Navigating Generational Investing in Trinidad & Tobago

Commentary

Across Trinidad & Tobago (T&T), each generation faces a distinct financial landscape, shaped by the interplay of historical events, economic cycles and evolving social realities. From Baby Boomers entering retirement to Generation Z just stepping into adulthood, the ways in which individuals earn, save, and invest are profoundly influenced by both their life stage and the broader economic environment. Understanding these generational differences is crucial, not only for appreciating the unique challenges and opportunities each cohort encounters, but also for crafting investment strategies that align with their goals, risk tolerance and time horizons.

Baby Boomers: The Conservative Savers

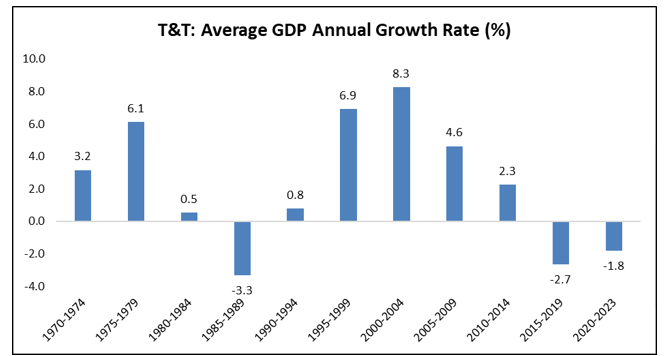

The Baby Boomer generation, those born between 1946 and 1964, is now firmly in the midst of retirement, with its youngest members turning 60 this year. Over the decades, they have witnessed and endured multiple economic and market cycles: the post-independence prosperity of the 1970s, the fervor of the real estate boom, and the harsh economic collapse that gripped Trinidad & Tobago in the 1980s. Shaped by these experiences, Boomers tend to be prudent and risk-averse investors, placing the highest priority on capital preservation and the generation of steady, reliable income.

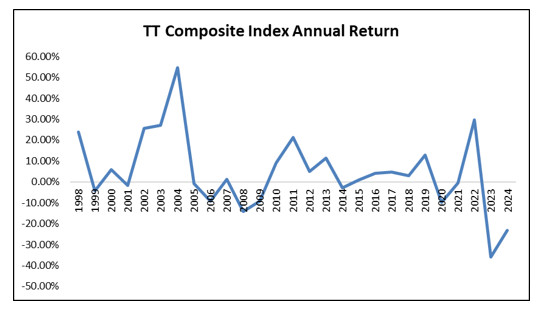

Yet, the economic and capital market environment in Trinidad & Tobago has shifted dramatically since their earlier years. In recent times, the nation’s economy has been marked by sluggish, almost stagnant growth, even as the cost of living has climbed persistently. The robust double-digit gains of the local stock market in the 2000s now seem a distant memory; since 2023, the market has recorded consecutive annual declines. Consequently, many Boomers find their pension and retirement savings under increasing strain.

In an era of muted growth, the prospect of enhanced government support, whether through expanded social assistance or increased national pension payments, appears limited. Compounding the challenge, elevated living costs threaten to outpace the fixed income many retirees rely upon from pensions, savings and grants. Subdued or even negative investment returns could further erode their financial security.

Against this backdrop, Boomers would be well advised to adopt a carefully diversified investment strategy, spreading their assets across multiple classes and sectors to mitigate risk and build resilience against economic headwinds. Given their naturally lower risk tolerance at this stage of life, a prudent course would be to reduce exposure to volatile assets and place greater emphasis on income-generating funds that offer competitive returns alongside ready access to capital. For retirees, stability and liquidity are not mere preferences, they are essential safeguards for financial well-being.

Figure 1: T&T GDP

Generation X: The Pragmatic Investors

Generation X, born between 1965 and 1980, now stands at a pivotal stage of life. The youngest members are in their mid-40s, while the eldest edge toward their 60s, with retirement no longer a distant thought but a looming reality. This generation was forged in the economic turbulence of the 1980s, matured in the comparative calm of the 1990s and navigated the exuberant boom years of the 2000s. However, they were tested by the global financial crisis, the decline of oil and gas fortunes, and most recently, the profound economic and social disruptions unleashed by the COVID-19 pandemic.

Many Gen Xers find themselves at the pinnacle of their professional careers, yet their status as the “sandwich generation” brings its own complexity. They are called to support aging parents while simultaneously nurturing children, often incurring considerable expense to finance tertiary education whether overseas or domestically. In T&T, the cost of tertiary education rose following the shift from full Government Assistance for Tuition Expenses (GATE) funding to a means-tested, partially funded system.

Despite being in their peak earning years, Gen Xers in T&T face mounting pressures. The rising cost of living continues to outpace wage growth, eroding purchasing power and limiting savings capacity. Meanwhile, the domestic equity market, once a reliable source of capital appreciation during the early 2000s, has in recent years struggled to deliver substantive returns.

For Generation X, the central challenge lies in striking a deliberate balance between meeting today’s financial obligations and securing tomorrow’s stability. With retirement drawing steadily closer, roughly within the next 10 to 20 years, disciplined saving and prudent investing are imperative. At this stage, Gen Xers stand to benefit from a balanced portfolio approach, blending assets that deliver growth with those that provide stability. This could mean combining traditional instruments such as bonds and blue-chip equities with measured exposure to newer opportunities, including select emerging market funds or a modest allocation to higher-risk, higher-reward assets.

Figure 2: T&T Stock Market Returns

Source: Trinidad and Tobago Stock Exchange

As the retirement horizon shortens, a proactive and regular review of one’s investment portfolio becomes essential. Strategic rebalancing toward more stable, lower-volatility instruments can help safeguard accumulated wealth, while ensuring the portfolio remains aligned with evolving family needs, long-term objectives, and shifting risk tolerance. Equally important is the focus on reducing outstanding debt and optimizing cash flow, so that financial flexibility is preserved.

Millennials: The Cautiously Curious Generation

Millennials, born between 1981 and 1996, are now in the prime of their working years, ranging from their late 20s to early 40s. Many are establishing themselves in their careers, purchasing homes, and raising young families, while others are still focused on building financial stability. This generation came of age during the rapid technological transformation of the early 2000s, entered the workforce amid the aftershocks of the global financial crisis, and in more recent years, has had to contend with the economic disruption caused by the COVID-19 pandemic and its lingering effects on the local economy.

While Millennials possess a high degree of adaptability and digital fluency, they face unique financial headwinds in T&T. Wage growth has often lagged behind the rising cost of living, making wealth accumulation more challenging. The partial rollback of the GATE programme has made tertiary education an increasingly personal expense, contributing to heavier student debt burdens. Meanwhile, the local equity market has struggled to offer steady returns, and employment security in certain sectors remains unsettled amid shifts in the global energy market and evolving economic realities.

With real estate prices soaring ever higher, the dream of homeownership, once considered an essential milestone of adulthood, is an elusive and sometimes unattainable aspiration. Unlike generations past, for whom property was often the first significant acquisition, today’s Millennials are frequently delaying this step. Instead, many are choosing to rent for longer periods, a choice that affords them reduced upfront costs and greater freedom of movement. This mobility enables them to channel surplus cash flow into robust investment portfolios, prioritizing capital accumulation in liquid, income-generating, or growth-oriented assets before assuming the burden of a mortgage.

Time is a distinct advantage for Millennials in building long-term wealth. With decades before retirement, they can afford greater exposure to growth-oriented assets such as equities, both locally and internationally, as well as exchange traded funds (ETFs) and select alternative investments. The boundless reach of the internet has dramatically expanded their financial universe, granting access to global markets and enabling prudent diversification. International investments, in particular, play a key role in mitigating risk, reducing overreliance on the narrow confines of the domestic market. As their careers mature and responsibilities evolve, it is wise for Millennials to gradually temper aggressive growth strategies, steering their portfolios toward a more balanced and resilient configuration, ensuring enduring security and prosperity for the future.

Generation Z: The Digital-Native Investors

Generation Z—broadly defined as those born between 1997 and 2012, is entering adulthood in a world of rapid change and uncertainty. The oldest members, now in their early to mid-20s, are either completing tertiary education, starting careers, or exploring entrepreneurial ventures, while the youngest are still in school. This is the first fully digital-native generation, having grown up with constant internet access, social media and global connectivity, shaping not only how they work and communicate but also how they approach money and investments.

In the realm of investment, Gen Z is redefining boundaries, bolstered by a comfort with digital platforms and instant access to information. Rather than fixating on home ownership or static job markets, they leverage technology to explore diverse opportunities, including digital assets like cryptocurrency, nomadic jobs and innovative business ventures.

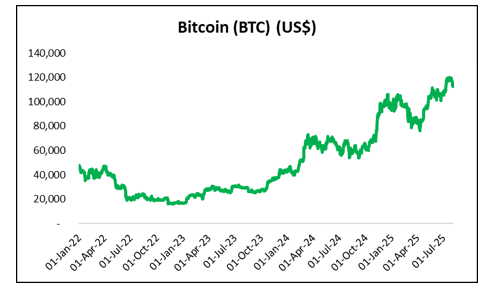

Cryptocurrency is an appealing asset class for Gen Z, fueled by the aggressive growth strategies that can be employed as they are decades ahead before retirement. This cohort’s inherently high-risk appetite is well-suited to navigating the extraordinary volatility and rapid innovation that define the crypto landscape. With a long investment horizon, Gen Z investors embrace short-term price swings and market corrections as part of a broader, opportunistic pursuit of significant long-term gains.

For Gen Z in T&T, digital currencies offer not only the promise of outsized returns but also fit seamlessly with their technological fluency and desire for autonomy. They actively leverage social media, online communities, and trading apps to stay abreast of the latest crypto trends, and many are unafraid to experiment with emerging coins, Non-Fungible Tokens (NFTs), and decentralized finance platforms. Unlike older generations who may prioritize capital preservation, Gen Z’s willingness to accept volatility enables them to capitalize on market rebounds and rapid asset appreciation.

However, the dynamic regulatory environment surrounding cryptocurrencies demands constant vigilance and adaptability. As new regulations are introduced, often with the aim of enhancing investor protection and curbing illicit activity, Gen Z should seek to research and understand legislative changes, diversify across regulated and non-regulated assets, and adopt innovative security practices to safeguard their holdings.

Figure 3: Bitcoin (US$)

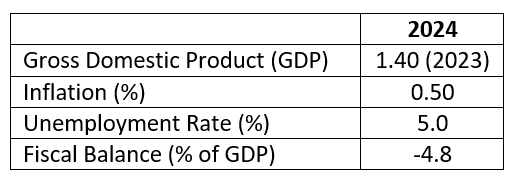

Figure 4: T&T Key Economic Indicators

Source: Central Bank of Trinidad & Tobago

As T&T traverses an era of economic uncertainty and relentless change, each generation’s approach to investing and financial planning reflects its defining experiences, risk appetites, and aspirations. While Baby Boomers prioritize stability and income, Generation X balances present obligations with future security. Millennials leverage time and technology to pursue growth while Generation Z, unburdened by tradition and emboldened by innovation, embraces new asset classes and digital opportunities. Across all generations, the common thread is the need for informed decision-making, disciplined saving, and thoughtful diversification. By recognizing the unique circumstances of each generation and adopting strategies tailored to their life stage, individuals can not only weather economic uncertainty but also position themselves for lasting financial prosperity.

Implications for Investors and Advisors in 2025

Each generation carries profound strategic implications for both investors and financial advisors. Advisors must move beyond one-size-fits-all approaches, adopting a segmented and personalized strategy that reflects the unique priorities of each cohort. Baby Boomers, for instance, often require guidance centered on income generation, capital preservation, and liquidity management in a low-growth environment. Generation X clients need solutions that balance debt reduction, education funding, and portfolio growth, while Millennials increasingly seek digitally accessible, growth-oriented strategies that leverage global markets and technological innovation. Generation Z, by contrast, looks for guidance and investment options in emerging asset classes, including cryptocurrencies and other digital platforms, along with educational support to navigate these opportunities.

For investors, thriving in this evolving landscape demands a disciplined evaluation of risk tolerance, time horizon, and financial objectives within the context of their generational experiences. Advisors, meanwhile, are called to harness technology, promote financial literacy, and provide flexible, multi-asset solutions capable of adapting to shifting market dynamics. Enduring success for both parties depends on a commitment to continuous learning, the thoughtful integration of innovative investment vehicles, and a proactive approach to diversification, together ensuring resilience amid ongoing market volatility.

DISCLAIMER

First Citizens Bank Limited (hereinafter “the Bank”) has prepared this report which is provided for informational purposes only and without any obligation, whether contractual or otherwise. The content of the report is subject to change without any prior notice. All opinions and estimates in the report constitute the author’s own judgment as at the date of the report. All information contained in the report that has been obtained or arrived at from sources which the Bank believes to be reliable in good faith but the Bank disclaims any warranty, express or implied, as to the accuracy, timeliness, completeness of the information given or the assessments made in the report and opinions expressed in the report may change without notice. The Bank disclaims any and all warranties, express or implied, including without limitation warranties of satisfactory quality and fitness for a particular purpose with respect to the information contained in the report. This report does not constitute nor is it intended as a solicitation, an offer, a recommendation to buy, hold, or sell any securities, products, service, investment, or a recommendation to participate in any particular trading scheme discussed herein. The securities discussed in this report may not be suitable to all investors, therefore Investors wishing to purchase any of the securities mentioned should consult an investment adviser. The information in this report is not intended, in part or in whole, as financial advice. The information in this report shall not be used as part of any prospectus, offering memorandum or other disclosure ascribable to any issuer of securities. The use of the information in this report for the purpose of or with the effect of incorporating any such information into any disclosure intended for any investor or potential investor is not authorized.

DISCLOSURE

We, First Citizens Bank Limited hereby state that (1) the views expressed in this Research report reflect our personal view about any or all of the subject securities or issuers referred to in this Research report, (2) we are a beneficial owner of securities of the issuer (3) no part of our compensation was, is or will be directly or indirectly related to the specific recommendations or views expressed in this Research report (4) we have acted as underwriter in the distribution of securities referred to in this Research report in the three years immediately preceding and (5) we do have a direct or indirect financial or other interest in the subject securities or issuers referred to in this Research report.