Budget FY2021/22: Sectoral Initiatives Hope to Boost Economic and Fiscal Prospects

Commentary

The Budget Statement for FY2021/22 was delivered on 4 October 2021, kicking off debates in both Parliament and the public square. Based on oil and gas price assumptions of USD65/bbl and USD3.75/mmbtu respectively, projected revenues are TTD43.33Bn and projected expenditure is TTD52.43Bn, yielding a projected deficit of TTD9.096Bn.

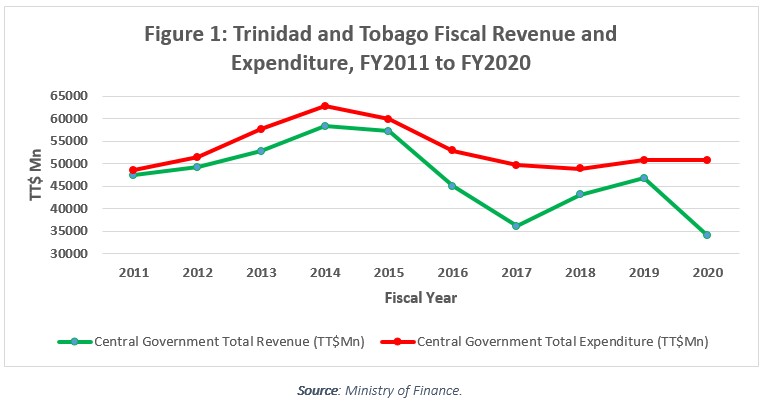

If the Government’s projections are realised, FY2021/22 would see a smaller deficit compared to the revised figures for FY2020/21, where revenue was estimated at TTD36.09Bn and expenditure was estimated at TTD56.8Bn. Figure 1 above shows the fiscal performance of Trinidad and Tobago in the period from 2011 to 2020.

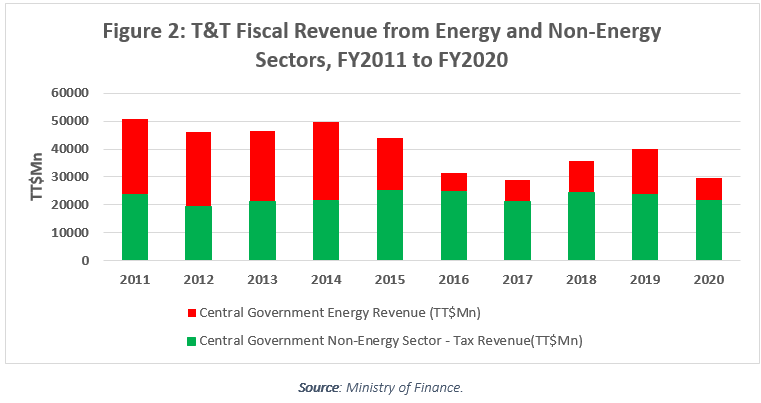

A further breakdown of the country’s revenues into energy and non-energy revenue, illustrated in Figure 2, reveals an interesting pattern. In the first half of the last decade, the energy sector contributed roughly half of total revenue. However, after the end of the commodity supercycle in the middle of the decade, this contribution declined rapidly, and the estimate for FY2021/22 is that energy revenues will represent less than 30% of the total. Non-energy revenues stayed relatively stable throughout the period, fluctuating in the TTD20Bn-25Bn range. With declining energy and flat non-energy income, overall revenues have sagged, especially since the onset of the COVID-19 pandemic.

Economic Rebound Requires Non-Energy Uptick

Given the stated intention of the Minister of Finance to achieve an overall fiscal balance by 2024, as well as the longer-term goal of economic diversification, there will be a need to significantly boost output and revenues from the non-energy sector if the domestic economy is to find more solid footing. In the Budget presentation, the Minister identified several fiscal incentives targeted at specific sectors of the economy, in particular the Agriculture, Construction, Digital and Manufacturing sectors. These incentives include but are not limited to:

- A TTD300Mn allocation to the Agriculture Stimulus Package Fund;

- A 50% tax exemption on the first $100,000 of chargeable income in the first year and the first $200,000 in the second year for new companies in the digital sector;

- A Development and Expansion Incentive for manufacturers investing in productive capacity, equivalent to a 5% tax reduction;

- A 3-year, 5% tax reduction for SMEs in the construction and digital sectors; and

- A Research and Development Capital Allowance of up to 40% of eligible expenditure.

Below we will briefly examine the performance of each targeted sector in recent times.

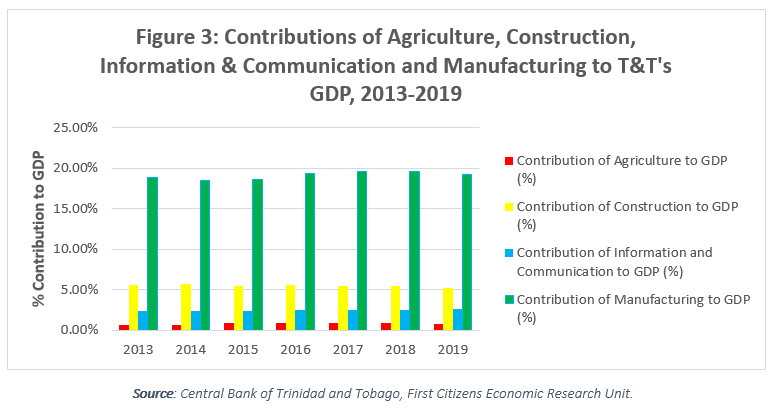

Figure 3 above illustrates the percentage contributions of the targeted sectors to the country’s GDP. Manufacturing is by far the largest contributor, with nearly 20% of domestic output in every year since 2013. However, it is important to note that in 2017 the CSO reclassified key industries such as LNG, petroleum refining and petrochemicals under Manufacturing, in accordance with the International Standard Industrial Classification of All Economic Activities (ISIC), revision 4. Previously these industries were classified under the Energy sector. Construction is the next largest contributor, at around 5% of GDP, while Information and Communication and Agriculture produce roughly 2.5% and 0.8% respectively. It should be noted that the Information and Communication sector encompasses both the digital sector (software, hardware, telecommunications and IT) and publishing activities, following ISIC rev. 4. Therefore, the digital sector will account for somewhat less than the stated Information and Communication sector figure, though an exact disaggregated estimate is not available.

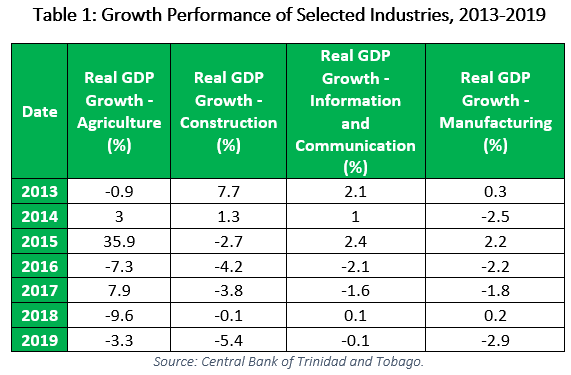

Turning to the recent growth performance of the targeted industries, illustrated in Table 1, the picture is fairly mixed. Agriculture experienced explosive growth of 35.9% in 2015, though in subsequent years the sector’s output has fluctuated significantly and generally tended towards the downside. According to the CBTT’s Quarterly Index of Real Economic Activity (QIEA), agricultural output grew by 33.7% between December 2019 and March 2021, and it appears that the COVID-19 pandemic has boosted local purchases of food items somewhat. This is a trend that Government will seek to encourage and sustain through its stimulus measures. Construction activity contracted in every year between 2015 and 2019, although the period from December 2019 – March 2021 did see a 6.8% increase in the construction QIEA, as some Government projects were initiated and continued when restrictions were lifted after the first COVID-19 wave. To maintain this momentum, however, more construction activity in the private sector will have to be incentivised, to ease the burden on Government investment as a driver of growth.

In the Information and Communication sector, growth from 2013-2019 was fairly flat, with positive growth in one year often reversed in the following year. The QIEA for the pandemic period December 2019 – March 2021 shows a similar pattern, with 4% growth in that time. Though some economic sectors transitioned to work-from-home and digital transformation initiatives were announced by Government and the private sector, thus far the impact on digital sector productivity has not yet been as explosive as hoped for. In Manufacturing, growth has been flat since 2013, and pandemic-era output has declined further, by 6.9% between December 2019 and March 2021. Though manufacturing was one of the first sectors to partially reopen following the initial lockdowns of 2020, significant work must be done to revive the fortunes of a significant non-energy contributor to the economy.

While the sectoral incentives announced in the Budget will come at some initial cost to the taxpayer, they will, if successful, help to increase the non-energy contribution to GDP. A significant turnaround in the targeted sectors, especially in manufacturing, plus improvements in tax administration through the proposed T&T Revenue Authority (TTRA), would increase the revenues available to the Government and hopefully bring the country closer to balancing the budget over the medium term.

DISCLAIMER

First Citizens Bank Limited (hereinafter “the Bank”) has prepared this report which is provided for informational purposes only and without any obligation, whether contractual or otherwise. The content of the report is subject to change without any prior notice. All opinions and estimates in the report constitute the author’s own judgment as at the date of the report. All information contained in the report that has been obtained or arrived at from sources which the Bank believes to be reliable in good faith but the Bank disclaims any warranty, express or implied, as to the accuracy, timeliness, completeness of the information given or the assessments made in the report and opinions expressed in the report may change without notice. The Bank disclaims any and all warranties, express or implied, including without limitation warranties of satisfactory quality and fitness for a particular purpose with respect to the information contained in the report. This report does not constitute nor is it intended as a solicitation, an offer, a recommendation to buy, hold, or sell any securities, products, service, investment or a recommendation to participate in any particular trading scheme discussed herein. The securities discussed in this report may not be suitable to all investors, therefore Investors wishing to purchase any of the securities mentioned should consult an investment adviser. The information in this report is not intended, in part or in whole, as financial advice. The information in this report shall not be used as part of any prospectus, offering memorandum or other disclosure ascribable to any issuer of securities. The use of the information in this report for the purpose of or with the effect of incorporating any such information into any disclosure intended for any investor or potential investor is not authorized.

DISCLOSURE

We, First Citizens Bank Limited hereby state that (1) the views expressed in this Research report reflect our personal view about any or all of the subject securities or issuers referred to in this Research report, (2) we are a beneficial owner of securities of the issuer (3) no part of our compensation was, is or will be directly or indirectly related to the specific recommendations or views expressed in this Research report (4) we have acted as underwriter in the distribution of securities referred to in this Research report in the three years immediately preceding and (5) we do have a direct or indirect financial or other interest in the subject securities or issuers referred to in this Research report.