Is Stagflation a real threat today?

Commentary

It is little surprise that the word “stagflation” is trending as the world contends with the possibility of slower economic growth, higher unemployment and higher inflation. Stagflation would be an unwelcome environment for investors and policy makers alike.

What is Stagflation?

Stagflation is the dual threat of economic stagnation and persistent inflation and occurs when economic growth stalls (less than 2% per annum), unemployment increases and inflation is high. Inflation refers to a general progressive increase in prices of goods and services in an economy. When the general price level rises, each unit of currency buys fewer goods and services. Consequently, inflation corresponds to a reduction in the purchasing power of money.

Such an unfavourable combination of no or low growth, high unemployment and high inflation is problematic and can be a dilemma for governments since most actions designed to lower inflation may raise unemployment levels, and policies designed to decrease unemployment may worsen inflation.

Causes of Stagflation

Causes of Stagflation

Initially, many economists believed stagflation wasn’t possible. After all, unemployment and inflation rates generally move in opposite directions. Usually, slow economic growth prevents rising prices based on the rules of supply and demand. With no impetus from consumer demand, prices normally fall.

While there is no consensus among economists on the causes of stagflation, there are some contributing factors including supply shocks and fiscal and monetary policies that serve to restrict growth.

A supply shock is an unexpected event that suddenly changes the supply of a good or service and thus results in an unforeseen change in price. The shock can be positive in that output increases causing prices to fall or negative in that production of the good or service decreases, causing prices to rise. Stagflation occurs when there is a negative supply shock that leads to a surge in price, making the production of goods costlier and less profitable, thus slowing economic growth.

Poorly constructed fiscal and monetary policies is another contributing factor to stagflation. A second theory states that stagflation can be a result of a poor economic policy. For example, the government can create a policy that harms industries while growing the money supply too quickly. The simultaneous occurrence of these events can lead to slower economic growth and higher inflation.

This economic phenomenon was first observed in the 1970s recession in the US. In the prior decade, the post-World War II economic boom began to fade and in an effort to spur growth, the former president Richard Nixon undertook a series of measures intended to create better jobs, remedy inflation and protect the US dollar. Such measures included lowering interest rates, implementing a 90-day wage and price freeze and removing the US from the gold standard (a monetary system in which the country’s currency is backed by gold).

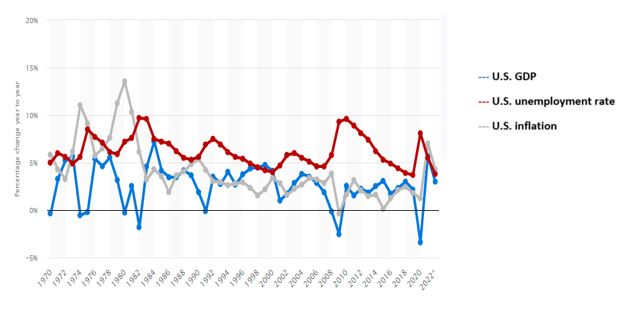

Some years later in the 1972, the US macroeconomic landscape was characterized by low interest rates, declining unemployment and strong economic growth. The following year however, inflationary pressures began to emerge and in an effort to counteract the rising inflation, the US Federal Reserve reversed its policies and began to increase the fed funds rate in 1973. This resulted in rising unemployment and slow economic growth that averaged 7.1% and -0.40% over 1974-1975 respectively.

Exacerbating the situation, an Organization of Petroleum Exporting Countries (OPEC) oil embargo on the US, that was implemented in 1973, caused oil prices to skyrocket. Demand fell to new lows, and industrial output suffered. Businesses passed those costs on to consumers, but they also cut back on production (increasing unemployment) as the supply shock made goods more scarce. The price of oil per barrel initially doubled, then quadrupled, pushing inflation higher and further straining an already struggling US economy.

Consequences of Stagflation

Stagflation matters as it directly impacts the everyone. There will be an uptick in the unemployment rate as the economy stalls, making it hard for many to meet their basic needs. Those who are still employed may suffer job loss and lower wages as business owners try to preserve their profit margins in the face of rising input cost and lower consumer demand.

Investors will not be spared as the reduction in sales and profit margins might reduce earnings per share thus leading to a decline in stock prices. The macroeconomic uncertainty may also weigh on investor sentiment, further propelling a general downturn in the stock market. Dividends may also be reduced or suspended as companies strive to conserve cash.

Bond investors also face significant headwinds in such an environment. Rising consumer prices will serve to erode the purchasing power of fixed income bond investors. The stagnant economic growth and tighter monetary conditions may cause credit conditions to deteriorate, widening credit spreads. Given the increased uncertainty, bond investors will demand higher yields which may result in portfolio losses given the inverse relationship between yields and bond prices.

Will Stagflation return?

When compared to the economic conditions that prevailed in the 1970s, oil price shocks, contractionary monetary policies and slowing economic growth were present, as is happening today. However, its reoccurrence will depend on how quickly the tighter monetary policy tames inflationary pressures, causes unemployment to rise and economic growth to decline.

Three months into 2022 and the global economy is already facing the risk of an oil supply shock given Russia’s invasion of Ukraine and have resulted in higher oil prices. As of March 2022, the price of oil increased by 76% year on year.

With energy being an essential input to the manufacturing process, many nations have seen a steady climb in consumer prices, with the US consumer prices rising to a 41 year high of 8.5% in March 2022. The return of Covid-19s to China once again, also threatens global supply chains, amplifying upward pressures on prices and downward pressure on output.

In March 2022, the US Federal Reserve began to tighten its monetary policy and has raised its fed funds target rate on two occasions by 25 bps (at its March 2022 meeting) and 50 bps (at its May 2022 meeting), with the rate forecasted to increase to a range of 2.4% to 3.1% through 2023. Furthermore, during the first quarter of 2022, the U.S. economy contracted at an annual rate of 1.4% after more than a year of rapid growth, fuelled by a reduction in retailers’ inventory and a widening trade deficit.

Comparison of stagflation indicators from 1970 to 2022

How to invest in a Stagflation Environment

A stagflation environment will create challenges for both equity and bond investors. However, opportunities will still exist within each investment space. Inflation-linked bonds should provide a certain degree of insulation from rising prices, along with floating rate bonds as the cash flows adjust for the movement in interest rates. Investment grade bonds can also be considered, as such issuers should have the financial strength to navigate such uncertain times.

Within equities, a defensive strategy should be favoured rather than cyclical stocks. Blue-chip stocks, which are stocks issued by large companies with a large market capitalization and a sound reputation, are likely to weather stagflation pressures. Large capitalization stocks are also favoured as such companies tend to be more mature and are experienced less share price volatility during rough markets.

It may appear that the conditions are ripe for impending stagflation, however the causes of stagflation still remain speculative up to this day. A lot of learning took place after the 1970s, with central banks and governments being ever so mindful and careful about pursuing contradictory policies. While no one knows with certainty whether stagflation will reoccur in the not too distant future, it is best to be prepared for it.

DISCLAIMER

First Citizens Bank Limited (hereinafter “the Bank”) has prepared this report which is provided for informational purposes only and without any obligation, whether contractual or otherwise. The content of the report is subject to change without any prior notice. All opinions and estimates in the report constitute the author’s own judgment as at the date of the report. All information contained in the report that has been obtained or arrived at from sources which the Bank believes to be reliable in good faith but the Bank disclaims any warranty, express or implied, as to the accuracy, timeliness, completeness of the information given or the assessments made in the report and opinions expressed in the report may change without notice. The Bank disclaims any and all warranties, express or implied, including without limitation warranties of satisfactory quality and fitness for a particular purpose with respect to the information contained in the report. This report does not constitute nor is it intended as a solicitation, an offer, a recommendation to buy, hold, or sell any securities, products, service, investment or a recommendation to participate in any particular trading scheme discussed herein. The securities discussed in this report may not be suitable to all investors, therefore Investors wishing to purchase any of the securities mentioned should consult an investment adviser. The information in this report is not intended, in part or in whole, as financial advice. The information in this report shall not be used as part of any prospectus, offering memorandum or other disclosure ascribable to any issuer of securities. The use of the information in this report for the purpose of or with the effect of incorporating any such information into any disclosure intended for any investor or potential investor is not authorized.

DISCLOSURE

We, First Citizens Bank Limited hereby state that (1) the views expressed in this Research report reflect our personal view about any or all of the subject securities or issuers referred to in this Research report, (2) we are a beneficial owner of securities of the issuer (3) no part of our compensation was, is or will be directly or indirectly related to the specific recommendations or views expressed in this Research report (4) we have acted as underwriter in the distribution of securities referred to in this Research report in the three years immediately preceding and (5) we do have a direct or indirect financial or other interest in the subject securities or issuers referred to in this Research report.