Geopolitical Tensions

Commentary

During 2021, confidence about the global economic recovery began to strengthen as various developed and emerging market nations began the rollback of pandemic-related restrictions as inoculation programs kicked off. Rising vaccination rates prompted the reopening of vital economic sectors such as trade, transport, manufacturing and tourism among others. The economic recovery was well underway but the emergence of new and highly infectious Covid-19 strains began to undermine economic growth, resulting in widespread downward revisions to growth forecasts during the year. A major risk placing further strain on economic forecasts stem from rising geopolitical tensions between nations such as Russia and Ukraine as well as China and the western economies (United States, European Union). Heightened tensions amongst these nations will weigh heavily on their respective economies, commodities markets such as energy and metals as well as other nations that depend on trade from these economies.

Russia-Ukraine Tensions

The Soviet Union, formerly known as the Union of Soviet Socialist Republics (USSR) was a former northern Eurasian empire that existed during 1917 – 1991 and during its existence, was the world’s largest country by space. In its final years of existence, it consisted of 15 nations inclusive of Russia and Ukraine. On 8 December 1991, three major members, Russia, Ukraine and Belorussia (now known as Belarus) declared that the Soviet Union will cease to exist, and each former member became independent nations. The historic ties and close-knit relationship between Russia and Ukraine is one of the main reasons for the ongoing tension. At the end of 2013, Ukraine’s former leader failed to sign an agreement to increase economic cooperation with the European Union (EU). Around that time, the Ukrainian government agreed to not become a member of the Eurasian Economic Union (EAEU), an international organisation designed for greater regional economic integration. Like other regional unions, the EAEU facilitates the free movement of goods, services, capital and labour and consists of five member states, the Republic of Armenia, the Republic of Belarus, the Republic of Kazakhstan, the Kyrgyz Republic and the Russian Federation. Thereafter, Russia’s annexation of Crimea in 2014 was deemed illegal by the United Nations General Assembly. The Russian government claimed at multiple instances Crimea held a referendum to re-join Russia but the EU claimed it to be illegal as the referendum occurred following the invasion of Russian troops. The Ukrainian government’s willingness to strengthen ties with the EU and the North Atlantic Treaty Organisation (NATO) instead of Russia is a major issue for President Vladimir Putin. Near the end of 2021 and throughout the beginning of 2022, Russia ramped up the number of troops near the Ukrainian border in a move that has been described by western nations to be the build up to an invasion. Various NATO members began sending troops to Ukraine due to fears of a ground invasion by Russia which amassed around 100,000 troops towards the end of January 2022. The respective governments of Russia’s main trading partners such as the United States (US) and EU announced their intention of placing substantial economic sanctions against Russia if they eventually invade Ukraine.

Commodity Markets Overview

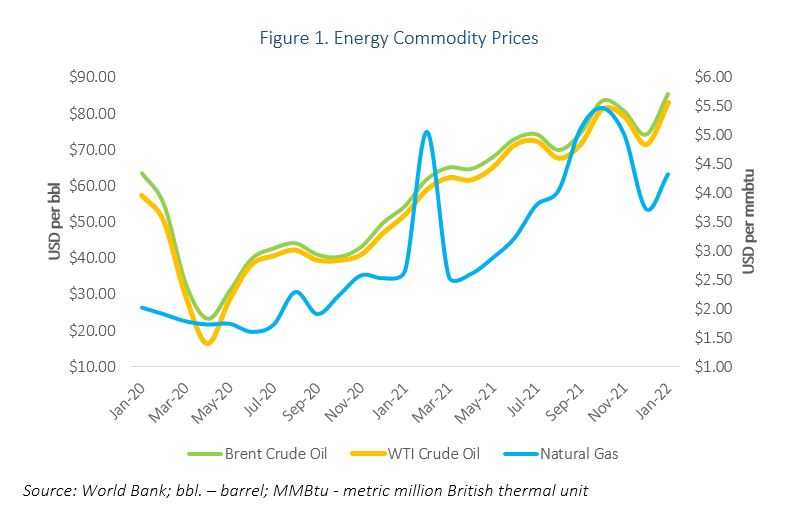

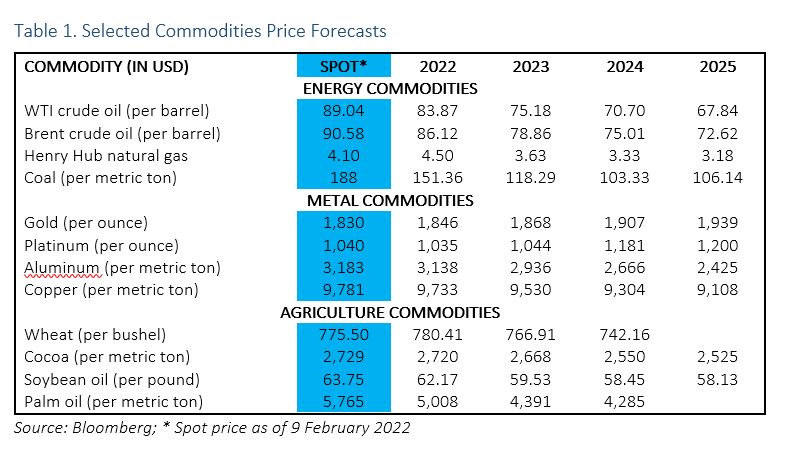

In 2021, various commodity prices began rising as demand for goods and services picked up in line with the reopening of economies across the globe. Energy prices in particular recorded tremendous gains with WTI crude oil moving from USD52.10 per barrel in January 2021 to USD83.12 per barrel in January 2022, a 59.54% increase. Over the same period, prices per barrel for Brent crude oil rose similarly by 56.79%. Coal prices saw the biggest year-on-year change in the energy commodities market moving from USD86.83 per metric ton in January 2021 to USD196.95 in January 2022. Price rises were mainly attributed to the rapid growth in demand that far exceeded the growth in supply, along with rising geopolitical tensions amongst Russia and the west. The failure of the Organisation of Petroleum Exporting Countries and associated entities (OPEC+) to ramp up supply to meet with demand also contributed to the continued upward trend in energy prices. The year-on-year prices of several agricultural commodities surged over the period January 2021 to January 2022 such as wheat (20.12%), palm oil (35.80%), soybean oil (33.76%), beef (34.00%) and chicken (59.41%). Metals needed in the manufacturing and industrial sectors also posted substantial price gains such as aluminium (50.00%), copper (22.71%) and tin (90.65%) over the same time period. The general rise in prices across all commodity markets contributed to the acceleration in inflation in advanced economies to 3.1% in 2021 from 0.7% in 2020 and emerging market and developing economies to 5.7% from 5.1% over the same period.

Throughout 2022, commodity prices are forecasted to remain elevated but will begin to gradually decline in the coming years as supply-chain disruptions dissipate. Ongoing Russia-West tensions will place upward pressure on oil prices given Russia’s position as the second largest oil exporter in the world. In January 2022, OPEC+ decided to increase crude oil production by 400,000 barrels per day in order to minimise the gap between demand and supply which is expected to lower the prices on energy commodities.

Domestic Economic Conditions

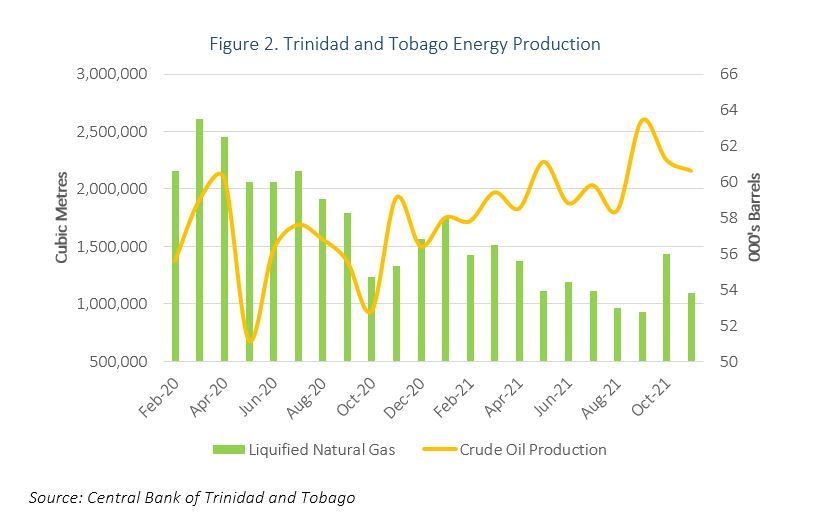

In 2021, Trinidad and Tobago (T&T) economy’s contracted by 1.01% in real GDP terms according to the International Monetary Fund (IMF), due to declines in overall domestic activity despite the rollback of various restrictions on several sectors such as hospitality, food and beverage as well as leisure. Declines in liquefied natural gas (LNG) production stemming from the closure of the Atlantic Train 1 facility and reduced utilisation rates at other LNG production facilities continue to strain T&T’s economic recovery and short-term growth potential. Various non-energy sectors posted declines in year-on-year activity for Q3 2021 such as wholesale and retail trade (10.9%), construction (13.0%) as well as supermarkets and groceries (9.0%). Year-on-year growth in Q3 2021 was posted in sectors such as transportation and storage (8.1%), financial and insurance activities (3.2%) as well as manufacturing (1.1%).

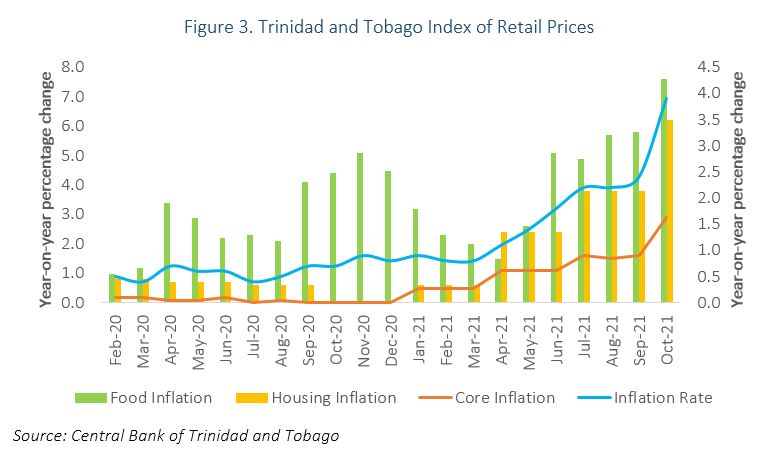

According to the Ministry of Labour, 1,098 persons were retrenched during the first ten months of 2021 and were reported in industries such as restaurants and hotels, energy and manufacturing. Headline inflation increased in November 2021 to 3.6% from 1.8% in June 2021 stemming from the surge in international food prices, higher shipping costs and international transportation delays. In the coming months, inflation is expected to remain elevated due to ongoing geopolitical tensions that continue to place upward pressure on commodity prices, as well as international supply chain disruptions and increased shipping costs.

Conclusion

In the years leading up to the pandemic, geopolitical tensions were high as well due to the disagreements on trade between the US and China however, the change in US presidency and the ongoing pandemic led to an ease in the tensions between the two nations. In 2021, the strained relationship between Ukraine and Russia flared up with the possibility of Ukraine joining NATO, a movement deemed negative to Russia’s national security according to President Putin. The amassing of troops near the two nations’ borders intensified concerns of western leaders in Europe and the US as it was speculated that if tensions continue to rise, Russia may invade Ukraine in the coming months. The potential escalation in tensions placed upward pressure on prices in commodity markets, in particular oil and gas. Global inflationary pressures is expected to remain elevated in the short-term as higher oil and gas prices impact the prices of goods and services especially coupled with the rise in global transportation costs. Ukraine is a major exporter of food commodities such as corn, seed oils and wheat, which have all been rising in the past months and are forecasted to rise further in the short-term. Heightened tensions and speculation of an invasion is expected to boost prices of these commodities due to the possible disruptions to their production and export capacities. The rising geopolitical tensions will have a spill over effect on T&T’s economy which runs an import bill worth over 23% of GDP in 2020. In the domestic market, the prices of food items, metals commodities such as steel and aluminium may continue to rise in the short-term and remain high due to the heightened geopolitical tensions. Although higher energy prices support economic activity, government revenue, per capita income and ultimately private consumption, weak oil and gas production may hinder the nation’s ability to benefit from the higher prices.

DISCLAIMER

First Citizens Bank Limited (hereinafter “the Bank”) has prepared this report which is provided for informational purposes only and without any obligation, whether contractual or otherwise. The content of the report is subject to change without any prior notice. All opinions and estimates in the report constitute the author’s own judgment as at the date of the report. All information contained in the report that has been obtained or arrived at from sources which the Bank believes to be reliable in good faith but the Bank disclaims any warranty, express or implied, as to the accuracy, timeliness, completeness of the information given or the assessments made in the report and opinions expressed in the report may change without notice. The Bank disclaims any and all warranties, express or implied, including without limitation warranties of satisfactory quality and fitness for a particular purpose with respect to the information contained in the report. This report does not constitute nor is it intended as a solicitation, an offer, a recommendation to buy, hold, or sell any securities, products, service, investment or a recommendation to participate in any particular trading scheme discussed herein. The securities discussed in this report may not be suitable to all investors, therefore Investors wishing to purchase any of the securities mentioned should consult an investment adviser. The information in this report is not intended, in part or in whole, as financial advice. The information in this report shall not be used as part of any prospectus, offering memorandum or other disclosure ascribable to any issuer of securities. The use of the information in this report for the purpose of or with the effect of incorporating any such information into any disclosure intended for any investor or potential investor is not authorized.

DISCLOSURE

We, First Citizens Bank Limited hereby state that (1) the views expressed in this Research report reflect our personal view about any or all of the subject securities or issuers referred to in this Research report, (2) we are a beneficial owner of securities of the issuer (3) no part of our compensation was, is or will be directly or indirectly related to the specific recommendations or views expressed in this Research report (4) we have acted as underwriter in the distribution of securities referred to in this Research report in the three years immediately preceding and (5) we do have a direct or indirect financial or other interest in the subject securities or issuers referred to in this Research report.