Bitcoin ETF Approval & Cryptocurrency Adoption

Commentary

On January 10, 2024, the United States Securities and Exchange Commission (SEC) granted approval for the listing and trading of spot bitcoin exchange-traded funds (BTC ETFs). This marks a reversal from the U.S. court’s decision in August 2023, when the SEC denied Grayscale Investments’ application to introduce a spot Bitcoin ETF.

A total of eleven companies had their applications approved, including prominent names like Blackrock, Fidelity, and Grayscale Investments. This regulatory development is expected to simplify the process for investors looking to gain exposure to bitcoin through traditional channels.

Furthermore, it’s worth noting that while spot bitcoin ETFs already exist in Canada and Europe, the United States boasts the world’s largest capital market, housing some of the globe’s most significant asset managers and institutional investors. As a result, this regulatory approval establishes a mainstream platform for the virtual asset within the United States.

What is a Spot Bitcoin ETF?

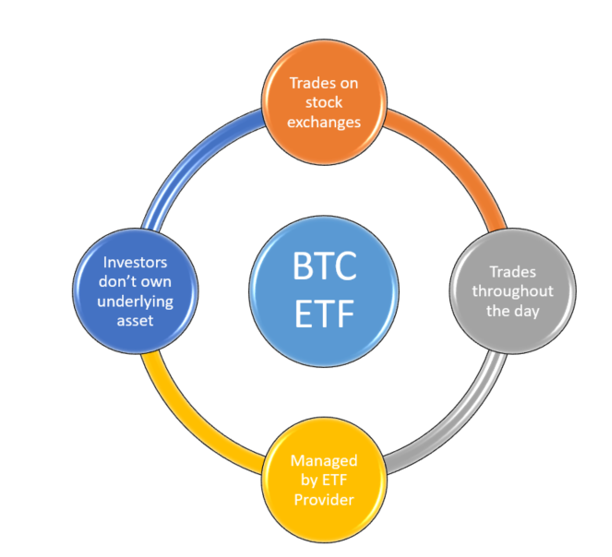

A bitcoin exchange-traded fund (ETF) is essentially an investment fund, akin to a mutual fund, designed to mirror the performance of an underlying asset. This underlying asset could be various things, such as stocks, a basket of currencies, a precious metal like gold, or, in the specific case of a bitcoin ETF, the cryptocurrency itself. Unlike traditional mutual funds, ETFs are traded on stock exchanges, enabling investors to buy and sell ETF shares at market prices throughout the trading day.

The term “spot” in this context refers to the immediate purchase or sale of the underlying assets, such as stocks or bonds, rather than engaging in futures or derivative contracts. Spot ETFs provide investors with an efficient and transparent way to gain exposure to a broad market index or a specific sector without having to buy individual securities.

Bitcoin Exchange-Traded Fund

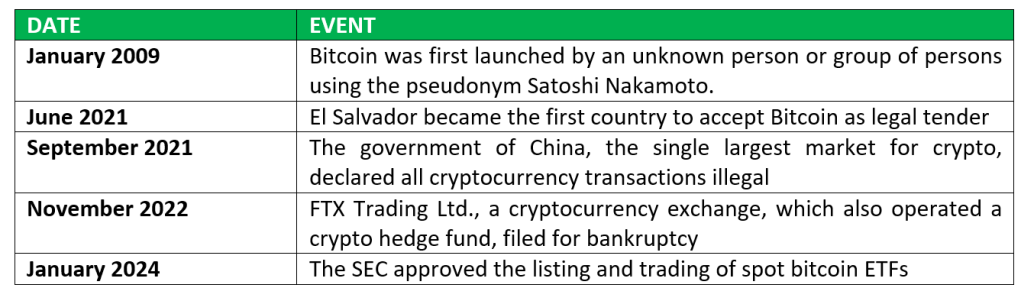

Developments in Cryptocurrency

Cryptocurrency (or crypto) has undergone several periods of value as well as contraction.

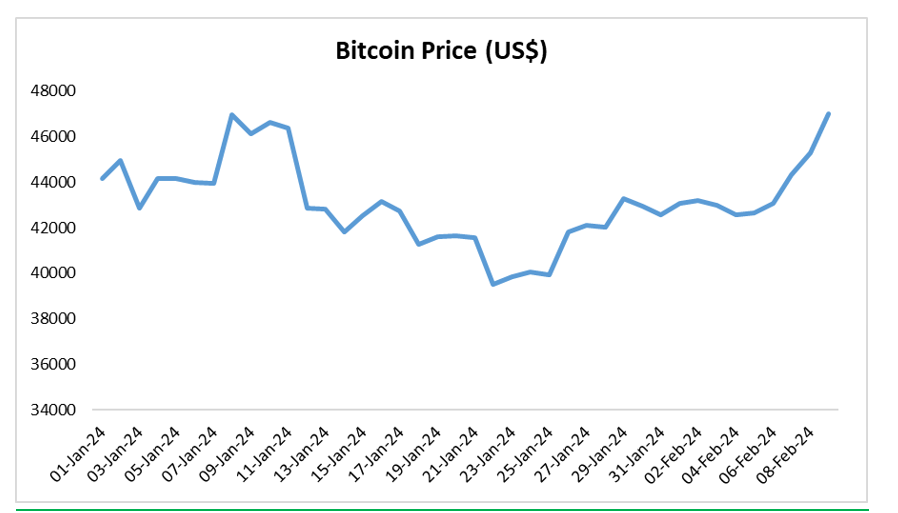

The impact of SEC Approval of Spot Bitcoin ETFs

The approval of a series of spot Bitcoin ETFs by the SEC marks a significant milestone in the cryptocurrency realm, ending over a decade of hesitancy and legal challenges. Despite the momentous nature of this approval, the immediate market response showed relative restraint. Initially, Bitcoin’s price saw an uptick nearing USD46,000, but it later receded to a low of USD39,075 as of January 23, 2024.

Several factors may account for this subdued price surge. Firstly, market expectations of the approval might have led to a less pronounced increase in price following the official announcement. Additionally, lingering regulatory uncertainties, despite the approval, could have tempered the overall market reaction.

Moreover, active traders might have augmented their bitcoin holdings in anticipation of the approval, leveraging the pre-approval price increase to capitalize on gains. This strategy could have exerted downward pressure on the price, contributing to the observed market dynamics.

Bitcoin Price Post Spot ETF Approval

What Bitcoin ETFs Mean for Investors and Crypto Adoption

Investing in Bitcoin, like any other investment, is not without risks, encompassing market fluctuations, regulatory changes, and cybersecurity threats. Bitcoin ETFs, however, offer a unique advantage by providing large institutions and market participants with exposure to the asset class without direct ownership, thereby mitigating inherent price and custody risks. This ETF structure also serves as an avenue for investors who were previously restricted from directly investing in alternative assets.

Bitcoin ETFs are anticipated to address concerns related to self-storage risks, potential cyberattacks or fraud, and legal uncertainties, instilling a sense of security and augmenting their attractiveness.

The reduction of the reward for mining new blocks, targeted for April 2024, will reduce availability, increasing scarcity and potentially driving up its value. Some cryptocurrency investors see the approval of spot Bitcoin ETFs as a gateway to institutional crypto investment, serving as a bullish catalyst for the market. However, there are concerns about potential negative consequences if large companies like BlackRock and other ETF issuers amass a significant portion of the world’s bitcoin for their ETFs, potentially causing market stagnation.

The approval of BTC ETFs has set off a global ripple effect, with financial hubs like Hong Kong preparing to launch additional bitcoin ETFs. This widespread adoption underscores Bitcoin’s growing acceptance and its potential to become a standard component in investment portfolios worldwide.

Conclusion

The SEC’s approval of BTC ETFs marks a significant milestone for the cryptocurrency industry, offering potential for increased liquidity and broader adoption. However, the pace of adoption is uncertain due to lingering skepticism from some investors and the SEC regarding this alternative asset. Despite approving BTC ETFs, the SEC emphasizes its non-endorsement of bitcoin or crypto trading platforms, citing non-compliance with federal securities laws and conflicts of interest.

Nevertheless, BTC ETFs have the potential to enhance the image and social acceptance of bitcoin as an asset class, reflecting a bullish outlook for its future. The approval signals the integration of traditional finance and crypto, reshaping the investment landscape with reduced barriers, institutional support, and potential widespread acceptance. Investors should comprehend the benefits, risks, and regulatory framework associated with BTC ETFs to make informed decisions aligned with their financial goals.

DISCLAIMER

First Citizens Bank Limited (hereinafter “the Bank”) has prepared this report which is provided for informational purposes only and without any obligation, whether contractual or otherwise. The content of the report is subject to change without any prior notice. All opinions and estimates in the report constitute the author’s own judgment as at the date of the report. All information contained in the report that has been obtained or arrived at from sources which the Bank believes to be reliable in good faith but the Bank disclaims any warranty, express or implied, as to the accuracy, timeliness, completeness of the information given or the assessments made in the report and opinions expressed in the report may change without notice. The Bank disclaims any and all warranties, express or implied, including without limitation warranties of satisfactory quality and fitness for a particular purpose with respect to the information contained in the report. This report does not constitute nor is it intended as a solicitation, an offer, a recommendation to buy, hold, or sell any securities, products, service, investment or a recommendation to participate in any particular trading scheme discussed herein. The securities discussed in this report may not be suitable to all investors, therefore Investors wishing to purchase any of the securities mentioned should consult an investment adviser. The information in this report is not intended, in part or in whole, as financial advice. The information in this report shall not be used as part of any prospectus, offering memorandum or other disclosure ascribable to any issuer of securities. The use of the information in this report for the purpose of or with the effect of incorporating any such information into any disclosure intended for any investor or potential investor is not authorized.

DISCLOSURE

We, First Citizens Bank Limited hereby state that (1) the views expressed in this Research report reflect our personal view about any or all of the subject securities or issuers referred to in this Research report, (2) we are a beneficial owner of securities of the issuer (3) no part of our compensation was, is or will be directly or indirectly related to the specific recommendations or views expressed in this Research report (4) we have acted as underwriter in the distribution of securities referred to in this Research report in the three years immediately preceding and (5) we do have a direct or indirect financial or other interest in the subject securities or issuers referred to in this Research report.