Oil Price Rally

Commentary

As the administration of the vaccines continues in many of the advanced economies globally, oil prices have been trending upward. Adding to the optimism in these economies is the sizeable fiscal support provided by those governments, specifically in the US. Both factors have boosted prospects for the global economy and a revival in energy demand. Notwithstanding these dynamics, many large emerging and developing economies are battling a deadly surge in COVID-19 cases and various strains and this devastative development will likely weigh on global demand. Further, the possibility of increased supply from the Organization of Petroleum Exporting Countries and alliances (OPEC+) also softens the outlook for crude oil prices.

Improving but Significantly Divergent Economic Recovery

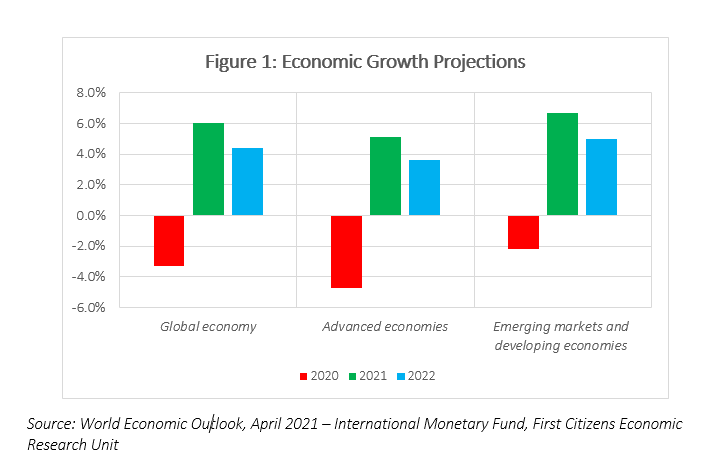

In its April 2021 World Economic Outlook, the International Monetary Fund (IMF) revised its forecast for global economic growth for 2021 upwards to 6% from 5.5% projected back in January 2021. The more upbeat outlook resulted from increased vaccination drives, technological advancements which have allowed continuation of economic activity as well as fiscal support. The forecasted economic growth of 6% for this year reverses the unprecedented 3.3% contraction experienced in 2020.

The world’s two largest economies, the US and China are both projected to register strong growth in 2021 of 6.4% and 8.4% respectively. These two countries are also the top two consumers of oil in the world, accounting for 20% and 14% of global consumption. At the time of the release of the WEO in April, the IMF projected economic growth of a robust 12.5% for India in 2021 – one of the very few countries expected to post a double-digit expansion. However, since April, India has become one of the worst hit countries struggling to contain a deadly wave of the COVID-19 virus. The total number of positive cases in India surpassed 20 million during the first week of May, with nearly seven million recorded in the month of April alone and over 400,000 cases per day being reported. Over 200,000 persons have died as a result of the virus and the health care system has become inundated as it is believed that the official numbers reported are grossly underestimated. The current health crisis in India is certainly worrying and will dampen energy demand into 2021, as India is the world’s third largest consumer of crude.

Uptick in Global Energy Demand?

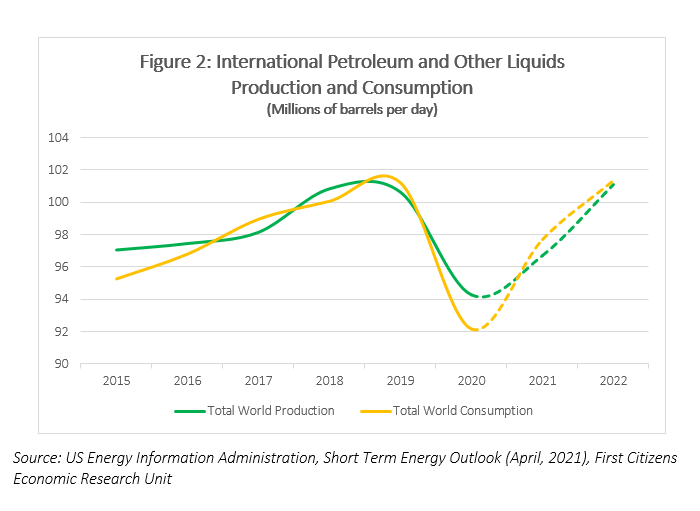

With demand for fuels virtually drying up in 2020 as a result of a halt in tourism, stay at home orders and other restrictions on economic activity resulting from the pandemic, consumption of fuels fell sharply. On the supply side, the decisions taken by OPEC+ countries to maintain and/ or cut supply levels contributed to the price stability at around USD40 per barrel during 2020, after reaching a low of USD30.56 per barrel in April. Based on data from the US Energy Information Administration (EIA)’s April 2021 Short Term Energy Outlook report, total international consumption of petroleum and other liquids fell by a record 8.9% in 2020 relative to 2019, while production declined by 6.4%. Estimates from the International Energy Agency (IEA) shows that of all categories of fuel, ‘oil was by far the hardest hit, with restrictions on mobility causing demand for transport fuels to fall by 14% from 2019 levels. At the peak of restrictions in April, global oil demand was more than 20% below pre-crisis levels. Overall, oil demand was down by almost 9% across the year.’

The EIA projects that total consumption of fuels will increase by 6% in 2021 and will moderate to growth of 3.7% in 2022, while production is likely to increase 2.6% and 4.6% in 2021 and 2022, respectively. The slow and subdued recovery in travel and tourism as well as the reduction in transportation activity globally, are all factors likely to constrain the growth in demand for energy in 2021.

Recent Rally in Oil Prices

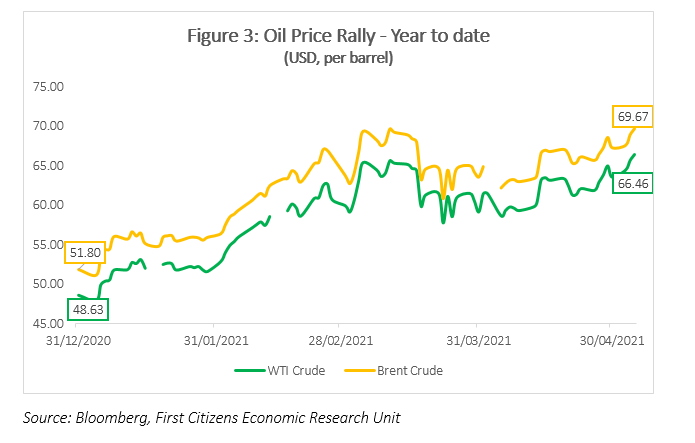

Year to date (YTD), WTI oil prices have been up 37% and was trading at USD66.52 per barrel as at 5 May, 2021. Similarly, Brent crude is up by close to 35% YTD.

Aggressive vaccination drives in large developed countries have added to the optimism in the energy market. The US has set a target of 70% of US adults receiving at least one COVID-19 vaccine by July 4 and in Europe, Prime Minister Boris Johnson has indicated that the lockdown in the UK will likely end within two months. The prospects of higher oil consumption from these large markets have so far offset the concerns about weaker demand from some Asian countries which are struggling amid soaring virus cases, including key oil importer, India. On 5 May, Saudi Arabia cut its June selling price to Asian markets amid the coronavirus surge in that region.

The oil inventory surplus which accumulated during the 2020 period has also been declining, which is also fueling the recent uptick in energy prices. The IEA noted recently that about 20% of the surplus remained as at February 2021, further, commercial oil inventories are back down to their five-year averages in the OECD countries, indicating that demand is recovering in some of those countries.

Uncertainty About the Future

While there seems to be many factors which may support a short term rally in oil prices, the outlook is riddled with uncertainties, mostly regarding the evolution of the COVID-19 virus and its variants. While vaccination programs are helping to spur an economic recovery in the advanced economies, some emerging and developing economies continue to struggle with waves of the virus which is destroying lives and livelihoods. Most energy experts believe that prices are likely to increase in 2021 with the EIA projecting WTI at USD58.89 per barrel and Bloomberg slightly more upbeat at USD63.50 per barrel. Global consumption is expected to marginally outstrip production in 2021 which should lead to a slight uptick in prices. However, there are many risks to this outlook. The COVID-19 shock may well undermine the fundamentals of the oil market which is already struggling with the long term shift towards renewable energy.

DISCLAIMER

First Citizens Bank Limited (hereinafter “the Bank”) has prepared this report which is provided for informational purposes only and without any obligation, whether contractual or otherwise. The content of the report is subject to change without any prior notice. All opinions and estimates in the report constitute the author’s own judgment as at the date of the report. All information contained in the report that has been obtained or arrived at from sources which the Bank believes to be reliable in good faith but the Bank disclaims any warranty, express or implied, as to the accuracy, timeliness, completeness of the information given or the assessments made in the report and opinions expressed in the report may change without notice. The Bank disclaims any and all warranties, express or implied, including without limitation warranties of satisfactory quality and fitness for a particular purpose with respect to the information contained in the report. This report does not constitute nor is it intended as a solicitation, an offer, a recommendation to buy, hold, or sell any securities, products, service, investment or a recommendation to participate in any particular trading scheme discussed herein. The securities discussed in this report may not be suitable to all investors, therefore Investors wishing to purchase any of the securities mentioned should consult an investment adviser. The information in this report is not intended, in part or in whole, as financial advice. The information in this report shall not be used as part of any prospectus, offering memorandum or other disclosure ascribable to any issuer of securities. The use of the information in this report for the purpose of or with the effect of incorporating any such information into any disclosure intended for any investor or potential investor is not authorized.

DISCLOSURE

We, First Citizens Bank Limited hereby state that (1) the views expressed in this Research report reflect our personal view about any or all of the subject securities or issuers referred to in this Research report, (2) we are not a beneficial owner of securities of the issuer (3) no part of our compensation was, is or will be directly or indirectly related to the specific recommendations or views expressed in this Research report (4) we have not acted as underwriter in the distribution of securities referred to in this Research report in the three years immediately preceding and (5) we do have a direct or indirect financial or other interest in the subject securities or issuers referred to in this Research report.