Market Review: Second Quarter of 2025

Commentary

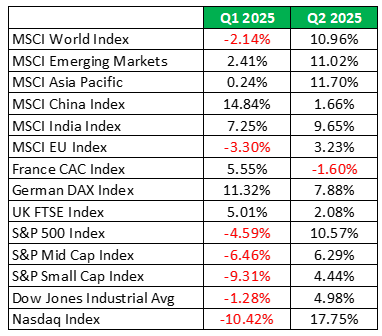

International Market Review

The second quarter of 2025 began amid heightened volatility in global equity markets, spurred by the announcement of sweeping U.S. tariffs that triggered a broad-based sell-off. However, sentiment began to stabilize by May, following a 90-day suspension of the tariffs and a more conciliatory tone from President Trump, allowing global stocks to regain their footing.

Volatility resurfaced in June as geopolitical tensions escalated sharply, with rising hostilities between Israel and Iran culminating in U.S.-led strikes on Iranian nuclear facilities. Despite the geopolitical shock, markets demonstrated resilience, rebounding swiftly and closing the quarter largely in positive territory across most major indices.

U.S. Stocks

During the first half of the second quarter of 2025, U.S. equities continued to underperform relative to their international counterparts, as investors grappled with heightened volatility following the events of “Liberation Day” on April 2nd. On this pivotal date, former President Trump announced an expansive and unexpected tariff regime—imposing a blanket 10% levy on all imported goods, alongside steeper “reciprocal” tariffs targeting countries with significant trade surpluses with the U.S. The sweeping scope and severity of these measures far exceeded market expectations, sparking sharp fluctuations across both domestic and global equity markets.

Investor sentiment was further dampened by the surprising contraction of the U.S. economy in the first quarter of 2025, with GDP declining by 0.3%. This marked the first quarterly decline since the brief, pandemic-related recession of 2020, and stood in stark contrast to consensus expectations for modest growth. The downturn was largely driven by a surge in imports, up 41%, as businesses and consumers accelerated purchases ahead of the impending tariffs.

Despite the early-quarter turbulence, markets staged a strong rebound in June. Major indices rallied to record highs, buoyed by renewed optimism surrounding trade negotiations, particularly with China and Canada. The rally was broad-based, extending beyond large-cap stocks to include mid- and small-cap equities, though the latter lagged slightly behind. The S&P 500 advanced nearly 5% for the month, repeatedly setting new all-time highs. The Nasdaq surged over 6%, while the Dow Jones Industrial Average recorded a solid 4% gain. This resurgence in investor confidence helped offset earlier losses and eased fears of further trade-related disruptions.

Europe

European equity markets lagged behind their U.S. counterparts in the second quarter of 2025, with major indices posting only modest gains amid persistent volatility. Initial market turbulence following “Liberation Day” was partially tempered by a temporary suspension of the 50% tariffs on imports from the European Union (EU), extended until July 9, 2025. This pause allowed room for renewed trade negotiations, prompting a measured rebound in European stocks. The recovery was further supported by a 25 basis point interest rate cut from the European Central Bank, aimed at stabilizing economic sentiment.

However, optimism for a swift resolution waned as the quarter progressed. Negotiations stalled, with both parties remaining entrenched in their positions and unwilling to make the substantial concessions necessary for a comprehensive agreement. The U.S. pressed for significant changes, including relaxed digital regulations for American tech firms, reforms to the EU’s value-added tax (VAT) system, increased imports of U.S. goods—particularly automobiles—and a narrowing of the transatlantic trade imbalance. The EU, however, held firm, rejecting demands that touched on core issues of digital governance and tax policy, which it regards as fundamental matters of sovereignty and thus non-negotiable.

German equities received a notable boost as the protracted political impasse was finally broken, with Christian Democratic Union leader Friedrich Merz securing parliamentary approval to become Chancellor. This decisive victory ended six months of governmental paralysis and opened the door for the new Chancellor to advance coalition negotiations with the Social Democrats. The prospect of renewed political stability and effective governance fostered a palpable sense of confidence among investors, further underpinning the strength of German markets.

Emerging Markets

Emerging market equities outpaced their developed market peers in the second quarter of 2025, propelled by a strong rally in Asian markets. The quarter began under a cloud of volatility, following a sharp selloff triggered by the announcement of sweeping U.S. tariffs. However, sentiment improved substantially in the latter half, as the U.S. adopted a more measured tone, pausing the rollout of additional tariffs and reinitiating trade talks with China. This de-escalation in geopolitical tensions helped to ease immediate downside risks and reignited investor confidence across emerging markets. Buoyed by these developments, the MSCI Emerging Markets Index delivered a robust return of 11.02% for the quarter, marking a notable acceleration from the 2.41% gain recorded in the previous period

Table 1: International Stock Indices Performance (Local Currency Returns)

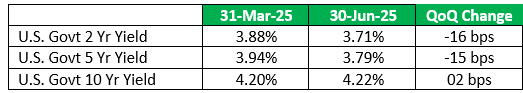

U.S. Treasury Yields

The U.S. Treasury market experienced heightened volatility throughout the second quarter of 2025, as investors responded to shifting trade policies, rising geopolitical tensions, and a mixed stream of economic data. Market unease intensified following the release of persistently high inflation figures, with the Personal Consumption Expenditures (PCE) index accelerating to 2.3% in May, up from 2.2% in April—remaining above the Federal Reserve’s 2% target. These inflationary pressures were further underscored by the Fed’s decision to hold interest rates steady for the third consecutive time in May, signalling continued caution in its monetary policy stance.

Investor sentiment was also dampened by growing concerns over the rising trajectory of the U.S. national debt. Fears mounted that sustained fiscal deficits—coupled with proposed tax cuts, would necessitate increased government borrowing, thereby expanding the supply of long-term Treasuries and exerting upward pressure on yields to attract demand.

As a result, the U.S. yield curve steepened during the quarter. Yields on the 10-year and 30-year Treasury notes rose by 2 and 20 basis points respectively, while shorter-dated maturities declined, with the 2-year and 5-year yields falling by 16 and 15 basis points.

Table 2: U.S. Treasury Yields

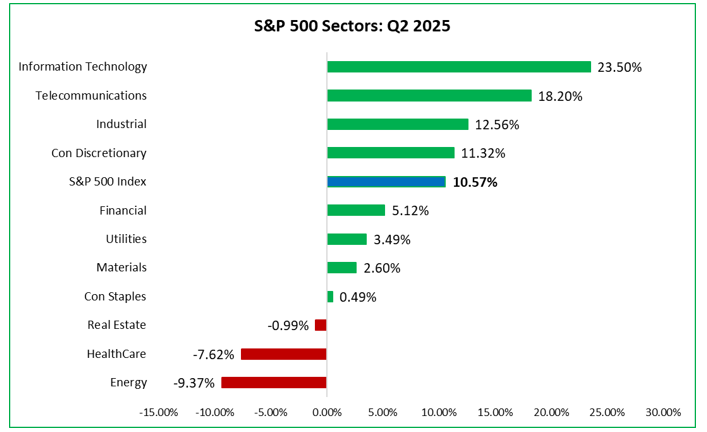

US Sector Performance

The second quarter of 2025 witnessed a pronounced shift in market sentiment, as investors rotated out of defensive sectors and into high-growth areas such as Technology, Communication Services, and cyclicals. Leading this surge was the Information Technology sector, which posted an impressive 24% gain for the quarter, supported by strong corporate earnings and sustained investor enthusiasm surrounding artificial intelligence and digital innovation. Communication Services closely followed, also delivering robust returns. In stark contrast, Energy and Health Care faltered, each registering quarterly declines.

Figure 1: U.S. Sector Performance: Q2 2025

Source: Bloomberg

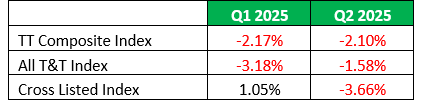

Local Market Review

The Trinidad and Tobago stock market extended its downward trend in the second quarter of 2025, weighed down by declines across both cross-listed and domestic equities. The Cross-Listed Index led the retreat, registering a quarterly loss of 3.66%, while the T&T Composite Index and the All T&T Index followed with declines of 2.10% and 1.58%, respectively.

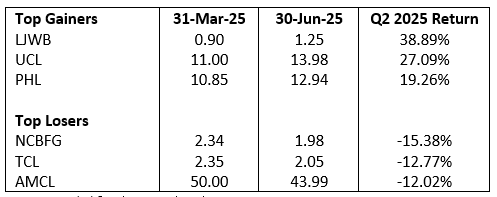

Despite the overall weakness, several stocks delivered notable gains. LJ Williams Limited (LJWB) surged by 38.89%, while Unilever Caribbean Limited (UCL) and Prestige Holdings Limited (PHL) posted strong advances of 27.09% and 19.26%, respectively. Conversely, the steepest losses were recorded by NCB Financial Group Limited (NCBFG), Trinidad Cement Limited (TCL), and Ansa McAL Limited (AMCL), with share price declines of 15.38%, 12.77%, and 12.02%, respectively.

In this challenging environment, only two sectors managed to deliver positive returns. The Property sector soared by 15.42%, while Manufacturing I posted a modest gain of 1.49%, propelled by robust, double-digit appreciation in PLD and UCL shares. In contrast, sharp declines in TCL and NGL weighed heavily on the Manufacturing II and Energy sectors, marking them as the quarter’s weakest performers.

Table 3: Local Stock Indices Performance

Table 4: Top Gainers and Losers: Q2 2025

Figure 2: Local Sector Performance: Q2 2025

Equity Markets Outlook

The equity market is expected to remain shaped by heightened volatility and persistent policy uncertainty. A key focal point for investors is the upcoming July 9 U.S. tariff deadline, which looms large over global markets. Should trade negotiations stall, the risk of broader levies, particularly on consumer goods, could introduce additional cost pressures and weigh heavily on corporate margins.

Inflation remains a central concern, with consumer prices continuing to run above central bank targets. The potential inflationary impact of renewed tariffs may further complicate the policy landscape, creating headwinds for equities by constraining both consumer demand and monetary policy flexibility.

Geopolitical risks also remain elevated. Escalating tensions in the Middle East and the ongoing conflict between Russia and Ukraine add another layer of uncertainty, with the potential to trigger abrupt market dislocations and dampen investor confidence.

Against this backdrop, equity markets are likely to remain sensitive to policy developments and global events. Investors may increasingly favor high-quality, resilient companies with pricing power, while adopting a more cautious stance toward risk assets until greater clarity emerges on trade, inflation, and geopolitical fronts.

DISCLAIMER

First Citizens Bank Limited (hereinafter “the Bank”) has prepared this report which is provided for informational purposes only and without any obligation, whether contractual or otherwise. The content of the report is subject to change without any prior notice. All opinions and estimates in the report constitute the author’s own judgment as at the date of the report. All information contained in the report that has been obtained or arrived at from sources which the Bank believes to be reliable in good faith but the Bank disclaims any warranty, express or implied, as to the accuracy, timeliness, completeness of the information given or the assessments made in the report and opinions expressed in the report may change without notice. The Bank disclaims any and all warranties, express or implied, including without limitation warranties of satisfactory quality and fitness for a particular purpose with respect to the information contained in the report. This report does not constitute nor is it intended as a solicitation, an offer, a recommendation to buy, hold, or sell any securities, products, service, investment or a recommendation to participate in any particular trading scheme discussed herein. The securities discussed in this report may not be suitable to all investors, therefore Investors wishing to purchase any of the securities mentioned should consult an investment adviser. The information in this report is not intended, in part or in whole, as financial advice. The information in this report shall not be used as part of any prospectus, offering memorandum or other disclosure ascribable to any issuer of securities. The use of the information in this report for the purpose of or with the effect of incorporating any such information into any disclosure intended for any investor or potential investor is not authorized.

DISCLOSURE

We, First Citizens Bank Limited hereby state that (1) the views expressed in this Research report reflect our personal view about any or all of the subject securities or issuers referred to in this Research report, (2) we are a beneficial owner of securities of the issuer (3) no part of our compensation was, is or will be directly or indirectly related to the specific recommendations or views expressed in this Research report (4) we have acted as underwriter in the distribution of securities referred to in this Research report in the three years immediately preceding and (5) we do have a direct or indirect financial or other interest in the subject securities or issuers referred to in this Research report.