Federal Reserve Balance Sheet and Quantitative Tightening

Commentary

The US Federal Reserve (FED) in its May 2022 meeting raised interest rates by 0.50% (50 bps), the single largest hike since 2000, bringing the rate to a target range of 0.75% to 1.00%. In addition to this, the FED announced that it will begin reducing its holdings of Treasury securities as well as agency debt and agency mortgage-backed securities (MBS) – a process known as Quantitative Tightening (QT) on 1 June 2022. QT is a component of policy normalization and is widely considered unconventional monetary policy as the FED’s main policy tool is the FED Funds Rate. The decision to reduce its holdings of Treasury securities and MBS has been in the making for several months, but FED officials are taking a measured approach. Securities held by the FED accounts for around 95% of its total balance sheet. Of this, approximately 66% are Treasury securities, including shorter-term Treasury bills, notes and bonds. The other 33% are Federal agency debt and mortgage-backed securities combined.

Since early 2021, the FED has openly discussed reducing its asset purchases, effectively giving markets advance notice of its intentions to limit any potential disruption. The FED also acknowledged discussions regarding QT at several of its meetings in 2021.

The Federal Reserve balance sheet

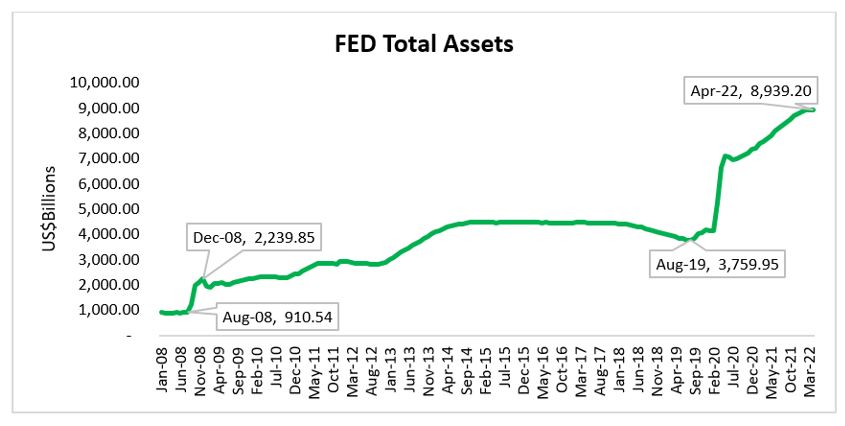

In response to weakening economic conditions due to the Global Financial Crisis, the FED lowered its target for the federal funds rate from 4.5% at the end of 2007 to 2% at the beginning of September 2008. As the financial crisis and the economic contraction intensified over September to December 2008, the FED accelerated its interest rate cuts, taking the rate to a target range of 0% to 0.25% by the end of 2008. The interest rate cuts however were not enough to stimulate the economy and resulted in the FED utilizing more unconventional tools – using its balance sheet to pump money into the economy for the first time. The FED’s balance sheet grew from under USD1 trillion before the 2008-2009 recession to around USD4.5 trillion in 2015.

Following the onset of the Covid-19 pandemic in March 2020, the FED purchased more than USD4.5 trillion of Treasury securities and agency mortgage-backed securities. These purchases facilitated smooth market functioning and supported the flow of credit to households and businesses. Additionally, this action also helped to put downward pressure on longer-term interest rates, thereby supporting the recovery from the pandemic as the cost of borrowing fell.

Over most of this period, the monthly pace of purchases was USD80 billion for Treasury securities and USD40 billion for agency MBS. Overall, securities holdings more than doubled, from about USD3.9 trillion in early March 2020 to USD8.9 trillion in April 2022.

Shrinking the Balance Sheet

The Federal Reserve started the process of shrinking its balance sheet in 2017 but after around two years, volatility in the money markets caused the FED to stop the shrinkage process. Now, the Federal Reserve is about to start reducing the balance sheet again which is worth significantly more than it was after the 2008-2009 recession.

The FED intends to reduce its securities holdings by not reinvesting the funds into new securities it receives from the securities that are maturing. Rather it will redeem the maturing security, which will reduce the amount of the Fed’s securities holdings and the size of its balance sheet.

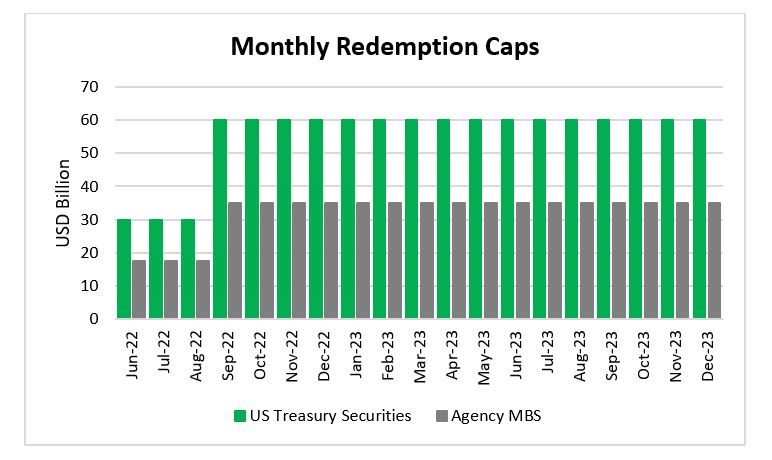

The pace of these runoffs will be capped, initially at USD30 billion a month for Treasury securities and USD17.5 billion per month for agency mortgage-backed securities. Those caps will be increased to twice the amount after three months with the FED’s securities holdings expected to decline by up to USD95 billion a month. While the FED has not stated how long the runoffs will continue, they indicated that enough securities will be retained to ensure the efficient and effective implementation of monetary policy.

At the current rate, the total reduction in the FED’s holdings will amount to around USD1.66 trillion by the end of 2023. To ensure a predictable and smooth reduction in its balance sheet, the FED has implemented redemption caps on the dollar amount of securities that will run off their portfolio in any given month. While the redemption caps have been established, the FED stated that they are prepared to adjust any of the details in its approach to reducing the size of the balance sheet in light of economic and financial developments.

Impact of Quantitative Tightening on Financial Markets

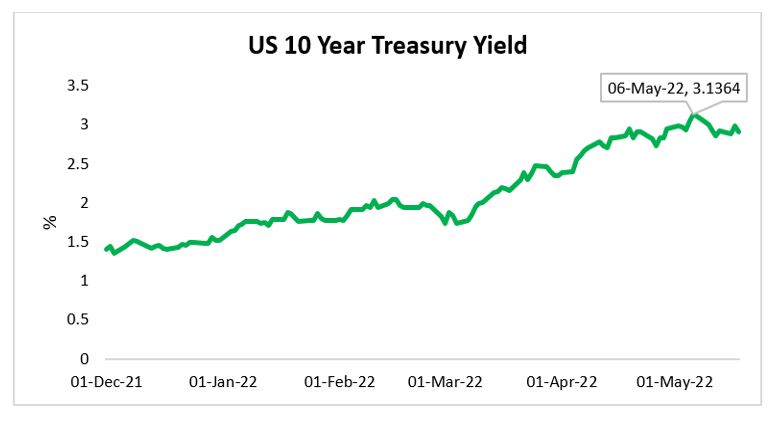

The FED’s Quantitative Tightening is expected to lead to higher interest rates. As the volume of the FED’s bond purchases fall, the supply of bonds for the market to absorb will increase which may lead to a fall in bond prices and a subsequent rise in interest rates in order to attract enough investor demand.

With the FED already implementing interest-rate hikes, when combined with shrinking its balance sheet it may create upward pressures on Treasury Yields. Treasury yields have soared in the first quarter of 2022 as the 10 year rates climbed about 0.71 percentage points. Further increases were experienced in April and early May with the 10-year treasury rate reaching a high of 3.13% on 6 May 2022.

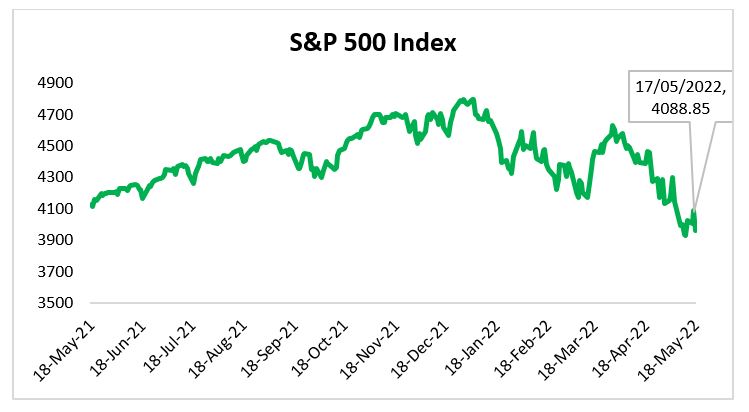

Riskier asset classes such as stocks may experience higher volatility as the FED continues to hike interest rates and shrinks its balance sheet. The accommodative monetary policy implemented by the FED during the Covid-19 pandemic is being withdrawn which reduces the safety net that investors previously experienced. As such, investors may reduce their exposure to stocks given the increased volatility.

The stock market is also being impacted by the disappointing quarterly earnings from major retailers whose profits were negatively impacted by rising costs and supply chain issues. These issues were worsened by the current geopolitical tensions between Russia and Ukraine. As a result, the S&P 500 Index has declined sharply, with a year to date loss of 14.2%. The outlook for US stocks was also impacted as Goldman Sachs, one of many investment houses lowered their forecast for the stock market due to higher interest rates and slower economic growth.

Outlook

As the FED continues to tighten its monetary policy with another rate hike on the horizon, coupled with efforts to shrink the balance sheet, there is a possibility that interest rates may continue to increase over the short to medium term. According to Wells Fargo Investment Institute, shrinking the FED’s balance sheet by USD1.5 trillion is the equivalent to hiking interest rates by up to 1 percentage point.

Consequently, investors may expect a more volatile stock market. Higher interest rates may further negatively impact investors who use margin facilities (trading using borrowed funds). As margin rates rise amidst a volatile market, investors are exposed to more risk as compared to regular stock trading. The investors who invest on margin will now have to pay a higher amount in interest on the borrowed money and a higher risk of losing money on their stock holdings. This may prompt a further sell off in the market as investors unwind their positions to reduce their risk exposure.

Given a bond’s sensitivity to interest rates, rising interest rates will lead to a reduction in a bond’s price to reflect its lower coupon rate when compared to the more recently issued bonds at higher rates. This loss in value can be cushioned somewhat by investing the coupon income at a higher rate. While the returns on fixed income securities may be negatively impacted, such holdings are important in reducing overall risk in a well-diversified portfolio.

While the FED is determined to shrink its balance sheet, it is also prepared to adjust the reduction in the size of the balance sheet in light of any economic and financial developments. The FED also has new tools at its disposal that it can use to avert any short-term strains in financial markets. In 2021, the FED introduced the Standing Repo Facility, which can provide as much as USD500 billion of cash overnight to the banking system. The Federal Reserve Bank of New York can also support unscheduled domestic repurchase agreements to calm the financial markets.

DISCLAIMER

First Citizens Bank Limited (hereinafter “the Bank”) has prepared this report which is provided for informational purposes only and without any obligation, whether contractual or otherwise. The content of the report is subject to change without any prior notice. All opinions and estimates in the report constitute the author’s own judgment as at the date of the report. All information contained in the report that has been obtained or arrived at from sources which the Bank believes to be reliable in good faith but the Bank disclaims any warranty, express or implied, as to the accuracy, timeliness, completeness of the information given or the assessments made in the report and opinions expressed in the report may change without notice. The Bank disclaims any and all warranties, express or implied, including without limitation warranties of satisfactory quality and fitness for a particular purpose with respect to the information contained in the report. This report does not constitute nor is it intended as a solicitation, an offer, a recommendation to buy, hold, or sell any securities, products, service, investment or a recommendation to participate in any particular trading scheme discussed herein. The securities discussed in this report may not be suitable to all investors, therefore Investors wishing to purchase any of the securities mentioned should consult an investment adviser. The information in this report is not intended, in part or in whole, as financial advice. The information in this report shall not be used as part of any prospectus, offering memorandum or other disclosure ascribable to any issuer of securities. The use of the information in this report for the purpose of or with the effect of incorporating any such information into any disclosure intended for any investor or potential investor is not authorized.

DISCLOSURE

We, First Citizens Bank Limited hereby state that (1) the views expressed in this Research report reflect our personal view about any or all of the subject securities or issuers referred to in this Research report, (2) we are a beneficial owner of securities of the issuer (3) no part of our compensation was, is or will be directly or indirectly related to the specific recommendations or views expressed in this Research report (4) we have acted as underwriter in the distribution of securities referred to in this Research report in the three years immediately preceding and (5) we do have a direct or indirect financial or other interest in the subject securities or issuers referred to in this Research report.