Government Driven Growth in the EU

Commentary

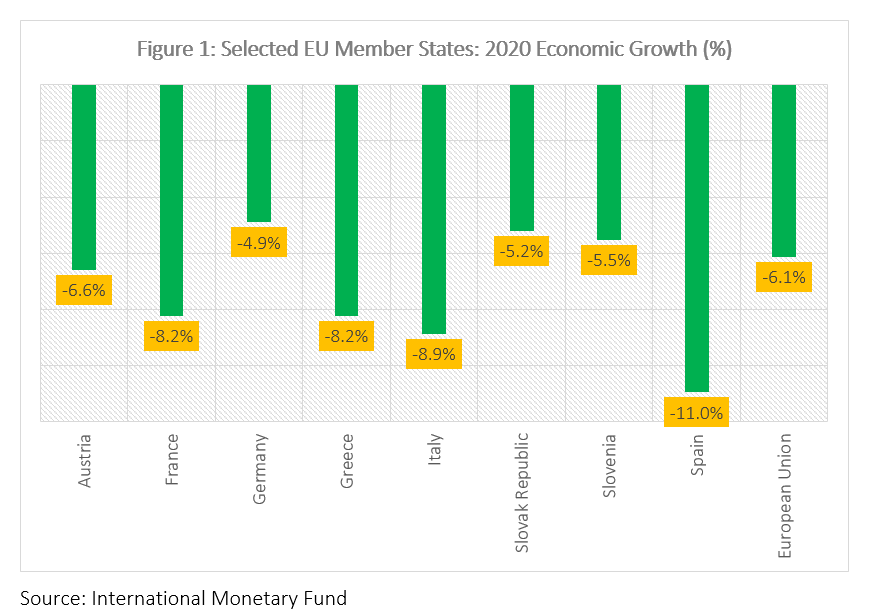

In 2020, the world’s largest trading bloc, the European Union (EU) incurred devastating human and economic losses due to the Covid-19 pandemic. Tough restriction measures implemented resulted in increased joblessness, significant declines in consumer demand and as almost all business sectors were negatively impacted, the EU bloc recorded sharp contractions in economic activity. On aggregate, the EU economy contracted by 6.1% in 2020 due to the global slowdown in trade and travel and as consumer demand plunged, the region slipped into deflationary period, with prices declining by 0.3% in the 12 months to December 2020.

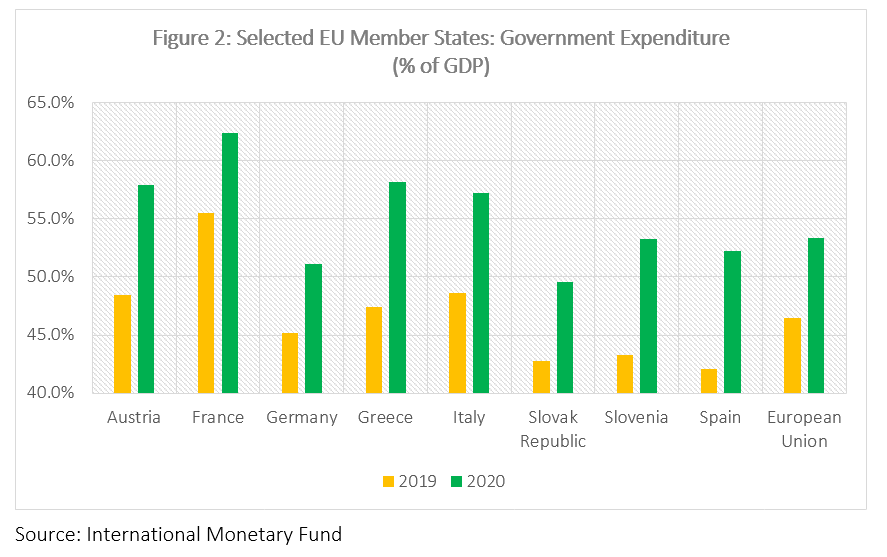

The European Commission acted quickly in 2020 to activate the general escape clause of the Stability and Growth Pact (SGP) which is used to prevent member states from accumulating substantial amounts of debt. Under the SGP, member states are encouraged to keep budget deficits below 3% of GDP in any fiscal year and maintain a debt to GDP ratio of more than 60%. However, it was decided by the European Council and President of the Commission that the fiscal support needed to support citizens and businesses during the pandemic far exceeded the ranges allowed under the SGP, allowing for its temporary suspension. Member states’ respective governments rapidly rolled out sizeable stimulus packages to mitigate the losses incurred due to the pandemic. As a result, total general government expenditure rose to 53.4% of GDP in the EU in 2020 from 46.5% in 2019.

The EU’s long-term budget, the Multiannual Financial Framework (MFF) 2021-2027 was approved and published in 2020. What makes this MFF unique is the inclusion of the EU’s largest stimulus package, the NextGenerationEU (NGEU). The MFF is worth EUR2.018tn in current prices (EUR1.8tn in 2018 prices) and consists of the EU’s long-term budget for 2021 to 2027 worth EUR1.211tn (EUR1.074tn in 2018 prices) and EUR806.9bn (EUR750bn in 2018 prices). The MFF will continue to be financed through customs duties, contributions from member states based on value added tax and member states’ contributions based on gross national income. The NGEU will be financed through borrowing on the markets via the EU Commission’s diversified funding strategy.

The NGEU is a temporary recovery instrument designed to alleviate and rebuild the economic and social damage suffered due to the pandemic. It is broken down into two major support schemes, the Recovery and Resilience Facility (RRF) and the Recovery Assistance for Cohesion and the Territories of Europe (REACT-EU). The RRF represents EUR672.5bn in loans and grants available to support fiscal reforms, investment projects and other activities that may boost economic activity. The aim of this facility is to make European economies more sustainable, resilient and to explore opportunities throughout the green and digital economic and social transitions. The second major arm of the NGEU, the REACT-EU is worth EUR47.5bn and aims to continue and extend crisis response as well as repair measures implemented under the EU’s Coronavirus Response Investment Initiative.

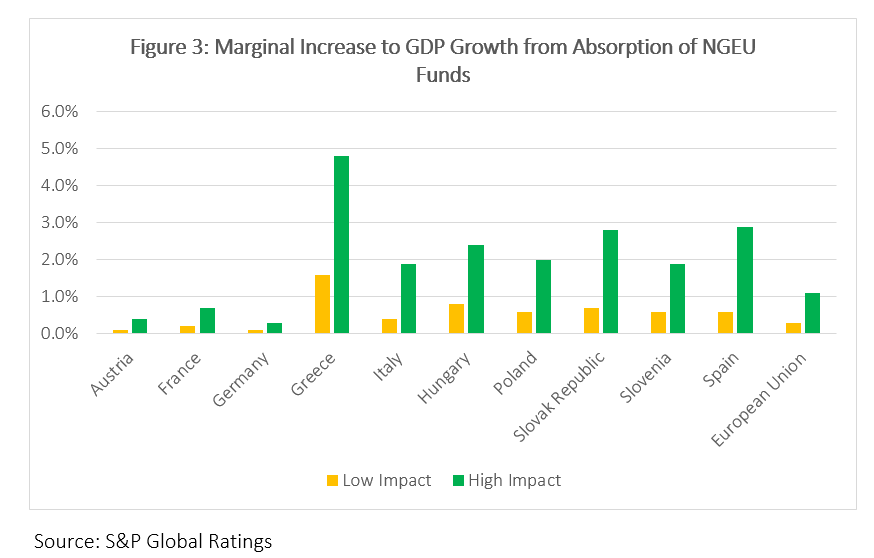

In an article published by S&P Global Ratings “Next Generation EU Will Shift European Growth into a Higher Gear” two main scenarios were examined to determine the impact of NGEU funding on the medium-term growth potential of EU member states. According to the low-impact scenario the EU’s economy may grow by 1.5% by 2026 or by 4.1% under the high-impact scenario over the same time frame. The analysis only considers use of the grants portion of the NGEU which account for roughly EUR377.8bn of which EUR338bn stems from the RFF and EUR39.8bn from REACT-EU. Loans are available to the tune of EUR360bn through the RFF and can be used by member states to boost their reforms. The growth rates faced by individual member states will depend heavily on the use and absorption of NGEU funds over the long-term through to 2026. The marginal increases in economic growth stemming from the NGEU on several member states are shown in figure 3 for the scenarios.

The EU’s GDP is expected to rebound by 4.4% in 2021 as rapid vaccination rollouts allow for easing of restrictions, which should result in resumption of trade and transport activity. Short-term growth will be driven by pent up consumer demand and government spending on ongoing stimulus packages launched in 2020. Medium to long-term growth will depend heavily on the use of NGEU funds within member states to promote economic activity and boost resilience. The NGEU will improve the business environment, labour market and education sector that were impacted severely due to the pandemic in 2020.

DISCLAIMER

First Citizens Bank Limited (hereinafter “the Bank”) has prepared this report which is provided for informational purposes only and without any obligation, whether contractual or otherwise. The content of the report is subject to change without any prior notice. All opinions and estimates in the report constitute the author’s own judgment as at the date of the report. All information contained in the report that has been obtained or arrived at from sources which the Bank believes to be reliable in good faith but the Bank disclaims any warranty, express or implied, as to the accuracy, timeliness, completeness of the information given or the assessments made in the report and opinions expressed in the report may change without notice. The Bank disclaims any and all warranties, express or implied, including without limitation warranties of satisfactory quality and fitness for a particular purpose with respect to the information contained in the report. This report does not constitute nor is it intended as a solicitation, an offer, a recommendation to buy, hold, or sell any securities, products, service, investment or a recommendation to participate in any particular trading scheme discussed herein. The securities discussed in this report may not be suitable to all investors, therefore Investors wishing to purchase any of the securities mentioned should consult an investment adviser. The information in this report is not intended, in part or in whole, as financial advice. The information in this report shall not be used as part of any prospectus, offering memorandum or other disclosure ascribable to any issuer of securities. The use of the information in this report for the purpose of or with the effect of incorporating any such information into any disclosure intended for any investor or potential investor is not authorized.

DISCLOSURE

We, First Citizens Bank Limited hereby state that (1) the views expressed in this Research report reflect our personal view about any or all of the subject securities or issuers referred to in this Research report, (2) we are a beneficial owner of securities of the issuer (3) no part of our compensation was, is or will be directly or indirectly related to the specific recommendations or views expressed in this Research report (4) we have not acted as underwriter in the distribution of securities referred to in this Research report in the three years immediately preceding and (5) we do have a direct or indirect financial or other interest in the subject securities or issuers referred to in this Research report.