Extreme Poverty

Commentary

Global poverty is a colossal issue facing the world today and the Caribbean is no exception. According to the World Bank, extreme poverty can be defined as living on less than USD1.90 per day and currently, there is a large portion of the Caribbean diaspora which continues to live below this poverty line. Historically, deep rooted issues such as slavery, colonisation, indentureship, racial and class inequality have impacted Caribbean economic and societal development and arguably resulted in a cycle of income inequality and poverty.

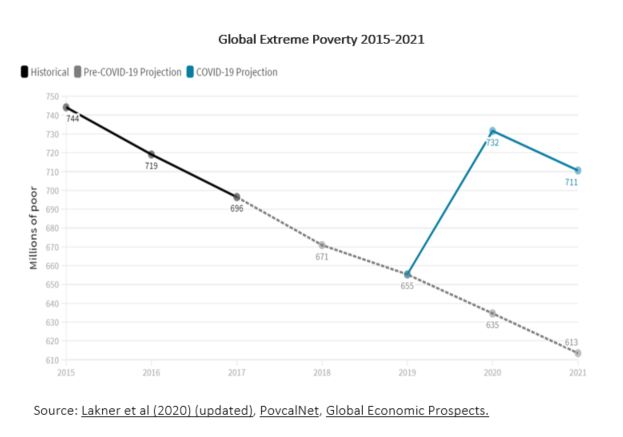

According to the World Bank, global extreme poverty rose for the first time in twenty years in 2020. It is estimated that the Covid-19 pandemic resulted in an additional 88 million to 115 million people being pushed into extreme poverty globally. The pandemic has propelled the world into an economic crisis, drastically affecting millions of lives globally. Countries implemented safety measures to guard lives which led to border closures and grounded flights. Business closure and job layoffs skyrocketed, creating immense pressure for those particularly within the low-income category.

Many governments across the globe increased expenditure to aid the socially vulnerable during the pandemic. Polices included an increase in healthcare fund allocation, a reduction in the cost of public facilities such as electricity and water, reduction in taxes, the issuing of cash grants and income support for heads of families and single individuals who are unemployed. Despite unprecedented government support to mitigate the impact of the pandemic, living standards and access to basic human necessities have been significantly eroded. As economies worldwide continue to battle with severe economic contractions, it is estimated that by the end of 2021, an additional 150 million people will fall below the poverty line worldwide.

Globally, there has been a significant decline in the poverty headcount ratio, which is the percentage of the population living below the national poverty lines, spanning from 36.2% in 1990 to 10.1% in 2015. In 2020, extreme poverty was likely to have affected 9.1% to 9.4% of the world population. Consistent with statistics stated in the Human Development Report 2020, 0.6% of Trinidad and Tobago’s population is considered ‘multidimensionally’ poor. Jamaica registers a headcount percentage of 4.7% while the Latin America and the Caribbean region averages a 7.2% headcount. This means that the individuals included within the Multidimensional Poverty Index (MPI) experiences various deprivations such as poor health, lack of education and poor work quality. The Caribbean has diversified and acclimatised to a highly globalised environment moving from Agriculture into Tourism, Manufacturing and the Oil and Gas industry which paved the way for economic growth and foreign investment opportunities. Despite countries experiencing significant economic growth and improved standards of living, approximately 30% of the Caribbean is still classified as being extremely poor, compared to global average of 9.2%

Poverty has immense social and human costs and is positively correlated to economic growth. It directly affects one’s nutrition, quality of education and access to basic needs. Human capital in a developing country is extremely important as transfer of knowledge and skills within the education system aids in expanding the skillset of the citizenry thus boosting productivity. Lack of investment in human capital leads to the poor having access to only low paying jobs, creating a vicious cycle of poverty. It is necessary for Caribbean countries to implement policies that would aid in the development of human resources and thus boost the ability to compete globally. Some Caribbean countries have shadowed first world countries such as Germany in understanding the importance of educating their population by providing free education. However, many are still faced with exorbitant fees for uniforms, registration and textbooks. Low-income families may not be able to financially meet the obligation, leading to high dropout rates. According to the Ministry of Education in Trinidad and Tobago, approximately 2,000 students have fallen out of the education system since virtual schooling began at the onset of Covid-19 in late March 2020. The economic fallout from the pandemic may be a major contributing factor to the increased dropout rates as students may not have access to the technology to necessitate online classes. Further, some may have had to become breadwinners in their families or may lack supervision to ensure online participation as parents and guardians report for work.

Consumer spending and business investments are other factors that are directly affected by a high poverty rate. Consumer spending contributes significantly to economic growth as it creates a ripple effect for employment. Increased employment or increased wages raises aggregate demand hence leading to a rise in employment in other areas such as the retail and manufacturing sectors. Similarly, increased consumer spending generates a viable business community. This can be seen as profits grow so too does business investments. Increased profits propel a domino effect in that, businesses are now able to expand capital investments and boost productivity and long-term profits.

The Caribbean has placed heightened emphasis on its response to the region’s poor, through the Special Development Fund (SDF). This fund was established in 1970 and is to date, the largest pool of concessionary funds which is used to address poverty and human development challenges throughout the Caribbean. On 25 March, 2021, the Caribbean Development Bank (CDB) endorsed a USD383 million-dollar programme for the 10th cycle of the Bank’s Special Development Fund. According to the CDB President, the key concern for the SDF over this particular cycle will be the need to respond meaningfully to the challenges of the poor and vulnerable groups whose conditions have been worsened by the Covid-19 pandemic. The resources will be available to the banks to assist Borrowing Member countries in addressing poverty, sustainable development, governance, capacity development, gender inequalities and environmental sustainability. In a unified move, member countries have pledged to contribute USD188.2 million to the SDF for the period 2020-2024 while the Bank has allocated USD162.8 million from international resources, such as loan repayments. The top five contributors to SDF 10 are: Canada (CAD81.4 million / USD59.6 million), United Kingdom (GBP21 million / USD26.5 million), Germany (EUR12.4 million / USD13.7 million), Jamaica (USD13 million) and Trinidad and Tobago (USD11.3 million). With this initiative, the member states hope to achieve social, economic and environmental resilience, the pillars on which the fund was built.

The Caribbean having a unified body of countries who forms the Caribbean Community (CARICOM) and Caribbean Single Market Economy (CSME) face similar economic, social and environmental issues. All islands having small open economies that are susceptible to exogenous shocks, should implement unified policies and procedures that would protect their most vulnerable in society. Diversification, increased regional trade and improving the education system are some factors that may aid in the Caribbean’s reduction of their poverty rate.

Global Extreme Poverty 2015-2021

DISCLAIMER

First Citizens Bank Limited (hereinafter “the Bank”) has prepared this report which is provided for informational purposes only and without any obligation, whether contractual or otherwise. The content of the report is subject to change without any prior notice. All opinions and estimates in the report constitute the author’s own judgment as at the date of the report. All information contained in the report that has been obtained or arrived at from sources which the Bank believes to be reliable in good faith but the Bank disclaims any warranty, express or implied, as to the accuracy, timeliness, completeness of the information given or the assessments made in the report and opinions expressed in the report may change without notice. The Bank disclaims any and all warranties, express or implied, including without limitation warranties of satisfactory quality and fitness for a particular purpose with respect to the information contained in the report. This report does not constitute nor is it intended as a solicitation, an offer, a recommendation to buy, hold, or sell any securities, products, service, investment or a recommendation to participate in any particular trading scheme discussed herein. The securities discussed in this report may not be suitable to all investors, therefore Investors wishing to purchase any of the securities mentioned should consult an investment adviser. The information in this report is not intended, in part or in whole, as financial advice. The information in this report shall not be used as part of any prospectus, offering memorandum or other disclosure ascribable to any issuer of securities. The use of the information in this report for the purpose of or with the effect of incorporating any such information into any disclosure intended for any investor or potential investor is not authorized.

DISCLOSURE We, First Citizens Bank Limited hereby state that (1) the views expressed in this Research report reflect our personal view about any or all of the subject securities or issuers referred to in this Research report, (2) we are not a beneficial owner of securities of the issuer (3) no part of our compensation was, is or will be directly or indirectly related to the specific recommendations or views expressed in this Research report (4) we have not acted as underwriter in the distribution of securities referred to in this Research report in the three years immediately preceding and (5) we do not have a direct or indirect financial or other interest in the subject securities or issuers referred to in this Research report.