What is a Budget and its importance to Investors?

Commentary

A government budget is a financial plan that outlines a nation’s expected revenues and proposed expenditures for a specific timeframe, commonly a fiscal year. In the case of Trinidad & Tobago, the fiscal year spans from October 1st to September 30th.

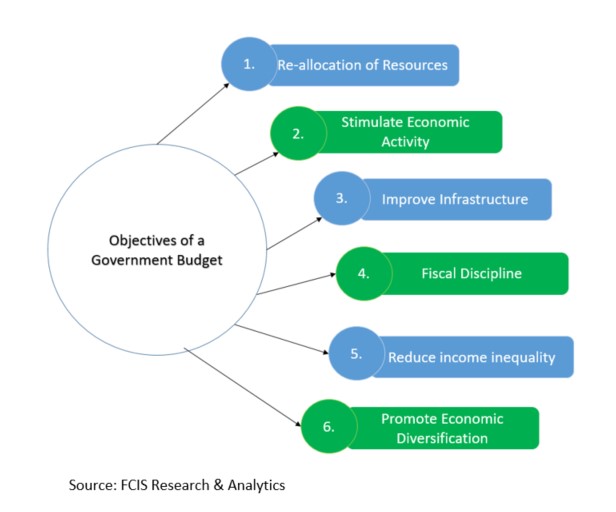

The objectives of a government budget are multi-faceted and encompass a spectrum of economic, social, and political aspirations. Among the primary objectives is the strategic reallocation of resources within a nation. Within the context of limited resources, the government faces the challenge of harmonizing competing demands. Within this context, a budget becomes a tool for prioritizing expenditures in alignment with the country’s needs and objectives. It plays a pivotal role in determining which sectors and programs warrants heightened attention and funding and thus ensures that critical domains like education, healthcare, infrastructure, and social welfare are adequately funded.

Investing in infrastructure is a key goal of many government budgets. Improved infrastructure, such as roads, bridges, and telecommunications, can enhance connectivity, facilitate trade, and attract private investment, thereby contributing to economic growth.

A well-structured budget aims to achieve fiscal discipline by ensuring that government expenditures do not exceed its revenues. This objective serves as a safeguard against excessive borrowing and the unwarranted accumulation of public debt, which could potentially precipitate economic instability over the long term.

Government budgets frequently incorporate provisions designed to alleviate poverty and support social welfare initiatives. By allocating funds to these targeted programs, governments aspire to elevate the living standards of marginalized and vulnerable populations thus reducing income inequality and promoting social equity.

Furthermore, budgets possess the potential to promote economic diversification by allocating resources to sectors extending beyond the conventional revenue sources. This strategic diversification reduces a nation’s dependency on a singular sector and augments the overall resilience of the economy.

Objectives of a Government Budget

Structure of a Budget

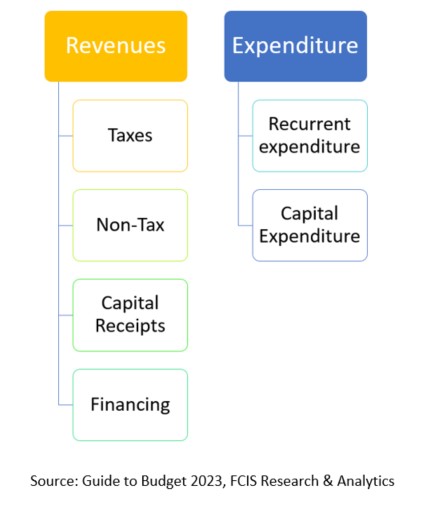

There are mainly two components of a budget: Revenues and Expenditures. Budget revenue is the monies collected by the Government that are used to fund its activities. In Trinidad & Tobago, revenues are primarily derived from four (4) sources:

- Tax Revenue: these are compulsory payments made by individuals and companies operating within the economy and includes taxes on income and profits, on goods and services, on property and international trade.

- Non-Tax Revenue: This segment pertains to revenue accrued from avenues other than taxes and includes property income, other non-tax revenue and repayment of past lending.

- Capital receipts: proceeds from the sale of government-owned assets such as land, buildings or equipment.

- Financing (Borrowing): Revenue generated from loans or borrowings by the government, which may include domestic or international borrowing.

Budget expenditure is categorized into two distinct components: Recurrent and Capital expenditure. Recurrent expenditure are disbursements for expenses incurred in the routine day-to-day operations and comprises salaries and wages of public officials, procurement of goods and services and the allocation of transfers and subsidies.

Subsidies are a form of financial aid extended to an economic sector (or institution, business, or individual) to support local industries, encourage investment and provide affordable services or goods to the population. The most common types of subsidies in Trinidad & Tobago are fuel, food, housing and public transportation.

Meanwhile, transfers denote payments intended to uphold social welfare initiatives, including cash transfers, pensions and social aid. These current transfers and subsidies constitute a significant portion of the government’s expenditure within the national budget, serving a pivotal role in addressing societal needs, aiding vulnerable demographics, fostering economic advancement and ensuring the provisioning of vital services.

Structure of Trinidad & Tobago National Budget

Fiscal Surplus & Deficit

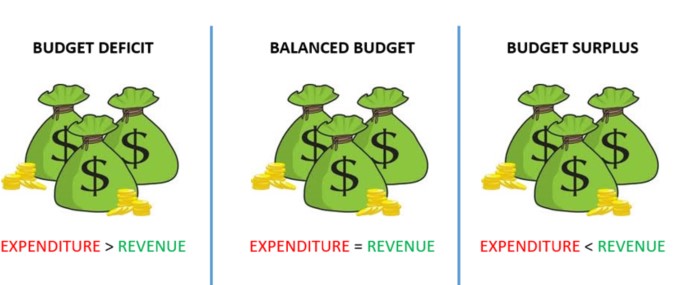

An overall fiscal balance in a national budget refers to the state of equilibrium between a government’s total expenditures and its total revenues over a specific period, typically a fiscal year. It signifies whether a government is spending more or less than it is collecting in terms of revenue. This balance provides insights into the government’s financial health and its ability to manage its finances responsibly.

There are three possible scenarios that can arise in relation to the overall fiscal balance: Fiscal surplus, fiscal deficit or fiscal balance. A fiscal surplus occurs when a government’s total revenues exceed its total expenditures and indicates that the government is collecting more revenue than it is spending, which can lead to a reduction in the national debt and an increase in fiscal stability.

A fiscal deficit arises when a government’s total expenditures exceed its total revenues which can lead to an increase in public debt as the government may need to borrow money to cover the shortfall. A balanced budget occurs when a government’s total revenues are equal to its total expenditures. In this scenario, there is neither a surplus nor a deficit. Achieving a balanced budget can indicate responsible fiscal management, but it’s worth noting that it may not always be feasible or advisable in certain economic situations. For example, during periods of economic recession, increased government spending can help stimulate economic activity and support the private sector.

Types of Budget

The National Budget and the Investor

The Trinidad & Tobago national budget is usually presented in the month of September. For investors, the government’s national budget is of significant importance as it provides valuable insights and signals about the economic and financial environment within the country. The upcoming budget will contain the government’s assessment of the economic conditions and its projections for the future. Investors should seek to analyze these projections to gauge the overall economic outlook of the country that will be crucial for investment decisions.

The budget usually highlights the sectors and projects that the government intends to invest in the upcoming fiscal period. This information is vital for investors looking for potential areas of growth and investment opportunities. For example, if the budget allocates substantial funds to infrastructure development, investors in construction, engineering, and related sectors may see potential for growth.

Investors should also closely examine the budget’s tax policies and incentives. Changes in tax rates, deductions, and incentives can impact businesses’ profitability and investment decisions. Favorable tax policies can attract investment, while unfavorable ones might lead investors to reconsider their strategies.

Investors should closely monitor the country’s national budget because it provides valuable insights into the government’s financial health, economic priorities, and policy direction. By analyzing the budget, investors can assess economic stability, fiscal responsibility, growth prospects and potential risks, enabling more informed investment strategies that will be aligned with the country’s economic trajectory.

DISCLAIMER

First Citizens Bank Limited (hereinafter “the Bank”) has prepared this report which is provided for informational purposes only and without any obligation, whether contractual or otherwise. The content of the report is subject to change without any prior notice. All opinions and estimates in the report constitute the author’s own judgment as at the date of the report. All information contained in the report that has been obtained or arrived at from sources which the Bank believes to be reliable in good faith but the Bank disclaims any warranty, express or implied, as to the accuracy, timeliness, completeness of the information given or the assessments made in the report and opinions expressed in the report may change without notice. The Bank disclaims any and all warranties, express or implied, including without limitation warranties of satisfactory quality and fitness for a particular purpose with respect to the information contained in the report. This report does not constitute nor is it intended as a solicitation, an offer, a recommendation to buy, hold, or sell any securities, products, service, investment or a recommendation to participate in any particular trading scheme discussed herein. The securities discussed in this report may not be suitable to all investors, therefore Investors wishing to purchase any of the securities mentioned should consult an investment adviser. The information in this report is not intended, in part or in whole, as financial advice. The information in this report shall not be used as part of any prospectus, offering memorandum or other disclosure ascribable to any issuer of securities. The use of the information in this report for the purpose of or with the effect of incorporating any such information into any disclosure intended for any investor or potential investor is not authorized.

DISCLOSURE

We, First Citizens Bank Limited hereby state that (1) the views expressed in this Research report reflect our personal view about any or all of the subject securities or issuers referred to in this Research report, (2) we are a beneficial owner of securities of the issuer (3) no part of our compensation was, is or will be directly or indirectly related to the specific recommendations or views expressed in this Research report (4) we have acted as underwriter in the distribution of securities referred to in this Research report in the three years immediately preceding and (5) we do have a direct or indirect financial or other interest in the subject securities or issuers referred to in this Research report.