Trinidad and Tobago’s Economic Road Ahead

Commentary

The new fiscal year (FY) has begun for Trinidad and Tobago (T&T) and the budget for fiscal 2025/2026 is pivotal in laying the foundation for economic policy and priorities in the upcoming 12-month period, at least. T&T’s economic cycle continues to be largely dictated by shifts in the global energy market given its heavy dependence on the energy sector. Though the contribution of the energy sector to GDP has declined in recent years, it remains the main export earner for T&T and a major contributor to government revenue. The challenges experienced in the energy sector have manifested in the weakened economic growth for T&T, widening government imbalances as well as external account pressure. Encouragingly, in the post-pandemic years the non-energy sector was able to support the overall economy even as the energy sector recorded persistent declines. As we face a new FY, there are many challenges which must be addressed to achieve the longer-term goal of sustainable economic diversification – an ambitious and arguably elusive goal.

Economic Growth Trends…

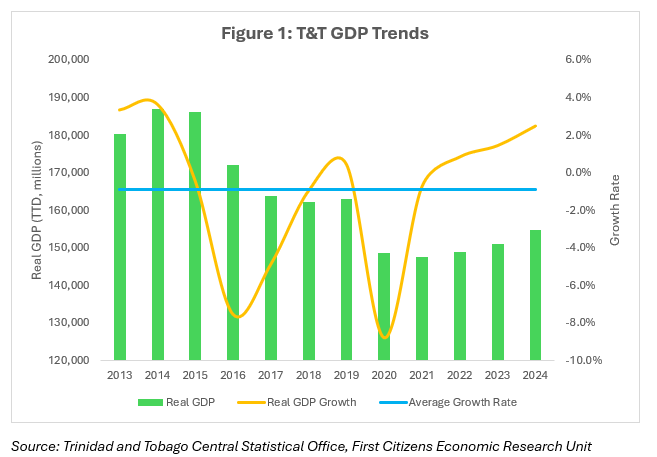

Since 2012, T&T’s economy has shrunk, as evidenced by GDP at purchasers’ prices. The size of T&T’s economy contracted by just under 12% as at the end of 2024 relative to 2012. Simultaneously, annual economic growth has averaged -0.9%, with a pickup only occurring in the post-pandemic period, when the economy recorded positive economic growth for three consecutive years during 2022-2024. The main impetus for this expansion was the non-energy sector, as energy sector output remained relatively weak. During this period, the mining and quarrying sector recorded an average contraction of 2.3%, while manufacturing was able to grow by an average of 2.6%, notwithstanding a 1.9% contraction in the manufacture of petroleum and chemical products.

More recent data, however, shows a reversal of the positive trend. The Central Statistical Office of Trinidad and Tobago (CSO) reported that real GDP growth came in at -2.1% year on year (YoY) in the first quarter of 2025 (the most updated data available). On a quarter on quarter (QoQ) basis, the contraction was more pronounced at -7.6%. The Q1 2025 performance reversed the positive performance of the previous two quarters when the economy grew consecutively. The performance was driven by a 6.4% YoY decline in mining and quarrying activity and a 2.5% contraction in the manufacture of petroleum and chemical products, most notably, in the subsectors of natural gas exploration and extraction (-12.9%), petroleum support services (-16.4%), refining (-4.6%) and petrochemicals (-3.6%). Manufacturing activity (excluding manufacture of petroleum and chemical products), construction and accommodation and food services boosted the non-energy sector, but most other sectors continued to face challenges. During Q125, the ‘trade and repairs’ component of GDP contracted by 6.5%, and weighed heavily on overall GDP, as it accounted for an average of 23.3% of GDP over the past five years.

Measures must be put in place to ensure that the recent growth momentum in the non-energy sector is sustained, especially given the bearish outlook for global energy prices in the short-to-medium term. WTI oil price is forecasted to average around USD48.50 per barrel by the end of 2026, according to projections from the US Energy Information Administration’s Short Term Energy Outlook (October 2025) as oil inventories increase with production increases expected to continue by OPEC+.

Slippery Fiscal Slope

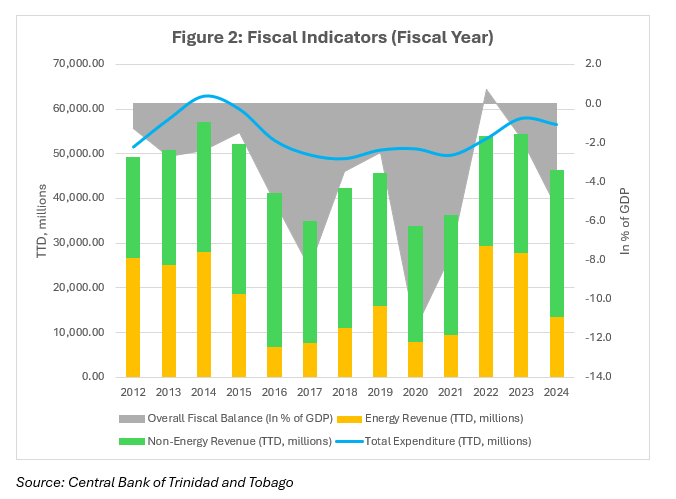

Prior to 2022, the last time T&T recorded an overall fiscal surplus was in FY2010, which was around the same time WTI oil prices averaged almost USD100 per barrel. In 2022, oil prices again rose sharply due to external factors, including Russia’s invasion of Ukraine, as well as other geopolitical developments, causing heightened concerns about supply shocks, which caused significant volatility in the global energy markets. This resulted in substantially higher energy revenues in FY 2022, which rose by 214% (YoY). Since then however, energy revenue has been declining– falling from TTD29.3 billion in FY 2022, to TTD13.4 billion in FY 2024, at the same time, non-energy revenue has increased from TTD24.6 billion to TTD33 billion.

Government expenditure also increased over the past few years, after a notable shrinkage of around 22% during the period 2014 – 2018. Since 2022, total expenditure has increased by around 6%, with a 4.6% increase witnessed in recurrent expenditure during the period. In FY 2024, the wage bill notably increased to above TTD10 billion for the first time since FY 2015.

As a result, the fiscal balance moved from a surplus of 0.7% of GDP in FY 2022, to a deficit of 5.3% of GDP by the end of FY 2024. The persistent fiscal deficit has resulted in an increase in the country’s debt, which rose to TTD148 billion by the end of June 2025, from around TTD137.8 billion in FY 2022. Accordingly, the debt to GDP ratio has increased from 74.7% to 85% during the period.

External Accounts Highlights Energy Dependence

Energy exports accounted for an average of 81% of total export earnings during the period 2011 – March 2025 and is clearly the major foreign exchange earner for the country. Though the current account continues to post surpluses, the overall balance of payment has remained in a deficit position with a brief reprieve in 2020 when a surplus of USD24.8 million was recorded. At the end of 2024, the balance of payments recorded a deficit of USD653.6 million or 2.5% of GDP. For the first quarter of 2025, the overall balance is estimated to have widened further to 5.1% of GDP, even as the current account balance is estimated to have improved to 7.5% of GDP from 4.8% of GDP at the end of 2024, highlighting persistent outflows from the capital and financial account. Consequently, the country’s foreign exchange reserves continue to be eroded. Since peaking at around USD11.5 billion at the end of 2014, net official reserves have fallen by 60% to their current level of USD4.6 billion, equivalent to just around 5.4 months of import cover at the end of August 2025.

Looking Ahead…

T&T is facing several challenges which must be addressed to achieve sustainable economic growth and development in the long term. The structural decline in the size of the economy can negatively impact economic activity which may erode tax revenues, and lead to possible higher unemployment and lower disposable income levels. Further, building on the growth momentum of the non-energy sector will support the productive capacity of the country as well as help to diversify away from the volatile energy sector. Creating an enabling operating environment will assist in this regard, but the non-energy sector faces challenges such as access to foreign exchange and the uncertainty associated with trade policies globally which can affect domestic exporters’ competitiveness.

T&T is facing several challenges which must be addressed to achieve sustainable economic growth and development in the long term. The structural decline in the size of the economy can negatively impact economic activity which may erode tax revenues, and lead to possible higher unemployment and lower disposable income levels. Further, building on the growth momentum of the non-energy sector will support the productive capacity of the country as well as help to diversify away from the volatile energy sector. Creating an enabling operating environment will assist in this regard, but the non-energy sector faces challenges such as access to foreign exchange and the uncertainty associated with trade policies globally which can affect domestic exporters’ competitiveness.

S&P projects that the fiscal account will post persistent deficits through to 2028, averaging around 3.2% of GDP. The erosion of fiscal flexibility reduces the government’s ability to respond to shocks. Many countries globally, and several in the Caribbean have adopted fiscal rules and frameworks to help address mounting fiscal challenges. These rules dictate specific targets/ limits in terms of spending, deficits, or debt (IMF, 2025) to promote fiscal discipline. It is important for authorities to balance and prioritize spending needs with fiscal discipline in order to sustainably reduce the disequilibrium on the fiscal account as well as the increasing debt trend.

While these economic realities are not new, bold and novel strategies are certainly necessary to propel the T&T economy out of the current doldrums, and into its next stage of development, even if it means, one small step at a time.

DISCLAIMER

First Citizens Bank Limited (hereinafter “the Bank”) has prepared this report which is provided for informational purposes only and without any obligation, whether contractual or otherwise. The content of the report is subject to change without any prior notice. All opinions and estimates in the report constitute the author’s own judgment as at the date of the report. All information contained in the report that has been obtained or arrived at from sources which the Bank believes to be reliable in good faith but the Bank disclaims any warranty, express or implied, as to the accuracy, timeliness, completeness of the information given or the assessments made in the report and opinions expressed in the report may change without notice. The Bank disclaims any and all warranties, express or implied, including without limitation warranties of satisfactory quality and fitness for a particular purpose with respect to the information contained in the report. This report does not constitute nor is it intended as a solicitation, an offer, a recommendation to buy, hold, or sell any securities, products, service, investment or a recommendation to participate in any particular trading scheme discussed herein. The securities discussed in this report may not be suitable to all investors, therefore Investors wishing to purchase any of the securities mentioned should consult an investment adviser. The information in this report is not intended, in part or in whole, as financial advice. The information in this report shall not be used as part of any prospectus, offering memorandum or other disclosure ascribable to any issuer of securities. The use of the information in this report for the purpose of or with the effect of incorporating any such information into any disclosure intended for any investor or potential investor is not authorized.

DISCLOSURE

We, First Citizens Bank Limited hereby state that (1) the views expressed in this Research report reflect our personal view about any or all of the subject securities or issuers referred to in this Research report, (2) we are a beneficial owner of securities of the issuer (3) no part of our compensation was, is or will be directly or indirectly related to the specific recommendations or views expressed in this Research report (4) we have acted as underwriter in the distribution of securities referred to in this Research report in the three years immediately preceding and (5) we do have a direct or indirect financial or other interest in the subject securities or issuers referred to in this Research report.