T&T’s Economic Update

Commentary

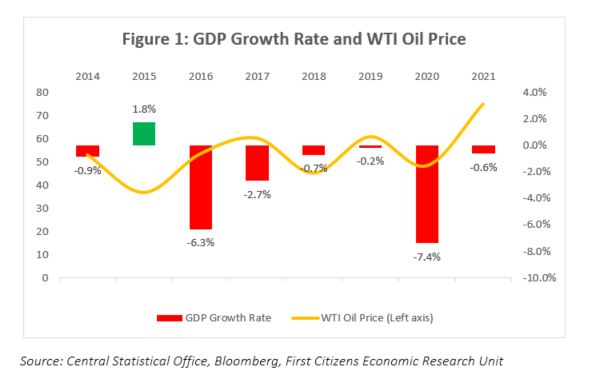

Trinidad and Tobago’s (T&T) economic performance has historically mirrored the movements in the global energy market given the significance of the energy sector in terms of government revenue, export earnings as well as contribution to GDP. Following the 2014/ 2015 oil price crash, real GDP in T&T contracted in the six subsequent years, with the contraction worsening further by the pandemic in 2020. The recent strong rally in energy commodity prices has improved the outlook for commodity-exporters globally, including that of T&T. In the mid-year review of fiscal 2022/ 2023, there was some level of cautious optimism with regards to the prospects for the T&T economy, given the estimated and projected data that were presented. There are nascent developments in the energy sector, and together with the higher energy prices, have supported the fiscal and external accounts over the first half of the fiscal year. Notwithstanding these encouraging signs, the non-energy sector still faces challenges as the economy emerges from the massive pandemic-induced economic fallout.

Economic Recovery Still Fragile Amid Rising Prices Pressures

Official data from the Central Statistical Office (CSO) show that real GDP contracted during the fourth quarter of 2021, by 0.1%, after posting two previous quarters of growth. The performance by sector was mixed during the final three months of 2021, as the mining and quarrying industry posted a decline of 0.4% (year on year), while the manufacture of petroleum and chemical products rose by 5.9%. The energy sector accounted for around 29.4% of GDP[1] at the end of 2021, down from 36.2% of GDP in 2014. On a year on year basis, October and December were the only two months of 2021 to record positive growth in natural gas production, by a substantial 16.2% in October driven by the start-up of bpTT’s Matapal project in September 2021 and marginal growth of 0.3% in December. Since then however, output has fallen by an average of 5.6% in the first three months of 2022. Crude oil daily production average has been on the increase, supported by BHP’s Ruby Development, which came on stream in May 2021. In the 12 months to March 2022, however, crude production has declined by 2.2%. The petrochemical industry has experienced increased production recently, however, its performance remains quite volatile. Manufacture of petrochemicals has been on the rise since Q22021, with average growth of 13.5% during the full year 2021, boosted by strong growth of 27.5% during the third quarter of the year.

In the non-energy sector, there were some encouraging signs, with construction activity up sharply by an average of 13% in 2021, while manufacturing rose by an average of 0.4%, but many sectors continue to face challenges even as pandemic-induced restrictions have been lifted.

Based on our rough calculations[2], the energy sector contracted by 5.3% in 2021, while non-energy[3] grew by 1.5%. This has led to an estimated decline of 0.62% in overall GDP for 2021, continuing the contraction recorded over the preceding five-year period, when the economy shrank by an average of 3.5%.

[1] Calculated as the sum of mining and quarrying and the manufacture of petroleum and chemical products in the National Accounts

[2] Energy GDP estimated by summing mining and quarrying and the manufacture of petroleum and chemical products in the National Accounts

[3] Calculated as the difference between GDP at basic prices and the sum of mining and quarrying and the manufacture of petroleum and chemical products in the National Accounts

Similar to the international trend of higher inflation, T&T’s inflation rate has moved upward, with the latest data showing that prices, as measured by the retail price index, rose by 4.9% in May 2022 on a year-on-year basis. Food inflation rose 8.1% while core inflation, which removes food prices, also trend higher.

Strong Revenue Growth Bolsters Fiscal Account

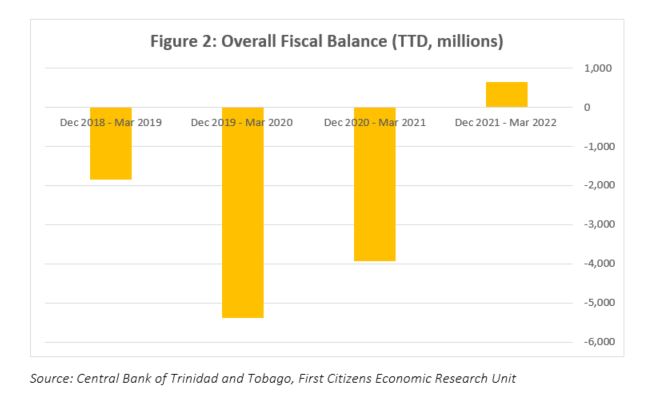

The favourable international energy market has benefitted government’s fiscal operations. Indeed, government revenue increased by 32.9% during the first half of the fiscal year (FY) (October 2021 – March 2022). This performance was primarily driven by a sharp rise in central government energy revenue, which increased from TTD3.1 billion in the first half of last FY to TTD10.3 billion in the same period in the current FY. This was supported by the sharp rise in international energy prices (WTI oil price increased by 32.5% and averaged USD85.91 per barrel during this period) as well as the uptick in production levels in the energy sector. Despite the removal of restrictions on business activity, non-energy revenue fell by 6% in the same period and highlights the challenges that the non-energy sector continues to face even as normal business activity resumes.

On the expenditure side, government spending rose by 5.9%, with fairly large increases in most categories including goods and services (+13.7%), interest payments (+12.3%) and capital expenditure which rose by 54% during the period October 2021 – March 2022, compared to the same period in the previous year.

As revenue growth outpaced the increase in expenditure, the overall fiscal account ended the period in a surplus position of TTD654 million, from a deficit of TTD3.9 billion in the same period a year earlier. The fiscal deficit for the full fiscal year ended 30 September 2021 came in at TTD13.7 billion

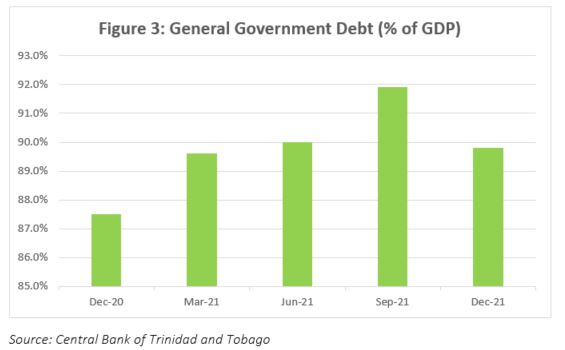

At the end of December 2021, the adjusted general government debt (excludes debt issued for sterilization purposes) stood at TTD130.3 billion or 83.3% of GDP, while the total general government debt stood at 89.8% of GDP (TTD140.6 billion). Domestic debt accounted for 55% of the central government’s debt outstanding (43% of GDP), while external debt represented 20.5% of GDP.

Financial Buffers

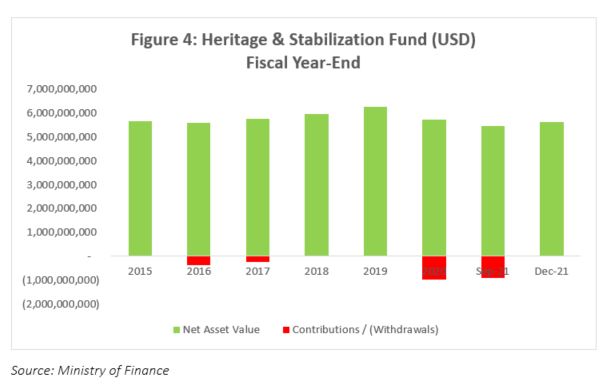

At the end of December 2021, the net asset value of T&T’s sovereign wealth fund – the Heritage and Stabilization Fund (HSF) stood at USD5.6 billion, up by 2.9% relative to the September 2021 closing value of the Fund. During the quarter, the HSF’s investment portfolio returned 2.97% driven by the positive performance of US Core Domestic Equities, according to the HSF’s Quarterly Report for the period ended December 2021. During the fiscal years 2020 and 2021, a total of USD1.87 billion was withdrawn from the HSF to help finance the widening fiscal shortfalls. In March 2020, the HSF Act was amended and approved by Parliament to allow for withdrawals of up to USD1.5 billion during a financial year to help finance the COVID-19 pandemic.

Year to date (YTD), T&T’s Net Official Reserves continued its generally downward trend, ending June 2022 at USD6.76 billion or 8.2 months of import cover. In February 2022, external reserves dipped to a YTD low of USD6.65 billion, and has since bounced by around 1.62%.

Standard and Poor’s estimates that the government’s liquid financial assets (comprising the HSF and other liquid funds such as treasury and other deposits held at the central bank) represent approximately 47% of GDP and that the HSF assets to average almost 20% of GDP during the period 2021 – 2024. Accordingly, S&P believes that the country’s sizeable financial buffers are likely to ‘mitigate the effect of economic cycles on the country’s fiscal performance’.

Challenges Persist

While 2022 began with more optimistic prospects as pandemic-related restrictions continued to be lifted across economies worldwide and normal business activity resumed, a culmination of factors would have severely dampened the outlook since. The ongoing conflict in Eastern Europe which has resulted in a commodity price-shock and the rising inflationary conditions have both slowed growth globally. The resultant tighter economic policies to combat soaring inflation will also impede economic activity.

These exogenous factors are likely to affect the T&T recovery. The commodity price shock has benefitted T&T in terms of improvements in the fiscal account as well as a boost in the external account through higher energy export earnings. Despite this however, the economic recovery remains fragile and the outlook is uncertain given the risks to the global economy. The resurgence in COVID-19 cases particularly in China has reignited concerns of prolonged bottlenecks in global supply chains, which may further fuel inflation. The tighter monetary policy stance, specifically in the US may have implications for domestic interest rate policy as well. At the June 2022 Monetary Policy Committee (MPC) meeting, the CBTT left the repo rate (the policy interest rate) unchanged at 3.5%, citing that the ‘impulses to domestic prices were currently externally generated and the statistics on credit and real sector activity pointed to a recovery that was underway but yet to be firmly established’. Any domestic interest rate decision will likely be based on the evolution of inflation weighed against the recovery in the domestic economy.

DISCLAIMER

First Citizens Bank Limited (hereinafter “the Bank”) has prepared this report which is provided for informational purposes only and without any obligation, whether contractual or otherwise. The content of the report is subject to change without any prior notice. All opinions and estimates in the report constitute the author’s own judgment as at the date of the report. All information contained in the report that has been obtained or arrived at from sources which the Bank believes to be reliable in good faith but the Bank disclaims any warranty, express or implied, as to the accuracy, timeliness, completeness of the information given or the assessments made in the report and opinions expressed in the report may change without notice. The Bank disclaims any and all warranties, express or implied, including without limitation warranties of satisfactory quality and fitness for a particular purpose with respect to the information contained in the report. This report does not constitute nor is it intended as a solicitation, an offer, a recommendation to buy, hold, or sell any securities, products, service, investment or a recommendation to participate in any particular trading scheme discussed herein. The securities discussed in this report may not be suitable to all investors, therefore Investors wishing to purchase any of the securities mentioned should consult an investment adviser. The information in this report is not intended, in part or in whole, as financial advice. The information in this report shall not be used as part of any prospectus, offering memorandum or other disclosure ascribable to any issuer of securities. The use of the information in this report for the purpose of or with the effect of incorporating any such information into any disclosure intended for any investor or potential investor is not authorized.

DISCLOSURE

We, First Citizens Bank Limited hereby state that (1) the views expressed in this Research report reflect our personal view about any or all of the subject securities or issuers referred to in this Research report, (2) we are a beneficial owner of securities of the issuer (3) no part of our compensation was, is or will be directly or indirectly related to the specific recommendations or views expressed in this Research report (4) we have acted as underwriter in the distribution of securities referred to in this Research report in the three years immediately preceding and (5) we do have a direct or indirect financial or other interest in the subject securities or issuers referred to in this Research report.