is not authorized.

DISCLOSURE

We, First Citizens Bank Limited hereby state that (1) the views expressed in this Research report reflect our personal view about any or all of the subject securities or issuers referred to in this Research report, (2) we are a beneficial owner of securities of the issuer (3) no part of our compensation was, is or will be directly or indirectly related to the specific recommendations or views expressed in this Research report (4) we have acted as underwriter in the distribution of securities referred to in this Research report in the three years immediately preceding and (5) we do have a direct or indirect financial or other interest in the subject securities or issuers referred to in this Research report.