Inflation in T&T and Abroad

Commentary

Source: Central Bank of Trinidad and Tobago (CBTT).

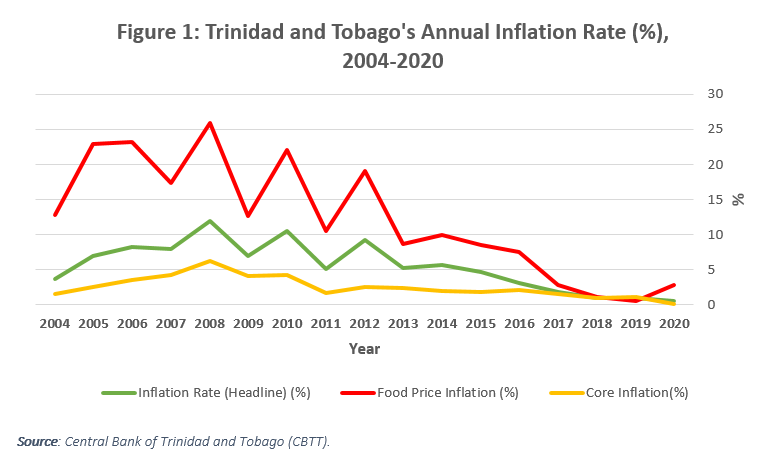

The inflation rate, which measures the rate of change in the general price level over a period of time, is one of the most important macroeconomic indicators available to policymakers and the general public as they try to understand the state of a country’s economy. In recent times, inflation in Trinidad and Tobago, which is measured by the change in the retail price index, has been relatively low, especially since the oil price shock of 2014 which brought the commodity boom years to an end. Since then, in a period of relative fiscal tightening, the inflation rate has trended further downwards, with both core inflation and headline inflation averaging well below 3% since 2016.

The Elements of Inflation

Headline inflation refers to the overall inflation rate, capturing the rate of increase in the Consumer Price Index (CPI) over a period of time. As the name suggests, the headline inflation rate is the one most frequently quoted in mainstream coverage of the price level. For policymakers, however, the core inflation rate is often of greater interest for the purposes of designing appropriate economic interventions as well as observing the effects of those interventions.

Core inflation, as defined by the International Monetary Fund/ International Labour Organization (IMF/ILO) Consumer Price Index Manual 2020, is a measure of inflation that excludes “movements in the inflation rate that are attributable to transient factors.” In some cases, core inflation excludes factors such as food and energy prices. Further, “measures of core inflation seek to measure the persistent or generalized trend of inflation.” In Trinidad and Tobago, core inflation excludes food prices, which are subject to a high degree of variability.

According to the Central Bank of Trinidad and Tobago’s (CBTT) Annual Economic Survey 2020, core inflation in 2020 was minimal, averaging just 0.1%, down from 1.1% in 2019. Unsurprisingly, the restrictions implemented to limit the spread of COVID-19 led to a slowdown in demand in several economic sectors. Accordingly, prices in some sub-sectors increased only moderately – in Health (2.7%) and Furnishings (0.7%) – while in other sub-sectors prices declined, e.g. Transport (-1%) and Recreation (-0.5%).

In the context of Trinidad and Tobago, food prices receive an overwhelming share of public attention due to their impact on our everyday lives, as well as their highly volatile nature. As a small island developing state with an open economy and relatively high per-capita income, a large component of Trinidad and Tobago’s overall food consumption is imported, and therefore food items are susceptible to price fluctuations on the international market, as well as any changes to the exchange rate.

For these reasons, the CBTT through its main policy instruments, has relatively less direct impact on domestic food prices compared with its ability to influence the core inflation rate. As figure 1 demonstrates, the boom years of 2004-2014 saw food prices increase at an average of well over 10% per year, sometimes greater than 20%, though moderating somewhat in more recent times. Food prices ticked upwards by 2.8% in 2020, driven mostly by international supply chain constraints generated by the COVID-19 pandemic.

The International Environment

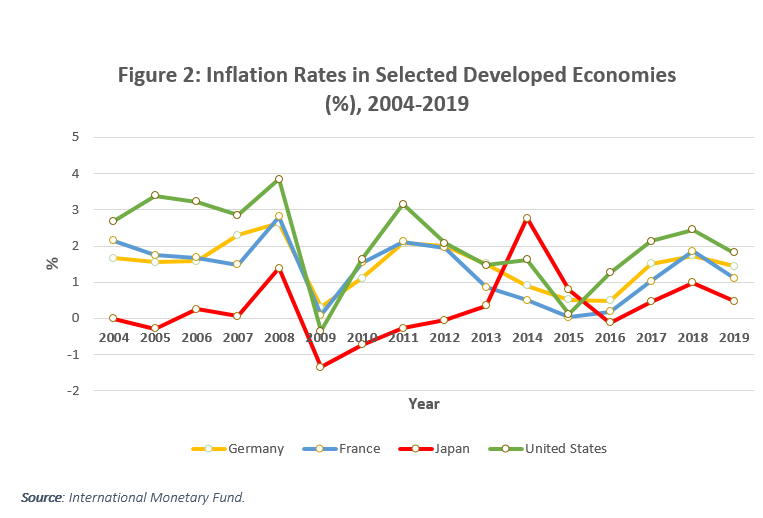

The major developed countries of the world have spent the past few decades in an almost permanent state of low (0% – 3%) inflation, a phenomenon which, along with the relatively stable economic growth in the pre-financial crisis era, was characterised as “The Great Moderation.”

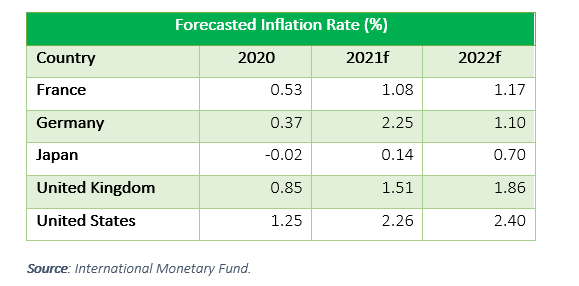

In 2020, the pandemic-induced recession led to even further subdued price levels. Japan, for example, dipped back into deflation for the first time in a decade. However, the anticipated recovery in 2021 and the unprecedented fiscal and monetary measures undertaken to support growth should portend demand upswings this year into 2022, with prices forecasted to rebound accordingly.

In the United States (US), inflation has been in the news recently given the upsurge in prices experienced in April 2021. The US CPI registered 0.8% higher than the previous month, and 4.2% higher than in April 2020, while core inflation (which in the US excludes food and energy prices), rose by 0.9% between March and April 2021 and 3% year-on-year. The monthly core inflation jump was the highest since 1982, according to the Bureau of Labour Statistics.

While the year-on-year rise partially reflects the comparison to last year’s pandemic trough (prices declined for three consecutive months in spring 2020), the rapid pace of the US vaccination programme has brought consumer spending roaring back, while fiscal expansion and accommodative monetary policy have seeded discussions among American economists suggesting that higher inflation may be here to stay. The Biden administration has expanded deficit spending– with over USD6Tn allocated to COVID-19 relief (USD1.9Tn), infrastructure spending (USD2.3Tn) and childcare/access to education (USD1.8Tn) – while the Federal Reserve has indicated that it is willing to temporarily “overshoot” its 2% inflation target in order to ensure a full economic and employment recovery.

Short-Term Domestic Outlook

In contrast to developed countries such as the US, Trinidad and Tobago has limited fiscal space with which to pursue aggressive, demand-boosting stimulus measures. Moreover, the recent surge in COVID-19 cases and subsequent restrictions, including the state of emergency, will suppress private consumption activity into Q32021. The CBTT, in its most recent Monetary Policy Announcement on 30 March, 2021 stated that “current financial conditions allowed further room for credit expansion without undue demand pressures on inflation.” This assessment is shared by the IMF, which forecasts 1.04% inflation in 2021 and 1.38% inflation in 2022 for Trinidad and Tobago.

DISCLAIMER

First Citizens Bank Limited (hereinafter “the Bank”) has prepared this report which is provided for informational purposes only and without any obligation, whether contractual or otherwise. The content of the report is subject to change without any prior notice. All opinions and estimates in the report constitute the author’s own judgment as at the date of the report. All information contained in the report that has been obtained or arrived at from sources which the Bank believes to be reliable in good faith but the Bank disclaims any warranty, express or implied, as to the accuracy, timeliness, completeness of the information given or the assessments made in the report and opinions expressed in the report may change without notice. The Bank disclaims any and all warranties, express or implied, including without limitation warranties of satisfactory quality and fitness for a particular purpose with respect to the information contained in the report. This report does not constitute nor is it intended as a solicitation, an offer, a recommendation to buy, hold, or sell any securities, products, service, investment or a recommendation to participate in any particular trading scheme discussed herein. The securities discussed in this report may not be suitable to all investors, therefore Investors wishing to purchase any of the securities mentioned should consult an investment adviser. The information in this report is not intended, in part or in whole, as financial advice. The information in this report shall not be used as part of any prospectus, offering memorandum or other disclosure ascribable to any issuer of securities. The use of the information in this report for the purpose of or with the effect of incorporating any such information into any disclosure intended for any investor or potential investor is not authorized.