Credit Card FAQs

Frequently Asked Questions

What are the requirements for a Credit Card?

Credit Card Application Checklist

Scan and upload the following documents via the Online Credit Card Application Portal

- Salary slip, not more than 1 month old

- Two (2) forms of valid identification

- Proof of Address not older than 3 months* (bank statements can be provided as a proof of address)

- Job Letter addressed to First Citizens not older than 3 months old

- Politically Exposed Persons (P.E.P) Declaration for Individual Form – This is your declaration on if you are a Politically Exposed Person (PEP), which the Bank needs to know, in line with the Proceeds of Crime Act 2000 (as amended) and the Financial Obligations (Amendment) Regulations 2014, Regulations 20(3). Definitions on who qualifies as a PEP is provided on the form

- Customer Declaration – This form provides the Bank with the customer’s declaration on if he/she has any tax obligations in any jurisdiction outside of Trinidad and Trinidad. This is in line with the Tax Information Exchange Agreements (United States of America) Act 2017

- Credit Card Standing Order Form – This form allows you to easily make arrangements so that your credit card payments are automatically kept up to date via standing order options which suits you.

- Note: *If the proof of address e.g. utility bill, is not in your name, a letter of authorization from the person in whose name the bill is in should be provided, along with a copy of a valid ID of the said individual.

- ** Co-applicants must be a minimum 16 years and one form of valid identification is required

For any questions, please contact us via any of the options below:

- Chat with us via WebChat

- Email us at: cardsales@firstcitizenstt.com

How can I obtain my Credit Card statement balance due?

You can obtain your Credit Card statement balance due via:

- Monthly Credit Card statement

- Online Banking

- Telebanking

- Mobile App

How can I obtain my real time Credit Card available balance?

You can obtain your real time available balance via Online Banking, the Mobile App or the ATM

What is my Credit Card statement date and when is my payment due?

Please refer to Table I below:

Table I

| Card Type | Statement Date | Payment Due Date | Minimum Balance Calculation |

| Visa Tertiary | 10th monthly | 30th of the same month | 1/24 of the outstanding balance as at the statement date |

| Visa Classic | 13th monthly | 2nd of the following month | 1/24 of the outstanding balance as at the statement date |

| Visa Purple | 13th monthly | 2nd of the following month | 1/24 of the outstanding balance as at the statement date |

| Visa 2 In 1 | 13th monthly | 2nd of the following month | Full Payment: total balance as at the statement date Minimum Payment: loan installment plus 1/24 of the outstanding balance as at the statement date |

| Vacation Lifestyle Mastercard | 13th monthly | 2nd of the following month | 1/25 of the outstanding balance as at the statement date |

| Vacation Lifestyle MasterCard Gold | 16th monthly | 5th of the following month | 1/30 of the outstanding balance as at the statement date |

| Visa Gold, Platinum Signature and Infinite | 16th monthly | 5th of the following month | 1/30 of the outstanding balance as at the statement date |

How can I make a Credit Card payment?

You can make a Credit Card payment via:

- Online Banking

- Telebanking

- Mobile Banking App

- ATM

- Fast Deposit Boxes located in any conveniently located First Citizens Branch

- A Standing Order from your First Citizens account or another Bank’s account

How soon do I have access to funds paid to my Credit Card?

You will have immediate access to funds on your Credit Card, once transferred from your First Citizens account to your Credit Card via First Citizens Online Banking, the Mobile App or Telebanking.

Please note:

- Payments made on Monday – Thursday by 3:00 pm or Friday by 4:15 pm are updated the same night

- Payments made on Fridays after 4:15 pm, will be credited to your Credit Card on Monday night

- Payments made on public holidays will be credited the night of the next business day

What Credit Card Reward programmes are offered?

There are two main Credit Card Reward programmes currently offered:

Is there insurance coverage with my Credit Card?

International Emergency Medical Services and World Wide Auto Rental Insurance are offered to Visa Platinum, Signature and Infinite Credit Cardholders.

Please click here for further information

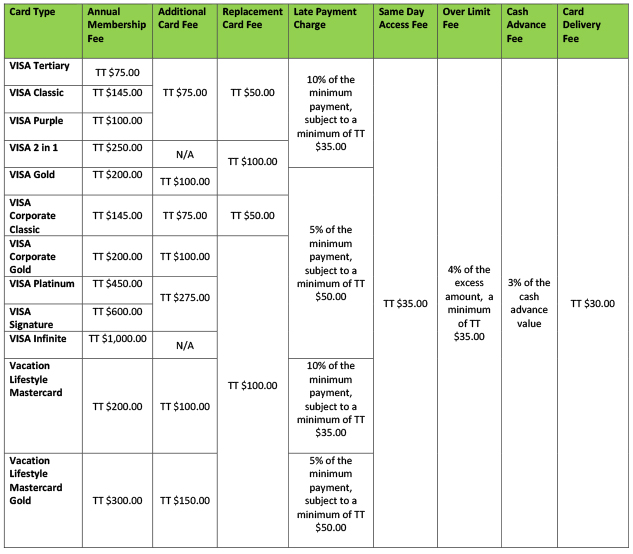

What are the fees and charges associated with my First Citizens Credit Card?

Please refer to Table II for the fees and charges associated with your First Citizens Credit Card:

Table II

When my Credit Card expires, how will I receive my renewed card?

Your renewed Credit Card will be directly delivered to you via TTPOST Couriers (TrackPak) to your mailing address currently on record at First Citizens. Please note, a delivery cost of TT $30.00 will be charged to your Credit Card.

How do I set a Standing Order payment to my Credit Card account?

You can log in to Online Banking:

- Click the “Payments” main tab and select “Standard Payee Payments” or

- Send a Secure Message by clicking the “My Messages” main tab and select “Send New Message” requesting a deduction of the minimum or full outstanding balance from your personal account on a specific date (the 28th is recommended).

You can also visit any conveniently located First Citizens Branch and a

Customer Service Representative will assist you.

How do I request a replacement card and/or PIN?

You can request a replacement card or PIN by logging in to Online Banking, click the “My Services” main tab, then select “Credit Card/ PIN Replacement”. Your card will be delivered within seven (7) business days and your PIN will be sent to a First Citizens Branch of your choice for collection. Please note, a delivery cost of TT $30.00 will be charged to your Credit Card.

For customers residing abroad, you can request a replacement card and/or PIN to be delivered by FedEx via Online Banking.

What should I do if my Credit Card is lost or stolen?

You are required to immediately call 62-FIRST (623-4778) to make a report and a new Credit Card will be issued and delivered to your local mailing address. Our Contact Centre is available every day from 6am to 10pm.

If you are abroad, call:

- VISA at 1-800-396-9665 when in the U.S.A /Canada, or in other countries, call 1-303-967-1098

- Mastercard at 1-800-307-7309 when in U.S.A /Canada, or in other countries, call or 1-636-722-7111