US Treasury Yield Curve Inversion

By Shaquille Noel – Investment Analyst, Research & Analytics

Commentary

Whenever the US treasury yield curve inverts, markets tend to become agitated as it usually precedes a downturn in the US economy. The inverted yield curve in the US has gained much notoriety as a leading indicator of a recession over the past few decades and has accurately predicted every recession since the 1955 (nine in total) with one false signal during that time. The yield inversion of two-year and 10-year government bonds is the most widely viewed yield spread as a recession predictor. The severity of a recession and the length of time it takes before a recession is announced by the National Bureau of Economic Research (NBER) following an inversion, varies. As news of the inverted yield curve continue to make its way around media houses through the US, investors are increasingly aware of the implications for the US economy.

Treasury Yield Curve Explained

A treasury yield is the interest offered on debt instruments issued by the government. When the government issues debt securities such as bonds, they are essentially inviting lenders to loan them money over a fixed period of time for an agreed upon interest rate, also known as the yield. The yields offered on bonds are determined by the forces of demand and supply at play in the market. Longer-dated treasury instruments usually offer higher yields to investors when compared to the shorter-dated instruments due to the theoretical understanding that uncertainty grows as the time horizon lengthens. Investors are therefore compensated more for the added risk and uncertainty for lending money over a longer period of time.

The Treasury Yield Curve plots the yields of government bonds of different maturities. Under normal market conditions a yield curve is upward sloping, which illustrates the concept that the longer the term of the bond’s life the higher interest rates it offers. An inverted yield curve appears when the short-dated bonds are offering a higher yield. This is graphically illustrated by a yield curve that has a downward slope.

In the case of a yield curve inversion, short-dated treasury yields exceed those of longer-dated ones. This typically happens when there is an increase in demand for bonds with longer maturities. The increase in demand causes the price of the bond to rise and the yield to fall as there exists an inverse relationship between a bond’s price and its yield. As investors shift their money into bonds with longer maturities they would demand less short term bonds and even sell them. As their price falls, the yields on these short term bonds will rise further adding to a treasury yield curve inversion.

US Treasury Yield Curve

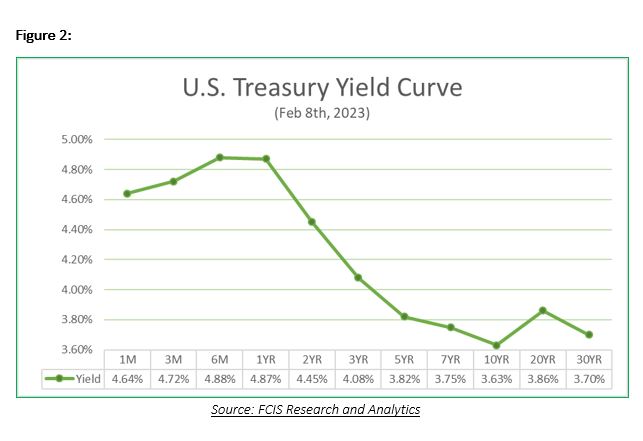

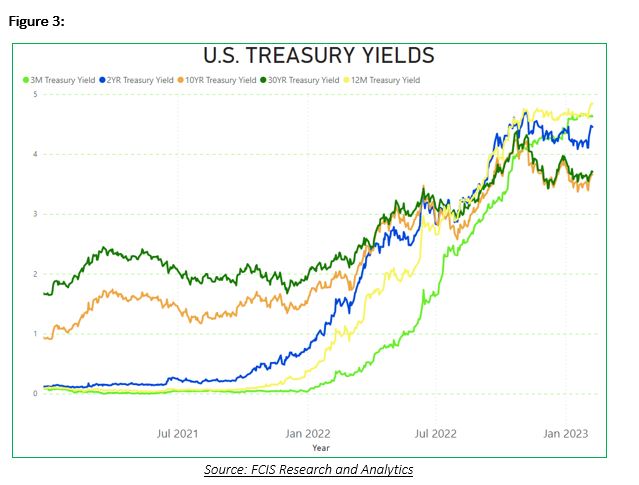

The treasury yield curve in the US inverted on 1 April 2022 after briefly inverting in 2019, which was the first inversion observed since 2006. Soon after, the yield curve reverted to its normal shape before inverting again on 5 July 2022. This trend persisted into 2023 where it remains to date. As at the 8 February 2023, the spread between the 10-year and two-year treasuries stood at -79.6 basis points (-0.796%). As the 10-year and two-year spread moved deeper into negative, other inversions were observed as can be observed in the US Treasury Yield Curve in Figure 2.

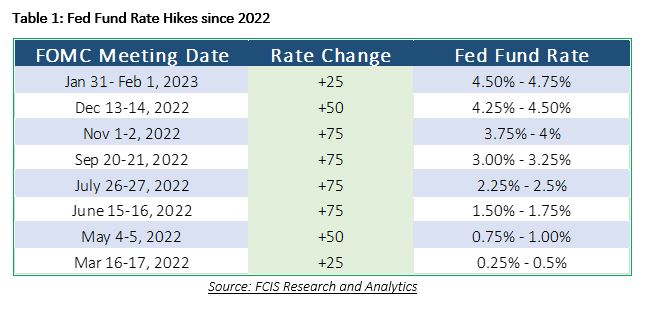

The United States Federal Reserve’s (Fed) commitment to reign in record high inflation and the possibility of such action resulting in a recession in the US is the main factor contributing to the yield curve inversion. Starting in 2022, the Fed began raising its benchmark interest rate (the Fed Fund Rate) in an effort to slow down the economy and bring down inflation. As the fed fund rate increases, the overall interest rate in the economy would follow suit as the fed fund rate acts as a base for different interest-rate-bearing financial instruments in the economy. With interest rates in the economy increasing, investors and individuals would be more enticed to seek safer government securities which are offering attractive rates rather than to continue to invest in riskier assets such as stocks. This contributes to a slowdown in economic activity as persons are spending less and saving more as the Fed continues to hike rates until they are satisfied that inflation has meaningfully come down.

Treasury Yields Outlook in 2023

Ever since the Fed has committed to hiking rates in the US, investor sentiment has been anchored to inflation and labour market data to gauge the Fed’s appetite to continue raising interest rates. At the last meeting in 2022, the Fed’s consensus target rate range of 5%-5.25% indicated that interest rates would be hiked by a further 75 basis points before they pause. In early February however, Fed chairman Jerome Powell delivered his State of the Union address revealing that should labour market data continue to come in strong, more rate hikes than what is already priced in may come. This latest revelation has cast uncertainty over when rate hikes would halt although investors still largely expect rate increases to come to an end towards the middle of 2023.

In the final quarter of 2022, overall treasury rates reversed its upward trend and began falling as investor sentiment on the bond market appeared to improve. The latest address by the Fed chairman has spooked investors because labour market data for January 2023 showed that conditions remain tight. In January 2023 more than half a million jobs were added, bringing the unemployment rate to its lowest in a decade. Investors expect that the Fed would maintain a strong appetite to raise rates beyond the expected consensus until labour market loosen as inflation continues to come down. Yield curves are expected to remain inverted throughout 2023 and treasury yields are expected to remain elevated in the near-term at least as investors gauge the rate hike trajectory by the Fed.

How To Position Your Portfolio

Inflation, Fed fund rate hikes and a possible recession are the key issues investors should consider when planning their investment strategy for 2023. The Federal Reserve’s main commitment remains reigning inflation even if it means some measure of economic pain. Asset allocation, which speaks to how investors structure their portfolio of investments, is of high importance with opportunities present in fixed income and equities.

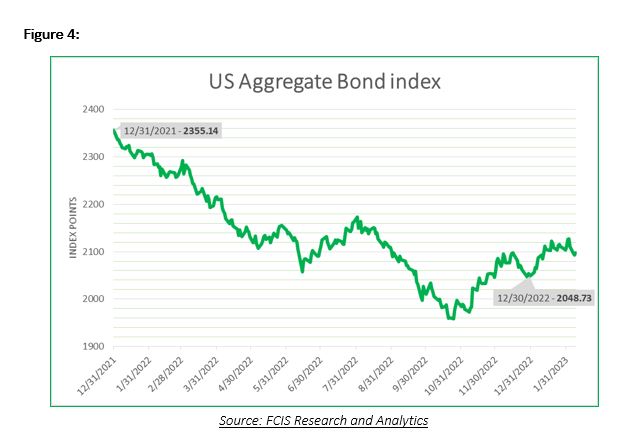

According to Edward McQuarrie, an investment historian and professor emeritus at Santa Clara University, the fixed income market experienced its worst year in 2022, down 13% according to the US Aggregate Bond Index, an index that tracks US investment-grade bonds (bonds with a low risk of default). The bond market was eroded by the Fed’s aggressive interest rate hike in 2022. Market intelligence in the US expects bonds to fare much better in 2023 as rate hikes are expected to halt by the first half of the year and as inflation is expected to continue to come down. Equally as important to the bond market performance in 2023 is that yields are at the highest in years which would be attractive to investors especially as the pace of rate hikes have slowed this year indicating that the hiking cycle may soon end. With a mild recession expected in 2023, the bond market provides a high-earning safe haven to investors which should more than offset bond price declines should Fed rate hike momentum concern bond investors.

The stock market performance in 2022 saw the S&P 500 down 19.44% for the year. Inflation and rising interest rates headlined some of the struggles corporates faced. Though stocks are now priced much lower since losing value in 2022, the outlook for stocks is still being tapered by the expectation of a recession beginning in the latter part of 2023. Defensive stocks and high dividend paying stocks are the best bet in the equity market to supplement less than impressive stock market returns which is usually the case during economic downturns. Defensive stocks from sectors such as healthcare, consumer staples and utilities usually outperform during economic downturns as demand for their goods and services prove to be stable regardless of the economic climate. High dividend yielding stocks provide investors with attractive income during periods where is it not as common. Investors can even use the dividends received to reinvested into the stock to supplement future dividend payments. Though the stock market is off to an excellent start in 2023, up by more than 7% YTD, the current and expected headwinds facing the market cautions against premature optimism.

Investors who develop a well thought out investment strategy and position their portfolio to account for the realities that are present, stand the best chance of maximising their returns. There will always exist some measure of risk in the investment landscape so working to build a diversified portfolio of assets is always advised and encouraged.

DISCLAIMER

First Citizens Bank Limited (hereinafter “the Bank”) has prepared this report which is provided for informational purposes only and without any obligation, whether contractual or otherwise. The content of the report is subject to change without any prior notice. All opinions and estimates in the report constitute the author’s own judgment as at the date of the report. All information contained in the report that has been obtained or arrived at from sources which the Bank believes to be reliable in good faith but the Bank disclaims any warranty, express or implied, as to the accuracy, timeliness, completeness of the information given or the assessments made in the report and opinions expressed in the report may change without notice. The Bank disclaims any and all warranties, express or implied, including without limitation warranties of satisfactory quality and fitness for a particular purpose with respect to the information contained in the report. This report does not constitute nor is it intended as a solicitation, an offer, a recommendation to buy, hold, or sell any securities, products, service, investment or a recommendation to participate in any particular trading scheme discussed herein. The securities discussed in this report may not be suitable to all investors, therefore Investors wishing to purchase any of the securities mentioned should consult an investment adviser. The information in this report is not intended, in part or in whole, as financial advice. The information in this report shall not be used as part of any prospectus, offering memorandum or other disclosure ascribable to any issuer of securities. The use of the information in this report for the purpose of or with the effect of incorporating any such information into any disclosure intended for any investor or potential investor is not authorized.

DISCLOSURE

We, First Citizens Bank Limited hereby state that (1) the views expressed in this Research report reflect our personal view about any or all of the subject securities or issuers referred to in this Research report, (2) we are a beneficial owner of securities of the issuer (3) no part of our compensation was, is or will be directly or indirectly related to the specific recommendations or views expressed in this Research report (4) we have acted as underwriter in the distribution of securities referred to in this Research report in the three years immediately preceding and (5) we do have a direct or indirect financial or other interest in the subject securities or issuers referred to in this Research report.