Bear Markets

Commentary

The terms bear and bull markets refer to trends in stock markets and can be used to describe the share price pattern in an overall market or index. Individual securities can also be considered to be in a bullish or bearish market trend. Capital markets are historically cyclical in nature and may follow a pattern of rise, peak, dip, and then bottom out. Traditionally, it is observed that as one market cycle is finished, another begins thus after every bear market, a bull market follows. The challenge is that the length and intensity of each market cycle is not uniform and of varying periods of duration.

What is a Bear Market?

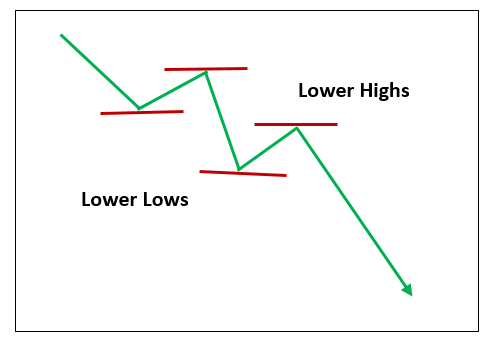

A bear market is a prolonged decline in market prices over a period of time, typically a month or more, with prices falling by 20% or more from its peak. Investors can also be bearish on an individual stock, which may not affect the market as a whole. While the market or stock may exhibit occasional relief rallies whereby the price climbs, in a bear market the general price trend is downward and is characterized by lower highs and lower lows. There are several theories concerning the origination of the term “bear”, with one referring to the way a bear attacks its opponents, with the animal swiping its paws downward. Another theory refers the “bear” market to the animal’s tendency to retreat in order to hibernate, thus bears represent a market that is retreating.

Figure 1: Price Pattern of a Bear Market

Usually in a bear market, economic conditions are generally unfavourable with falling gross domestic product (GDP), rising unemployment and low investor confidence. Resultantly, fear and uncertainty dominate and cause investors to be more risk averse and sell off their holdings of risky assets such as stocks, pushing prices even lower.

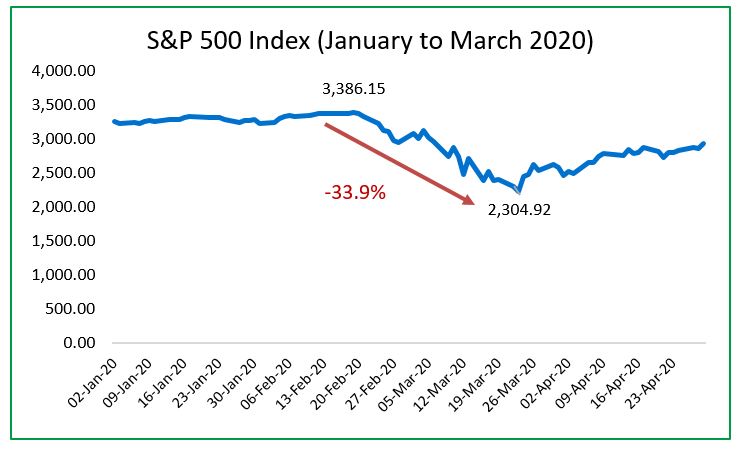

Based on available data for the period 1928 to 2020 for the US, there have been 26 bear markets. The most recent bear market occurred from 19 February to 23 March 2020 when the S&P 500 index fell by 33.9% with the onset of the COVID-19 pandemic and is illustrated in figure 2. The US economy experienced wide ranging measures that restricted movement in an effort to curb the infection rate. As a result, the economy experienced a contraction in its GDP, a sharp uptick in the unemployment rate and a reduction in corporate profits.

Figure 2: Performance of the S&P 500 Index

Are we in a bear market now?

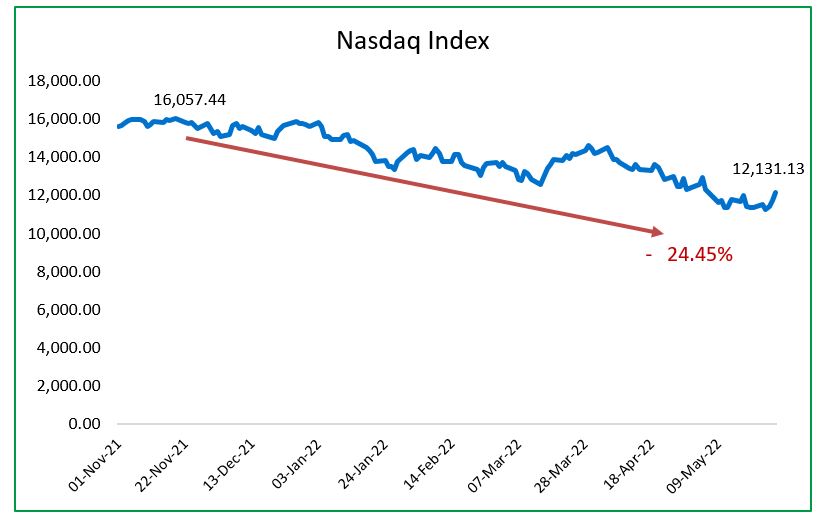

Presently, the US stock market is at the cusp of a bear market, as all three stock indices (S&P 500 Index, Dow Jones Industrial Average Index and Nasdaq Composite Index) are exhibiting downward trends and weakness evidenced by lower highs and lower lows. As at 27 May 2022, among the three indices, the Nasdaq is already in a bear market as the index is down by 24.45% from its peak on 19 November 2021.

Figure 3: NASDAQ Index Performance

For the week ended 19 May 2022, the S&P 500 Index posted a loss of 18.7% from its 2022 high on 3 January and has since clipped its losses to return -13.31% as at 27 May 2022. Similarly, the Dow Jones Industrial Average Index posted a decline of 15.1% as at 19 May 2022. A week later, a modest rally allowed the index to pare some of the losses and return -9.75% at the end of 27 May 2022.

The bearish sentiment is being fuelled by rising interest rates, high inflation, a contraction in US GDP, the conflict between Russia and Ukraine and a slowdown in China’s economy.

The US economy is presently challenged by significant headwinds as it faces rising inflationary pressures which has prompted the Federal Reserve to pivot away from its accommodative monetary stance with record-low interest rates to a tighter monetary posture. Price pressures are being driven by Russia’s war in Ukraine that have pushed up commodity prices. The price of crude oil has risen by 53.43% on a year to date basis as it climbed from USD75.21 per barrel at the end of 2021 to USD115.07 as at 27 May 2022. Resultantly, the US inflation rate peaked at 8.5% year on year in March 2022, a 41-year high.

In an attempt to dampen such inflationary pressures, the US Federal Reserve has raised the key benchmark rate on two occasions (March and May 2022) by a collective 0.75% or 75 bps. Further interest rate increases are expected as the Fed signalled additional rate hikes in the upcoming months.

As interest rates rise, the cost of borrowing also increases, thus customers are paying more to borrow money to fund their purchases. As a result, overall demand may fall and companies may experience less revenues and profits that will impact their earnings and dividend payments. Investors thus may be less willing to purchase stocks which are inherently a risky asset and opt for less risky investments such as bonds which are paying more in interest due to the higher interest rate environment.

During the first quarter of 2022, the U.S. economy contracted at an annual rate of 1.5% after more than a year of rapid growth, fuelled by a reduction in retailers’ inventory and a widening trade deficit. Higher borrowing costs has the potential of slowing down the economy. Consequently, there are concerns that the US economy may contract for another quarter and enter into a recession if the Fed raises rates too quickly.

How to invest during a bear market?

The downturn in the market can be seen as an opportunity for investors to purchase additional shares at lower prices in an effort to reduce the average acquisition cost, a strategy known as dollar-cost averaging. Dollar-cost averaging refers to an investment strategy of continually investing in small quantities over time instead of buying the security in one transaction at a single purchase price.

For example, an investor decides to spread out his investment of $510.00 over a three-month period at the following prices. At a share price of $15, the average acquisition price is $15.00. In February, the share price falls to $12.00, at this lower price, purchasing the same quantity allows the average acquisition cost to decline to $13.50. In the next month when the share price falls again but this time to $7.00, the average acquisition cost falls to $11.33. Thus for the three-month period, buying as the share price falls allows the investor to reduce the average acquisition cost by 24%.

| Month | Share Price | No. of Shares purchased | Average Acquisition Cost |

| January | $15.00 | 15 | $15.00 |

| February | $12.00 | 15 | $13.50 |

| March | $ 7.00 | 15 | $11.33 |

While diversification is key in any market cycle, it is especially crucial in bear markets. When the bear market extends to the overall market, all stock prices generally fall, however not necessarily by the same magnitude. Some stocks are more volatile than the market, other stocks are less volatile while some stocks are just as volatile as the market. This degree of volatility is measured by a metric known as Beta. High beta stocks have a beta in excess of 1.0 and low beta stocks have a beta less than 1.0. Investing in a mix of stocks with different betas aids in minimizing the overall losses in a portfolio.

The broad market sell-off and resulting reduction in value can also provide great investment bargains for investors to purchase stocks at significantly reduced prices compared to their intrinsic value, which is the present value of the expected cash flows. The reduction in price does not correspond to the company’s long-term fundamentals hence it is an opportunity for investors to profit by buying stocks at sale prices.

Investments in several asset classes such as bonds, gold or real estate is also prudent. While the stock market may be bearish, bull markets might be occurring in other asset classes due to different drivers of demand and supply. Thus as investors face lower share prices, the losses incurred can be cushioned by price rallies in other types of assets. Investors can also consider geographically diversifying as other regions of the world may be experiencing bull markets.

Bear markets do not last forever, markets also rebound, thus investors focus should be long-term. Knee-jerk reactions to market volatilities and downward trend in prices can create missed opportunities when the market picks up again. Investment decisions made on emotions can result in investors selling off their investments, thus removing any opportunity of potential gains in the future when the market turns around.

Outlook

If the markets continue to fall, the S&P 500 and the Nasdaq indices can enter into a bear market. Investors should not be overly concerned as the investment landscape is characterized by market cycles, with bear markets being inevitable. Creating an investment strategy will serve as an anchor for investors as it will provide a roadmap amidst the fear and emotions as stock markets tumbles and the desire to sell rises.

DISCLAIMER

First Citizens Bank Limited (hereinafter “the Bank”) has prepared this report which is provided for informational purposes only and without any obligation, whether contractual or otherwise. The content of the report is subject to change without any prior notice. All opinions and estimates in the report constitute the author’s own judgment as at the date of the report. All information contained in the report that has been obtained or arrived at from sources which the Bank believes to be reliable in good faith but the Bank disclaims any warranty, express or implied, as to the accuracy, timeliness, completeness of the information given or the assessments made in the report and opinions expressed in the report may change without notice. The Bank disclaims any and all warranties, express or implied, including without limitation warranties of satisfactory quality and fitness for a particular purpose with respect to the information contained in the report. This report does not constitute nor is it intended as a solicitation, an offer, a recommendation to buy, hold, or sell any securities, products, service, investment or a recommendation to participate in any particular trading scheme discussed herein. The securities discussed in this report may not be suitable to all investors, therefore Investors wishing to purchase any of the securities mentioned should consult an investment adviser. The information in this report is not intended, in part or in whole, as financial advice. The information in this report shall not be used as part of any prospectus, offering memorandum or other disclosure ascribable to any issuer of securities. The use of the information in this report for the purpose of or with the effect of incorporating any such information into any disclosure intended for any investor or potential investor is not authorized.

DISCLOSURE

We, First Citizens Bank Limited hereby state that (1) the views expressed in this Research report reflect our personal view about any or all of the subject securities or issuers referred to in this Research report, (2) we are a beneficial owner of securities of the issuer (3) no part of our compensation was, is or will be directly or indirectly related to the specific recommendations or views expressed in this Research report (4) we have acted as underwriter in the distribution of securities referred to in this Research report in the three years immediately preceding and (5) we do have a direct or indirect financial or other interest in the subject securities or issuers referred to in this Research report.