ESG and Its Transformative Impact on the Investing Landscape

Commentary

What is ESG?

ESG stands for Environmental, Social, and Governance and refers to a framework used to assess an organization’s business practices and performance on various sustainability and ethical issues. Environmental factors include issues like climate change, pollution, and resource management. Social factors focus on aspects such as human rights, labor practices, and community relations. Governance factors assess the quality of a company’s leadership, transparency, and ethical standards. The objective of ESG is to encourage companies and investors to consider broader societal and environmental consequences alongside financial performance.

In Trinidad and Tobago, the ESG agenda is being incorporated through the national development strategy called Trinidad and Tobago’s Vision 2030. This strategy attempts to provide a cohesive socio-economic framework until 2030 and focuses on bolstering environmental governance and management systems, addressing climate change, renewable energy, waste and water, food, and energy security.

These reforms are poised to reshape the domestic business landscape, with a heightened focus on ESG issues. The implementation of environmental policies and laws is anticipated to incentivize businesses to adhere to emerging regulations, attracting investors keen on supporting sustainable practices. Consequently, this paves the way for increased interest in ESG investing within the local market, indicating a promising direction forward.

Integrating ESG in Investment Practices

Incorporating ESG factors into investment practices entails integrating ESG considerations into various stages of the investment process, from portfolio construction to company analysis and risk management.

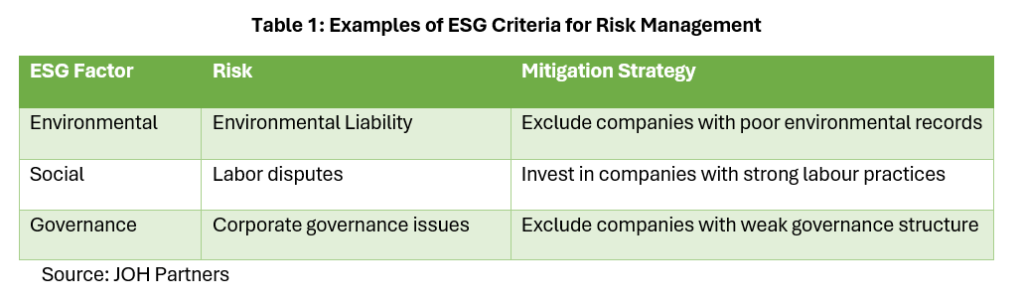

One way which this can be achieved is by developing and implementing an ESG screening criteria that will seek to exclude companies and industries with poor ESG performance or involvement in contentious activities. For instance, an asset manager might opt to remove companies with inadequate environmental track records from their portfolio in an effort to avoid potential environmental liabilities. Likewise, they might decide to invest in firms with commendable labor practices to mitigate the risk of future labor conflicts.

ESG factors can also in integrated into the financial analysis and valuation models and can be achieved with the implementation of a comprehensive risk framework. Along with the traditional risks that a company may be exposed to, an assessment can be conducted to determine how environmental regulations, social trends, and governance practices could affect the company’s operational efficiency, cost structure, revenue growth, and profitability. It is important to also consider the financial implications of ESG-related risks, such as regulatory fines, litigation costs, supply chain disruptions and reputational damage.

ESG Investing Strategies

ESG investment strategies offer investors a range of approaches to integrate environmental, social, and governance considerations into their investment decisions. Within recent years, ESG investment strategies have gained significant traction as investors increasingly recognize the importance of incorporating sustainability criteria into their investment decisions.

One such strategy is Thematic investing that involves investing in companies that are likely to benefit from the development of trends related to sustainability, technology, and demographic shifts. The approach focuses on specific themes or trends expected to drive significant economic, social, or technological change in the future. Such themes includes renewable energy and the transition to renewable energy sources such as solar, wind and hydroelectric power. Another theme is clean technology that encompasses technologies and solutions aimed at reducing environmental impact and includes energy efficiency, water purification and waste management.

Impact investing is also popular. This strategy entails identifying organizations, or projects that address key societal or environmental challenges, such as poverty alleviation, healthcare access, or sustainable development.

The Best-in-class approach is another investment tactic where investors invest in companies that rank highest within their respective industries based on their ESG performance metrics. As such, investors select companies that exhibit superior environmental stewardship, social responsibility, and ethical governance practices compared to their peers. This strategy allows investors to maintain diversification while emphasizing sustainability leadership within specific sectors.

Benefits of ESG Investing for Investors

ESG investing offers several benefits for investors, both financial and non-financial. Understanding and analyzing ESG factors can provide insights into potential risks that traditional analysis might overlook. Companies with strong ESG practices often exhibit lower risk profiles. By factoring in environmental risks such as climate change and pollution, social risks like labor disputes and community controversies, and governance risks such as corruption and executive compensation, investors can mitigate potential downsides in their portfolios.

Additionally, companies with robust ESG practices frequently demonstrate superior long-term financial performance. Numerous studies have demonstrated a positive correlation, which is the movement of two variables in the same direction, between high ESG ratings and enhanced returns, underscoring the potential for integrating ESG factors to improve investment outcomes over time.

Companies that makes ESG a priority often enjoy the spillover effects on their reputation and brand, which may provide the opportunity for increased customer loyalty and investor confidence. Subsequently, by investing in such companies, investors may be poised to benefit from the companies’ strong financial performance and market perception.

ESG considerations have emerged as key factors shaping the modern investing landscape, reflecting a growing recognition of the interconnectedness between financial performance and sustainability. By integrating environmental, social, and governance factors alongside financial metrics, investors can construct more resilient, sustainable, and responsible portfolios.

DISCLAIMER

First Citizens Bank Limited (hereinafter “the Bank”) has prepared this report which is provided for informational purposes only and without any obligation, whether contractual or otherwise. The content of the report is subject to change without any prior notice. All opinions and estimates in the report constitute the author’s own judgment as at the date of the report. All information contained in the report that has been obtained or arrived at from sources which the Bank believes to be reliable in good faith but the Bank disclaims any warranty, express or implied, as to the accuracy, timeliness, completeness of the information given or the assessments made in the report and opinions expressed in the report may change without notice. The Bank disclaims any and all warranties, express or implied, including without limitation warranties of satisfactory quality and fitness for a particular purpose with respect to the information contained in the report. This report does not constitute nor is it intended as a solicitation, an offer, a recommendation to buy, hold, or sell any securities, products, service, investment or a recommendation to participate in any particular trading scheme discussed herein. The securities discussed in this report may not be suitable to all investors, therefore Investors wishing to purchase any of the securities mentioned should consult an investment adviser. The information in this report is not intended, in part or in whole, as financial advice. The information in this report shall not be used as part of any prospectus, offering memorandum or other disclosure ascribable to any issuer of securities. The use of the information in this report for the purpose of or with the effect of incorporating any such information into any disclosure intended for any investor or potential investor is not authorized.

DISCLOSURE

We, First Citizens Bank Limited hereby state that (1) the views expressed in this Research report reflect our personal view about any or all of the subject securities or issuers referred to in this Research report, (2) we are a beneficial owner of securities of the issuer (3) no part of our compensation was, is or will be directly or indirectly related to the specific recommendations or views expressed in this Research report (4) we have acted as underwriter in the distribution of securities referred to in this Research report in the three years immediately preceding and (5) we do have a direct or indirect financial or other interest in the subject securities or issuers referred to in this Research report.