Implications of a Strong US Dollar

Commentary

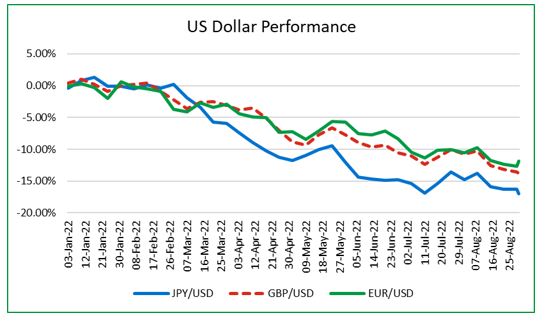

The US Dollar has steadily gained against many global currencies, with the strengthening particularly acute over the past couple of months, reaching historic highs against the Euro, Japanese Yen and the British Pound. A currency is considered strong when it rises in value against other currencies in the foreign exchange market. A strengthening U.S. dollar means it can buy more of a foreign currency than before.

Based on the U.S. Dollar index (DXY), the dollar, also termed the greenback, has been sitting at 20-year highs since May of this year. The DXY is one measure of the dollar’s value against six other currencies: the Euro, the Swiss Franc, the Japanese Yen, the Canadian Dollar, the British Pound and the Swedish Krona. When the index is up, it means that the U.S. dollar is gaining value in comparison to those currencies.

Likely Reasons for the strong US Dollar

The rapid appreciation of the US Dollar is twofold. The tighter monetary stance by the US Federal Reserve to aggressively fight inflation led to steady hikes in the benchmark interest rate. Beginning the year with a target interest rate of between 0% and 0.25%, the Fed has raised rates four times thus far to a range of 2.25% to 2.5%. As consumer prices continue to climb, there are promises of future rate increases.

Global interest rates are low across many developed nations. The Fed’s decision to hike interest rates increased the attractiveness to hold US interest-bearing assets globally. As a result, investors across the globe are shifting to US assets to benefit from the higher interest rate environment. As at 30th August 2022, the 10 Year US Treasury yield stood at 3.112% compared with the 10 Year German bund of 1.460% and the UK 10 Year Treasury of 2.607%.

The preference for US assets also stems from the perceived safety and better economic growth prospects when compared to other developed countries. The uncertainty and geopolitical risks rose sharply following Russia’s invasion of Ukraine and the subsequent disruption of energy and food supplies to Europe owing to the retaliatory sanctions imposed on Russia. Consequently, the heightened demand for US securities around the world will increase the demand for the dollar, further fueling the currency’s strength.

Impact of a strong currency

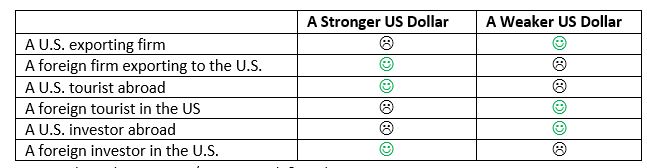

There are both advantages and disadvantages of a stronger currency. One advantage of a stronger currency is the affordability of imports. US manufacturers who source their raw materials overseas may likely pay less for their inputs due to the stronger dollar. As such, the cost of manufacturing may go down for such companies and may enable lower prices for consumers or the opportunity for higher profit margins.

Foreign companies with significant business to the US will benefit as the strong dollar reduces the cost of their goods and services, effectively increasing the competitiveness that may lead to greater demand and higher overall sales.

Non-US investors may also benefit as the return they receive from US assets will be boosted by the additional appreciation of the US dollar versus their local currency.

The impact of a stronger U.S. dollar on six different groups of economic actors

There are however disadvantages of a strong dollar as US exports may become more expensive in foreign markets, thus reducing the competitiveness and overall demand. For example, an American-made car that costs $20,000 would cost €14,815 in Europe, with an exchange rate of $1.35/€; however, it increases to €17,857 when the dollar strengthens to $1.12/€.

US investors who have international assets in their portfolio may experience a decline in their returns given the foreign currency depreciation. Portfolio returns can take a further hit as companies with a large exposure to overseas markets may achieve lower sales and miss their profit targets, thus reducing dividend payments and negatively affecting their share prices. Several companies including Microsoft, Coca-Cola, Phillip Morris and Proctor & Gamble have lowered their profit expectations based on currency impacts.

International issuers of dollar-denominated debt may face higher interest and principal payments that may increase the risk of possible default and subsequent credit downgrades. As a result, the yields of such securities may rise as investors demand a higher yield for the additional risk. Given the inverse relationship of yields and bond prices, investors may experience losses in their bond holdings.

What should investors do?

Currency markets are extremely hard to predict, so it’s difficult to say whether the dollar will continue to climb or fall in the coming months. However, as inflationary pressures spread to other countries, other central banks have also adopted a tighter monetary stance and started to raise their benchmark interest rates. Thus there is a view that the US dollar would not stay strong forever and there is the expectation that it should stabilize later on in the year. However, caution should be taken as it pertains to emerging-market debt and small to medium-sized corporations that issue dollar-denominated debt as they may face higher repayment burdens as the dollar continues its ascent.

DISCLAIMER

First Citizens Bank Limited (hereinafter “the Bank”) has prepared this report which is provided for informational purposes only and without any obligation, whether contractual or otherwise. The content of the report is subject to change without any prior notice. All opinions and estimates in the report constitute the author’s own judgment as at the date of the report. All information contained in the report that has been obtained or arrived at from sources which the Bank believes to be reliable in good faith but the Bank disclaims any warranty, express or implied, as to the accuracy, timeliness, completeness of the information given or the assessments made in the report and opinions expressed in the report may change without notice. The Bank disclaims any and all warranties, express or implied, including without limitation warranties of satisfactory quality and fitness for a particular purpose with respect to the information contained in the report. This report does not constitute nor is it intended as a solicitation, an offer, a recommendation to buy, hold, or sell any securities, products, service, investment or a recommendation to participate in any particular trading scheme discussed herein. The securities discussed in this report may not be suitable to all investors, therefore Investors wishing to purchase any of the securities mentioned should consult an investment adviser. The information in this report is not intended, in part or in whole, as financial advice. The information in this report shall not be used as part of any prospectus, offering memorandum or other disclosure ascribable to any issuer of securities. The use of the information in this report for the purpose of or with the effect of incorporating any such information into any disclosure intended for any investor or potential investor is not authorized.

DISCLOSURE

We, First Citizens Bank Limited hereby state that (1) the views expressed in this Research report reflect our personal view about any or all of the subject securities or issuers referred to in this Research report, (2) we are a beneficial owner of securities of the issuer (3) no part of our compensation was, is or will be directly or indirectly related to the specific recommendations or views expressed in this Research report (4) we have acted as underwriter in the distribution of securities referred to in this Research report in the three years immediately preceding and (5) we do have a direct or indirect financial or other interest in the subject securities or issuers referred to in this Research report.