Are Bonds a Good Investment?

Commentary

Bonds, commonly known as fixed income investments, are a type of investment that can help preserve capital and provide a steady income stream. Bonds can also provide diversification benefits as they tend not to move in the same direction as stocks, thus when stock prices fall, bond prices tend to go up and vice versa. Consequently, bonds play a central role in portfolio diversification, stability and income generation.

What is a Bond?

At its core, a bond is a fixed-income security, representing a loan by an investor to a government or company. In return for the use of that money, the issuer agrees to pay interest to the investor at a stated rate known as the “coupon rate.” At the end of an agreed-upon time period when the bond “matures,” the issuer repays the investor’s principal. They are commonly used by governments and companies to raise funds for various purposes, and investors can buy and sell bonds in the financial markets.

Characteristics of a Bond

Bonds are characterized by their face value, often known as par value. This represents the amount the issuer pledges to repay at maturity and is often set at $1,000. Another critical feature is the maturity date, which is the life span of the bond. Bonds can be short-term, medium-term or long-term. The various maturity dates allow investors to align their investment horizon with their financial goals.

Coupon payments are another mainstay to a bond structure and refers to the annual interest paid. It is expressed as a percentage of the bond’s face value. For example, a bond with a face value of $1,000 has a coupon of 7%. The coupon payment is $70 ($1,000 x 0.07%) and is typically paid semi-annually, meaning the investor will receive $35 in coupon payments every six months.

Bonds are issue by several issuers, ranging from governments to corporates. Not all issuers have the same creditworthiness. In an effort to guide investors on the risk associated with the investments, independent credit rating agencies usually rate and assign a credit rating to bond issuers. Ratings are often in the form of letters or alphanumeric ratings. The three major credit rating agencies are Standard & Poor’s, Moody’s Investors Service and Fitch Ratings.

Bonds may be structured with special provisions. The two main provisions are callable provisions and putable provisions. Bonds with callable provisions gives the issuer the right, but not the obligation, to redeem or call the bond before the maturity date. This option is beneficial to the issuer if interest rate declines after the bond is issued, allowing the issuer to call the bond and reissue new bonds at a lower coupon rate, hereby reducing their interest expense.

Putable bonds gives the investor the right, not the obligation, to sell the bonds back to the issuer before the maturity date. This option is quite valuable in a rising interest rate environment as the investor can exercise the put option and sell the bond back to the issuer and purchase new bonds with a higher coupon rate.

Types of Bonds

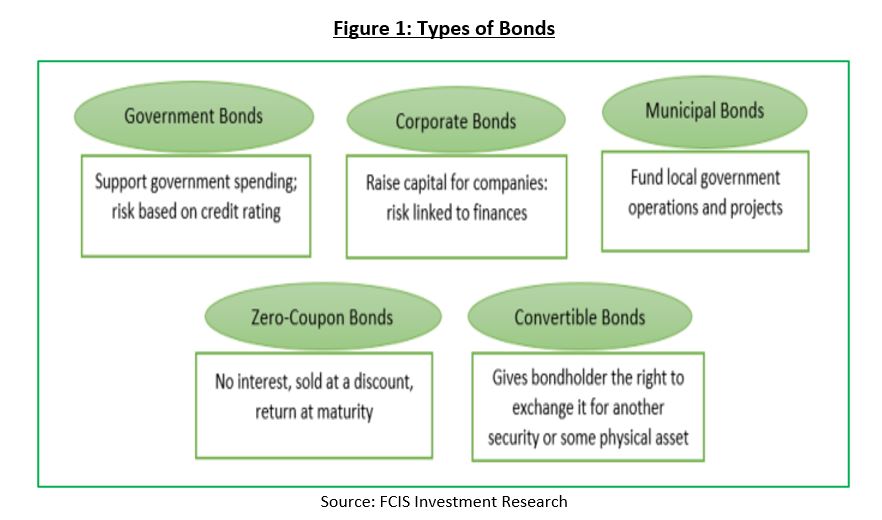

In the bond market, there are various types of bonds with unique characteristics and benefits. Bonds are classified according to the issuer and type of coupon rate. As it pertains to the issuer classification, there are government bonds which are debt securities issued by governments. Such securities are backed by the government and are considered low-risk investments as governments have the ability to raise funds through taxation and thus fulfil their debt obligations.

There are also corporate bonds that are issued by companies. Such bonds are issued to raise capital for business activities such as acquisitions and expansions. When compared to government bonds, corporate bonds carry a higher risk as they are not backed by the taxing power of the government.

Municipal bonds are another type of issuer bonds, where the issuers are municipalities which includes cities, counties, states and other local government entities. Such bonds are usually raised to fund the finance of public projects such as schools, hospitals and other community-based initiatives.

Traditional bonds usually have a fixed coupon rate, where the coupon rate is set at the time of issuance and remains constant. Some bonds however, do not have a fixed coupon rate but the coupon rate is reset periodically. Such bonds are known as variable rate bonds, where the reset frequency can be every month, three, six or twelve months. This reset feature allows the bond’s coupon payments to adjust to changes in market interest rates.

Zero coupon bonds are fixed income securities that do not make period interest (coupon) payments like traditional bonds. Such bonds are structured for investors to purchase the bond at a price below its face value, which is the value to be received upon maturity. The return is comprised of the difference between the purchase price and the face value received at maturity.

Convertible bonds are a unique classification and are a hybrid between debt and equity. Convertible bonds commence as traditional debt securities, where the investor receives period interest payments and the principal amount at the maturity date. An additional feature of convertible bonds is the embedded conversion option that allows investors the opportunity to convert their bond holdings into a predetermined number of common shares of the issuing company. When bondholders exercise the conversion option, they transition from being creditors (debt holders) to becoming equity holders in the company.

The Role of Bonds in a Portfolio

Unlike stocks, which can fluctuate wildly in value, bonds typically offer more predictable returns. Bonds provide a steady income stream through regular interest payments, providing investors with a reliable source of cash flow. This stability acts as a cushion during market downturns, offsetting the volatility inherent in equity investments. Moreover, different types of bonds, exhibit varying levels of risk and return. By diversifying across these bond categories, investors can further spread risk and enhance the resilience of their portfolio against economic uncertainties.

For investors with a focus on capital preservation, bonds offer a sense of security. While they may not yield as high returns as stocks during bull markets, bonds are less susceptible to significant losses. Their fixed interest payments and the return of principal at maturity provide a safety net for investors seeking to protect their capital. Additionally, bonds serve as an income-generating asset. Especially in times of low-interest rates or market volatility, the regular interest payments from bonds can supplement an investor’s income stream. However, in a raising interest rate environment investors are at risk of not being able to sell their bonds when needed, as there would be higher yielding bonds in the market.

In the world of investing, bonds are like essential building blocks that help create a strong and steady portfolio. Given the dynamics of financial markets, it is prudent to include bonds in any investment portfolio. Bonds do more than just generate income; they also help reduce risks, protect wealth, and add a degree of diversification, thus making the overall holdings more secure against the ups and downs of the market.

DISCLAIMER

First Citizens Bank Limited (hereinafter “the Bank”) has prepared this report which is provided for informational purposes only and without any obligation, whether contractual or otherwise. The content of the report is subject to change without any prior notice. All opinions and estimates in the report constitute the author’s own judgment as at the date of the report. All information contained in the report that has been obtained or arrived at from sources which the Bank believes to be reliable in good faith but the Bank disclaims any warranty, express or implied, as to the accuracy, timeliness, completeness of the information given or the assessments made in the report and opinions expressed in the report may change without notice. The Bank disclaims any and all warranties, express or implied, including without limitation warranties of satisfactory quality and fitness for a particular purpose with respect to the information contained in the report. This report does not constitute nor is it intended as a solicitation, an offer, a recommendation to buy, hold, or sell any securities, products, service, investment, or a recommendation to participate in any particular trading scheme discussed herein. The securities discussed in this report may not be suitable to all investors, therefore Investors wishing to purchase any of the securities mentioned should consult an investment adviser. The information in this report is not intended, in part or in whole, as financial advice. The information in this report shall not be used as part of any prospectus, offering memorandum or other disclosure ascribable to any issuer of securities. The use of the information in this report for the purpose of or with the effect of incorporating any such information into any disclosure intended for any investor or potential investor is not authorized.

DISCLOSURE

We, First Citizens Bank Limited hereby state that (1) the views expressed in this Research report reflect our personal view about any or all of the subject securities or issuers referred to in this Research report, (2) we are a beneficial owner of securities of the issuer (3) no part of our compensation was, is or will be directly or indirectly related to the specific recommendations or views expressed in this Research report (4) we have acted as underwriter in the distribution of securities referred to in this Research report in the three years immediately preceding and (5) we do have a direct or indirect financial or other interest in the subject securities or issuers referred to in this Research report.