IMF WORLD ECONOMIC OUTLOOK UPDATE – July 2023

Commentary

Global recovery is slowing but signs of progress are undeniable.

The global economy is on track to recover…

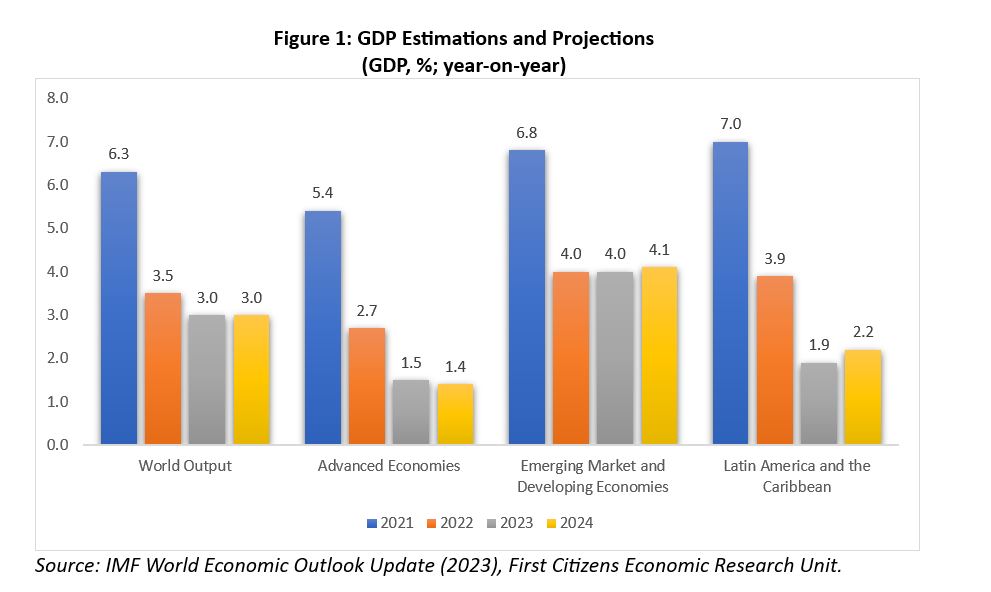

The global economy continues on the road to recovery from the COVID-19 pandemic and the Russia-Ukraine conflict. Supporting this recovery is the fact that the COVID-19 health crisis has officially ended and supply chain disruptions are returning to pre-pandemic levels. Economic activity continues to be resilient resulting in a 0.2 percentage point increase in the global growth forecast for 2023. The global economy is now expected to expand at a 3.0% pace in 2023 and this is expected to remain stable through 2024.

But is not out of the woods yet…

However, economic activity decreased from 3.5% in 2022 and it remains weak by historical standards. The deceleration in global economic activity was largely driven by the advanced economies as growth is estimated to fall from 2.7% in 2022 to 1.5% and 1.4% in 2023 and 2024 respectively. However, emerging market and developing economies have maintained momentum with estimated economic growth of 4.0% in 2022 and 2023, which is expected to marginally increase to 4.1% in 2024. This resilience is mainly driven by the services sector amid a weaker manufacturing sector.

Latin America and the Caribbean continue to be vulnerable…

Economic activity in Latin America and the Caribbean continues to be vulnerable as evidenced by a slowdown from 3.9% in 2022 to 1.9% in 2023. This fading of growth from 2022 reflects a plateauing from the initial rebound from the post-pandemic reopening of the economy as well as lower commodity prices for exporters. A slight uptick to 2.2% is nonetheless projected for 2024 following stronger-than-expected growth in Brazil and Mexico in 2023 from agricultural production and services.

Continued expectations of disinflation…

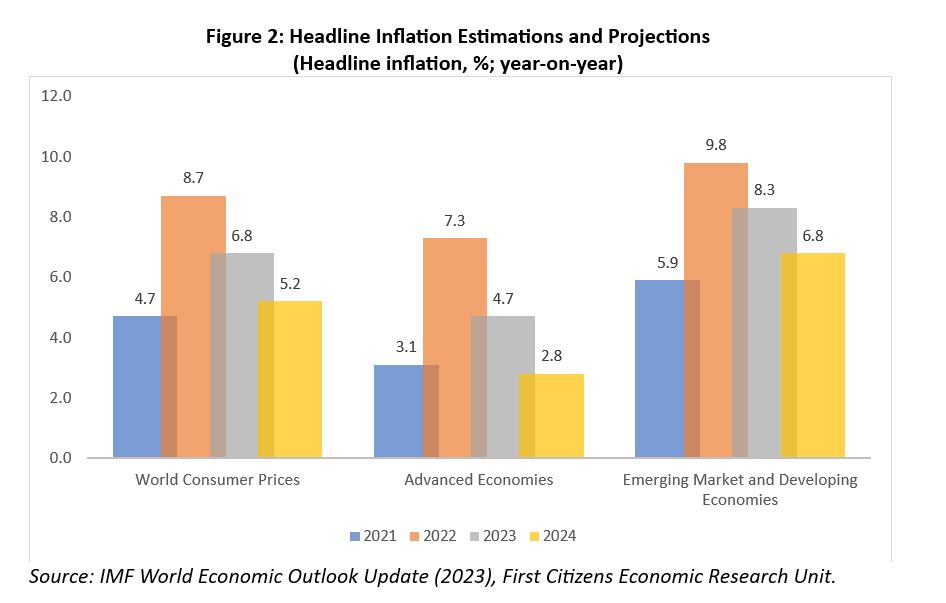

Inflation remains above pre-pandemic levels, but 75% of all economies expect headline disinflation in 2023. The rate of global headline inflation is expected to decrease from 8.7% in 2022 to 6.8% in 2023, tapering in 2024 to 5.2%. The decline in 2023 came faster than expected due to energy and food prices falling faster than anticipated from the conflict-induced peaks. Disinflation is more pronounced for advanced economies with inflation estimated to fall from 7.3% in 2022 to 4.7% in 2023, which was primarily attributed to the decline in commodity prices. However, the dampening of inflation was less evident in emerging market and developing economies with inflation falling meagerly from 9.8% in 2022 to 8.3% in 2023. Continued headline disinflation is expected through 2024 by 89% of economies.

Core inflation globally (which excludes energy and food prices) is declining but at a more gradual pace than headline inflation. Core inflation averaged 6.5% in 2022, and it is expected to decrease marginally to 6.0% in 2023, and 4.7% in 2024. Core inflation continues to exhibit downward stickiness resulting in an upward revision of 0.4 percentage points to the 2024 estimates. The stickiness in core inflation is partly attributable to nominal wage growth remaining strong, and unemployment rates below pre-pandemic levels. More worrisome is that core inflation in advanced economies is expected to remain unchanged at 5.1% in 2023, before declining to 3.1% in 2024. Approximately 50% of economies expect to see no decline in core inflation in 2023.

Risks remain tilted downwards…

Risks to global economic activity remain tilted downwards despite improvements and positive growth surprises since the April 2023 World Economic Outlook. Downside risks include:

- Persistent inflation due to tight labor markets, wage pressures and spirals, extreme weather conditions due to El Niño, the continued conflict in Ukraine, and unfavorable currency movements.

- Financial markets repricing to reflect a higher cost of borrowing as they adjust to tightening monetary policy. These movements could further present interest rate risks, and stress on banks’ and non-banks’ balance sheets as they become more vulnerable to bad debts, loan defaults, and large exposure to interest-sensitive assets. Capital flight can also result in an appreciation of reserve currencies such as the US dollar, and this has repercussions for global trade and growth.

- Debt distress can increase as borrowing costs for emerging market and developing economies remain high, and with limited fiscal space, it increases the risk of debt distress.

- If geoeconomic fragmentation deepens, and the conflict in Ukraine and other geopolitical tensions intensify, this can contribute additional volatility to commodity prices.

As such, certain policies should be prioritized…

In light of these downside risks, policies should prioritize addressing these risks in order to accelerate on the road to economic recovery. These priorities may include:

- A continued and clear commitment to conquering inflation.

- Maintain financial stability and prepare and strengthen the financial system to absorb shocks.

- Rebuild fiscal buffers, create fiscal space, and promote credible medium-term fiscal consolidation.

- Ease the funding squeeze for developing and low-income countries through the Group of Twenty (G20) Common Framework and the Global Sovereign Debt Roundtable.

On the optimistic side…

Upside risks and policy priorities can result in an increased probability of favorable global growth relative to the baseline forecasts. Both headline and core inflation could fall faster than expected with lower energy prices and cost absorption by businesses. As a result, it would reduce the need for monetary policy tightening, thus allowing for a softer landing. Consumers continue to have a stock of excess savings they accumulated, and this could further sustain the recent strength in consumption. Financial instability following the March 2023 banking turmoil remains contained thanks to actions from the US and Swiss authorities. Given these upside risks as well as continued and proactive policy measures, near-term resilience can be expected with awareness of persistent challenges.

DISCLAIMER

First Citizens Bank Limited (hereinafter “the Bank”) has prepared this report which is provided for informational purposes only and without any obligation, whether contractual or otherwise. The content of the report is subject to change without any prior notice. All opinions and estimates in the report constitute the author’s own judgment as at the date of the report. All information contained in the report that has been obtained or arrived at from sources which the Bank believes to be reliable in good faith but the Bank disclaims any warranty, express or implied, as to the accuracy, timeliness, completeness of the information given or the assessments made in the report and opinions expressed in the report may change without notice. The Bank disclaims any and all warranties, express or implied, including without limitation warranties of satisfactory quality and fitness for a particular purpose with respect to the information contained in the report. This report does not constitute nor is it intended as a solicitation, an offer, a recommendation to buy, hold, or sell any securities, products, service, investment or a recommendation to participate in any particular trading scheme discussed herein. The securities discussed in this report may not be suitable to all investors, therefore Investors wishing to purchase any of the securities mentioned should consult an investment adviser. The information in this report is not intended, in part or in whole, as financial advice. The information in this report shall not be used as part of any prospectus, offering memorandum or other disclosure ascribable to any issuer of securities. The use of the information in this report for the purpose of or with the effect of incorporating any such information into any disclosure intended for any investor or potential investor is not authorized.

DISCLOSURE

We, First Citizens Bank Limited hereby state that (1) the views expressed in this Research report reflect our personal view about any or all of the subject securities or issuers referred to in this Research report, (2) we are a beneficial owner of securities of the issuer (3) no part of our compensation was, is or will be directly or indirectly related to the specific recommendations or views expressed in this Research report (4) we have acted as underwriter in the distribution of securities referred to in this Research report in the three years immediately preceding and (5) we do have a direct or indirect financial or other interest in the subject securities or issuers referred to in this Research report.