Trump’s Tariff Card – Global Trade Outlook 2025

April 2025 has been one of the most volatile months since the COVID-19 pandemic, with United States (US) President Donald Trump announcing the most aggressive and far-reaching trade policy in the form of global tariffs on the 2 April 2025, when a 10% global tariff was imposed. In addition to this global tariff, 57 countries deemed as “worst offenders” were slapped with country-specific tariffs. Only a week later, Donald Trump made a complete U-turn in the policy, pausing the reciprocal tariffs for 90 days on all countries except for China, but keeping the 10% global tariff in effect. In the case of China, the trade war intensified for a short period of time with rapid increases in tariffs between both countries. The increase in tariffs forced negotiations between the US and China, who arrived to a trade deal on 12 May 2025. The trade deal will see a 90-day pause on tariffs imposed by both nations, with the US cutting their tariff against China to 30% from 145%; whereas China will cut its tariff against the US to 10% from 125%.

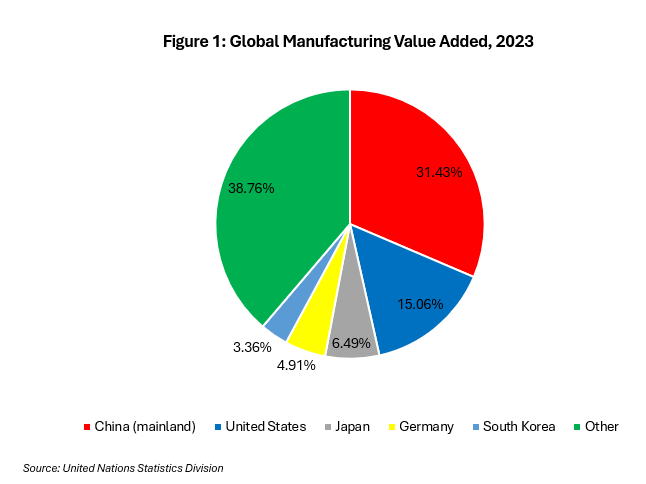

The US and China are the first and second largest economies respectively, in the world and there are growing fears of a resurgence in inflation, and a global recession. China and the US account for roughly 46% of global manufacturing value added, and roughly 44% of global economic value in 2023 according to United Nations Data. The combined size of both economies means that their domestic conditions tend to have ripple effects on the wider global economy.

What is a tariff and how does it work?

A tariff is defined by the World Trade Organization (WTO) as “a customs duty applied by a government on imported goods.” Tariffs are usually placed on goods which a government seeks to reduce consumption of, adding additional levies on the affected items. Tariffs are not only limited to imported goods; they can also be applied to exports, though they are not commonly used.

There are a number of reason why a government may choose to impose a tariff. These include, but are not limited to:

- To raise more revenue

- To protect local industries

- To provide locally produced goods at a price advantage

- To rebalance international trade, potentially reducing the size of a trade deficit

- As leverage by a government for negotiations

Regardless of the reason, the end result is expected to be the same – imported goods become less attractive to the final consumer when tariffs come into effect. Prices may increase, however, it depends on the pass-through effect of the tariff. The importer can choose to fully pass on the price increase as a result of a tariff to the final consumer, or some part of this increased cost. Conversely, affected exporters can also choose to adjust their prices to counteract the demand impact of a tariff.

An IMF study in 2019 titled “Tariff Passthrough at the Border and at the Store: Evidence from US Trade Policy” looked at how prices were affected given the US trade policy stance in 2018. The study found that the pass-through effect varied by product category, but importantly, the level of imports on tariffed good typically increased between the period of a tariff announcement and its implementation, limiting the immediate impact on prices, though long-term effects were as expected. A current example of this is seen in the US GDP growth for Q1’25. The US economy shrunk by 0.3% year-on-year in Q1’25 and was largely due to a 41.3% surge in imports in light of looming tariffs. This alone contributed negatively to the overall GDP figure by 5.03 percentage points. This surge in imports before the implementation of the tariffs will delay the resulting price increase and inflationary impact of the imposed tariffs, allowing for a more gradual rise in prices in the coming months.

A look at US Trade

Consideration to the US trade balance may have dictated the somewhat drastic approach regarding trade policies and may have ultimately informed the initial reciprocal tariffs. In determining the initial reciprocal tariff, the US considered the size of their trade deficit with a specific country, relative to the amount of imports the US has from that country.

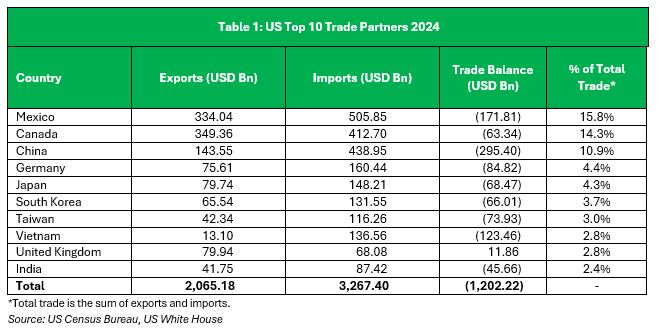

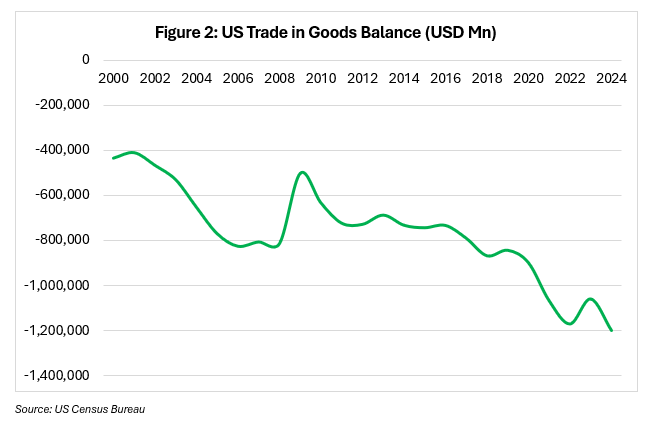

Table 1 below shows the top 10 trade partners of the US.

Of the 203 countries the US conducted trade with in 2024, goods trade deficits were recorded with 92 countries, while surpluses were recorded with 111 countries. Despite the surpluses recorded, the deficits far outweighed them.

The US goods trade deficit has almost consistently widened since the financial crisis of 2008, reaching a record deficit level of USD1.2 trillion in 2024 after widening by 13.2% year-on-year.

The drastic measures being considered have become a necessity for the US to renegotiate terms of trade, strong-arm a push for domestic manufacturing, and limit non-critical imports. While the implementation reciprocal tariffs have been paused for 90 days, and is currently set to be re-implemented in July, there is no guarantee that diplomacy and negotiations will prevail. This was the case for both Mexico and Canada which currently face a 25% tariff following an implementation pause to negotiate terms.

How will tariffs impact global trade and the wider economy?

Unsurprisingly, the global 10% tariff is expected to adversely affect global trade. Many international organizations have attempted to forecast the impact, however, the extreme volatility since its announcement has made a clear outcome difficult to ascertain.

In their April 2024 update, the World Trade Organization estimates that Global trade for 2025 is expected to contract by 0.2%, compared to 3% growth that was previously forecasted in October 2024, a downward revision of 3.2 percentage points (pp). The regions that will be most affected by the Tariffs include North America, Asia, South America (which includes Central America and the Caribbean), and Europe.

The IMF in their World Economic Outlook update for April 2025 also considered the effect of the initial round of global and reciprocal tariffs on economic growth. The IMF presents a more optimistic outlook for global trade in light the tariff restrictions, with expected growth of 1.7%, a downward revision from the January 2025 global trade growth forecast of 3.2%.

Global growth is expected to be 2.8% for 2025, and 3% for 2026 – a slowdown from 3.3% previously forecasted for both years in January 2025. Both Advanced and emerging market economies have seen similar downward revisions in their growth forecasts. Advanced economies will grow by 1.4% in 2025 and 1.5% in 2026, slowdowns of 0.5pp and 0.3pp respectively. Emerging market economies will grow by 3.7% in 2025, and 3.9% in 2026, slowdowns of 0.5pp and 0.4pp respectively.

Global inflation expectations are now seen to exceed the target ranges of central banks in most countries given the upward pressures being placed. Global inflation is expected to average 4.5% for 2025, and 3.6% for 2026, up 0.3pp and 0.1pp respectively from the January 2025 forecasts.

The TT – US Trade Landscape

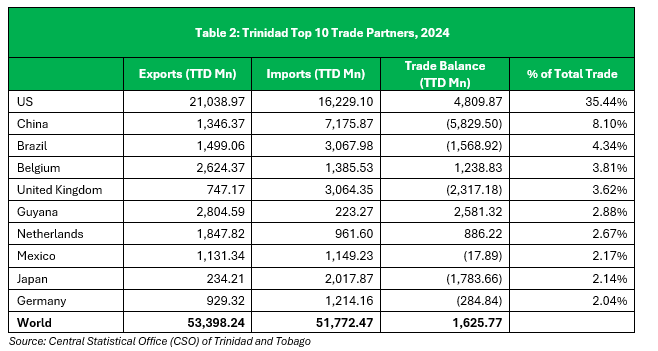

Trinidad and Tobago only faces the 10% blanket tariff imposed on all countries. The latest data from the Central Statistical Office (CSO) of Trinidad and Tobago indicates that for 2024, the US accounted for 35.44% of total trade for T&T – 39.4% of total exports, and 31.3% of total imports. Total trade from the US is more than the combined total trade amounts of the other top trade partners of T&T.

Table 2 shows the top 10 trade partners for T&T.

The tariffs imposed by the US are expected to have an impact on roughly 53% of T&T’s total exports to the US (TTD11,150.65 million of 2024 exports), with the other 47% (TTD9,888.31 million of 2024 exports) being exempted according to the Ministry of Trade and Industry.

The Central Bank of Trinidad and Tobago (CBTT) notes that in the short term, the impact of the tariff may be limited, but the long-term will have a certain level of uncertainty and depends on a number of factors including consumer demand, and trade agreements with the US. Nevertheless, the resulting global impact of tariffs may also affect international trade and inflation in T&T.

The T&T economy is expected to see limited growth as a result of expected increases in energy production being offset by a challenging global economy and tariffs that are likely to impact exports and tourism. Business Monitor International (BMI) forecasts that GDP growth with remain somewhat constrained at 1.3% for 2025, an acceleration from 1% in 2024. The current account, while forecasted to remain at a surplus of 7.8% of GDP for 2025, will narrow from an estimated 8.5% in 2024 as a result of exports shrinking (3.4%) at a faster rate than imports (0.6%).

For consumers, the most visible effect of Trump’s tariffs will be increased prices, and a resurgence in inflation. Forecasts by the IMF sees inflation increasing to 2.2% by the end of 2025, significantly higher than the 0.5% recorded at the end of 2024. This adds further pressures to consumers in T&T, who have already faced cumulative inflation of 14.7% since the pandemic (March 2020 – March 2025), with food prices having increased by 30.7% within the same period.

Conclusion

The global tariff implemented by Donald Trump, and the resulting trade war that has been sparked with China will undoubtedly have far reaching implications on the global economy, slowing international trade and GDP growth, as well as straining long-standing alliances. Over the coming weeks, many nations will continue to engage in negotiations with the US to avoid further tariffs, however, there is no guarantee that these negotiations will be successful.

Trinidad and Tobago, like many other nations, have been caught in the crossfire of the global tariff placed on almost all imports into the US. T&T’s dependence on imports, coupled with the ongoing foreign exchange shortage can temporarily result in a resurgence in inflation. Further, weaker export potential may constrain economic growth and external accounts.

DISCLAIMER

First Citizens Bank Limited (hereinafter “the Bank”) has prepared this report which is provided for informational purposes only and without any obligation, whether contractual or otherwise. The content of the report is subject to change without any prior notice. All opinions and estimates in the report constitute the author’s own judgment as at the date of the report. All information contained in the report that has been obtained or arrived at from sources which the Bank believes to be reliable in good faith but the Bank disclaims any warranty, express or implied, as to the accuracy, timeliness, completeness of the information given or the assessments made in the report and opinions expressed in the report may change without notice. The Bank disclaims any and all warranties, express or implied, including without limitation warranties of satisfactory quality and fitness for a particular purpose with respect to the information contained in the report. This report does not constitute nor is it intended as a solicitation, an offer, a recommendation to buy, hold, or sell any securities, products, service, investment or a recommendation to participate in any particular trading scheme discussed herein. The securities discussed in this report may not be suitable to all investors, therefore Investors wishing to purchase any of the securities mentioned should consult an investment adviser. The information in this report is not intended, in part or in whole, as financial advice. The information in this report shall not be used as part of any prospectus, offering memorandum or other disclosure ascribable to any issuer of securities. The use of the information in this report for the purpose of or with the effect of incorporating any such information into any disclosure intended for any investor or potential investor is not authorized.

DISCLOSURE

We, First Citizens Bank Limited hereby state that (1) the views expressed in this Research report reflect our personal view about any or all of the subject securities or issuers referred to in this Research report, (2) we are a beneficial owner of securities of the issuer (3) no part of our compensation was, is or will be directly or indirectly related to the specific recommendations or views expressed in this Research report (4) we have acted as underwriter in the distribution of securities referred to in this Research report in the three years immediately preceding and (5) we do have a direct or indirect financial or other interest in the subject securities or issuers referred to in this Research report.