How to Balance Your Investment Portfolio Amidst the Current Tariff Landscape

The imposition of tariffs by the U.S, particularly under President Trump’s administration, has introduced significant volatility into global financial markets. Tariffs are designed to protect domestic industries and reduce trade deficits, but they often lead to inflation, supply chain disruptions, and slower economic growth. The recent surge in U.S. tariffs, branded as “Liberation Day” by President Donald Trump, has introduced significant uncertainty into global financial markets as they are expected to disrupt global trade, reduce economic growth, and increase inflation. The World Trade Organization and the International Monetary Fund have both revised down their forecasts for global trade and GDP growth in 2025, citing tariff-induced disruptions and policy unpredictability.

For investors, this creates a challenging environment where traditional strategies may need adjustment to mitigate risks and capitalize on emerging opportunities. Balancing an investment portfolio during such periods requires diversification, strategic asset allocation, and a focus on sectors less affected by tariffs. By strategically positioning portfolios to mitigate tariff-related risks while capitalizing on market dislocations, investors can better navigate the complexities introduced by tariffs and maintain a path toward long-term growth.

Understanding the Impact of Tariffs on Investments

Tariffs and retaliatory measures directly raise the cost of imported goods, materials, or components that many companies rely on to manufacture their products. For businesses with global supply chains, even modest tariffs can significantly increase production expenses. To maintain competitiveness, some firms attempt to absorb these additional costs rather than passing them on to consumers, which leads to smaller profit margins. Over time, persistent tariff pressure can erode profitability, reduce reinvestment capacity, and strain financial performance—particularly for manufacturers and exporters.

Not all firms can absorb the higher costs and they may seek to pass on rise in manufacturing and production costs to consumers in the form of higher prices. As everyday items become more expensive, household purchasing power weakens, leading to reduced consumption. This decline in consumer spending can ripple across the economy, affecting businesses of all sizes and slowing overall growth. In sectors where demand is price-sensitive, even small increases can lead to significant drops in sales. Over time, this can lead to lower corporate revenues, job cuts, and diminished economic momentum, particularly if tariffs remain in place for an extended period.

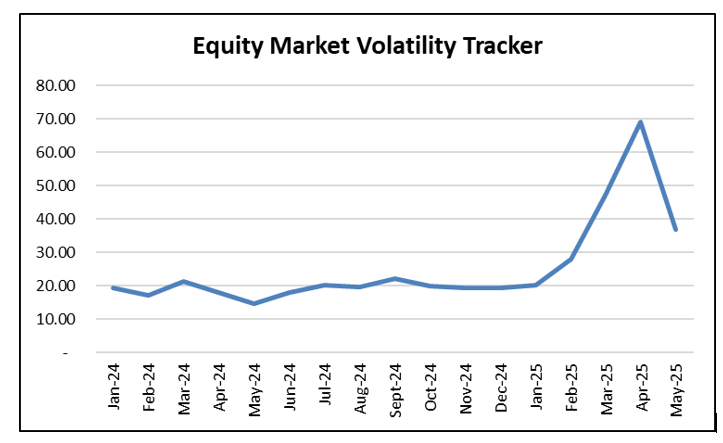

Consequently, tariffs contribute to market volatility and corporate uncertainty primarily by injecting unpredictability into the economic landscape. When governments announce or adjust tariffs, investors and companies face unclear costs and shifting trade relationships. As such, companies in trade-dependent industries and economies like manufacturing and technology often experience sharp stock price movements following tariff announcements. Investors quickly adjust their expectations for company earnings and may lower stock valuations in response to potential challenges to profitability and demand.

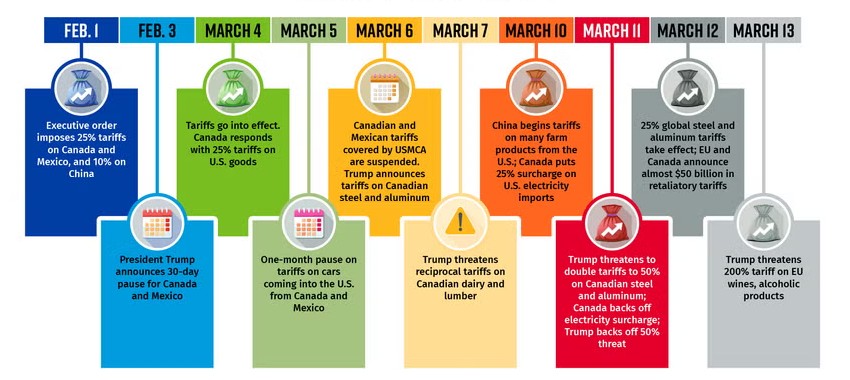

Retaliatory tariffs can have even wider effects, often leading to prolonged trade disputes where countries keep responding to each other with new tariffs. This back-and-forth cycle increases market instability and uncertainty, discouraging businesses from expanding and making global cooperation more difficult. It can also break up global trade networks, forcing companies to find new markets or suppliers—often at much higher costs. On top of the economic impact, retaliatory tariffs can strain diplomatic relations and complicate negotiations on broader political and security issues, further fueling investor worries and market anxiety.

Key Challenges Investors Face Due To Tariffs

Investors usually rely on corporate earnings growth and estimates as a means of assessing the attractiveness of an investment. Tariffs however may reduce the effectiveness of such a barometer as they introduce a high level of unpredictability into economic policy, making it difficult for businesses to plan for the future. Companies face uncertainty about which products will be taxed, at what rates, for how long and if they will be any retaliatory actions by trading partners. This lack of clarity leads many firms to delay or scale back investments, hiring, and expansion plans as they wait to see how trade policies evolve.

The reduction in consumer spending due to tariffs can cause a slowdown in economic activity and increases the risk of recession. The risk of recession is just not isolated in the U.S, however it spans the global economy in lieu of the broad-based reciprocal tariffs introduced in April. The International Monetary Fund and other economic forecasters have cut global growth projections, citing tariffs as a major factor behind the slowdown. This heightened volatility makes it harder for investors to predict market direction and increases the risk premium demanded for holding equities, often resulting in lower stock valuations.

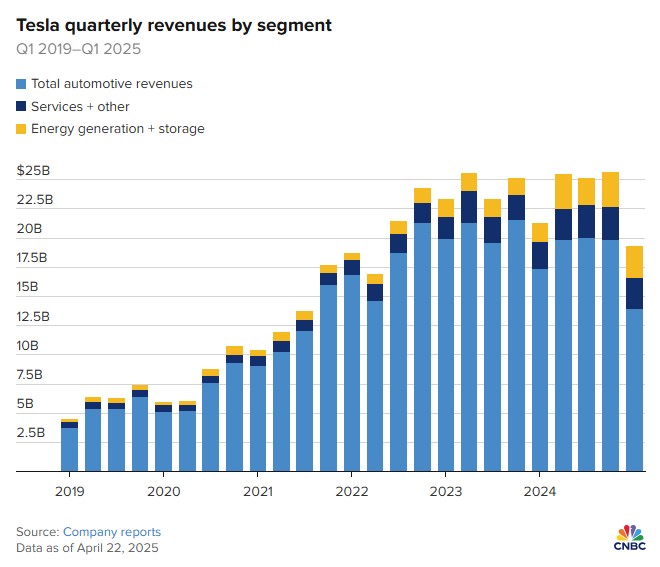

Not all companies or regions are affected equally by tariffs. Industries heavily reliant on global supply chains—such as manufacturing, technology, and automotive—face greater cost pressures and uncertainty. Similarly, companies with significant sales or production in countries targeted by tariffs, like China, Mexico, or the European Union, experience more direct impacts. Conversely, firms focused on domestic markets or less tariff-exposed regions may be more insulated. This uneven exposure creates challenges for investors trying to balance risk and return, as they must carefully analyze which sectors and geographies are most vulnerable and adjust their portfolios accordingly.

Tariff policy remains fluid and politically charged, with announcements, pauses, escalations, and negotiations occurring frequently. This dynamic environment makes it extremely difficult to forecast the final scope, duration, and impact of tariffs. For instance, proposals for tariffs on imports from Canada and Mexico have been delayed or modified multiple times, and ongoing trade talks continue to shape the outlook. Such unpredictability complicates investment decisions, as companies and investors cannot reliably price in future costs or market conditions. The risk of sudden policy shifts keeps markets on edge, contributing to ongoing volatility and making long-term strategic planning more challenging.

Strategies to Balance an Investment Portfolio amid Rising Tariffs

To successfully navigate the challenges of a market shaped by tariffs, investors should embrace a diversified approach. Spreading investments across different asset types—such as stocks, bonds, real estate, and commodities, can help reduce the overall risk that tariffs pose to a portfolio. While stocks may experience fluctuations due to market volatility, bonds and commodities often provide a steadier foundation, helping to balance out ups and downs.

International diversification is especially important in this environment. Since U.S. tariffs affect countries and industries unevenly, some regions face greater risks while others remain relatively insulated. By investing in international stocks and bonds from countries less impacted by these tariffs, investors can shield their portfolios from some of the direct cost increases and uncertainties tied to U.S. trade policies. However, to make the most of this strategy, it’s essential for investors to stay informed about global trade developments and focus on economies with stable or improving trade relationships.

Since tariffs mainly affect international trade, investors should focus on companies that rely on domestic markets as their revenues and operating costs are insulated from the trade risks. In addition, domestic firms may be less dependent on overseas suppliers, reducing their vulnerability to disruptions in international trade or price hikes caused by tariffs.

Investors should also see to invest in commodities and precious metals as they often serve as safe-haven assets during economic uncertainty. Since tariffs can lead to inflation, tangible assets like precious metals and agricultural commodities tend to increase in value. Including these in a portfolio can provide a useful hedge against inflation and market volatility.

The tariff landscape for 2025 will continue to evolve, requiring investors to stay vigilant and adaptable. The introduction of a 10% baseline tariff on most imports, along with sharply higher rates on key partners, has created a more complex and uncertain trade environment. While the recent 90-day pause on new tariffs provided temporary relief, sectors like manufacturing, technology, and automotive remain under pressure from tariffs and retaliatory measures. As trade tensions reshape global commerce, those who stay informed, flexible, proactive, and diversify geographically and sectorally will be best positioned to navigate volatility and seize emerging opportunities.

DISCLAIMER

First Citizens Bank Limited (hereinafter “the Bank”) has prepared this report which is provided for informational purposes only and without any obligation, whether contractual or otherwise. The content of the report is subject to change without any prior notice. All opinions and estimates in the report constitute the author’s own judgment as at the date of the report. All information contained in the report that has been obtained or arrived at from sources which the Bank believes to be reliable in good faith but the Bank disclaims any warranty, express or implied, as to the accuracy, timeliness, completeness of the information given or the assessments made in the report and opinions expressed in the report may change without notice. The Bank disclaims any and all warranties, express or implied, including without limitation warranties of satisfactory quality and fitness for a particular purpose with respect to the information contained in the report. This report does not constitute nor is it intended as a solicitation, an offer, a recommendation to buy, hold, or sell any securities, products, service, investment, or a recommendation to participate in any particular trading scheme discussed herein. The securities discussed in this report may not be suitable to all investors, therefore Investors wishing to purchase any of the securities mentioned should consult an investment adviser. The information in this report is not intended, in part or in whole, as financial advice. The information in this report shall not be used as part of any prospectus, offering memorandum or other disclosure ascribable to any issuer of securities. The use of the information in this report for the purpose of or with the effect of incorporating any such information into any disclosure intended for any investor or potential investor is not authorized.

DISCLOSURE

We, First Citizens Bank Limited hereby state that (1) the views expressed in this Research report reflect our personal view about any or all of the subject securities or issuers referred to in this Research report, (2) we are a beneficial owner of securities of the issuer (3) no part of our compensation was, is or will be directly or indirectly related to the specific recommendations or views expressed in this Research report (4) we have acted as underwriter in the distribution of securities referred to in this Research report in the three years immediately preceding and (5) we do have a direct or indirect financial or other interest in the subject securities or issuers referred to in this Research report.