Rising Interest Rates and the Impact on Bonds

Commentary

What are Bonds?

Bonds are securities that represent a loan from a group of investors to a company, government or government agency. The borrower will seek to issue bonds when they desire to raise money to be used to refinance existing debt, or finance a new project or maybe just maintain operations. Investors who purchase such bonds are lending money to the borrower.

The bond is governed by a contract that states when the bond matures (when the amount borrowed will be repaid) and interest payment terms which are referred to as coupons. The coupon payments are paid through the life of the loan, most often such payments are made twice for the year, or semi-annually.

Interest Rate Environment

The onset of the COVID-19 pandemic led to significant economic developments across the world, including the reduction of key benchmark rates by several central banks. The restrictive measures implemented to reduce the rate of infection of the virus, created recessionary pressures as several economies remain closed for extended periods of time. In an effort to shore up the economies, central banks took the decision to cut their key benchmark rates, effectively reducing borrowing costs to encourage consumption and spending.

In the US, at its March 2022 meeting, the Federal increased the interest rate from near zero for the first time since December 2018 by 25 basis point or 0.25%. They also signalled hikes at all six remaining FOMC meetings this year. This change in posture was propelled by rising inflationary pressures as consumer prices reached a 40-year high in February 2022 where the consumer price index rose by 7.9%.

Federal Funds Target Rate

This recent rate hike saw US Treasury yields rise, causing market prices of existing bonds to fall immediately as new bonds will offer investors higher interest rate payments.

Impact on Bonds

A bond’s interest payments or coupon rate is related to the prevailing interest rates in the economy. Most bonds have a fixed coupon rate, which remains constant despite fluctuations in market interest rates. Investors are always looking for the best investment and ways to increase their income stream. As such, when market rates rise, new bonds that are issued have a higher coupon rate and thus provides more income to the investor. Conversely, when rates fall, new bonds have a lower coupon rate and do not provide the same level of income as their higher coupon counterparts.

The previously issued bonds cannot change their coupon rates (unless it is a floating rate bond) and are thus locked into the original terms. In an effort to remain competitive and still attract investors, when market rates increase, the bond price must fall to compensate investors for the lower coupon income; such bonds are described as trading at a discount. Existing bonds are thus valued at a lower price, resulting in accounting losses.

When market rates decline, bonds with higher coupon rates become more valuable to investors as more income can be earned than a new issue, thus bidding up the bond’s price and are referred to as trading at a premium. Valued at a higher price, accounting profits will be booked. The risk posed by changing interest rates is called interest rate risk.

Inverse Relationship between Interest Rates and Bond Prices

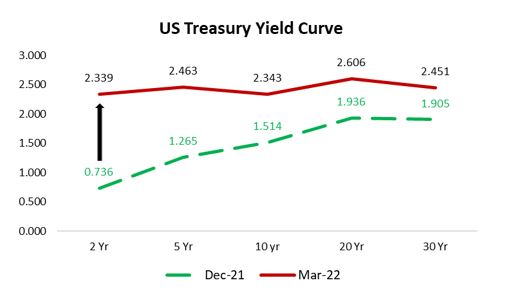

Along with the direction of the interest rate movement, the size of the change should also be noted. Based on the yield curve that tracks US Treasury securities, the yields on all tenors climbed against the backdrop of the federal rate hike, however it was not uniform across the different maturity buckets. Typically, yield curves are upward sloping, with investors demanding a higher yield the longer the term to maturity.

At the end of March 2022, the short-term yields rose by a greater amount than the longer-term yields. The gap between long-term and short-term yields in December 2021 stood at 1.15%. Three months later this gap has since narrowed to 0.11% – indicating that the yield curve is flattening, with investors demanding nearly comparable yields for shorter-term bonds than longer-term bonds.

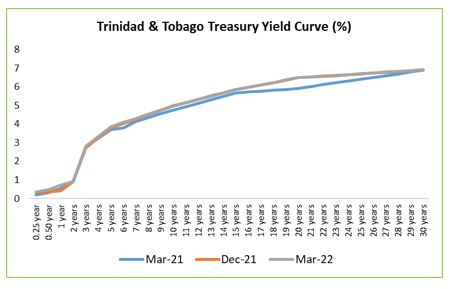

Trinidad and Tobago Yield Curve Movement

Similar to other central banks, the Central Bank of Trinidad & Tobago (CBTT) lowered the repo rate to 3.5% from 5% as well as the reserve requirement to 14% from 17% in an effort to support economic activity from the Covid-19 induced recession.

This tightening posture was however not adopted as the CBTT chose to maintain the repo rate at 3.50% in March 2022, despite the hike in the US federal funds rate. This decision was made against the backdrop of early signs of a domestic economic recovery and moderate inflation as headline inflation stood at 3.8% year on year in January 2022, down from 3.9% in October 2021. With no impetus, domestic Treasury yields remained relatively stagnant over the past year, with yields in the medium to long term rising marginally.

How can Investors take advantage of rising interest rates?

Higher US interest rates are expected over the short-term given the Federal Reserve transparent communication for future rate hikes for the rest of the year.

For investors who favour bonds, rising US rates can have significant portfolio implications. Typically, bonds who have longer terms to maturity and lower coupon rates are more exposed to such price changes than short-term bonds and bonds with higher coupon rates who may be less affected by rising interest rates.

Long term bonds tend to lock investors into the original and lower coupon rates. In an effort to capitalize on rising interest rates, investors can reduce exposure to long-term bonds and increase positions in short and medium-term bonds which are less sensitive to rate increases.

Investors can also adopt a bond ladder strategy – investing in bonds that mature at regular intervals such as three months, six months, nine months and one year. As the bonds mature, the proceeds can be reinvested into new bonds at the new higher interest rate.

Another sound strategy is to invest in floating rate bonds – bonds whose coupon rates vary over its life. The coupon rate is usually tied to a short-term benchmark rate such as the Federal Reserve fund rate, the London Interbank Offered Rate (LIBOR) or the prime rate. As such, as interest rates rise, the coupon rate also increases, minimizing the impact on the bond’s price.

Diversification is also crucial within the fixed income portfolio, with exposures to diverse sources of credits within the bond space. The risk of default is low given the steady traction in economic growth across the globe that is supportive of high yield securities. As such, allocations to corporate bonds that are of investment grade and high-yield and emerging market debt and developed market debt will allow investors to participate when risk assets rally.

Domestically, bond prices are expected to remain somewhat stable with the anticipation that the CBTT will continue to hold rates firm. However, depending on the rate of inflation, the US may more aggressively raise rates which may prompt the CBTT to follow suit in an effort to maintain the interest rate differential. The aforementioned strategies can be adopted in the local bond environment.

DISCLAIMER

First Citizens Bank Limited (hereinafter “the Bank”) has prepared this report which is provided for informational purposes only and without any obligation, whether contractual or otherwise. The content of the report is subject to change without any prior notice. All opinions and estimates in the report constitute the author’s own judgment as at the date of the report. All information contained in the report that has been obtained or arrived at from sources which the Bank believes to be reliable in good faith but the Bank disclaims any warranty, express or implied, as to the accuracy, timeliness, completeness of the information given or the assessments made in the report and opinions expressed in the report may change without notice. The Bank disclaims any and all warranties, express or implied, including without limitation warranties of satisfactory quality and fitness for a particular purpose with respect to the information contained in the report. This report does not constitute nor is it intended as a solicitation, an offer, a recommendation to buy, hold, or sell any securities, products, service, investment or a recommendation to participate in any particular trading scheme discussed herein. The securities discussed in this report may not be suitable to all investors, therefore Investors wishing to purchase any of the securities mentioned should consult an investment adviser. The information in this report is not intended, in part or in whole, as financial advice. The information in this report shall not be used as part of any prospectus, offering memorandum or other disclosure ascribable to any issuer of securities. The use of the information in this report for the purpose of or with the effect of incorporating any such information into any disclosure intended for any investor or potential investor is not authorized.

DISCLOSURE

We, First Citizens Bank Limited hereby state that (1) the views expressed in this Research report reflect our personal view about any or all of the subject securities or issuers referred to in this Research report, (2) we are a beneficial owner of securities of the issuer (3) no part of our compensation was, is or will be directly or indirectly related to the specific recommendations or views expressed in this Research report (4) we have acted as underwriter in the distribution of securities referred to in this Research report in the three years immediately preceding and (5) we do have a direct or indirect financial or other interest in the subject securities or issuers referred to in this Research report.