Fed Pivot

Commentary

Economies around the world have faced rising inflationary pressures for most of 2022, propelled by global supply-chain disruptions caused by the COVID-19 pandemic and higher energy prices largely due to the conflict in Ukraine. Many countries are experiencing record high inflation, including the US, UK and Brazil and in an attempt to temper the rise in consumer prices, several major central banks have been implementing aggressive monetary tightening measures.

The US was the first among the developed nations to hike interest rates in 2022. The US Federal Reserve (Fed) began raising interest rates in March 2022, starting with a 25 basis points (bps) hike, bringing the federal funds rate range to 0.25% – 0.50%. As inflation continued its ascent, the Fed was continually prompted to raise rates, hiking interest rates four times for the year so far, with the latest increase occurring in November 2022 where the federal fund rate was increased by 75 basis points (bps), bringing the target range to 3.75% – 4.00%.

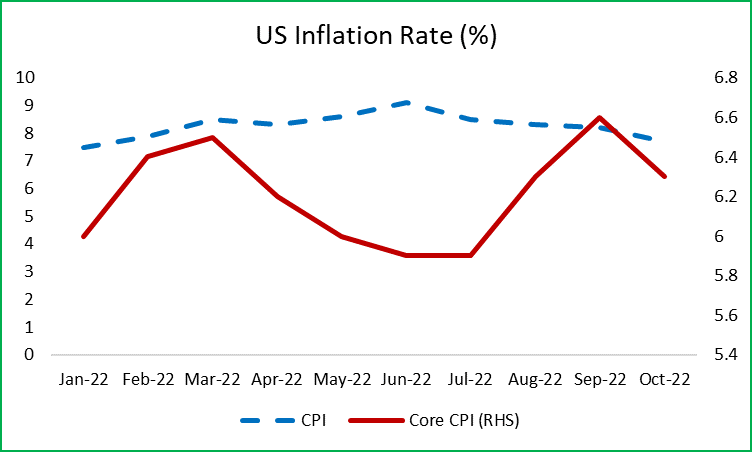

Since peaking at 9.1% in June 2022, the US inflation rate has eased, albeit marginally, to 8.5% in July, 8.3% in August and 8.2% in September 2022. For the month of October 2022, the rise in consumer prices decelerated materially as it slowed to 7.7% – a level that has not been seen since the beginning of the year. This deceleration in the inflation rate appears to suggest that the impact of a tighter monetary policy has started to take effect, suggesting that a pivot by the US Fed in the near term may be warranted.

Source: Bloomberg

What is a Pivot?

A pivot occurs when the Fed reverses its policy outlook and shifts from expansionary to contractionary monetary policy or, conversely, from contractionary to expansionary policy. A pivot typically happens when economic conditions have fundamentally changed in such a way that the Fed can no longer continue its prior policy stance. In March 2022, a change in strategy from accommodative to tighter monetary policy marked a Fed pivot.

The pivot is likely to follow these stages:

- A reduction in the size of the rate hikes.

- A pause in rate hikes, likely to assess the economic landscape and the progressive impact of the hikes.

- Rate cuts.

Pivot Example

The coronavirus pandemic triggered a deep economic downturn worldwide as several economies implemented lockdowns and other restrictive measures in an attempt to curb the infection rate. In order to cushion the economic fallout, many central banks loosened monetary policy by implementing quantitative easing, which is large scale asset purchases, and lowering key interest rates. In the US, the Fed promptly pivoted and cut the Fed Funds rate from around 2.5% to close to 0%, where it remained until early 2022, when inflation began increasing.

Why Does a Pivot Matter?

High interest rates increase the costs of borrowing. As a result, consumers and companies tend to borrow less which may affect the country’s economic performance. Faced with reduced sales as consumers temper their borrowing activities amidst higher borrowing costs, companies may start to lay off staff and delay capital expenditure programmes in an attempt to preserve profit margins. Companies’ earnings may be adversely impacted and dividends may be cut or reduced, negatively impacting share prices. As at the end of October 2022, the S&P 500 Index year-to-date (YTD) return was -22.15%. When the Fed does pivot from tightening to loosening, this could possibly trigger a positive shift for the stock market.

Timing of the pivot

While the US Fed has pledged to keep hiking interest rates until inflation returns closer to its 2% target rate, at the November 2022 press conference, some committee members judged that a slowing in the pace of the Fed funds rate increase would likely be appropriate in the near future. A pause may be warranted as it would allow the committee to assess the impact of the rate hikes thus far and determine the extent to which further increases are needed to keep inflation at an acceptable level.

The timing of the pivot will be based on certain economic milestones, notably slower headline and core inflation, a pullback in wage growth and a softer labour market (which has remained resilient thus far). Some experts say it’s reasonable to expect the first cut to happen late in 2023 or, at the latest, in early 2024. However, monetary policy works with lags, thus determining when interest rates have reached the level needed to bring inflation down is somewhat challenging.

Positioning Your Investment Portfolio for a Pivot

Where the markets go from here and how to position an investment portfolio largely depends on the timing and how precisely the Fed changes its strategy. Investors must be careful not to position their portfolio for a single outcome, since markets are unpredictable.

History suggests the path to a Fed pivot could be volatile for stocks due to elevated inflation and interest rate risk. Some investors may consider allocating their portfolio towards investments that may better weather a recession. Another option may be to consider defensive stocks (like utilities, healthcare or consumer staples), or stocks that do well when there is solid economic growth like energy and financial services.

Treasuries or high quality corporate bonds may also be considered, with the knowledge that a recession may increase the default risk of corporate bond issuers. In anticipation of a lower interest rate environment, bonds with longer tenors can be sought to lock in the prevailing high yields.

During times of heightened market volatility, investors should strive to have a balanced portfolio approach in an effort to reduce the overall risk. If the stock market takes a hit, bond values might help anchor the portfolio, and vice versa. While no one can accurately predict the future of financial markets, investors can prepare for anything the markets may bring.

DISCLAIMER

First Citizens Bank Limited (hereinafter “the Bank”) has prepared this report which is provided for informational purposes only and without any obligation, whether contractual or otherwise. The content of the report is subject to change without any prior notice. All opinions and estimates in the report constitute the author’s own judgment as at the date of the report. All information contained in the report that has been obtained or arrived at from sources which the Bank believes to be reliable in good faith but the Bank disclaims any warranty, express or implied, as to the accuracy, timeliness, completeness of the information given or the assessments made in the report and opinions expressed in the report may change without notice. The Bank disclaims any and all warranties, express or implied, including without limitation warranties of satisfactory quality and fitness for a particular purpose with respect to the information contained in the report. This report does not constitute nor is it intended as a solicitation, an offer, a recommendation to buy, hold, or sell any securities, products, service, investment or a recommendation to participate in any particular trading scheme discussed herein. The securities discussed in this report may not be suitable to all investors, therefore Investors wishing to purchase any of the securities mentioned should consult an investment adviser. The information in this report is not intended, in part or in whole, as financial advice. The information in this report shall not be used as part of any prospectus, offering memorandum or other disclosure ascribable to any issuer of securities. The use of the information in this report for the purpose of or with the effect of incorporating any such information into any disclosure intended for any investor or potential investor is not authorized.

DISCLOSURE

We, First Citizens Bank Limited hereby state that (1) the views expressed in this Research report reflect our personal view about any or all of the subject securities or issuers referred to in this Research report, (2) we are a beneficial owner of securities of the issuer (3) no part of our compensation was, is or will be directly or indirectly related to the specific recommendations or views expressed in this Research report (4) we have acted as underwriter in the distribution of securities referred to in this Research report in the three years immediately preceding and (5) we do have a direct or indirect financial or other interest in the subject securities or issuers referred to in this Research report.