Capital Markets Review 3rd Quarter 2022

Commentary

Global Macro-Economic Review

The downward momentum that characterized the first half of 2022 was maintained in the third quarter as uncertainty and volatility remained elevated throughout the period. Global stock and bond markets continued to be affected by the ongoing crisis in Russia and Ukraine, decades-high inflation, aggressive interest-rate hikes and extreme movements in currency markets.

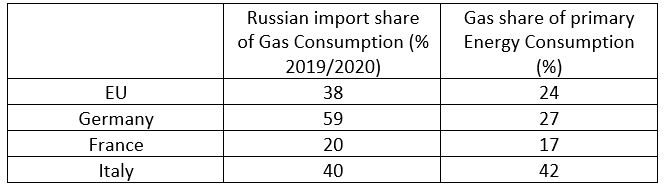

Following Russia’s invasion of Ukraine in February 2022, the war continued unabated into the third quarter of the year. In response, several countries including the US, European Union (EU) and the UK implemented economic sanctions against Russian citizens and companies. In retaliation, Russia implemented similar measures against the US and other countries. Russia’s latest measure however is expected to have a more dire impact with the threat to shut down its Nord Stream pipeline for as long as Western sanctions are in place. Natural gas accounts for 24% of Europe’s energy supply as such, if this threat is acted upon, it can serve to undermine Europe’s economic standing.

For the period 2015 to 2020, the benchmark Title Transfer Facility (TTF) price, a pricing proxy for the overall European LNG import market, averaged €16/megawatt hour (mwh). The ongoing war has served to push up energy prices significantly, with the TTF gas price climbing to €200/mwh or US$600 per barrel. Given Russia’s threat and the drastic rise in natural gas prices, the possibility of a recession and an energy crisis in Europe increased dramatically over the third quarter of 2022.

Dependence on Russia gas imports for selected European Countries

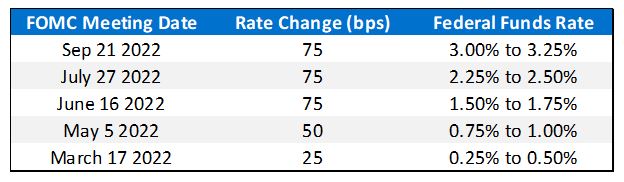

Nine months into the year and inflation has remained stubbornly high. Inflationary pressures are supported by high energy costs, fueled by the Russia-Ukraine war, supply constraints caused by the lockdowns implemented by China following a resurgence of the COVID-19 virus and cost pressures from tight labour markets as economies fully re-opened. In an attempt to cool such pressures, many central banks including the US Federal Reserve, European Central Bank and the Bank of England, aggressively increased their benchmark interest rate in the third quarter of 2022 with the objective of dampening consumer demand.

US Federal Funds Rate

The US Dollar has steadily gained against many global currencies, with the strengthening particularly acute over the past couple of months, reaching historic highs against the Euro, Japanese Yen and the British Pound, with the Euro losing parity in mid-September 2022. Companies with a large exposure to overseas markets are anticipating lower sales and missed profit targets, negatively impacting their share prices. Several companies including Microsoft, Coca-Cola, Phillip Morris and Proctor & Gamble have lowered their profit expectations based on currency impacts.

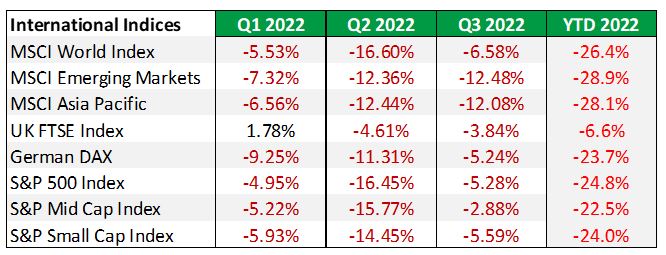

International Market Performance

International Stock Indices

At the end of September 2022, with the exception of the UK FTSE, the remaining major stock markets are in bear markets. A bear market is a prolonged decline in market prices over a period of time, typically a month or more, with prices falling by 20% or more from its peak. The bearish sentiment is being fuelled by macro-economic factors including rising interest rates, high inflation, recessionary pressures in some of the largest economies, the conflict between Russia and Ukraine and a slowdown in China’s economy.

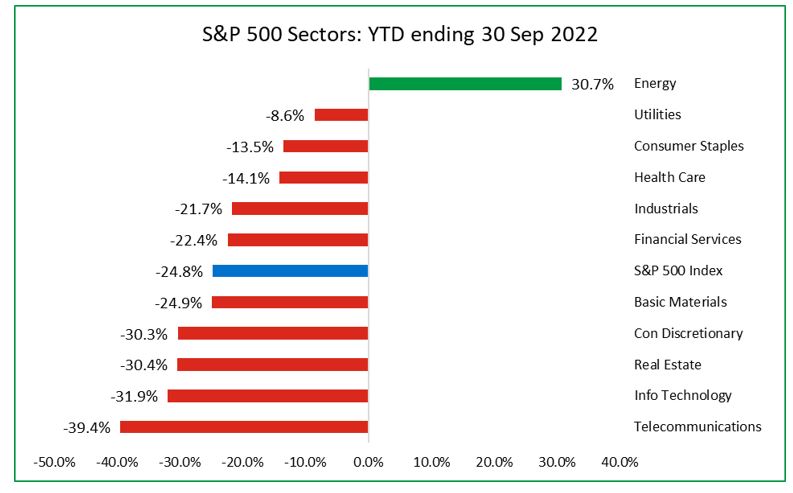

US Sector Performance

From a sector perspective, Energy was the only sector that posted positive returns on a Year to Date (YTD) basis, with a gain of 30.7%. The worst performing sectors year to date are Telecommunications (39.4%), Information Technology (31.9%) and Real Estate (30.4%).

Crude oil prices increased sharply from US$75.21 per barrel at the end of 2021 to US$114.67 per barrel at the end of May, a 52% rise in price, fuelled by the cut in oil supply as nations imposed economic sanctions on Russia. At the end of September however, crude oil prices stood at US$79.49 per barrel, 31% lower than its peak in May as demand declined due to the slowdown in China and recessionary pressures in other parts of the world.

US Sector Performance

Local Market Review

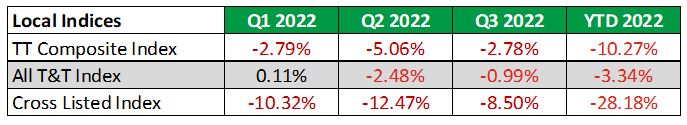

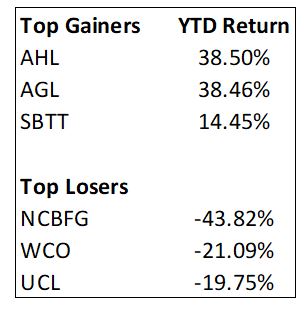

Similar to the international stock market, the local stock indices are also down, with the All T&T Composite Index declining by 10.27%, led by the Cross-Listed Index that posted a loss of 28.18%. The stocks with the largest share price gains over the nine month period ending September 2022 were Angostura Holdings (AHL), Agostini’s %, Limited (AGL) and Scotiabank Trinidad & Tobago (SBTT) with returns of 38.50%, 38.46% and 14.45% respectively. Leading the declines were NCB Financial Group Limited (NCBFG), West Indies Tobacco Company (WCO) and Unilever Company Ltd (UCL) with losses of 43.82%, 21.09% and 19.75% respectively.

Local Stock Indices

Top Gainers and Losers YTD Basis

Equity Markets Outlook

Uncertainty is expected to continue on many fronts into the last quarter of the year. The risks of a global recession are high and continues to grow, supported by the higher interest rate environment that is prevailing across many countries, Europe’s energy crisis and China’s economic slowdown.

Recessionary pressures are strong in the US given the US yield curve inversion, which is a main warning sign. The spread between the yields on the 10-year and 2-year Treasury bonds are negative – the most in 40 years. Based on the historical definition of a recession, a decline in Gross domestic Product (GDP) over two consecutive quarters, the US economy is already experiencing a recession.

In Europe, a recession is anticipated as energy prices are surging and is expected to rise higher as winter approaches and with the commencement of EU’s ban on seaborne imports of Russian crude on 5th December 2022. Such volatility is also being seen in the UK, evident by the Bank of England (BOE) recent pivot of its monetary policy on 28 September 2022 when it restarted quantitative easing (QE) in an effort to restore orderly market conditions.

Emerging markets who are dependent on China for trade may face weaker demand from China for their goods and services as the country attempts to navigate the property crisis and the supply disruptions from their COVID Zero policy. Locally, the local economy should benefit from higher energy prices. However, economic activity is anticipated to weaken if there is a global recession as it may lead to lower energy prices and lower revenues, which may create instability in domestic financial markets.

With such headwinds, volatility is expected to remain elevated during this upcoming quarter. A sound investment strategy will be beneficial as it should serve as an anchor to help investors stay the course and avoid any knee-jerk reactions to any deterioration in the economic landscape. In addition, asset class, sector and geographic diversification are essential in order to reduce the overall portfolio risk.

DISCLAIMER

First Citizens Bank Limited (hereinafter “the Bank”) has prepared this report which is provided for informational purposes only and without any obligation, whether contractual or otherwise. The content of the report is subject to change without any prior notice. All opinions and estimates in the report constitute the author’s own judgment as at the date of the report. All information contained in the report that has been obtained or arrived at from sources which the Bank believes to be reliable in good faith but the Bank disclaims any warranty, express or implied, as to the accuracy, timeliness, completeness of the information given or the assessments made in the report and opinions expressed in the report may change without notice. The Bank disclaims any and all warranties, express or implied, including without limitation warranties of satisfactory quality and fitness for a particular purpose with respect to the information contained in the report. This report does not constitute nor is it intended as a solicitation, an offer, a recommendation to buy, hold, or sell any securities, products, service, investment or a recommendation to participate in any particular trading scheme discussed herein. The securities discussed in this report may not be suitable to all investors, therefore Investors wishing to purchase any of the securities mentioned should consult an investment adviser. The information in this report is not intended, in part or in whole, as financial advice. The information in this report shall not be used as part of any prospectus, offering memorandum or other disclosure ascribable to any issuer of securities. The use of the information in this report for the purpose of or with the effect of incorporating any such information into any disclosure intended for any investor or potential investor is not authorized.

DISCLOSURE

We, First Citizens Bank Limited hereby state that (1) the views expressed in this Research report reflect our personal view about any or all of the subject securities or issuers referred to in this Research report, (2) we are a beneficial owner of securities of the issuer (3) no part of our compensation was, is or will be directly or indirectly related to the specific recommendations or views expressed in this Research report (4) we have acted as underwriter in the distribution of securities referred to in this Research report in the three years immediately preceding and (5) we do have a direct or indirect financial or other interest in the subject securities or issuers referred to in this Research report.