Market Review: Third Quarter of 2025

Commentary

International Market Review

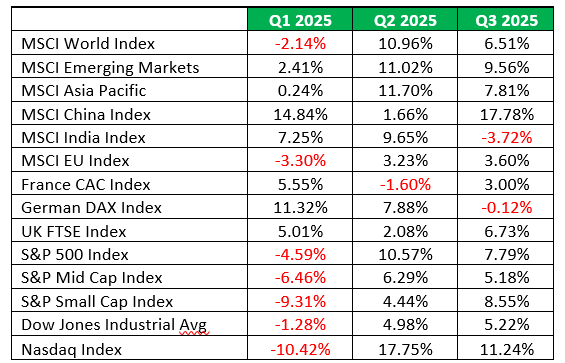

Global equities registered a strong and broad-based performance in the third quarter of 2025, marking a decisive departure from the heightened volatility that had overshadowed markets in the preceding quarter. Between July and September, global stock markets advanced meaningfully, underpinned by renewed investor confidence and a more favourable risk backdrop. The rally was fuelled in large part by growing clarity on trade tariffs, as constructive progress in negotiations between the U.S. and its major trading partners signalled a potential easing of trade tensions. For investors, the period underscored how swiftly market dynamics can change when policy headwinds give way to constructive dialogue, paving the way for renewed confidence in global growth prospects.

U.S. Stocks

After trailing their international counterparts in the first half of the year, U.S. equities posted solid gains in the third quarter of 2025, with major indices climbing to record highs. The rally, which extended steadily over the three-month period, was fuelled by a powerful combination of robust corporate earnings, resilient economic indicators and easing trade frictions. Standout results from technology leaders such as Nvidia, Microsoft, and Meta provided significant momentum, while U.S. GDP growth surpassed expectations and inflation showed encouraging signs of containment.

On the policy front, the U.S. secured new trade agreements with several key partners, extended negotiation timelines with others and imposed higher levies on remaining holdouts. These actions helped to temper tariff-related anxieties, adding further confidence to an already buoyant market.

Investor sentiment was also shaped by shifting monetary policy expectations, as the Federal Reserve (Fed) cut its benchmark interest rate by 25 basis points, its first reduction of the year. The move, set against a backdrop of stable inflationary pressures, offered additional reassurance to markets. Notably, the Fed’s preferred inflation gauge, the Price Consumption Expenditure (PCE) Index increased marginally to 2.7% in August 2025, up from 2.6% in July, underscoring the central bank’s balancing act between supporting growth and containing price stability.

Europe

European equity markets continued to lag their global peers in the third quarter of 2025, with major indices delivering only modest gains. Investor sentiment across the region remained subdued, weighed down by multiple headwinds. Chief among them was the unfavourable outcome of EU–U.S. trade negotiations, which resulted in the U.S. imposing a 15% tariff on most European goods entering the U.S., lower than the initially threatened 30% levy, but nonetheless a drag on confidence. Compounding matters, the EU bloc agreed to purchase USD750 billion worth of U.S. energy as well as American military equipment, further fuelling concerns about Europe’s bargaining position and long-term competitiveness.

Adding to the cautious tone, economic data from the region reinforced doubts about growth prospects. Germany’s economy contracted by 0.30% in Q2 2025, sparking renewed fears of a potential recession in Europe’s largest economy. Meanwhile, political instability in France further unsettled markets. Prime Minister François Bayrou’s decision to call a confidence vote on 8 September backfired when he was defeated, forcing his resignation. The vote stemmed from his government’s unpopular attempt to push through fiscal reforms aimed at addressing France’s ballooning budget deficit. The political upheaval not only rattled French equities but also raised concerns over the country’s debt trajectory, weighing on sovereign bond markets.

In contrast, the U.K. offered a brighter picture. The FTSE 100 broke above the 9,000 mark for the first time since its inception in 1984, supported by robust earnings from corporate heavyweights such as AstraZeneca, Rolls-Royce, and BAE Systems. Sentiment was further lifted by the conclusion of a more favourable trade agreement with the U.S. and supportive domestic policy. Early in the quarter, the Bank of England reduced interest rates by 25 basis points, while macroeconomic data remained resilient, with Q2 GDP growth advancing by 0.3%.

Emerging Markets

Emerging market equities extended their leadership over developed markets in the third quarter of 2025, driven largely by a powerful rally across Asian stocks, mainly China. Investor confidence was revived by the steady de-escalation of geopolitical tensions, as well as progress in global trade negotiations which yielded tangible outcomes. Notably, the U.S. extended its tariff pause beyond the 12 August deadline, most significantly with China, while a series of new bilateral trade agreements across Asia further reinforced optimism around regional growth prospects. Bolstered by these developments, the MSCI Emerging Markets Index and the MSCI China Index delivered robust returns of 9.56% and 17.78% for the quarter respectively.

Table 1: International Stock Indices Performance (Local Currency Returns)

U.S. Treasury Yields

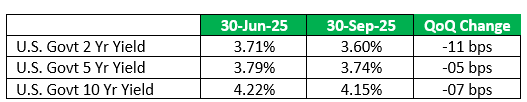

Between July and September 2025, the U.S. Treasury yield curve continued its steepening trend, though at a more measured pace. The movement was driven by a sharper decline in short-term yields relative to longer maturities, reflecting market expectations and the eventual confirmation of the Federal Reserve’s decision to lower its policy rate at the September meeting. This policy shift had been well-telegraphed, following Chair Powell’s dovish commentary at Jackson Hole, which primed investors for near-term easing.

In contrast, longer-dated yields proved more resilient, retreating only modestly as investors remained cautious about the long-term inflation outlook. Inflation continues to hover above the Fed’s 2% target, stoking concern that price pressures may persist over time. Compounding these anxieties are the U.S. government’s widening fiscal deficits and the substantial refinancing needs tied to a heavy calendar of maturing Treasury securities in 2025. The resulting surge in new bond issuance has heightened sensitivity to supply dynamics, tempering the decline in long-term rates.

Yields on the 10-year and 30-year Treasury Notes fell by 7 and 4 basis points respectively, while shorter-dated maturities declined by a larger margin, with the 2-year and 5-year yields falling by 11 and 5 basis points.

Table 2: U.S. Treasury Yields

U.S. Sector Performance

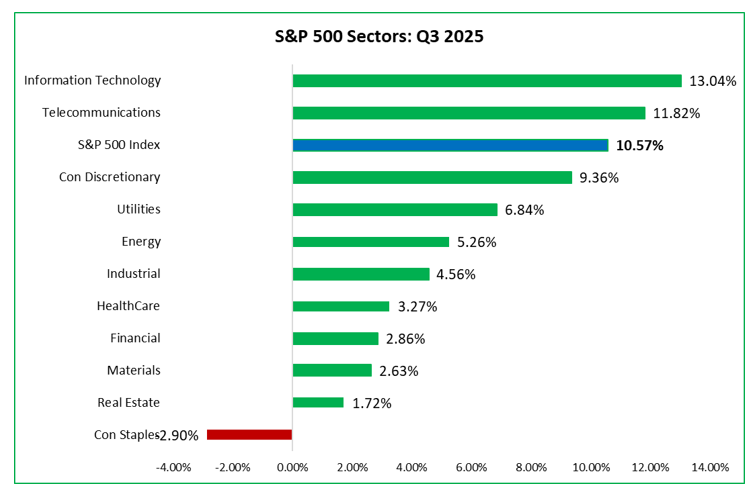

The rally in the third quarter was broad-based, evident by the gains in all sectors with the exception of Consumer Staples that fell by 2.90%. Information Technology maintained its dominance in Q3 2025, as AI-driven growth propelled technology and semiconductor stocks, making this sector one of the leaders for Q3 performance. Communication Services closely followed, also delivering robust returns. The rotation towards cyclical growth sectors negatively impacted the Consumer Staples sector. In addition, the sector was challenged by rising input costs for commodities, packaging and logistics, which pressured profit margins of several companies.

Figure 1: U.S. Sector Performance: Q3 2025

Source: Bloomberg

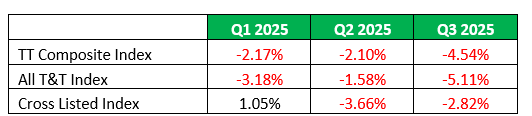

Local Market Review

The quarter was marked by pronounced weakness, as several equities registered lacklustre performances.

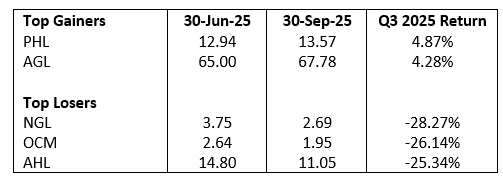

The overall weakness was evident in the subpar performance of several stocks, with Trinidad & Tobago NGL Limited (NGL), One Caribbean Media (OCM) and Angostura Holdings Limited leading the declines with losses ranging from 28.27% to 25.34%. Only two stocks posted gains in the quarter, Agostini Limited with a return of 4.28% and Prestige Holdings Limited that was up 4.87% over the quarter.

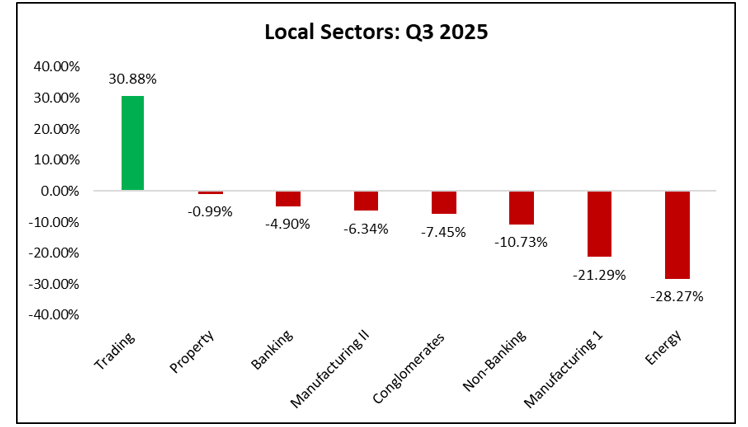

At the sectoral level, gains were similarly scarce. The Property sector surged by an impressive 15.42%, while the Manufacturing I sector delivered a modest uplift of 1.49%, buoyed by strong double-digit rallies in PLD and UCL shares. Conversely, sharp contractions in TCL and NGL dragged down the Manufacturing II and Energy sectors, cementing their positions as the weakest performers of the period.

Table 3: Local Stock Indices Performance

Table 4: Top Gainers and Losers: Q3 2025

Figure 2: Local Sector Performance: Q3 2025

Equity Markets Outlook

Equity Markets are expected to remain along its upward trajectory for the last quarter of 2025, with markets positioned for further gains, supported by robust corporate performance and monetary policy. However, serious risks linger which can prove destabilizing.

Geopolitical uncertainty further compounds the fragility of the backdrop. Tensions between the U.S. and China continue to oscillate, with trade, technology, and security flashpoints representing ongoing sources of instability. In parallel, conflict in the Middle East remains fluid, while the war in Ukraine shows little sign of abating.

Against this backdrop, equity markets are likely to remain sensitive to policy developments and global events. Investors should remain nimble, focusing on sectors aligned with growth and benefiting from macro tailwinds while maintaining diversification given persistent risks.

DISCLAIMER

First Citizens Bank Limited (hereinafter “the Bank”) has prepared this report which is provided for informational purposes only and without any obligation, whether contractual or otherwise. The content of the report is subject to change without any prior notice. All opinions and estimates in the report constitute the author’s own judgment as at the date of the report. All information contained in the report that has been obtained or arrived at from sources which the Bank believes to be reliable in good faith but the Bank disclaims any warranty, express or implied, as to the accuracy, timeliness, completeness of the information given or the assessments made in the report and opinions expressed in the report may change without notice. The Bank disclaims any and all warranties, express or implied, including without limitation warranties of satisfactory quality and fitness for a particular purpose with respect to the information contained in the report. This report does not constitute nor is it intended as a solicitation, an offer, a recommendation to buy, hold, or sell any securities, products, service, investment or a recommendation to participate in any particular trading scheme discussed herein. The securities discussed in this report may not be suitable to all investors, therefore Investors wishing to purchase any of the securities mentioned should consult an investment adviser. The information in this report is not intended, in part or in whole, as financial advice. The information in this report shall not be used as part of any prospectus, offering memorandum or other disclosure ascribable to any issuer of securities. The use of the information in this report for the purpose of or with the effect of incorporating any such information into any disclosure intended for any investor or potential investor is not authorized.

DISCLOSURE

We, First Citizens Bank Limited hereby state that (1) the views expressed in this Research report reflect our personal view about any or all of the subject securities or issuers referred to in this Research report, (2) we are a beneficial owner of securities of the issuer (3) no part of our compensation was, is or will be directly or indirectly related to the specific recommendations or views expressed in this Research report (4) we have acted as underwriter in the distribution of securities referred to in this Research report in the three years immediately preceding and (5) we do have a direct or indirect financial or other interest in the subject securities or issuers referred to in this Research report.