Has T&T’s Economy Become More or Less Energy-Dependent?

Commentary

Economic diversification has been on Trinidad and Tobago’s agenda since the first “oil boom” of the 1970s, and has remained a major topic of intellectual debate and policy discussion ever since. Recently, the Prime Minister made reference to both past and present government initiatives to develop industries that would reduce this country’s dependence on revenues from the energy sector (oil and natural gas) as drivers of the domestic economy. This has led to a new wave of conversation on the subject among stakeholders in academia, industry and civil society. In this article, we take a look at the energy dependency of T&T’s economy from a macro perspective, as well as recent trends that indicate the direction of the overall diversification thrust.

Link to Energy Prices Remains Tight

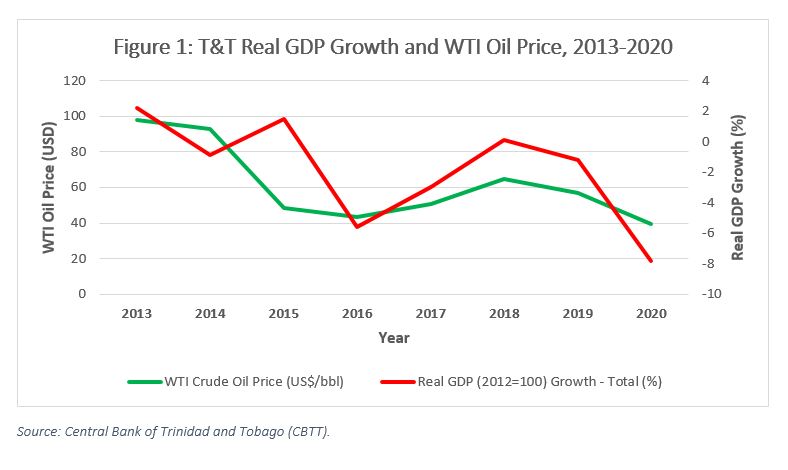

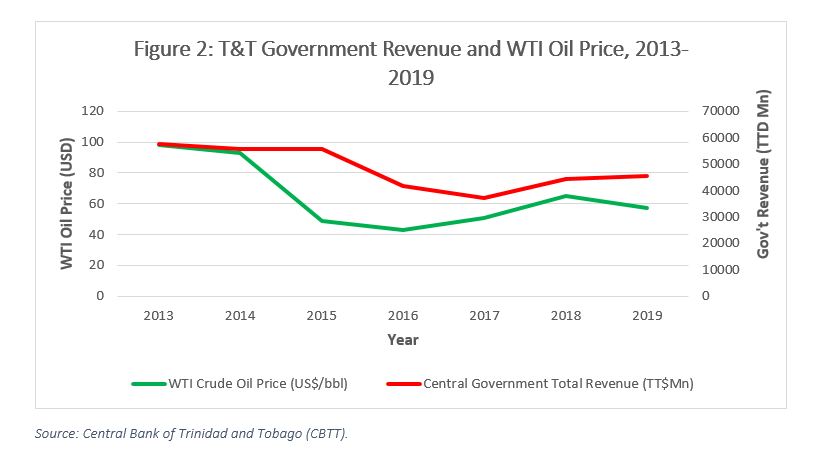

In everyday conversation as well as in official statements such as the National Budget speech, the oil price is an indicator at the forefront when forecasting the fortunes of the T&T economy. As Figures 1 and 2 below show, this is with good reason since both the country’s GDP growth and government revenue track very closely the fluctuations in the West Texas Intermediate (WTI) oil price. Moreover, this relationship has remained tight in recent years.

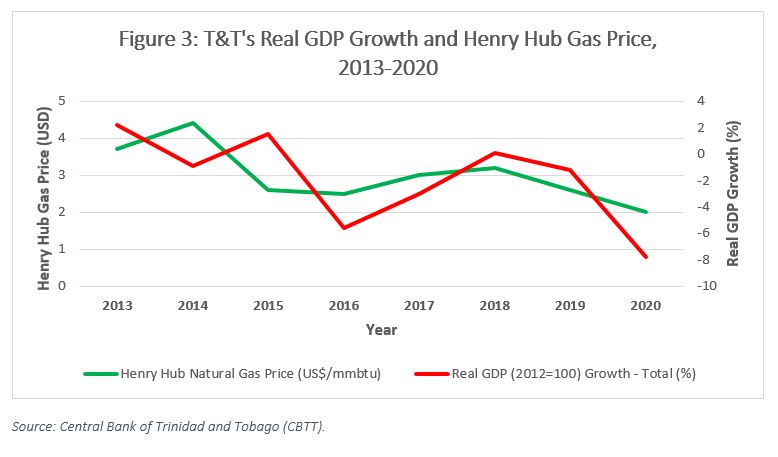

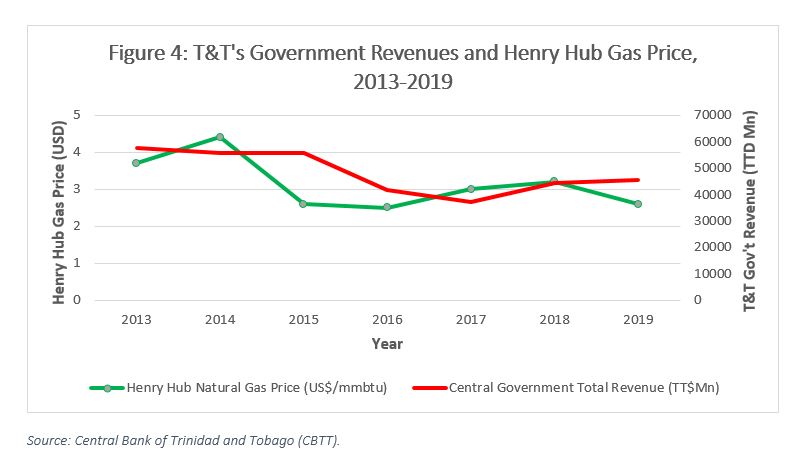

Within the past 20 to 30 years, Trinidad and Tobago has transitioned from a primarily oil-based economy to one that is gas-based. Accordingly, the relationship between the gas price and the country’s key economic indicators has become strong and remained so within the past decade (see Figures 3 and 4).

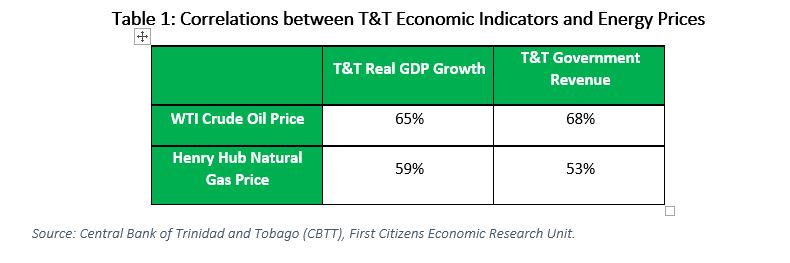

Interestingly, despite the pre-eminence of natural gas in T&T, the oil price is still more strongly correlated with GDP growth and government revenue (65% and 68%) than the gas price (59% and 53%), illustrated in Table 1 below.

Table 1: Correlations between T&T Economic Indicators and Energy Prices

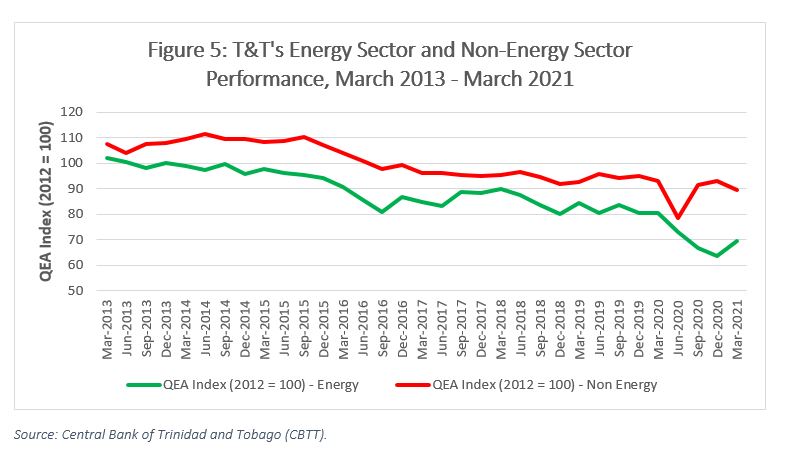

Energy vs Non-Energy Output

Noting that the domestic economy remains sensitive to the prices of hydrocarbon commodities, we turn our attention to the sectoral composition of economic activity itself. The Quarterly Index of Real Economic Activity (QEA), an economic performance indicator compiled by the Central Bank of Trinidad and Tobago, shows that energy sector output at March 2021 stood at only 69.5% of its 2012 level, while non-energy sector output was 89.4% of its 2012 level (see Figure 5). By this measure, the non-energy contribution to output has risen, and so in a literal sense the economy has become more diversified away from oil and gas. However, this change in relative terms cannot hide the reality that overall output in both the energy and non-energy sectors has declined significantly within that same time.

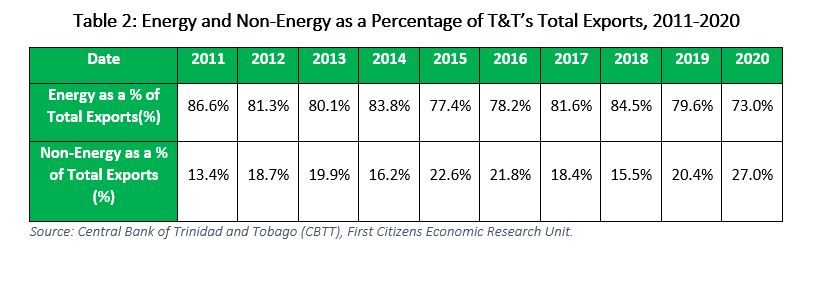

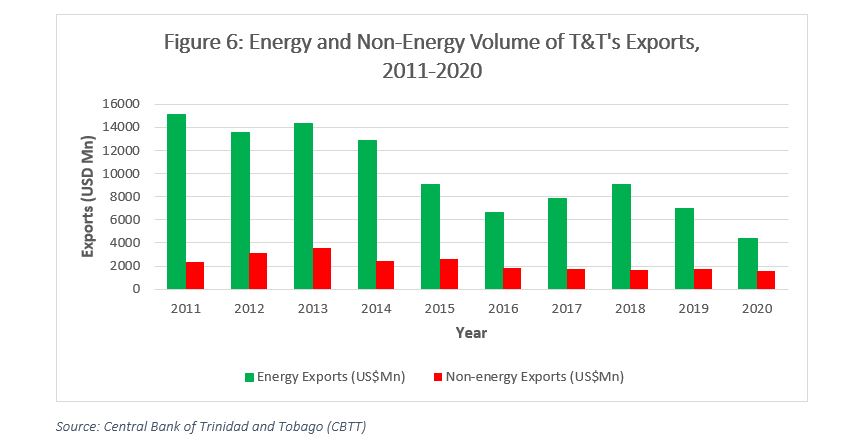

International trade performance, especially for small open economies such as Trinidad and Tobago, is a useful marker of a country’s economic development, since exports are subject to international competition and are less susceptible to the distortive impacts of subsidies. Looking at the trade data from a diversification perspective, a familiar pattern is apparent when we observe the relative proportion of Trinidad and Tobago’s exports split between energy and non-energy (see Table 2 below). Non-energy tradeable products have doubled their percentage contribution of exports from 13.4% in 2011 to 27% in 2020 with a generally upward trend observed throughout the decade. On a relative basis, one could say that the export base of the country has become more diverse. However, the absolute value of those exports (seen in Figure 6) show that this phenomenon is primarily driven by the decline in energy exports since the collapse of the commodity supercycle in 2014, while the value of non-energy exports has remained relatively flat throughout the decade.

Table 2: Energy and Non-Energy as a Percentage of T&T’s Total Exports, 2011-2020

Achieving Sustainable Diversification

As the data shows, the relatively larger non-energy percentage of output and exports in the past decade is almost entirely due to the decline in hydrocarbon prices and production, rather than from growth in dynamic new sectors. To stimulate the latter, which is the goal of economic diversification, research suggests that difficult choices will have to be made, and sooner rather than later. While the standard toolkit of structural reforms to improve the business environment, enhance infrastructure and upgrade the skillset of the workforce is necessary, and has indeed been pursued by the Government in various forms, a 2014 IMF study[1] suggests that these “will not be sufficient due to fundamental market failures stemming from Dutch disease, broadly defined as the crowding out of the non-oil tradable sector by the income generated from oil exports.” Using the examples of Indonesia, Malaysia and Mexico as oil exporters which successfully diversified their economies after the oil price crash of the 1980s, the authors identify aggressive export promotion (Malaysia), exchange rate flexibility (Indonesia) and promotion of foreign direct investment (Mexico) as key drivers in their pursuit of new economic activities. Furthermore, a 2016 IDB study[2] focusing on Trinidad and Tobago, notes that while several diversification initiatives have been pursued, a limiting factor in their effectiveness is the overvaluation of the exchange rate, which severely inhibits the competitiveness of non-energy exports. A combination of measures will be required to ensure that future economic diversification is based on increasing productivity and dynamism.

DISCLAIMER

First Citizens Bank Limited (hereinafter “the Bank”) has prepared this report which is provided for informational purposes only and without any obligation, whether contractual or otherwise. The content of the report is subject to change without any prior notice. All opinions and estimates in the report constitute the author’s own judgment as at the date of the report. All information contained in the report that has been obtained or arrived at from sources which the Bank believes to be reliable in good faith but the Bank disclaims any warranty, express or implied, as to the accuracy, timeliness, completeness of the information given or the assessments made in the report and opinions expressed in the report may change without notice. The Bank disclaims any and all warranties, express or implied, including without limitation warranties of satisfactory quality and fitness for a particular purpose with respect to the information contained in the report. This report does not constitute nor is it intended as a solicitation, an offer, a recommendation to buy, hold, or sell any securities, products, service, investment or a recommendation to participate in any particular trading scheme discussed herein. The securities discussed in this report may not be suitable to all investors, therefore Investors wishing to purchase any of the securities mentioned should consult an investment adviser. The information in this report is not intended, in part or in whole, as financial advice. The information in this report shall not be used as part of any prospectus, offering memorandum or other disclosure ascribable to any issuer of securities. The use of the information in this report for the purpose of or with the effect of incorporating any such information into any disclosure intended for any investor or potential investor is not authorized.

DISCLOSURE

We, First Citizens Bank Limited hereby state that (1) the views expressed in this Research report reflect our personal view about any or all of the subject securities or issuers referred to in this Research report, (2) we are a beneficial owner of securities of the issuer (3) no part of our compensation was, is or will be directly or indirectly related to the specific recommendations or views expressed in this Research report (4) we have acted as underwriter in the distribution of securities referred to in this Research report in the three years immediately preceding and (5) we do have a direct or indirect financial or other interest in the subject securities or issuers referred to in this Research report.

[1] Reda Cherif and Fuad Hasanov. 2014. “Soaring of the Gulf Falcons: Diversification in the GCC Oil Exporters in Seven Propositions.” IMF Working Papers WP/14/177.

[2] Jeetendra Khadan and Inder J. Ruprah. 2016. “Diversification in Trinidad and Tobago: Waiting for Godot?” IDB Policy Brief IDB-PB-256.