Global Inflation Outlook: Can monetary policy effectively control the ongoing shocks?

Commentary

Inflation relates to a situation where the purchasing power of money is eroded over time, typically manifesting as higher prices for goods and services. It is measured by the rate of change in a basket of goods over a period of time, usually the Consumer Price Index (CPI) or a Retail Price Index (RPI). Since around mid-2021, global inflationary pressures have grown and have continued to place downward pressures on economic growth prospects. As at end March 2022, inflation around the world was close to historic highs: US inflation stood at 8.5%, the highest level since 1981; UK inflation came in at 7%, the highest level since 1992; Jamaica’s annual inflation was at its highest level in 11 years (11.3%). The five top performing Latin American economies (LA5) (Brazil, Mexico, Colombia, Chile and Peru) have seen their highest inflation rates in 15 years according to the IMF, breaching the official target inflation ranges set by the respective central bank with price pressures expected to remain elevated in the medium term.

What has been causing the high inflation?

Inflation is currently being driven by two major events, recovery in the economy as pandemic restrictions ease and activity is restarted, and the ongoing Ukraine/Russia conflict. Throughout the COVID-19 pandemic, lockdown measures and support offered by governments have caused imbalances between demand and supply in domestic and global commodity markets. With the easing of restrictions and a return of some level of normalcy, inflation levels were already high and the Russia/Ukraine conflict further stoked price pressures globally.

The impact of the Russia/Ukraine conflict is arguably more profound on inflation due to the nature of the shock, and the far reaching implications it continues to have, not only on global commodity markets but also geopolitical relations and supply disruptions. Both Russia and Ukraine’s presence in global markets are significant and the disruption has seen commodity prices spike significantly.

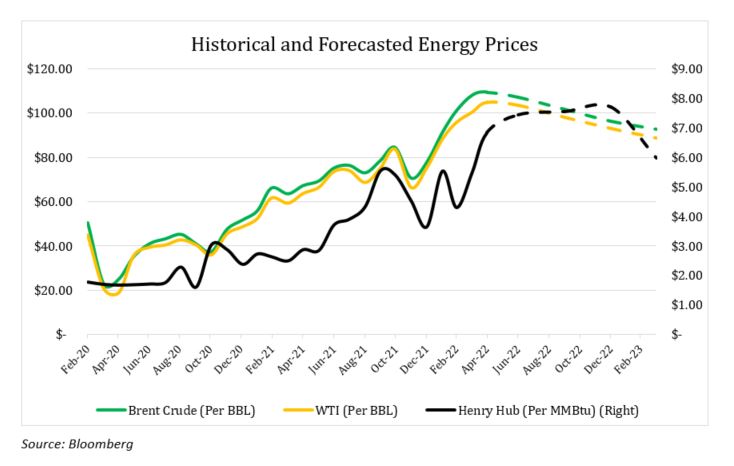

In the energy market, oil and gas prices have been on the rise as sanctions and backlash stacks against major oil and gas producer, Russia. WTI oil prices raised from USD91.64 per barrel before the invasion to a high of USD123.70 on 8 March, while Brent crude prices moved from USD97.13 per barrel in February to a high of USD123.21 on 7 March. Natural gas prices have been on a continual rise, with the Henry Hub Natural gas price increasing from USD4.40 per MMBTU to a high of USD7.82 in April 2022.

Though prices have begun to pull back, forecasts show that prices will remain well above pre-pandemic levels throughout the year. Rising energy prices have seen transportation and freight costs increase significantly, with other commodity prices following as a result.

Agricultural commodity markets have also been disrupted as a result of the Russia/Ukraine conflict, particularly grains such as barley, wheat and corn. Combined, Russia and Ukraine make up roughly 14% and 28% of global wheat production and exports, respectively and 18% and 30% of global barley production and exports respectively. In 2021, Ukraine was the world’s seventh largest producer of corn and the fourth largest exporter with 13% of global exports. Year to date to 9 May, 2022, wheat prices have increased by an average of 42%, while corn prices are up by around 32%.

China, sometimes referred to as ‘the World’s Factory’ has been in lockdown since March 2022 as the country is experiencing an outbreak of new COVID-19 cases. Major manufacturing hubs Shenzhen and Dongguan are among the provinces currently locked down, mounting further pressure on global supply chains. This has also dampened the demand outlook, specifically for energy commodities, given that China is the world’s second largest consumer of oil.

Why is it important to monitor and control inflation?

On the consumer level, inflation increases the cost of living, meaning the amount of money needed to sustain the same lifestyle would increase. While all consumers are affected by this, some are hit harder than others, the spending bundle differs from one income group to another. Low income households are those that are hit hardest by the effects of inflation. According to the World Economic Forum, families in the lowest 20% of income bracket in America typically spend about 15% of their income on groceries alone. This is estimated to be 60% higher than families in the top 20% of income bracket. Fixed income households are usually hit hardest by the effects of inflation. While disposable income remains constant, its value would be reduced proportionate to the rate of inflation. In addition to a change in spending habits, saving habits and capabilities will also be affected. Some consumers may need to dip into savings in the short term in order to maintain a consistent standard of living in an inflationary environment. Lower income households may not have financial buffers to ease the increased burden and may require more drastic measures, thus widening the income inequality gap.

On a macroeconomic scale, high levels of inflation have negative implications for economic growth and stability. The lower demand of goods and services as well as weakened investor sentiment affect two of the main drivers of any economy: consumption and investment. It is for this reason that many central banks across the world adopt an inflation targeting regime in order to achieve price stability given its positive impact on the macro-economy.

If high inflation is left unchecked, or if excessive expansionary policies are implemented, price pressures can accelerate rapidly and reach levels which, while rare, can indicate hyperinflation. Hyperinflation in itself is a rare occurrence, though examples throughout history still exist, two more recent and popular are Zimbabwe and Venezuela. The two most popular causes of hyperinflation historically are reckless policy measures (usually in printing money), and times of war in which production is affected in conjunction with expansionary policies.

Policy Responses to inflation

Economic theory indicates that increases in central bank interest rates can be effective in curbing rising inflation. This is due to the effect it has on investment, consumption and the money supply. As interest rates increase, the cost of borrowing also increases while saving is incentivized since individuals will receive a higher return on savings, which in turn reduces consumption levels, thus relieving price pressures on the demand side. Even though inflation should begin to decline from an interest rate hike, the time it would take to see tangible effects on the economy can range anywhere from a few months to upwards of two years according to the Bank of England. With this time lag, Central Banks must consider all scenarios and be forward looking before implementing an interest rate increase.

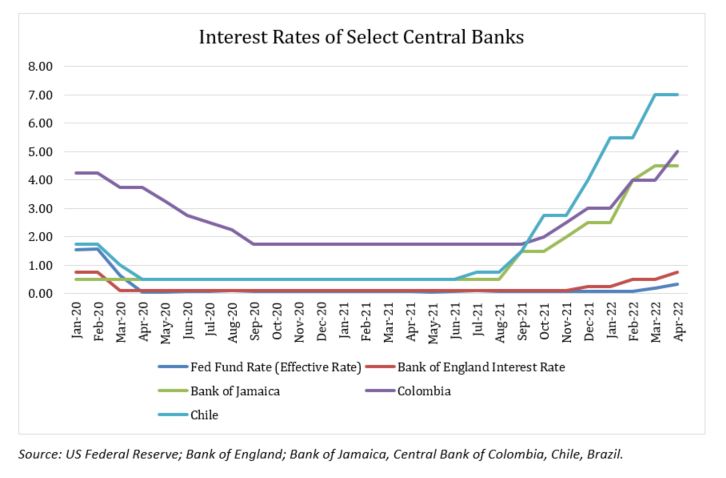

Keeping in line with theory, central banks around the world have been implementing interest rate hikes in order to tackle rising prices. The US Federal Reserve (Fed) is currently tightening its monetary policy by increasing rates and signaling more hikes to come in the fight against inflation. Given its importance in global financial markets, other monetary authorities have to consider policy decisions by the Fed when it comes to their domestic rates. Some selected interest rate adjustments are shown below:

While interest rate hikes can be an effective tool when it comes to controlling inflation, the question can be raised on how much is too much. The effect of rate hikes on investment, consumption and savings levels may lead to economic activity declining significantly. An example of this is Brazil; the Central Bank of Brazil has been implementing aggressive rate hikes since 2021, raising rates from 2% to its current level of 12.75% as of May 2022 in order to combat rampant inflation which came in at 11.3% in March 2022 (the highest level in 28 years). As a result, growth estimates by the IMF for 2022 is a modest 0.81% with the stagnation continuing in 2023 with projected growth of 1.4%. These figures come off the back of 2021’s growth of 4.62%.

Conclusion

The current wave of inflation is having drastic effects on consumers and the wider economy. As central banks engage in monetary policy in an attempt to control inflation, the effectiveness of such policy is difficult to ascertain. This is due to the nature in which inflation is exerting its influence on the global economy, since it largely stems from supply disruptions. While in the past, interest rate manipulation allowed central banks to directly exert influence and manage inflation by tapering demand, the current shocks to the global economy fall outside of this. The direct effect of the interest rate hikes may reduce consumption and investment, however, when coupled with the supply side pressures, may also result in a slowdown in economic growth. Though quick and decisive action is being taken, the IMF expects inflation to remain elevated throughout 2022 and into the first quarter of 2023, weighing heavily on global and regional growth.

DISCLAIMER

First Citizens Bank Limited (hereinafter “the Bank”) has prepared this report which is provided for informational purposes only and without any obligation, whether contractual or otherwise. The content of the report is subject to change without any prior notice. All opinions and estimates in the report constitute the author’s own judgment as at the date of the report. All information contained in the report that has been obtained or arrived at from sources which the Bank believes to be reliable in good faith but the Bank disclaims any warranty, express or implied, as to the accuracy, timeliness, completeness of the information given or the assessments made in the report and opinions expressed in the report may change without notice. The Bank disclaims any and all warranties, express or implied, including without limitation warranties of satisfactory quality and fitness for a particular purpose with respect to the information contained in the report. This report does not constitute nor is it intended as a solicitation, an offer, a recommendation to buy, hold, or sell any securities, products, service, investment or a recommendation to participate in any particular trading scheme discussed herein. The securities discussed in this report may not be suitable to all investors, therefore Investors wishing to purchase any of the securities mentioned should consult an investment adviser. The information in this report is not intended, in part or in whole, as financial advice. The information in this report shall not be used as part of any prospectus, offering memorandum or other disclosure ascribable to any issuer of securities. The use of the information in this report for the purpose of or with the effect of incorporating any such information into any disclosure intended for any investor or potential investor is not authorized.

DISCLOSURE

We, First Citizens Bank Limited hereby state that (1) the views expressed in this Research report reflect our personal view about any or all of the subject securities or issuers referred to in this Research report, (2) we are a beneficial owner of securities of the issuer (3) no part of our compensation was, is or will be directly or indirectly related to the specific recommendations or views expressed in this Research report (4) we have acted as underwriter in the distribution of securities referred to in this Research report in the three years immediately preceding and (5) we do have a direct or indirect financial or other interest in the subject securities or issuers referred to in this Research report.