The US Infrastructure Development Plan and its Potential Sector Impact

Commentary

Following the passage of the USD $1.9 trillion coronavirus relief package, United States (US) president Joe Biden unveiled a USD $2.3 trillion infrastructure plan also known as the American Jobs Plan. This initiative is aimed at making major investments in the nation’s infrastructure and is intended to not only improve existing infrastructure, but also be a catalyst that will usher the United States into a greener and more environmentally sustainable future.

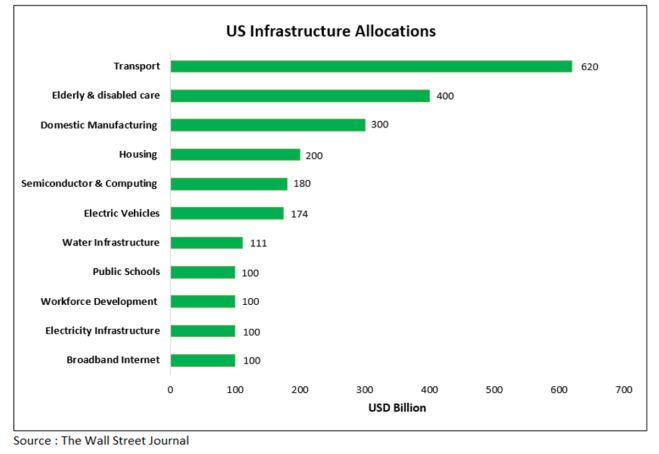

The White House plan dedicates US$620 billion to transportation, US$300 billion for domestic manufacturing efforts, US$111 billion to water infrastructure and US$100 billion to expand broadband access among other efforts. The investment will be primarily funded by increases in corporate taxes and has the potential to impact many sectors within the US economy. The plan is expected to be passed by the US Congress in July 2021.

While the investment is anticipated to have a positive ripple effect across most industries, there are specific sectors that stand to benefit much more following its approval and subsequent rollout.

Major Sectors impacted by the Infrastructure bill

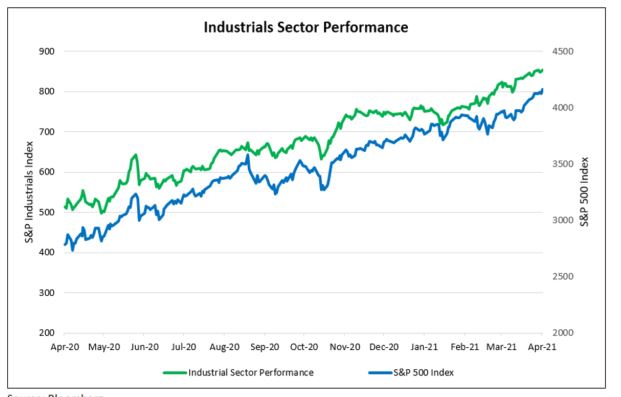

The Industrials sector stands to be the largest beneficiary due to the anticipated increase in demand for capital goods, industrial technology and building products. A major contributor to this demand would be the anticipated $620 billion spend with respect to transportation infrastructure which includes the modernization of roads and bridges. Industrial stocks have significantly outperformed the broader S&P 500 Index over the last three months, with the S&P 500 gaining 5.77% over the quarter compared to the Industrial sector which increased by 11%, and could be set for even more gains following approval of the bill.

The global semiconductor shortage has negatively impacted the US electronics and automotive sectors over the past six months as these industries have been unable to secure a consistent supply from foreign suppliers. The infrastructure bill proposes $50 billion geared towards boosting domestic semiconductor chip production and design, so less dependence is placed on countries such as China and Taiwan. This initiative is likely to gain bipartisan support in congress and could see the expansion of the semiconductor industry following the passage of the bill. As a result, investor sentiment towards this industry may be elevated especially in the second half of 2021.

There is also an anticipated shift in the automotive industry as the Biden administration has an aggressive $174 billion strategy to assist companies producing electric vehicles. The assistance ranges from direct subsidies to manufacturers to tax credits and other incentives for consumers. It also includes federal spending on 500,000 new charging stations to accelerate the rollout of infrastructure needed for a robust, functioning electric vehicle market. With increased demand projected in the electric vehicle market as a direct result of these incentives, major US automakers have undertaken significant investment to modify their fleets in order to meet this predicted surge in demand. Major US automaker General Motors would have allocated $27 billion dollars in 2020 towards the manufacture and development of electric vehicles.

The renewable energy sector also stands to benefit under the American Jobs Plan in an attempt to reshape the energy sector by promoting renewables while curbing fossil fuels. The plan is aimed at assisting clean energy producers with direct payments for research and development while also providing tax incentives for clean energy generation and storage. The plan would also seek to expand the market for renewable energy producers by instructing federal buildings to use only clean-power sources for energy, with the intention to move the US away entirely from carbon emitting sources by 2035. This proposed plan presents significant upside for the renewable energy sector following implementation.

Investment outlook

As the United States transitions into this new era of infrastructural development with significant upside for certain industries, it is vital that investors seek to position their portfolios in sectors that stand to benefit the most. While the bill will be strongly debated in congress with some amendments to be made, the democratic led party is likely to use its slim majority in order to implement the plan. As a result, an early transition of portfolios into these industries may likely lead to greater returns in the medium to long term.

DISCLAIMER

First Citizens Bank Limited (hereinafter “the Bank”) has prepared this report which is provided for informational purposes only and without any obligation, whether contractual or otherwise. The content of the report is subject to change without any prior notice. All opinions and estimates in the report constitute the author’s own judgment as at the date of the report. All information contained in the report that has been obtained or arrived at from sources which the Bank believes to be reliable in good faith but the Bank disclaims any warranty, express or implied, as to the accuracy, timeliness, completeness of the information given or the assessments made in the report and opinions expressed in the report may change without notice. The Bank disclaims any and all warranties, express or implied, including without limitation warranties of satisfactory quality and fitness for a particular purpose with respect to the information contained in the report. This report does not constitute nor is it intended as a solicitation, an offer, a recommendation to buy, hold, or sell any securities, products, service, investment or a recommendation to participate in any particular trading scheme discussed herein. The securities discussed in this report may not be suitable to all investors, therefore Investors wishing to purchase any of the securities mentioned should consult an investment adviser. The information in this report is not intended, in part or in whole, as financial advice. The information in this report shall not be used as part of any prospectus, offering memorandum or other disclosure ascribable to any issuer of securities. The use of the information in this report for the purpose of or with the effect of incorporating any such information into any disclosure intended for any investor or potential investor is not authorized.

DISCLOSURE

We, First Citizens Bank Limited hereby state that (1) the views expressed in this Research report reflect our personal view about any or all of the subject securities or issuers referred to in this Research report, (2) we are a beneficial owner of securities of the issuer (3) no part of our compensation was, is or will be directly or indirectly related to the specific recommendations or views expressed in this Research report (4) we have acted as underwriter in the distribution of securities referred to in this Research report in the three years immediately preceding and (5) we do have a direct or indirect financial or other interest in the subject securities or issuers referred to in this Research report.