The United States’ Economic Recovery

Commentary

The United States’ (US) economy is set to recover significantly in 2021 following a year of subpar economic performance due to restrictions on movement and trade implemented to protect citizens from the novel coronavirus. The economy is set to grow by 7.0% in 2021 following a contraction of 3.5% in 2020. Restrictions on movement of persons and business activity are slowly being lifted as the population becomes inoculated. Private consumption has increased sharply as households flocked to spend on sectors such as automotive, housing and retail. The swift rollout of vaccination drives across the States will contribute positively to the acceleration in growth in the short-term. In June 2021, it was noted the US vaccination campaign delivered roughly 2.5Mn vaccines per day since March. As of 14 July 2021, 336Mn vaccination doses were administered to the US population and roughly 160Mn citizens were fully vaccinated representing 48.9% of the entire population. Additionally, highly accommodative monetary policy, coupled with unprecedented fiscal stimulus continues to significantly support the US economic recovery.

Stimulus-Propelled Recovery

The government of the world’s largest economy was quick to enact expansionary fiscal policy measures to provide support to the economy, citizens and businesses.

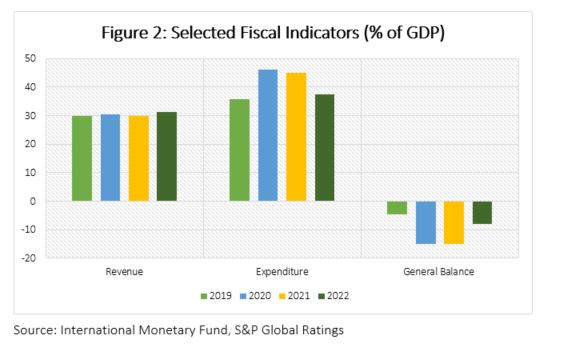

Government expenditure increased substantially by over USD2.8Tn in 2020 due to the government’s substantial fiscal stimulus package. Total government expenditure rose to 46.17% of GDP in 2020 from 35.68% in 2019 and will remain elevated in the short-term. The government plans to spend a further USD2.2Tn and USD1.8Tn on the American Jobs Plan (AJP) and the American Families Plan (AFP). The AJP will lead to critical investments in infrastructural projects including but not limited to the refurbishment of highways and bridges along with the upgrading of ports, airports, and transit terminals. The delivery of clean water, revitalisation of the electricity grid and construction of millions of homes are also included in the AJP. The AJP will provide millions of jobs to citizens in the medium-term and lower the unemployment rate drastically from 6.8% in 2020 to as low as 3.0% by 2023. The AFP is a major investment in human capital and aims to reduce poverty and inequality amongst major ethnic groups across the nation. The AFP will add at least four years of free public education, make college more affordable, provide direct support to children and families and extend tax cuts for families with children that fall into the lower and middle-income brackets in society.

The introduction of the sizable stimulus package in 2020 led to a sharp uptick in government debt from 79.2% of GDP in 2019 to 100.1% in 2020 which was necessary to finance the 14.9% of GDP fiscal deficit in 2020. Throughout the medium-term, net government debt will stay elevated at over 100% of GDP peaking at 107.3% of GDP in 2026 according to the International Monetary Fund (IMF).

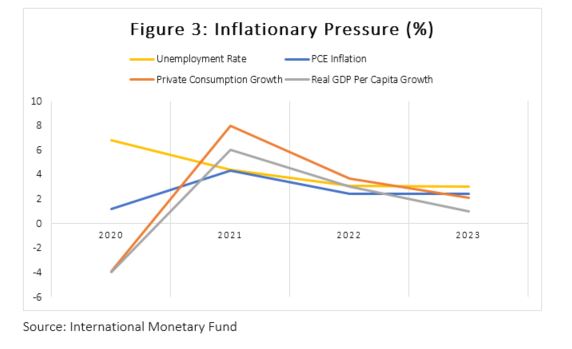

Private consumption declined by 3.9% in 2020 due to government restrictions. Reopening of the economy will lead to a reversal in this contraction with private final consumption expected to grow by 8.0% in 2021 as household spending recovers. In the first half of the year 2021, household spending was boosted by robust demand in the automotive and retail sectors. Spending on bars and restaurants as well as clothing helped lift the inflation rate to 3.8% in May 2021. Supply-side shortages of semiconductors for automobiles along with higher commodity prices provided upward pressure on the inflation rate. Inflation is projected to remain elevated in 2021 and 2022 as the economic recovery takes root. The recovery in commodity prices will also provide upward pressure on inflation averaging 4.3% and 2.4% annually in 2021 and 2022, respectively. Through the medium-term, strong wage growth will increase household incomes and contribute positively to household consumption, thus supporting inflationary expectations.

The Federal Reserve Bank (Fed) adjusted its monetary policy strategy to target an average inflation rate of 2% over the longer-term instead of adjusting monetary policy tools in response to short-term fluctuations of the inflation rate. The Fed aims to achieve maximum employment and inflation at 2% over the longer-term and will continue holding the current key policy rate (Fed funds rate) at 0-0.25% through to 2023 based on guidance from the last Fed meeting. The Fed intends to adjust policy rates when maximum employment is observed according to their calculations along with the rise in inflation to 2% with expectations for the rate to remain elevated. Additionally, the Fed engages in quantitative easing like the European Central Bank and the Bank of England, purchasing government debt monthly. The Fed spends USD80Bn in Treasury securities and USD40Bn in agency mortgage-backed securities each month to achieve the Fed’s goals. Several institutions such as S&P Global Ratings and Fitch Ratings expect the Fed to being raising the key interest rate near the end 2022 or mid 2023 due to inflation and unemployment rate projections.

The restrictions on the movement and business activity to reduce the spread of Covid-19 led to a substantial economic contraction in 2020. Unemployment soared to over 8% in the year as businesses shut down due to depressed revenues and activity, inflation averaged 1.2% in the year and government expenditure skyrocketed. Rapid vaccination rollouts throughout the nation will allow restrictions to be removed thus restoring business activity. This, in addition to pent up household demand will result in a strong economic recovery of 7.0% for 2021. Throughout the medium-term growth will be driven by large infrastructural projects introduced by the government such as the AJP and AFP. These plans will increase labour demand significantly and help reduce poverty levels, potentially reducing government support to these households. Robust investments in renewable energy projects and revitalisation of the national energy grid will provide further demand for labour. Annual per capita income will rise to USD68,308 in 2021 well beyond pre-pandemic levels of USD65,253 in 2019 due to upward pressure on wages stemming from labour market tightening.

The outlook for the US economy is favourable. Economic growth throughout the year will be supported by strong household consumption as the government’s effective vaccination drives allow for the lifting of pandemic-related restrictions. Growth will taper off to 4.9% and 1.9% in the 2022 and 2023 respectively but will be supported through large infrastructural projects such as the AJP and AFP. These plans will contribute significantly to the reduction in unemployment in the medium-term to 3.0% by 2023. The resumption of international trade will result in a gradual reduction in the current account deficit from 3.8% of GDP in 2021 to 1.9% by 2026 as the pace of export growth picks up over the horizon due to strong global demand for US goods and services.

DISCLAIMER

First Citizens Bank Limited (hereinafter “the Bank”) has prepared this report which is provided for informational purposes only and without any obligation, whether contractual or otherwise. The content of the report is subject to change without any prior notice. All opinions and estimates in the report constitute the author’s own judgment as at the date of the report. All information contained in the report that has been obtained or arrived at from sources which the Bank believes to be reliable in good faith but the Bank disclaims any warranty, express or implied, as to the accuracy, timeliness, completeness of the information given or the assessments made in the report and opinions expressed in the report may change without notice. The Bank disclaims any and all warranties, express or implied, including without limitation warranties of satisfactory quality and fitness for a particular purpose with respect to the information contained in the report. This report does not constitute nor is it intended as a solicitation, an offer, a recommendation to buy, hold, or sell any securities, products, service, investment or a recommendation to participate in any particular trading scheme discussed herein. The securities discussed in this report may not be suitable to all investors, therefore Investors wishing to purchase any of the securities mentioned should consult an investment adviser. The information in this report is not intended, in part or in whole, as financial advice. The information in this report shall not be used as part of any prospectus, offering memorandum or other disclosure ascribable to any issuer of securities. The use of the information in this report for the purpose of or with the effect of incorporating any such information into any disclosure intended for any investor or potential investor is not authorized.

DISCLOSURE

We, First Citizens Bank Limited hereby state that (1) the views expressed in this Research report reflect our personal view about any or all of the subject securities or issuers referred to in this Research report, (2) we are a beneficial owner of securities of the issuer (3) no part of our compensation was, is or will be directly or indirectly related to the specific recommendations or views expressed in this Research report (4) we have not acted as underwriter in the distribution of securities referred to in this Research report in the three years immediately preceding and (5) we do have a direct or indirect financial or other interest in the subject securities or issuers referred to in this Research report..