Avoiding the “January Debt Hangover”

Commentary

The holiday season in Trinidad and Tobago (T&T) and across the wider Caribbean is a treasured time, filled with joyful celebrations, vibrant cultural traditions, and the warmth of family gatherings. From the lively rhythms of parang and the exchange of thoughtful gifts, to reunions, indulgent Christmas feasts, and the excitement of Boxing Day sales, the season carries a spirit that is unmistakably Caribbean. Yet behind this festive charm lies a quieter, more challenging reality for many households: the “January Debt Hangover.” This describes the financial strain that emerges after weeks of heavy spending, often reflected in rising credit card balances, overdue loan payments, and tight budgets that make the start of the new year more stressful than celebratory.

Holiday Spending Habits

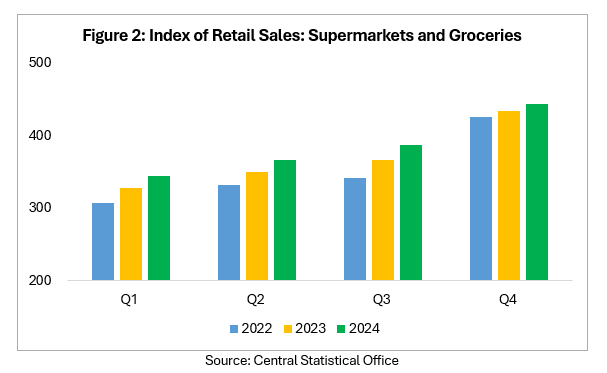

Christmas remains the single most important retail period in Trinidad and Tobago. Data from the Central Statistical Office (CSO) show that retail sales consistently peak in the fourth quarter as households increase spending on food, beverages and other discretionary items for the season. While these figures reflect cultural enthusiasm and economic momentum, they also reveal a troubling truth – much of this spending is impulsive, emotionally driven and financed through debt rather than planned savings.

Implementing Smart Budgeting Strategies for the Holidays

To break the cycle of holiday overspending, intentional planning and realistic spending strategies are essential. The most effective starting point is a well-defined budget. Individuals should estimate their December income, subtract the amount required for regular bills and savings, and use only the remaining balance for Christmas-related expenses. Under no circumstance should money from future months be used to finance December purchases.

Creating a detailed list with price caps for each category of spending also helps maintain control. By assigning limits to gifts, food, décor, and entertainment, shoppers can avoid the impulse purchases that typically lead to overspending. More affordable gifting options, such as group gifts, family gift exchanges, or offering meaningful experiences instead of costly items, can keep spending manageable without diminishing the spirit of the season.

Another crucial strategy for preserving financial stability is being mindful of how and when credit is used. While credit cards, hire-purchase agreements, and buy-now-pay-later plans can offer flexibility, especially during a season of increased social and family activities, uncontrolled use may lead to higher debt levels and financial strain in the new year. Individuals are therefore encouraged to monitor their spending closely, balance credit use with cash or debit payments, and avoid taking on unnecessary debt. Where additional credit is considered, seeking financial advice and clearly understanding repayment terms can help ensure borrowing remains manageable. If a credit card is used, it is wise to repay the full balance within 30 days to prevent interest charges from accumulating and lingering for months.

New Year Resolutions

To be financially prepared for Christmas 2026 and to enter the new year on solid footing, several practical steps can be taken. For individuals carrying a high debt burden, a key priority is to organise their debt by interest rate and focus on reducing the most expensive ones, typically credit card balances. Lump-sum inflows such as bonuses or backpay can be strategically applied to these high-cost debts to accelerate repayment. In addition, debt consolidation or refinancing options may be helpful, as they can lower interest rates, reduce monthly payments, and make debts easier to manage. Before taking this step, it is prudent to consult a financial advisor to ensure these solutions align with long-term financial goals.

Once the most expensive debt has been reduced to a manageable level, the same monthly payment amount can then be redirected into an automatic savings account or an investment vehicle such as a money market fund. The goal is to build an emergency fund—a dedicated pool of money reserved for unexpected events such as sudden medical expenses, urgent home or car repairs, or even an unplanned loss of income. This fund is not meant for everyday spending; rather, it acts as a financial safety net, reducing reliance on credit cards or the need to sell investments during stressful times. A prudent guideline is to build an emergency fund that covers three to six months of essential living expenses—housing, food, utilities, transportation, insurance, and minimum debt payments. Individuals with irregular income, dependents, or higher financial risks may benefit from aiming toward the upper end of this range, or even more.

After costly holiday debt has been eliminated and an adequate emergency reserve is in place, the next step is to begin systematic investing in assets that align with one’s risk tolerance and long-term objectives. Ideally, investments should be diversified across several asset classes and sectors to protect the portfolio from concentration risk. A balanced mix of stocks, mutual funds, and fixed-income securities can offer the potential for steady returns. Over time, the growth from this investment portfolio can be used to fund future Christmas spending—allowing the individual to enjoy the season without turning to debt.

Holidays symbolize warmth, generosity, music, and love. None of these require financial strain. With intentional planning, practical budgeting, and a better understanding of local spending habits during holidays, families can embrace the season fully while avoiding the weight of the January Debt Hangover. By shifting from tradition-driven spending to mindful financial choices, households can enjoy every moment of the holidays, and step into the new year with peace, confidence, and stable financial footing.

DISCLAIMER

First Citizens Bank Limited (hereinafter “the Bank”) has prepared this report which is provided for informational purposes only and without any obligation, whether contractual or otherwise. The content of the report is subject to change without any prior notice. All opinions and estimates in the report constitute the author’s own judgment as at the date of the report. All information contained in the report that has been obtained or arrived at from sources which the Bank believes to be reliable in good faith but the Bank disclaims any warranty, express or implied, as to the accuracy, timeliness, completeness of the information given or the assessments made in the report and opinions expressed in the report may change without notice. The Bank disclaims any and all warranties, express or implied, including without limitation warranties of satisfactory quality and fitness for a particular purpose with respect to the information contained in the report. This report does not constitute nor is it intended as a solicitation, an offer, a recommendation to buy, hold, or sell any securities, products, service, investment, or a recommendation to participate in any particular trading scheme discussed herein. The securities discussed in this report may not be suitable to all investors, therefore Investors wishing to purchase any of the securities mentioned should consult an investment adviser. The information in this report is not intended, in part or in whole, as financial advice. The information in this report shall not be used as part of any prospectus, offering memorandum or other disclosure ascribable to any issuer of securities. The use of the information in this report for the purpose of or with the effect of incorporating any such information into any disclosure intended for any investor or potential investor is not authorized.

DISCLOSURE

We, First Citizens Bank Limited hereby state that (1) the views expressed in this Research report reflect our personal view about any or all of the subject securities or issuers referred to in this Research report, (2) we are a beneficial owner of securities of the issuer (3) no part of our compensation was, is or will be directly or indirectly related to the specific recommendations or views expressed in this Research report (4) we have acted as underwriter in the distribution of securities referred to in this Research report in the three years immediately preceding and (5) we do have a direct or indirect financial or other interest in the subject securities or issuers referred to in this Research report.