Is The World Heading Into A Recession?

Commentary

According to the National Bureau of Economic Research (NBER), a US private, non-profit organization that is dedicated to conducting economic research, a recession is a significant decline in economic activity, measured by negative Gross Domestic Product (GDP), that is spread across the economy and lasts more than a few months. One of the most popular characteristics of a recession is the decline in GDP over two consecutive quarters.

Market participants in the US and around the world are becoming increasingly concerned that a recession is inevitable, given the US Federal Reserve’s (Fed) aggressive attempt to tame soaring inflation mainly through tightening monetary policy. The consumer price index, a common gauge of inflation, increased by 8.6% in May 2022 compared to a year ago hitting a 40-year high, well above the Fed’s target of 2%. The Fed’s Chairman Jerome Powell admitted that the Fed’s main objective is to cool inflation and while slowing down the economy may be necessary to achieve this, a recession may be an unintended spill-over effect.

The US is one of the world’s largest economies with financial linkages to many other economies, therefore, should they enter into a recession, it can have global implications causing other economies to tread a similar contractionary path.

Indicators of a Recession

Predicting a recession can be difficult even in the presence of an economic slowdown given the many possible causes. Though it is difficult to predict, there are indicators that can help assess whether a recession is likely to occur.

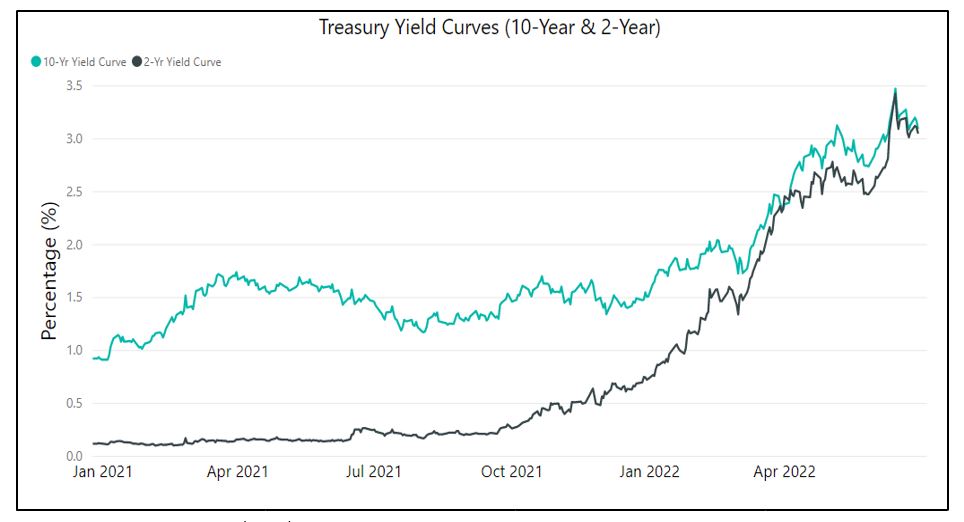

Inverted Yield Curves

A yield curve illustrates the interest rates on bonds of increasing maturities and is normally upward sloping, with long-term bonds having higher interest rates given the inherent higher risk such as rising inflation and default risk. An inverted yield curve occurs when the interest rates on bonds with shorter terms to maturity of the same credit quality exceeds the longer maturities. An inverted yield curve is seen as a leading indicator of an impending recession, with the spread between the US 2-year and 10-year Treasury securities being the most popular metric.

In times of economic uncertainty, investors tend to favor safer assets such as government securities and bonds with long tenors compared to bonds with short term maturities. The rise in demand for such assets causes the yields to fall given the inverse relationship between bond prices and interest rates.

The dramatic uptick in inflationary pressures has served to accelerate the inversion process given the rate hikes implemented by the US Fed and the expectation of future rate hikes. On June 13, 2022, the yield curve inverted for the second time in 2022 following a huge sell-off in the stock market, with the spread falling to -0.02% or -2 basis points.

Figure 1: US Treasury Yield Curve

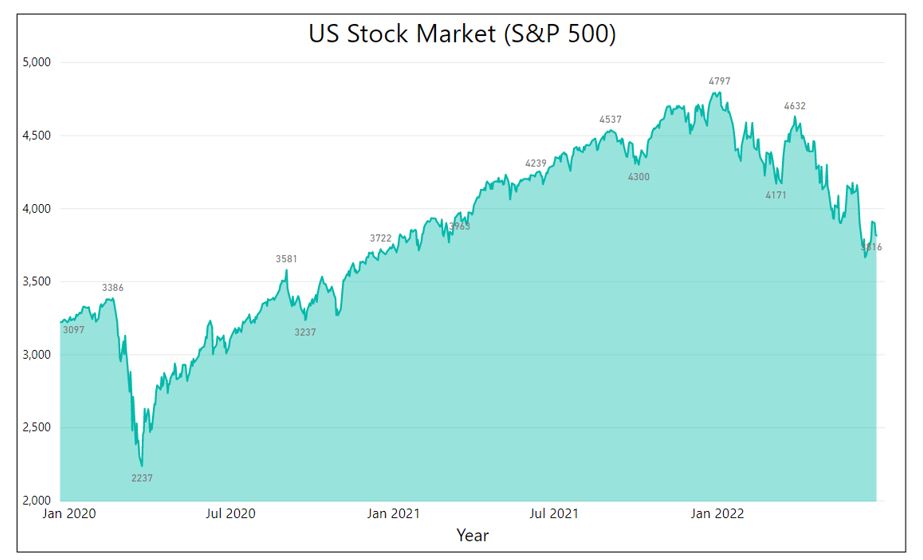

Stock Market Declines

Stock market declines are also a leading indicator of a recession. After having a year of record highs in 2021, the US stock market has been trending downward since the turn of this year. Earlier this month, huge sell-offs would have seen the stock market decline by over 20% for the year as it closed at 3,666.77 on 16 June 2022, the lowest level so far for 2022. Wall Street uses the “bear market” term to describe a sustained period when the equity markets are down at least 20% from their recent peaks. According to LPL Research analysis, it takes approximately 19 months on average for stock prices to stop falling once the bearish market trend has begun.

Figure 2: US S&P 500 Index

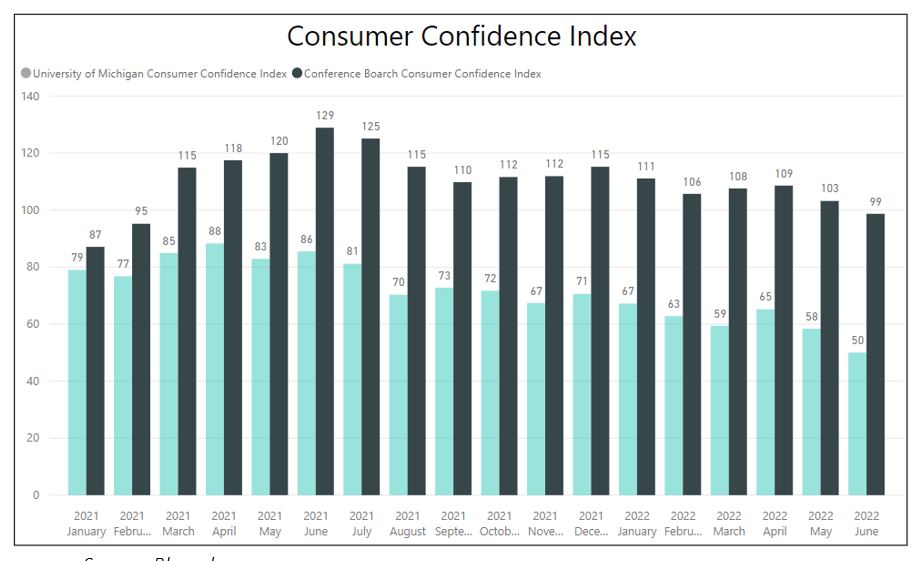

Consumer Confidence

Consumer confidence, an economic indicator that measures how optimistic consumers feel about their finances and the state of the economy, is another important gauge of a possible recession. In the US, there are two indices that measure consumer confidence – the University of Michigan Consumer Sentiment Index and the Conference Board Consumer Confidence Index

In June 2022, the University of Michigan released the results of their survey revealing that consumer sentiment was down to a record low of 50 from 58.4 in the previous month due to increasing inflation concerns. Also, the Conference Board Consumer Confidence Index decreased in June 2022 to 98.7 from 103.2 in May 2022 and now stands at its lowest level since February 2021 which was 95.2. Should investor sentiment remain subdued for a sustained period it can contribute to a slowdown of the economy and eventually lead to a recession as investors would opt to reduce their spending and save more money.

Figure 3: Consumer Confidence Indices

Effects of a Recession

A recession affects every part of an economy. Businesses of all sizes would be negatively affected as the general level of spending would be low. In response to the reduction in spending, businesses may cut back on capital expenditure and hiring plans which may lead to a contraction in earnings and dividend payments. If such recessionary pressures are over a prolonged time period, several businesses may go out of business, creating a wave of corporate defaults.

In capital markets, the pull back in earnings and dividend payments may cause investors in the stock market to reduce their exposure to risky assets such as stocks, further fuelling the price decline. In bond markets, the deterioration in credit quality and rise in defaults may trigger a liquidity crunch as lenders may begin to tighten lending standards which will make securing financing harder for both businesses and individuals.

What can Investors do?

While a recession largely spells bad news for an economy, there are still opportunities for investors. Investors can diversify their portfolio by adding stocks from recession-resistant industries to their portfolio. These companies see an increase in demand when consumers cut back on more expensive goods or brands or seek relief and security from fear and uncertainty. Consumer staples, health care sector and utilities are examples of recession-resistant industries.

As previously stated, the US is currently in a bear market which is characterized by falling stock prices. This is an opportunity for investors to enter the stock market at reduced prices and diversify their portfolio. Some investors would seize the opportunity to buy usually high value stocks whose prices has fallen with the expectation that its price will soon begin to rise. This strategy does come with risks as there may not be an accurate indicator to predict how low stock prices may fall before they start to raise again.

Value investing is also a strategy that investors resort to in time of economic downturns. Value stocks are stocks that typically trade at a discount to their intrinsic price, have good cash flow generation and, in some cases, have a high dividend yield. Value stocks gain more attractiveness as investors seek more value for their dollar under these market conditions. During a bear market, value stocks tend to outperform the overall market whereas growth stocks usually lag the overall market.

While many news sources and analysts believe that a recession is imminent, it may be too early to say; but the general consensus is that a recession seems unavoidable given the worsening inflation and the Fed’s commitment to getting it under control. Analysts at Goldman Sachs forecast a 30% probability of a recession within the next year, up from 15%. Bank of America economists on the other hand, have predicted a 40% chance of a recession in 2023. With the precursors evident, investors should begin to position themselves for the reality of a recession in order to give themselves the best chance to maximize the performance of their portfolio.

DISCLAIMER

First Citizens Bank Limited (hereinafter “the Bank”) has prepared this report which is provided for informational purposes only and without any obligation, whether contractual or otherwise. The content of the report is subject to change without any prior notice. All opinions and estimates in the report constitute the author’s own judgment as at the date of the report. All information contained in the report that has been obtained or arrived at from sources which the Bank believes to be reliable in good faith but the Bank disclaims any warranty, express or implied, as to the accuracy, timeliness, completeness of the information given or the assessments made in the report and opinions expressed in the report may change without notice. The Bank disclaims any and all warranties, express or implied, including without limitation warranties of satisfactory quality and fitness for a particular purpose with respect to the information contained in the report. This report does not constitute nor is it intended as a solicitation, an offer, a recommendation to buy, hold, or sell any securities, products, service, investment or a recommendation to participate in any particular trading scheme discussed herein. The securities discussed in this report may not be suitable to all investors, therefore Investors wishing to purchase any of the securities mentioned should consult an investment adviser. The information in this report is not intended, in part or in whole, as financial advice. The information in this report shall not be used as part of any prospectus, offering memorandum or other disclosure ascribable to any issuer of securities. The use of the information in this report for the purpose of or with the effect of incorporating any such information into any disclosure intended for any investor or potential investor is not authorized.

DISCLOSURE

We, First Citizens Bank Limited hereby state that (1) the views expressed in this Research report reflect our personal view about any or all of the subject securities or issuers referred to in this Research report, (2) we are a beneficial owner of securities of the issuer (3) no part of our compensation was, is or will be directly or indirectly related to the specific recommendations or views expressed in this Research report (4) we have acted as underwriter in the distribution of securities referred to in this Research report in the three years immediately preceding and (5) we do have a direct or indirect financial or other interest in the subject securities or issuers referred to in this Research report.