Growth or Value Investing

Commentary

In the midst of the current economic environment of rising inflation and economic slowdown, exists a recurring debate among investors of which is better – growth or value investing? Many world renowned investors such as Warren Buffet and Benjamin Graham (regarded as the “father of value investing”) adhere to the value investing principle. Others such as Amazon’s founder Jeff Bezos and hedge fund billionaire Bill Ackman favour growth investing. Regardless of their investing style, investors have the same goal of buying low and selling high. They are just using different approaches to achieve this.

Defining Value and Growth

By definition, growth investing is a stock-buying strategy that looks for companies that are expected to grow at an above-average rate compared to their industry or the broader market. Other attractive characteristics of growth companies also include strong customer loyalty and a valuable and irrefutable brand.

Growth stocks are priced at a premium, which is a price that is higher than its intrinsic value, which is the present value of a company’s future cash flows. Investors will purchase growth stocks with the expectation that they will deliver better-than-average returns.

These companies usually enjoy very strong growth in earnings and often, such growth does not depend on economic conditions. Consequently, such companies are smaller and younger and are positioned to expand and increase earnings and profitability in the future. The premise is that this growth will eventually translate into higher stock prices, as such growth investing is also called capital growth strategy or capital appreciation strategy. The share prices of growth stocks are often more volatile than the overall market and are also known as high beta stocks.

Value investing on the other hand, is an investment strategy where investors aim to buy stocks whose trading prices are below their intrinsic value. These stocks are relatively cheap compared to the underlying revenue and earnings from their businesses and are underappreciated by other investors and the market at large. These stocks may be undervalued for a number of reasons like a short-term public relations crisis or profit disappointment which often leads to a sharp share price fall.

Investors who use this strategy hope that the stock price will rise as more investors learn the true intrinsic value of the company. The greater the difference between the intrinsic value and the current stock price, the greater the ‘margin of safety’ for value investors. This margin of safety will minimize an investor’s losses in the event that their judgement of the success of a company was incorrect.

With value stocks, once other investors realize there is a mismatch between the stock’s current price and its intrinsic value, the share price should go up to reflect this value, and those who purchased the stock at a discount, will gain profits.

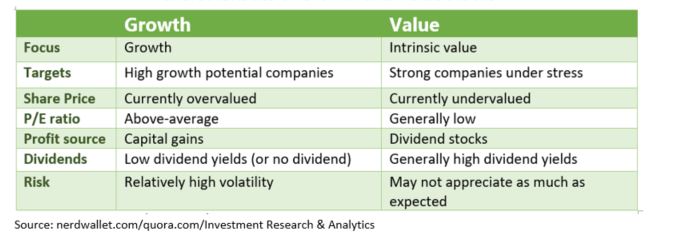

Characteristics of Growth and Value Stocks

Performance of Growth and Value Stocks

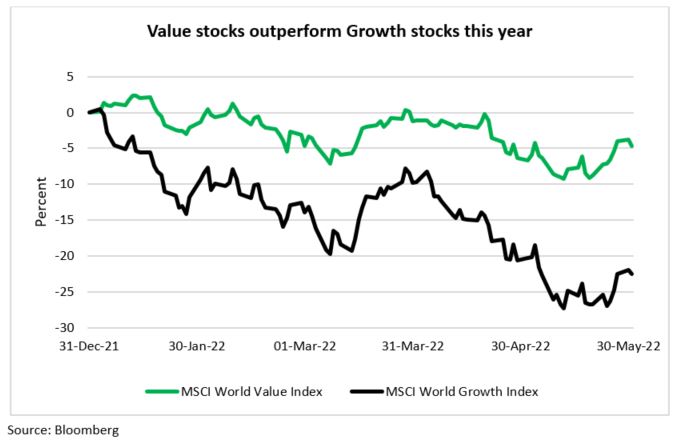

The Federal Reserve raised interest rates for the third time this year, in June 2022, in an effort to temper inflation. According to Bloomberg, higher interest rates mean a bigger discount for the present value of future profits, hurting growth stocks with the highest valuations and boosting value shares. Some value sectors have performed well lately as rising energy prices fuelled inflation and increased investor’s expectations of higher interest rates.

The S&P 500 is not broken down into growth and value stocks. However, the two sectors that are often considered growth are technology and consumer discretionary, while the value sectors are considered to be financials, industrials, energy, and consumer staples.

Both the overall market as measured by the S&P 500 and the tech-heavy Nasdaq is in bear market territory, dropping over 20% from its January 2022 and its November 2021 highs respectively. As a result, all stocks have underperformed, as the rise in bond yields pressures the value of future cash flows that those stocks’ valuations rely on. While the market is down, based on the MSCI indices, value stocks declined by a smaller degree when compared to growth stocks.

Which Investment Style is Better?

All asset classes will have periods of being in and out of favour. There is nothing stating that value will always be safer than growth, or that growth will always outperform value.

Growth stocks experience stock price swings in greater magnitude when compared to value stocks, so they may be best suited for risk-tolerant investors with a longer time horizon. Growth stocks may do better when interest rates are low and expected to stay low.

Value investing requires patience and a long-term mindset as it often takes some time for a value stock to get repriced in line with its intrinsic value. As interest rates rise, many investors shift to value stocks. Economic downturns present an opportunity for a value investor. The goal of value investing is to acquire shares at a discount, and the best time to do so is when the entire stock market is on sale.

The decision to invest in growth or value stocks is ultimately left to an individual investor’s preference, as well as their personal risk tolerance, investment goals, and time horizon. It should be noted that over shorter periods, the performance of either growth or value will also depend in large part upon the point in the cycle that the market happens to be in.

For example, value stocks tend to outperform during bear markets and economic recessions, while growth stocks tend to excel during bull markets or periods of economic expansion. This factor should, therefore, be taken into account by shorter-term investors or those seeking to time the markets.

Growth and value investing is not an either-or option as both offer profitable investing opportunities to their shareholders. There is room for both in investment portfolios and a combined approach can be used, called growth at a reasonable price (GARP). This approach focuses on companies with earnings growth potential without extremely high valuations. It adds diversity to the equity side of a portfolio, offering the potential for returns when either side is in favour.

DISCLAIMER

First Citizens Bank Limited (hereinafter “the Bank”) has prepared this report which is provided for informational purposes only and without any obligation, whether contractual or otherwise. The content of the report is subject to change without any prior notice. All opinions and estimates in the report constitute the author’s own judgment as at the date of the report. All information contained in the report that has been obtained or arrived at from sources which the Bank believes to be reliable in good faith but the Bank disclaims any warranty, express or implied, as to the accuracy, timeliness, completeness of the information given or the assessments made in the report and opinions expressed in the report may change without notice. The Bank disclaims any and all warranties, express or implied, including without limitation warranties of satisfactory quality and fitness for a particular purpose with respect to the information contained in the report. This report does not constitute nor is it intended as a solicitation, an offer, a recommendation to buy, hold, or sell any securities, products, service, investment or a recommendation to participate in any particular trading scheme discussed herein. The securities discussed in this report may not be suitable to all investors, therefore Investors wishing to purchase any of the securities mentioned should consult an investment adviser. The information in this report is not intended, in part or in whole, as financial advice. The information in this report shall not be used as part of any prospectus, offering memorandum or other disclosure ascribable to any issuer of securities. The use of the information in this report for the purpose of or with the effect of incorporating any such information into any disclosure intended for any investor or potential investor is not authorized.

DISCLOSURE

We, First Citizens Bank Limited hereby state that (1) the views expressed in this Research report reflect our personal view about any or all of the subject securities or issuers referred to in this Research report, (2) we are a beneficial owner of securities of the issuer (3) no part of our compensation was, is or will be directly or indirectly related to the specific recommendations or views expressed in this Research report (4) we have acted as underwriter in the distribution of securities referred to in this Research report in the three years immediately preceding and (5) we do have a direct or indirect financial or other interest in the subject securities or issuers referred to in this Research report.