Foreign Direct Investment (FDI) in Latin America and Caribbean

Commentary

Foreign direct investment (FDI) has long been an important driver of economic growth in countries around the world as it significantly impacts a country’s external accounts, as well as its long-term productivity and growth prospects. Particularly for Latin America and the Caribbean (LAC), FDI plays a crucial role in economic development as it helps the region overcome existing structural and institutional barriers to economic growth, increase competitiveness, and integrate more effectively into the global economy.

According to the Economic Commission for Latin America and the Caribbean (ECLAC),

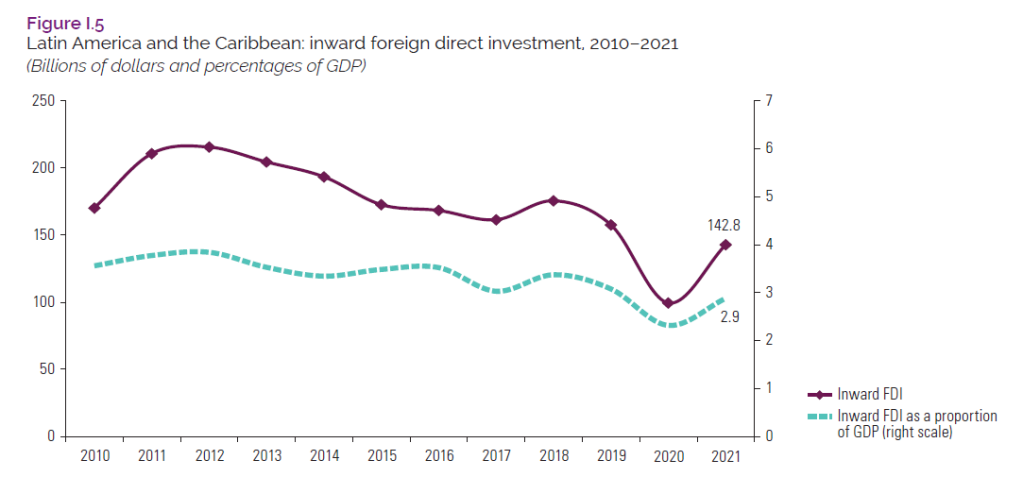

FDI flows to the Latin America and Caribbean region witnessed a significant decline of 34% in 2020 due to the COVID-19 pandemic and its global economic impacts. However, there were positive signs of recovery in the second half of 2020, with FDI flows increasing by 9% compared to the first half. In 2021, global FDI inflows saw a surge of 64% reaching approximately USD1.6 Tn, but the Latin America and Caribbean region experienced a sharp decline. Despite receiving USD142.8 Bn (or 2.9% of GDP) in FDI in 2021 (see Figure 1), which was 40.7% more than in 2020, the growth was insufficient to achieve its pre-pandemic levels, according to ECLAC.

Figure 1: Latin America and the Caribbean: inward foreign direct investment, 2010-2021

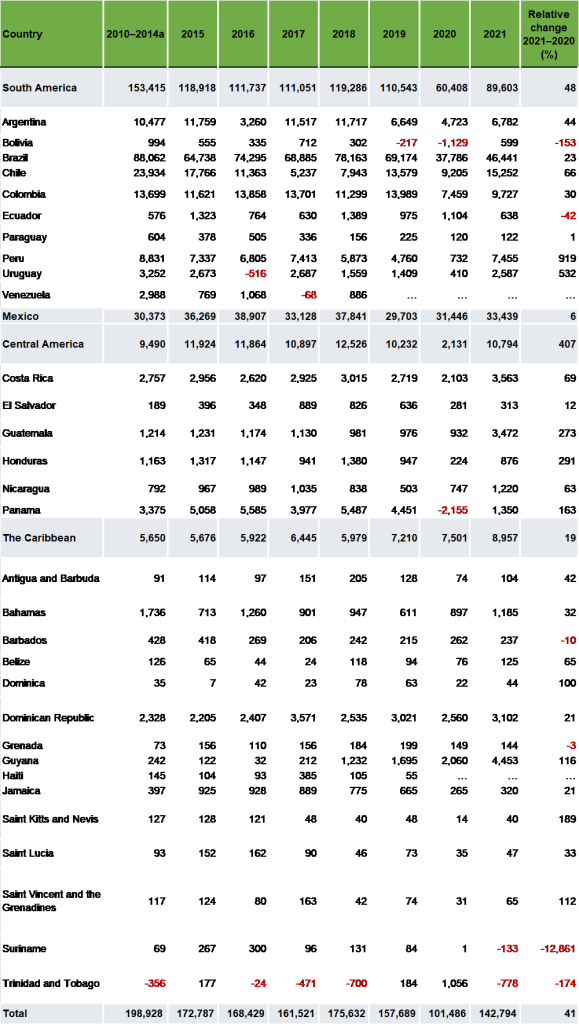

The highest FDI inflows were received by Brazil (33% of the total), followed by Mexico (23%), Chile (11%), Colombia (7%), Peru (5%) and Argentina (5%). For the Caribbean, total inflows in 2021 totalled USD8.96 Bn which was a 19.4% increase from 2020. This was accounted for mainly by Guyana who exhibited the strongest growth in inflows, accounting for 50%, surpassing the Dominican Republic, which had been the leading recipient of investments in previous years (see Table 1). The main sectors triggering interests for FDI in the region in recent years, include renewable energy, technology, and the service sector. Many countries in the region have also been promoting investment in infrastructure projects, particularly in the areas of transportation, energy, and telecommunications. Investment in the tourism and hotel industry is also higher by 24% since 2019 with countries such as Dominican Republic, Jamaica and Barbados showing strong potential for attracting investment from outside companies.

In 2021, The Bahamas experienced a significant increase in FDI inflows of 32%, reaching USD1.12 Bn, which is the highest amount recorded since 2016. The financial services sector accounted for the largest share of FDI project announcements, which amounted to USD43 Mn, a significant increase from the previous year, where there were no announcements. The expansion of the Royal Bank of Canada’s private banking operations in the country was the most notable announcement, valued at USD33 Mn. The Organisation of Eastern Caribbean States (OECS) countries, including Antigua and Barbuda, Dominica, Grenada, St Kitts and Nevis, St Lucia, and St Vincent and the Grenadines, saw an increase in FDI inflows of 37%, totalling USD445 Mn, however, none of these countries were able to recover to pre-pandemic FDI levels. In contrast, Trinidad and Tobago experienced a negative FDI inflow of USD778 Mn in 2021, a decline of 174% from 2020, primarily due to outflows in the hydrocarbon sector.

Table 1: Latin America and the Caribbean: inward foreign direct investment, by recipient country and sub-region, 2010–2014 and 2015–2021

Despite the challenges, net FDI flows to the LAC region saw a surge in the first quarter of 2022 and though volatile, many countries recorded their highest inflows in over a decade. The Economist Intelligence Unit (EIU) speculates that this spike may be attributed to one-off transactions or a ‘pile-up’ of investments that were delayed due to the pandemic. There are other existing economic indicators however that highlight the strength of activity in the region’s major economies such as, the recovery of private-sector credit which is growing robustly; wage growth in many countries is still positive in real terms; and job growth has also gathered pace.

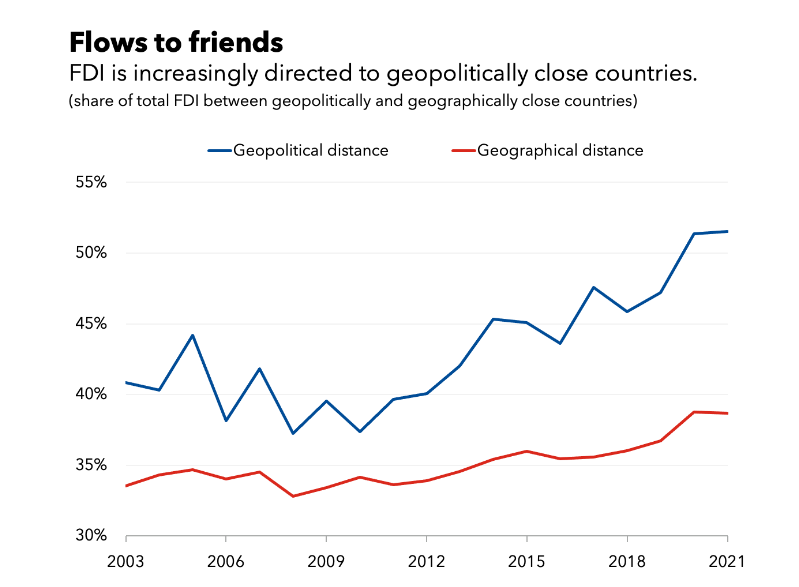

However, external conditions have turned bleaker following the recent banking crisis in the US and Europe. Investors have turned more risk-averse, and credit has become more expensive. Furthermore, upcoming political and social tensions might also keep some investors away in 2023 and beyond. The International Monetary Fund (IMF) has noted that as geopolitical tensions intensify, companies and policymakers are increasingly considering strategies to strengthen supply chains by relocating production to trusted countries or back to their home countries. Over the past decade, the flow of FDI between geo-politically aligned economies have been increasing even more so than those that are nearer in geographic proximity (see Figure 2).

Figure 2: Flows to Friends: FDI is increasingly directed to geopolitically close countries

Source: International Monetary Fund (IMF)

As FDI becomes more concentrated amongst aligned countries, emerging markets and developing countries are left in a vulnerable position as opposed to advanced economies as they rely more on geo-politically distant countries.

The LAC region has the potential to benefit from the global trend of nearshoring and the move towards greener industries. The World Bank has suggested that countries in the region should preserve their resilience and take advantage of the opportunities presented by nearshoring and green industries to boost economic growth. For instance, Mexico has successfully taken advantage of nearshoring by capturing US market share from China and other Asian countries. According to the EIU, in May 2022, Mexico’s exports to the US accounted for 44% of total, up from 41% in the previous year and 37% in 2018, just before the US-China trade war began. The adoption of nearshoring can increase trade openness and attract more FDI flows to the LAC region. In addition, the transition to cleaner energy in the region is attracting private capital, which could create opportunities for foreign investors interested in sustainable investing.

According to ECLAC, to ensure a positive impact of FDI, it is imperative to align productive development policies with the attraction of high-productivity investments. These investments should focus on activities that support virtuous development processes in terms of inclusivity, employment quality, environmental sustainability, innovation, and technological complexity. However, the outlook for FDI flows in 2023 remains uncertain due to economic deceleration, heightened recession risks, a challenging external environment, and political and social tensions. Despite these challenges, the LAC region remains an attractive destination for investors, and strategic efforts should be made to maximize its potential.

DISCLAIMER

First Citizens Bank Limited (hereinafter “the Bank”) has prepared this report which is provided for informational purposes only and without any obligation, whether contractual or otherwise. The content of the report is subject to change without any prior notice. All opinions and estimates in the report constitute the author’s own judgment as at the date of the report. All information contained in the report that has been obtained or arrived at from sources which the Bank believes to be reliable in good faith but the Bank disclaims any warranty, express or implied, as to the accuracy, timeliness, completeness of the information given or the assessments made in the report and opinions expressed in the report may change without notice. The Bank disclaims any and all warranties, express or implied, including without limitation warranties of satisfactory quality and fitness for a particular purpose with respect to the information contained in the report. This report does not constitute nor is it intended as a solicitation, an offer, a recommendation to buy, hold, or sell any securities, products, service, investment or a recommendation to participate in any particular trading scheme discussed herein. The securities discussed in this report may not be suitable to all investors, therefore Investors wishing to purchase any of the securities mentioned should consult an investment adviser. The information in this report is not intended, in part or in whole, as financial advice. The information in this report shall not be used as part of any prospectus, offering memorandum or other disclosure ascribable to any issuer of securities. The use of the information in this report for the purpose of or with the effect of incorporating any such information into any disclosure intended for any investor or potential investor is not authorized.

DISCLOSURE

We, First Citizens Bank Limited hereby state that (1) the views expressed in this Research report reflect our personal view about any or all of the subject securities or issuers referred to in this Research report, (2) we are a beneficial owner of securities of the issuer (3) no part of our compensation was, is or will be directly or indirectly related to the specific recommendations or views expressed in this Research report (4) we have acted as underwriter in the distribution of securities referred to in this Research report in the three years immediately preceding and (5) we do have a direct or indirect financial or other interest in the subject securities or issuers referred to in this Research report.