Inflation Targeting

Commentary

Inflation is generally defined as a rise in the general level of prices over a given period of time and is often compared to standardised timeframes such as month-on-month, quarter-on-quarter or year-on-year. The phenomenon of inflation was first explained using the quantity theory of money in the 18th century by David Hume, which assumed that prices will rise as the supply of money increases. In the 20th century, Milton Friedman refined the quantity theory arguing that the supply of money needs to increase at a rate equal to that at which the economy is expanding in order for prices to stabilise. John Maynard Keynes presented the idea that inflation stemmed from a greater demand for goods and services than that of supply which leads to higher prices. The cost-push theory was observed later on when employees’ demand for higher wages led employers to pass on these higher costs to the final price of goods, thus contributing to inflation. Early central bank stabilisation plans involved adjusting the supply of money (monetary targeting) or exchange rates (exchange targeting) to generate changes in macroeconomic variables. Many nations have moved on from monetary and exchange targeting to inflation targeting with the exception of a few. Several Caribbean islands still use exchange rate targeting to date such as Barbados and islands in the Eastern Caribbean.

Central banks over the past years adopted a technique known as inflation targeting to control the general rise in the price level. Inflation targeting is a simple and straightforward mechanism which starts by the central bank forecasting the future path of inflation, comparing these forecasts with a target inflation rate, and finally adjusting monetary policies to keep the forecasts in line with target. Before a central bank adopts an inflation targeting scheme, the International Monetary Fund (IMF) noted the central bank must possess two important criteria. First, a central bank must be able to conduct monetary policy independent of government influence. The IMF goes on to note “a country cannot exhibit symptoms of fiscal dominance that is, fiscal policy considerations cannot dictate monetary policy (Guy Debelle).” A country that is free from fiscal dominance is one that implies government borrowing from the central bank is low to nil and that domestic financial markets are deep enough to absorb public debt. The second requirement for inflation targeting is the willingness and ability of the central bank not to target other indicators such as wages, employment or the exchange rate. Targeting multiple indicators would make policy decisions more difficult for the central bank and will increase speculation in the market.

Upon satisfying the two criteria, a central bank can introduce its inflation targeting scheme by executing four main steps highlighted by the IMF:

- Establishing an explicit target/s for inflation over a specified period of time

- Make public the intent of the central bank to achieve its inflation target over all other monetary policy objectives

- Create or use a credible model or methodology for inflation forecasting

- Formulate a forward-looking procedure that illustrates the use of monetary policy instruments that are adjusted in line to the chosen target

Advantages and Disadvantages of Inflation Targeting

Advantages

Inflation targeting allows central bankers to implement monetary policy measures to mitigate against and rebound from economic shocks that take place domestically. Inflation targeting gives market players a sense of predictability in the direction of interest rates, based on the conditions set forth by the central bank to adjust rates. This assists in decision making, for instance, investment decisions by portfolio managers on whether to purchase, hold or sell off their bond holdings in nations with high inflation rates. Expectations would be more clearly coordinated as central bank’s future decisions can be assessed based on the target inflation rate and the current and/or future inflation trend. In emerging or developing nations, the prerequisites for inflation targeting can necessitate improvements in institutional framework which can positively impact upon the country’s investor and business climate. Further, a sovereign’s the institutional profile as well as monetary policy framework can significantly impact the overall sovereign credit rating thus, improvements in these areas necessitated through inflation targeting can improve the rating. Inflation targeting regimes often raise the probability that a central bank may over the long-term lower and maintain the inflation rate at around the targeted rate, which helps to anchor inflationary expectations.

Disadvantages

When a central bank utilises an inflation targeting regime, it has to forego other forms of monetary policy targeting such as money supply and exchange rate. The conditions necessary to implement an effective inflation targeting policy will take a number of years to achieve. According to the IMF, prior to adopting inflation targeting, several measures must be undertaken such as altering fiscal policy to be more favourable to low inflation (reducing government expenditure, budget deficits and improving government revenue generation), increasing the autonomy of central banks and the economy must be globally competitive. These conditions are less likely to be met easily in developing or emerging market nations given wide fiscal imbalances and high indebtedness. As central banks focus monetary policy strictly on keeping inflation within their target, other economic variables such as economic growth and unemployment may not be factored into monetary policy decisions. Monetary policy decisions to keep inflation low can result in low and unstable real GDP growth as faced in advanced economies such as the United Kingdom and European Union. Another disadvantage of inflation targeting stems from timing – in the short-term monetary policy may not be able to reduce fluctuations in inflation. Fiscal policies implemented to foster economic growth may result in strong wage and price growth which can add pressure to the central bank when enacting monetary policy given the short-term impacts fiscal policy may have on inflation. Another disadvantage of inflation targeting is for nations that run high import bills. The respective central banks will find difficulty in controlling prices as domestic monetary policy tools often have little to no effect on the prices of internationally traded commodities.

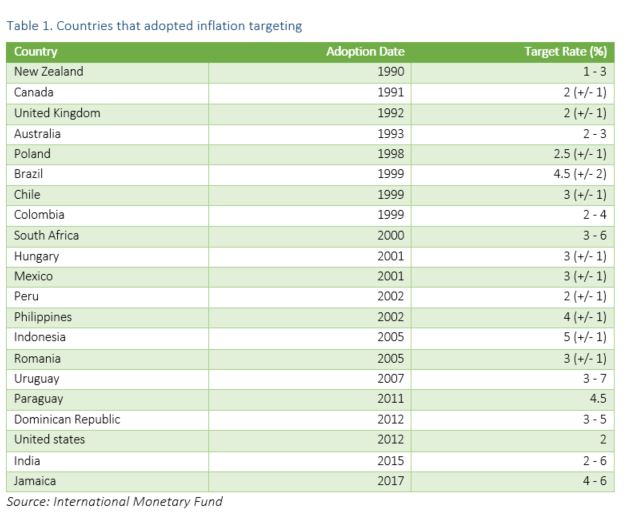

Inflation Targeting Across the Globe

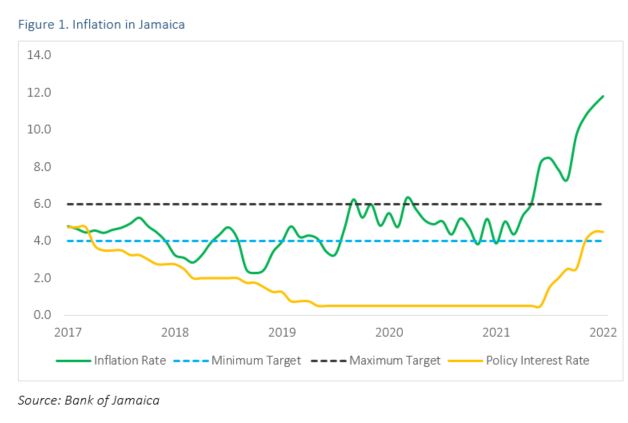

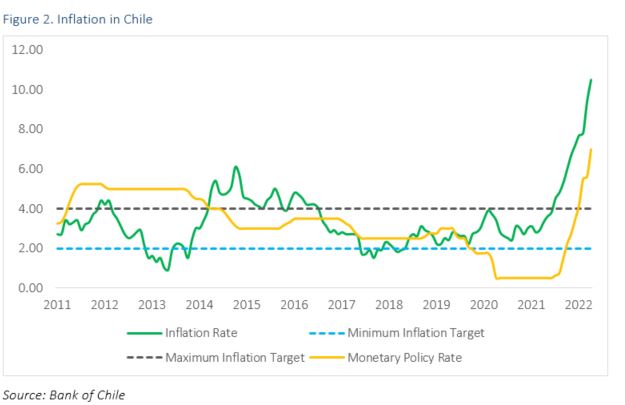

Inflation targeting has gained prominence throughout advanced as well as emerging market and developing nations. In the Caribbean, Jamaica is the only country whose central bank targets an explicit inflation rate, which is within a range of 4.0 – 6.0%. The Bank of Jamaica (BoJ) adjusts the policy interest rate which is the interest rate the central bank pays on balances in the current accounts of deposit-taking institutions. Several Latin American countries operate within an explicit inflation targeting framework, such as Brazil, Chile, Colombia, Dominican Republic, Mexico, Paraguay, Peru and Uruguay. In Chile, the central bank targets an inflation rate within a range of 3.0% (+/- 1.0%). In conducting monetary policy, the Central Bank of Chile adjusts the Monetary Policy Rate such that inflation moves in line with its target goal over two-year periods.

Recent Price Surge and Policy

In the years leading up to the BoJ inflation target adoption, inflation outturns were mixed. In the 2000’s inflation was running in double-digits, peaking at 22.02% in 2008. Inflationary pressure on goods and services declined substantially since 2008 and more so following the BoJ’s inflation targeting adoption in 2017. In the period 2017-2020, inflation remained within the BoJ’s target range of 4.0-6.0%. The economic fallout stemming from the pandemic followed by substantial increases in energy commodity prices led to higher energy and transport costs in Jamaica which resulted in an uptick of inflation. In 2021, inflation rose to 6.8% and is expected to rise to 11.4% in 2022 due to further escalations in energy prices. Accordingly, since October 2021, the BoJ has been increasing its main policy rate, which has moved from 0.50% to 5.00% in May 2022 in an effort to slow inflation. Over the medium-term, inflation is expected to decline due to concerns about global growth and as energy prices decline moderately.

The Central Bank of Chile adopted inflation targeting in 1999, following several years of soaring double-digit inflation which peaked at 30.40% in October 1990. The inflation target range has remained unchanged at 3.0% +/- 1.0%. The central bank has been effective at keeping annual inflation within the target range through most of the years since it began targeting inflation, but in periods of exceptional commodity price growth, price increases exceeded the upper bound of the target. In 2021, annual inflation averaged 4.51% and will edge up to 9.20% in 2022 as commodity prices are forecasted to remain elevated due to the ongoing war in Eastern Europe. Over the short-term, inflation will remain above the central bank’s target range requiring additional hikes in the monetary policy rate.

Monetary Policy Framework in Trinidad and Tobago

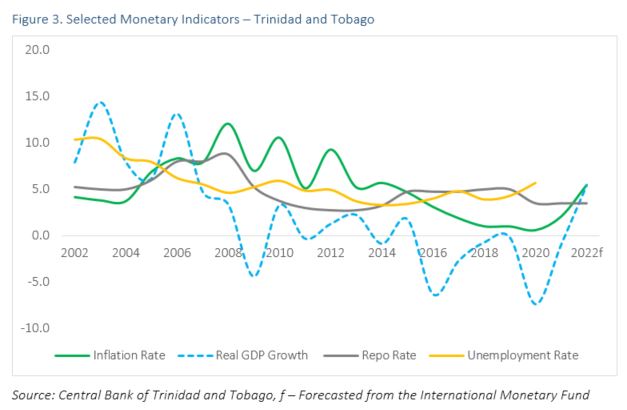

In Trinidad and Tobago, monetary policy is implemented by the Central Bank of Trinidad and Tobago (CBTT) with the aim of “maintaining a low and stable rate of inflation, an orderly foreign exchange market and an adequate level of foreign exchange reserves (Central Bank of Trinidad and Tobago).” In conducting monetary policy the CBTT “utilises a range of monetary policy tool to influence the level of liquidity in the banking system which indirectly influence the level of interest rates and, ultimately, the overall demand for goods and services in the economy(Central Bank of Trinidad and Tobago).” Unlike central banks that target inflation strictly with an explicit target and timeframe, the CBTT engages in what is referred to as implicit/flexible inflation targeting. This form of inflation targeting occurs when a central bank focuses on stabilising other economic variables such as interest rates, exchange rates or unemployment. The CBTT in mid-2002 revised its monetary policy framework based on the use of the Repurchase (Repo) rate. The Repo rate is charged to commercial banks for borrowing funds on an overnight basis from the CBTT. Additionally, the CBTT from time to time may adjust the reserve requirement ratio of commercial banks to influence liquidity conditions domestically. In the CBTT’s strategic plan for fiscal 2021/22 – 2025/26 monetary policy will remain relatively unchanged but some processes involved in conducting its monetary operations will be revamped and enhanced.

Conclusion

The case for inflation targeting outweighs the disadvantages, given the level of stability it provides to an economy and the potential improvements it poses for countries with weaker institutional strength. Over the longer-term, inflation expectations can be anchored allowing for smoother and more efficient wage negotiations for unionised companies or sectors. Prior to the pandemic the United States (US) enjoyed low and stable inflation within its target range, through the years 2012-2020. In the 5 years prior to the pandemic from 2015 to 2020 inflation rates in countries such as the US, United Kingdom, Chile, Jamaica, Indonesia and Australia all experienced annual average inflation rates within the target ranges of their respective central banks. Periods when inflation fluctuated out of the target range were consistent with global commodity price increases. There are significant benefits to be derived from implementing an inflation targeting regime, especially for countries which frequently experience significant price volatility.

DISCLAIMER

First Citizens Bank Limited (hereinafter “the Bank”) has prepared this report which is provided for informational purposes only and without any obligation, whether contractual or otherwise. The content of the report is subject to change without any prior notice. All opinions and estimates in the report constitute the author’s own judgment as at the date of the report. All information contained in the report that has been obtained or arrived at from sources which the Bank believes to be reliable in good faith but the Bank disclaims any warranty, express or implied, as to the accuracy, timeliness, completeness of the information given or the assessments made in the report and opinions expressed in the report may change without notice. The Bank disclaims any and all warranties, express or implied, including without limitation warranties of satisfactory quality and fitness for a particular purpose with respect to the information contained in the report. This report does not constitute nor is it intended as a solicitation, an offer, a recommendation to buy, hold, or sell any securities, products, service, investment or a recommendation to participate in any particular trading scheme discussed herein. The securities discussed in this report may not be suitable to all investors, therefore Investors wishing to purchase any of the securities mentioned should consult an investment adviser. The information in this report is not intended, in part or in whole, as financial advice. The information in this report shall not be used as part of any prospectus, offering memorandum or other disclosure ascribable to any issuer of securities. The use of the information in this report for the purpose of or with the effect of incorporating any such information into any disclosure intended for any investor or potential investor is not authorized.

DISCLOSURE

We, First Citizens Bank Limited hereby state that (1) the views expressed in this Research report reflect our personal view about any or all of the subject securities or issuers referred to in this Research report, (2) we are a beneficial owner of securities of the issuer (3) no part of our compensation was, is or will be directly or indirectly related to the specific recommendations or views expressed in this Research report (4) we have acted as underwriter in the distribution of securities referred to in this Research report in the three years immediately preceding and (5) we do have a direct or indirect financial or other interest in the subject securities or issuers referred to in this Research report.