Establishment of a State-Sponsored REIT – What it means for local investors?

Commentary

In the 2026 National Budget presented on October 13, 2025, the government of Trinidad and Tobago revealed plans to establish a state-sponsored Real Estate Investment Trust (REIT). This initiative aims to unlock value from state-owned lands and properties by creating a publicly listed REIT, offering citizens a new avenue for investing in real estate and contributing to economic growth. This marks a significant step in diversifying the investment landscape, supporting the real estate market and unlocking new avenues of non-debt financing for the Government of Trinidad and Tobago.

What is a REIT? How do they work?

A Real Estate Investment Trust (REIT) is a company that owns, operates or finances income generating real estate. REITs allow investors to pool their funds to invest in a diversified portfolio of properties including office buildings, healthcare facilities, industrial properties and commercial infrastructure. Investors then buy shares in the REIT which represents partial ownership of all the properties held therein. They were designed to make investing in real estate more accessible to small investors who wish to diversify their portfolios. Shares of publicly traded REITs are listed on stock exchange providing liquidity and accessibility not commonly found in direct real estate investments.

REITs (Real Estate Investment Trusts) operate in a manner akin to mutual funds, in that they pool capital from numerous investors and manage the assets professionally. However, instead of investing in stocks or bonds, REITs provide investors with access to a diversified portfolio of income-producing real estate properties.

Types of REITS

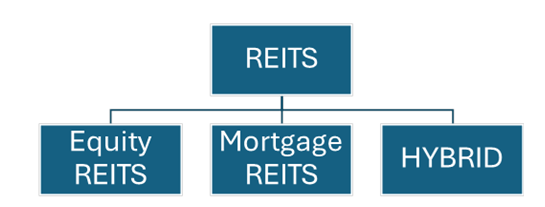

As illustrated in Figure 1, there are three main structures of REITs: Equity REITs, Mortgage REITs and Hybrid. Equity REITs are the most common type. They own and operate income-producing real estate, such as office buildings, apartments, shopping centres, warehouses or hotels. Their primary source of income is rental revenue from tenants and investors benefit from steady dividend income and potential capital appreciation as property values grow.

Mortgage REITs do not typically own physical properties. Instead, they invest in mortgages or mortgage-backed securities. Their income comes mainly from the interest earned on these loans or securities which is essentially the spread between the interest they earn on mortgage loans and the cost of funding these loans.

Hybrid REITs combine the strategies of both Equity REITs and Mortgage REITs. Like Equity REITS, they own real estate properties, however, they also invest in mortgages like Mortgage REITS. This structure allows investors to benefit both from rental income as well as interest income.

In the Caribbean, there are a small but growing number of Real Estate Investment Trusts (REITs) listed on Caribbean stock exchanges, primarily in Jamaica. In Jamaica there is the Carlton Savannah REIT which was incorporated in 2008 and was the first REIT to be officially listed on the Jamaica Stock Exchange (JSE). It’s investment strategy focused on acquiring and managing a diversified portfolio of commercial and luxury residential properties across multiple Caribbean jurisdictions. In 2009, the name was changed to Kingston Properties Limited (KPREIT).

Another REIT listed on the Jamaica Stock Exchange is Proven REIT, which serves as the real estate investment arm of PROVEN Group Limited—a leading Caribbean financial group originally established in St. Lucia. Proven REIT grows its portfolio by acquiring, developing, and managing a range of properties, including commercial offices and high-end residential developments. It generates income through rental earnings, property sales, and strategic partnerships. Its shares trade publicly under the name “PROVEN,” providing everyday investors with a straightforward way to participate in the company’s real estate growth and performance.

Benefits of REITS

REITs provide meaningful advantages to investors, particularly in terms of diversification and risk management. By investing in a broad mix of real estate assets, REITs help spread risk across different property types and locations. This enables investors to benefit from the stability of real estate without the concentrated exposure that comes from owning a single property. As a result, including REITs in an investment portfolio can help smooth overall returns, especially since real estate tends to move differently from stocks and bonds.

REITs typically provide regular income via dividends generated from the trust’s rental and lease income or net interest margin depending on its structure. Usually, REITS are required to distribute a significant portion of their earnings which can provide a measure of financial stability in uncertain economic periods.

Moreover, many REITs have the potential to increase their distributions over time, supported by rising property values, higher rental rates, and effectively managed portfolios. As a result, REITs not only offer steady income, but also the possibility of long-term income growth and capital appreciation, making them an attractive component in a diversified investment strategy.

Another important advantage is liquidity and ease of access. Unlike purchasing physical real estate—which can take months to buy or sell, publicly traded REITs can be traded on stock exchanges just like regular shares. This means investors can quickly increase, reduce, or exit their real estate exposure as market conditions or personal cash flow needs change.

Risks and Considerations

REITs also come with certain risks that investors should carefully consider. A major factor is their sensitivity to interest rates. REITs often use debt to finance property acquisitions and development, and as a consequence, an increase in interest rates raises their borrowing costs. Higher interest rates can lower REIT profitability and slow dividend growth because they increase the cost of borrowing, which is a key source of financing for acquiring and developing properties. As interest expenses rise, a larger share of the REIT’s cash flow must be used to service debt, leaving less available for earnings and dividend distributions. Additionally, higher rates can make new investments and expansions less attractive, slowing the growth of rental income over time.

Another important consideration is that REITs are closely tied to overall economic conditions. Their income depends heavily on tenants’ ability to pay rent and on maintaining strong occupancy levels across their properties. During periods of economic slowdown or recession, businesses may downsize or close, and households may reduce spending or relocate, which can lead to lower occupancy rates and downward pressure on rental prices. As rental income declines, the REIT’s cash flow and ability to sustain dividend payments can weaken.

In addition, falling demand for real estate can reduce property values, which may negatively affect a REIT’s share price and overall financial strength. In this way, REITs can be particularly vulnerable during downturns in the property cycle or broader economic stress, and investors should be mindful of how changing economic conditions may influence both income and capital value.

Overall Opinion

The renewed government-backed REIT initiative in 2026 offers promising possibilities. Investors can include government-owned real estate assets in their portfolios, establishing exposure to a broader, potentially more stable asset base.

As Trinidad and Tobago moves toward the proposed listing of a REIT in 2026, it will be important for investors to pay close attention to how the structure is designed and governed once more information becomes available. A supportive regulatory framework will be essential—particularly one that encourages participation from institutional investors, who can provide stability and depth to the market. The REIT should also be backed by strong disclosure practices and transparent, independent valuation standards to ensure confidence in how property values and performance are assessed. Additionally, prudent use of leverage and disciplined payout policies will be important to protect the REIT’s financial health while still providing reliable distributions to investors. Together, these elements will help to ensure that the REIT is built on a sound foundation, supports long-term investor confidence, and contributes meaningfully to the development of the local capital market.

A successful state-sponsored REIT could invigorate Trinidad and Tobago’s capital markets by providing a new, regulated investment vehicle, increasing market development and encouraging private sector REIT development. Monetizing state-owned real estate can fund public projects while offering citizens an accessible investment opportunity. This may also stimulate growth in the real estate sector through increased funding availability and improved asset management practices. Increased investor confidence may occur as state sponsorship and careful structuring address past concerns, boosting the confidence of retail and institutional investors.

DISCLAIMER

First Citizens Bank Limited (hereinafter “the Bank”) has prepared this report which is provided for informational purposes only and without any obligation, whether contractual or otherwise. The content of the report is subject to change without any prior notice. All opinions and estimates in the report constitute the author’s own judgment as at the date of the report. All information contained in the report that has been obtained or arrived at from sources which the Bank believes to be reliable in good faith but the Bank disclaims any warranty, express or implied, as to the accuracy, timeliness, completeness of the information given or the assessments made in the report and opinions expressed in the report may change without notice. The Bank disclaims any and all warranties, express or implied, including without limitation warranties of satisfactory quality and fitness for a particular purpose with respect to the information contained in the report. This report does not constitute nor is it intended as a solicitation, an offer, a recommendation to buy, hold, or sell any securities, products, service, investment, or a recommendation to participate in any particular trading scheme discussed herein. The securities discussed in this report may not be suitable to all investors, therefore Investors wishing to purchase any of the securities mentioned should consult an investment adviser. The information in this report is not intended, in part or in whole, as financial advice. The information in this report shall not be used as part of any prospectus, offering memorandum or other disclosure ascribable to any issuer of securities. The use of the information in this report for the purpose of or with the effect of incorporating any such information into any disclosure intended for any investor or potential investor is not authorized.

DISCLOSURE

We, First Citizens Bank Limited hereby state that (1) the views expressed in this Research report reflect our personal view about any or all of the subject securities or issuers referred to in this Research report, (2) we are a beneficial owner of securities of the issuer (3) no part of our compensation was, is or will be directly or indirectly related to the specific recommendations or views expressed in this Research report (4) we have acted as underwriter in the distribution of securities referred to in this Research report in the three years immediately preceding and (5) we do have a direct or indirect financial or other interest in the subject securities or issuers referred to in this Research report.