The Evergrande Liquidity Crisis and the Potential Impact on Emerging Markets

Commentary

The Company

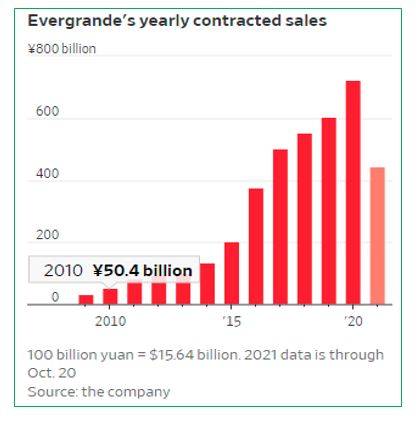

The China Evergrande Group is the second largest property developer in China by sales. Formerly called the Hengda Group, Evergrande was founded by Hui Ka Yan in the southern Chinese city of Guangzhou in 1996, during a period of mass urbanization in China. It sells apartments mostly to upper- and middle-income earners and in 2018, it became the most valuable real estate company in the world. The Group operates through the following segments: Real Estate, Automotive, Entertainment, Tourism, Health, Food, Finance, and Sports.

For more than two decades, Evergrande was China’s largest developer, minting money from a property boom on a scale the world had never seen. Evergrande’s rapid expansion over the years was fueled by debt, aggressively raising loans to support its land buying spree and selling apartments quickly despite low margins so as to start the cycle again. Once China’s most prolific property developer, Evergrande has become the country’s most indebted company.

Financial Problems

The warning signs of a potential collapse appeared as early as 2018 when Evergrande was flagged as a risk by China’s Central Bank, adding the company to its list of highly indebted conglomerates to watch.

Beijing helped trigger much of the stress at Evergrande when it imposed new rules in 2020, known as the “three red lines”, requiring developers to bring down debt levels before they could borrow more. The policy places a limit on debt in relation to a firm’s cash flows, assets and capital levels. The new measures squeezed Evergrande, which had borrowed heavily as it expanded aggressively and led Evergrande to offer its properties at major discounts to ensure money was coming in to keep the business afloat.

In the summer of 2021, payments came due on its debt and resulted in the Evergrande liquidity crisis. The firm is currently struggling to sell assets fast enough to service its massive $305 billion of debt.

Global ratings companies including Fitch, Moody’s and S&P downgraded Evergrande’s outlook to negative. The conglomerate’s shares have since crashed by almost 80% this year and trading of its bonds was repeatedly halted by Chinese stock exchanges in the past weeks.

Evergrande Share Price: Hong Kong Stock Exchange (HK$)

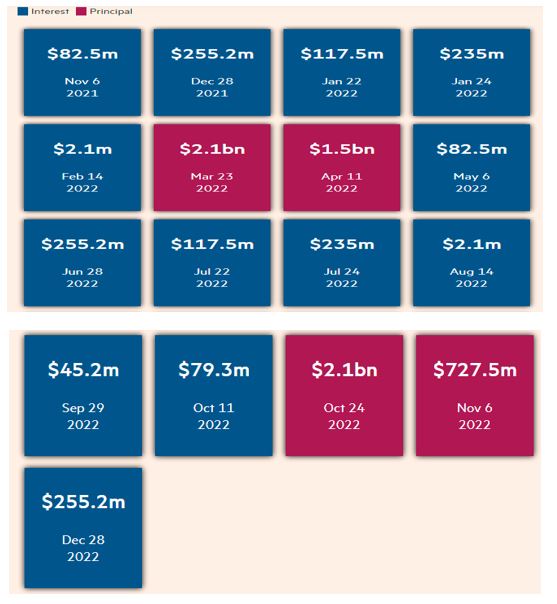

In the coming year, Evergrande faces significant principal and interest repayment pressure and is struggling to manage roughly $300 billion in liabilities, including close to $20 billion in outstanding U.S. dollar bonds.

Potential Impact of the Evergrande Crisis on Emerging Markets

The Evergrande is currently the second largest property developer in China. In 2018, China’s Central Bank highlighted in its financial instability report of the systematic risk companies like Evergrande could pose to the nation’s financial system. Given Evergrande’s size, there is a myriad web of contractors and businesses across the globe who are owed money, with roughly 128 banking institutions and 121 non-banking institutions having exposure to the Chinese real estate giant.

This problem is not unique to Evergrande, but has extended to other major real estate developers who also reported liquidity problems including Kaisa Group Holdings who missed a payment on a wealth management product and China Properties Group Holdings who recently defaulted on their obligations.

In the event of a default, China’s growth trajectory can be significantly derailed as real estate and construction is the main pillar of the country’s economic dominance, accounting for 30 percent of the country’s GDP. In addition, roughly 41% of China’s banking system’s assets are directly or indirectly associated with the property sector and 78% of the invested wealth of urban Chinese nationals is in residential property.

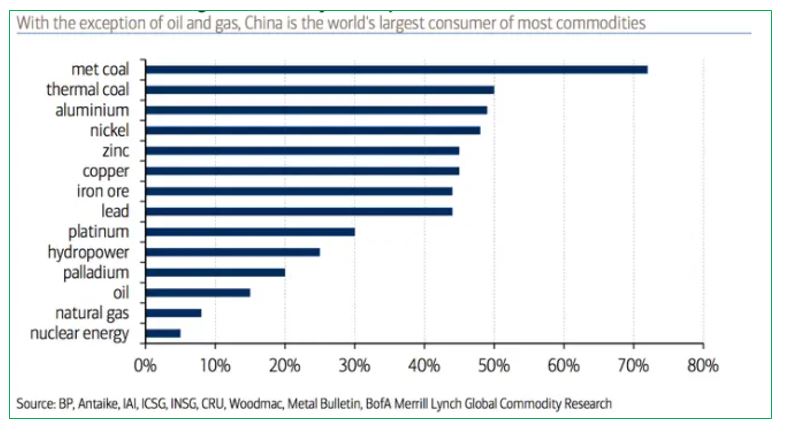

Given that China is the world’s second largest economy and is the largest consumer of most commodities, a slowdown in economic growth may have a negative impact on other emerging markets who are highly dependent on imports and whose main export market is China. Owing to the global trade economic system, this deceleration will not only be confided to Emerging markets, but to the rest of the world.

Consequently, investor confidence and appetite for such assets may fall and trigger sharp declines in asset prices in Emerging Markets financial markets. Stock prices in emerging markets may experience significant declines in share prices while the yields on Emerging bonds may rise sharply as investors demand a higher return to compensate for the additional perceived risk.

China’s share of global commodity consumption

Will Evergrande Elude Collapse?

Chinese authorities have publicly suggested that they won’t bail out Evergrande or inject money into the company, which would undermine their goal of showing that no private firms are too big to fail in China.

The firm has hired financial advisers to help assess the Group’s capital structure, evaluate the liquidity and explore all feasible solutions to ease the current liquidity issue and reach an optimal solution for all stakeholders as soon as possible.

Some investors feared that the Group would collapse spectacularly, triggering losses far and wide. Instead, the Chinese state is dismantling the giant developer slowly and behind the scenes. Much of the work so far has focused on Evergrande’s hundreds of stalled projects, a process that will likely involve bringing in other developers to take over. The plan is to sell off some Evergrande assets to Chinese companies while limiting damage to home buyers and businesses involved in its projects.

Under orders from Beijing, most of the 200 or so cities with Evergrande projects have set up task forces to help manage the process. A central concern for government is making sure people get the properties they paid for as Evergrande presold more than a million apartments that remain unfinished. Local authorities have required Evergrande to transfer revenues from unfinished homes to escrow accounts overseen by the government.

The company is sitting on many completed and unsold homes in different locations. It’s less clear what will happen with those. Home sales have fallen sharply recently as buyers have become unnerved about the ability of developers to stay afloat.

The fate of Evergrande remains unclear as it continues to work assiduously to meet its debt obligations as the months progress. As the rest of the world looks on, it is in the best interest of all stakeholders that the company survives this crisis.

DISCLAIMER

First Citizens Bank Limited (hereinafter “the Bank”) has prepared this report which is provided for informational purposes only and without any obligation, whether contractual or otherwise. The content of the report is subject to change without any prior notice. All opinions and estimates in the report constitute the author’s own judgment as at the date of the report. All information contained in the report that has been obtained or arrived at from sources which the Bank believes to be reliable in good faith but the Bank disclaims any warranty, express or implied, as to the accuracy, timeliness, completeness of the information given or the assessments made in the report and opinions expressed in the report may change without notice. The Bank disclaims any and all warranties, express or implied, including without limitation warranties of satisfactory quality and fitness for a particular purpose with respect to the information contained in the report. This report does not constitute nor is it intended as a solicitation, an offer, a recommendation to buy, hold, or sell any securities, products, service, investment or a recommendation to participate in any particular trading scheme discussed herein. The securities discussed in this report may not be suitable to all investors, therefore Investors wishing to purchase any of the securities mentioned should consult an investment adviser. The information in this report is not intended, in part or in whole, as financial advice. The information in this report shall not be used as part of any prospectus, offering memorandum or other disclosure ascribable to any issuer of securities. The use of the information in this report for the purpose of or with the effect of incorporating any such information into any disclosure intended for any investor or potential investor is not authorized.

DISCLOSURE

We, First Citizens Bank Limited hereby state that (1) the views expressed in this Research report reflect our personal view about any or all of the subject securities or issuers referred to in this Research report, (2) we are a beneficial owner of securities of the issuer (3) no part of our compensation was, is or will be directly or indirectly related to the specific recommendations or views expressed in this Research report (4) we have acted as underwriter in the distribution of securities referred to in this Research report in the three years immediately preceding and (5) we do have a direct or indirect financial or other interest in the subject securities or issuers referred to in this Research report.