Arbitrage Opportunity or Not?

What is Arbitrage?

Capital markets are very dynamic, with the prices of securities changing on a daily basis. The primary objective of all investors and traders in capital markets is to earn a profit, which is often derived when the price of an asset moves in a favorable direction. For example, if an investor purchases a stock for $10, it will benefit them to wait until the current trading price exceeds this threshold and sell in order to earn a profit.

Another technique which can be used is arbitrage which is the act of simultaneously buying and selling the same asset, but in different markets in order to gain from any difference in price. The simplest form of arbitrage occurs when an asset can be purchased at a lower price in one market and sold in another market where the price is higher.

While an arbitrage opportunity can arise in any asset class that is traded in different markets, it often occurs in currency and stock markets. Contrary to economic theory which states that markets should be efficient and all similar assets should converge to the same price, markets are not completely efficient, which gives rise to arbitrage opportunities. The inefficiency may arise as each market would have different amounts of demand and supply for the security which can lead to differential pricing. In addition, each country has its own currency which can also lead to differences in prices.

In stock markets, arbitrage arises when a company is listed on more than one stock exchange; such companies are called Dual-Listed companies. Organizations may be motivated to list on multiple stock exchanges in order to raise more capital as they will have access to a larger investor base rather than being limited to investors in its home country. Dual listing also increases the liquidity of the traded stock as it facilitates a larger of number of investors to buy and sell the stock.

The price of a stock that is listed on more than one exchange should ideally be the same, accounting for differences in the exchange rates and transaction costs. The price should be the same due to arbitrage as an investor can earn a profit by purchasing the stock on the exchange where the price is lower and sell it on the exchange where the price is higher.

Hypothetical Arbitrage Opportunities in the Regional Markets

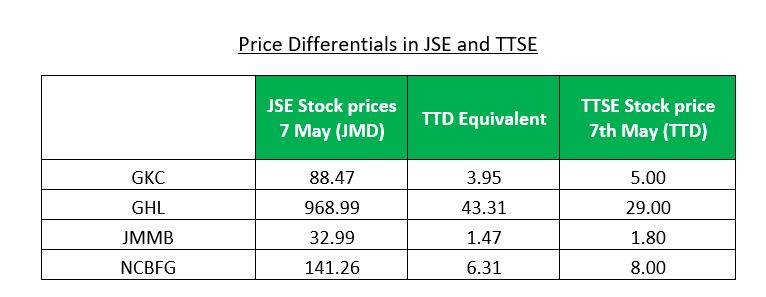

On the Trinidad and Tobago Stock Exchange (TTSE) and the Jamaican Stock Exchange (JSE), there are a few dual listed companies which can provide potential arbitrage opportunities for investors. On the TTSE, the cross listed shares include GraceKennedy Limited (GKC), JMMB Group Limited (JMMB) and NCB Financial Group Limited (NCBGF), which were all originally listed on the JSE while in the Jamaican stock market, Guardian Holdings Limited (GHL) is the cross listed stock.

Let us explore if any hypothetical opportunities may exist for local investors to capitalize on any possible price differences in the T&T and Jamaica stock markets. As illustrated in the table below, as at 7 May 2021, GKC, JMMB and NCBFG traded at JMD88.47 (TTD3.95 equivalent), JMD32.99 (TTD1.47 equivalent) and JMD141.26 (TTD6.31 equivalent) on the JSE[1]. Interestingly, at the same time, GKC, JMMB and NCBFG traded on TTSE at TTD5.00, TTD1.80 and TTD8.00 respectively.

Similarly, one observed possible arbitrage opportunity may be GHL. GHL has recently listed on the JSE and currently trades at JMD968.99 (TTD43.31 equivalent)[2] on the JSE while it trades at TTD29.00 on the TTSE. A possible price difference of TTD14.31 per share. These price differences are an example of a situation where an opportunity for arbitrage exists.

Risks involved in Arbitrage

The investor however must be aware of the transaction costs that are applicable in both stock markets, as these can lower or offset any gains from the trades. Another factor that must be considered is exchange rate fluctuations and an illiquid foreign exchange environment. Any substantial changes in the exchange rate while the trade is being executed can erode potential profits. An investor faces the risk of loss if there is a sudden appreciation of the currency when the stock has to be bought. Conversely, if the currency depreciates when the stock has to be sold, the investor’s profit can be eroded.

The time period of such arbitrage opportunities is usually short. Once the information is widely available and traders identify the price gap, they may act and as such, the price of the security will eventually be restored to equilibrium, eliminating all possibilities of making a profit.

While arbitrage offers a great opportunity for investors to boost their returns, it must be noted that it does not guarantee returns. Investors must be agile to spot and act on such opportunities before the inefficiencies are restored.

Breakdown of the Arbitrage Process

DISCLAIMER

First Citizens Bank Limited (hereinafter “the Bank”) has prepared this report which is provided for informational purposes only and without any obligation, whether contractual or otherwise. The content of the report is subject to change without any prior notice. All opinions and estimates in the report constitute the author’s own judgment as at the date of the report. All information contained in the report that has been obtained or arrived at from sources which the Bank believes to be reliable in good faith but the Bank disclaims any warranty, express or implied, as to the accuracy, timeliness, completeness of the information given or the assessments made in the report and opinions expressed in the report may change without notice. The Bank disclaims any and all warranties, express or implied, including without limitation warranties of satisfactory quality and fitness for a particular purpose with respect to the information contained in the report. This report does not constitute nor is it intended as a solicitation, an offer, a recommendation to buy, hold, or sell any securities, products, service, investment or a recommendation to participate in any particular trading scheme discussed herein. The securities discussed in this report may not be suitable to all investors, therefore Investors wishing to purchase any of the securities mentioned should consult an investment adviser. The information in this report is not intended, in part or in whole, as financial advice. The information in this report shall not be used as part of any prospectus, offering memorandum or other disclosure ascribable to any issuer of securities. The use of the information in this report for the purpose of or with the effect of incorporating any such information into any disclosure intended for any investor or potential investor is not authorized.

DISCLOSURE

We, First Citizens Bank Limited hereby state that (1) the views expressed in this Research report reflect our personal view about any or all of the subject securities or issuers referred to in this Research report, (2) we are a beneficial owner of securities of the issuer (3) no part of our compensation was, is or will be directly or indirectly related to the specific recommendations or views expressed in this Research report (4) we have acted as underwriter in the distribution of securities referred to in this Research report in the three years immediately preceding and (5) we do have a direct or indirect financial or other interest in the subject securities or issuers referred to in this Research report.