Review of Equity Markets over the 1st Quarter 2022

Commentary

International Market Review

The strong momentum that characterized the last quarter of 2021 was not evident in the first quarter of 2022 as uncertainty and volatility permeated throughout much of the first three months of the year. Most major equity markets ended the first quarter of 2022 in negative territory owing to the ongoing crisis in Russia and Ukraine, rising inflationary pressures globally and the commencement of a rate hiking cycle by the US Federal Reserve.

In the first month of the year, stocks quickly nose-dived as investors braced for a more aggressive interest-rate hike by the US Federal Reserve as consumer prices maintained its upward trend, hitting a 40-year high in January 2022. Rising inflationary pressures were initially deemed as transitory and saw the Fed policy makers being divided over whether to raise interest rates. In December 2021, the Federal Reserve changed their course of action and signaled their intentions to raise its benchmark rate in the near term.

Following this announcement, markets somewhat stabilized. However, in late February 2022, Russia invaded the Ukraine, causing oil and commodity prices to soar. This geopolitical risk and uncertainty prompted many investors to sell off equity positions, causing many major stock indices to decline more than 10% from their all-time highs.

In March, investors were faced with another development, as the US Federal Reserve raised interest rates for the first time in nearly four years, after cutting their key benchmark rate to near-zero at the beginning of the COVID-19 pandemic. Having signaled their intentions at the end of 2021, the move was expected and failed to dampened investor sentiment, with the S&P 500 index ending the day up in excess of 2%.

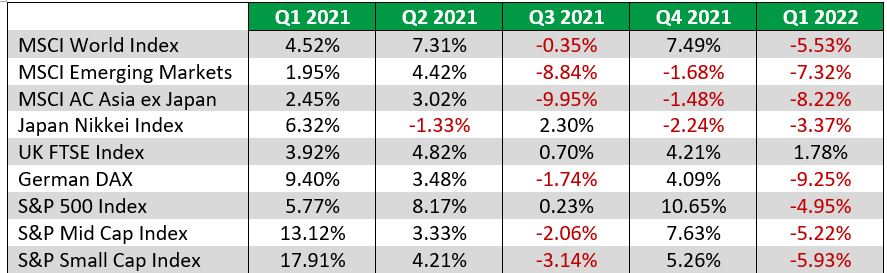

International Stock Indices

For Q1 2022, the MSCI World Index, a benchmark for global equities, declined by 5.53% after posting gains of 7.49% in the last quarter of the year. The downward trend was driven by Asian and Emerging Market equities that registered losses of 8.22% and 7.32% respectively in Q1 2022.

Asian stocks were negatively impacted following the US Securities Exchange Commission (SEC) identification of 273 companies were who at risk of being delisted. In 2020, the US Securities Exchange Commission passed the Holding Foreign Companies Accountable Act (HFCCA), which requires the institution to have complete access to the books of US-listed companies. The companies that do not comply will be delisted. However, Beijing did not abide by this legislation citing national security concerns, forbidding foreign inspection of working papers from local accounting firms. Consequently, in March 2022, the SEC named five Asian companies that are facing delisting, causing stocks to fall.

Investor confidence also waned as COVID infection rates surged yet again in China in March – with this wave deemed as the worst COVID surge since the original outbreak in early 2020. Consequently, China was forced to re-implement large-scale lockdowns which has the potential of being more disruptive than the previous restrictions.

European stocks were negatively impacted by the global geopolitical and economy uncertainty following the war conflict between Russia and the Ukraine and the ensuing disappointing talks between the two countries aimed at arriving at a solution to the conflict. As a result, the modest gains achieved in Q4 2021 were not repeated in Q1 2022, with the UK posting a marginal return of 1.78% and German stocks incurring a loss of 9.25%. European stocks were also battered by record-high price increases, with elevated inflation readings in Germany, Spain, France and Italy. Against this backdrop, investors are worried that other major central banks may also begin to tighten interest rates that may bring on recessions.

The S&P 500 began the year at an all-time high at 4,793.54 on 3 January 2022. However, by the end of February 2022, the stock index plunged 8% year to date. Investor confidence took a hit amidst rising consumer prices, with the annual inflation rate accelerating to 7.9% in February 2022 – the highest since January 1982. During the month of March, US stocks recovered partially as the S&P 500 index closed the quarter down by 4.95%.

By market capitalization, Small and Medium cap stocks underperformed their large cap counterparts in Q1 2022, with losses of 5.93% and 5.22% respectively, down from positive returns in Q4 2021.

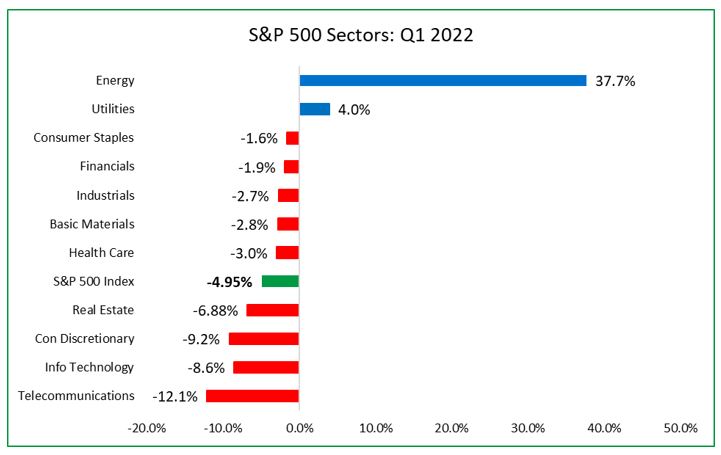

US Sector Performance

From a sector perspective, only two sectors posted positive returns in Q1 2022, compared to all eleven sectors in Q4 2021. Energy and Utilities were the top performing sectors with gains of 37.7% and 4% respectively over the quarter. The worst performing sectors over the quarter were Telecommunications (12.1%), Information Technology (8.6%) and Consumer Discretionary (9.2%).

Energy prices were already on the rise due to higher demand as economies reopened from the pandemic-induced shut down. After plunging to USD19.38 per barrel in April 2020, crude oil prices rebounded strongly in 2021 to end the year at USD75.21 per barrel. Oil prices rose sharply in March 2022 following the conflict as investors anticipated a cut in oil supply as nations who are not in support of the war imposed sanctions on Russia. Oil prices have since pulled back as it became apparent that oil supplies would not be significantly impacted.

Chart 2: US Sector Performance

Local Market Review

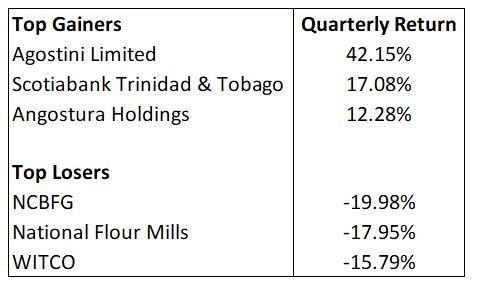

After posting gains in Q4 2021, there was a pullback in the local stock market in Q1 2022, with the Composite Index down 2.79% from a gain of 4.63% in the prior quarter, led by losses in the cross listed stocks. The Cross Listed Index maintained its downward trend from the last quarter of 2021 with a loss of 10.32% compared to a loss of 2.87% in Q4 2021. The All T&T index was stagnant over the quarter, marginally up by 0.11% compared to 7.87% in the prior quarter.

The stocks with the largest share price gains over the first quarter of 2022 were Agostini’s Limited (AGL), Scotiabank Trinidad & Tobago (SBTT) and Angostura Holdings (AHL) with returns of 42.15%, 17.08% and 12.28% respectively. Leading the declines were NCB Financial Group Limited (NCBFG), National Flour Mills (NFM) and West Indies Tobacco Company (WCO) with losses of 19.98%, 17.95% and 15.79% respectively.

Trinidad & Tobago Stock Exchange Largest Gains and Declines: 31 December 2021 to 31 March 2022

Equity Markets Outlook

Uncertainty is expected to continue on many fronts into the second quarter of the year. Despite several meetings for peace talks between Russia and the Ukraine, a resolution appears unlikely in the short term, which may serve to threaten the European economy given the region’s dependence on Russia for their energy supplies. Europe obtains more than 40% of its natural gas and 20% of its oil from Russia, thus the region’s ability to quickly switch to other energy suppliers is limited.

Inflationary pressures most likely will persist and will challenge companies’ cost structures and profit margins. Of importance is the world’s dependence on Russia and Ukraine for wheat, with both countries supplying roughly a quarter of global wheat exports. Continued supply-side disruptions will see commodity prices climb further and thus suppress income levels and purchasing power.

Another source of risk is the expectation of more central banks pivoting their monetary policies towards higher interest rates to tame such inflationary pressures. This action may not support economic and earnings growth, thus may destabilize the global economic recovery.

The United States appears to be among the most resilient economies globally, given its energy independence, lower share of commodity consumption in GDP and investors expectation of further rate hikes which are priced in given communication strategy by the Federal Reserve.

Locally, economic activity is expected to pick up following the full relaxation of Covid-19 restrictions against the backdrop of higher vaccination levels and a marked slowdown in infection rates. The rise in energy prices should auger well for the domestic economy.

With such headwinds, volatility may remain elevated during this upcoming quarter. As such, investors may use the pullbacks as opportunities to rebalance or diversify portfolios. Equities are more effective at hedging inflation and thus should play a more meaningful role in portfolios as historically, equity returns have outpaced inflation rates over the long term. Fixed income securities should not be discounted as it may protect the portfolio from wide swings in stock prices.

DISCLAIMER

First Citizens Bank Limited (hereinafter “the Bank”) has prepared this report which is provided for informational purposes only and without any obligation, whether contractual or otherwise. The content of the report is subject to change without any prior notice. All opinions and estimates in the report constitute the author’s own judgment as at the date of the report. All information contained in the report that has been obtained or arrived at from sources which the Bank believes to be reliable in good faith but the Bank disclaims any warranty, express or implied, as to the accuracy, timeliness, completeness of the information given or the assessments made in the report and opinions expressed in the report may change without notice. The Bank disclaims any and all warranties, express or implied, including without limitation warranties of satisfactory quality and fitness for a particular purpose with respect to the information contained in the report. This report does not constitute nor is it intended as a solicitation, an offer, a recommendation to buy, hold, or sell any securities, products, service, investment or a recommendation to participate in any particular trading scheme discussed herein. The securities discussed in this report may not be suitable to all investors, therefore Investors wishing to purchase any of the securities mentioned should consult an investment adviser. The information in this report is not intended, in part or in whole, as financial advice. The information in this report shall not be used as part of any prospectus, offering memorandum or other disclosure ascribable to any issuer of securities. The use of the information in this report for the purpose of or with the effect of incorporating any such information into any disclosure intended for any investor or potential investor is not authorized.

DISCLOSURE

We, First Citizens Bank Limited hereby state that (1) the views expressed in this Research report reflect our personal view about any or all of the subject securities or issuers referred to in this Research report, (2) we are a beneficial owner of securities of the issuer (3) no part of our compensation was, is or will be directly or indirectly related to the specific recommendations or views expressed in this Research report (4) we have acted as underwriter in the distribution of securities referred to in this Research report in the three years immediately preceding and (5) we do have a direct or indirect financial or other interest in the subject securities or issuers referred to in this Research report.