World Economic Outlook – April 2024 Update

Commentary

Global Update

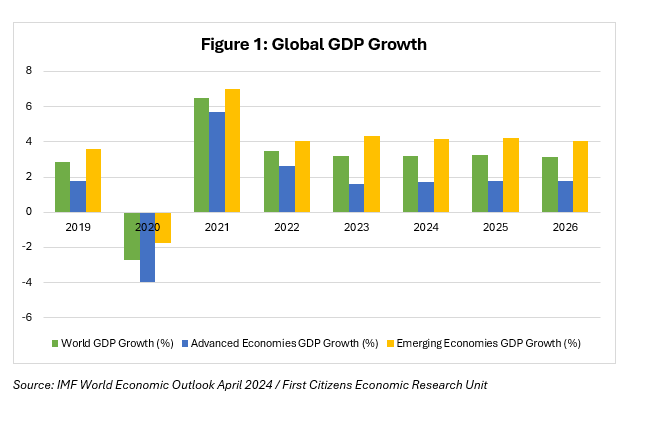

Major global events in recent years such as the COVID-19 pandemic which has since ended, the ongoing Russia / Ukraine conflict, the Israel / Gaza [AS1] conflict, the banking crisis following the collapse of Silicon Valley Bank, and disruptions in major global shipping routes have all affected the global economy. Added to the mix is soaring inflation levels since 2022 that have led central banks to tighten monetary policy, hiking interest rates very aggressively to levels that have not been seen since the 2008 – 2009 financial crisis, and bringing the fear of a stagflation scenario (a period with high levels of inflation and weak, stagnating economic activity) for many economies. Despite these challenges, the global economy remained resilient throughout 2023 with growth of 3.2% compared to 3.5% in 2022, avoiding both a recession and stagflation.

Looking ahead, global growth for 2024 is projected to remain steady at 3.2%, with emerging market economies expected to post a stronger performance (4.2%) relative to advanced economies (1.7%). Across the globe, 2024 has already proven to be turbulent year, as the lagged effect of interest rate hikes, as well as factors affecting individual economies take effect.

The US economy is forecasted to expand by 2.7% for 2024, following growth of 2.5% for 2023. While this is above pre-pandemic trend, latest data indicate that the US economy is showing signs of slowing down with GDP growth of 1.6% for Q1 2024, well below market expectations. The slowdown reflects declines in exports, consumer and government spending.

The economies of Euro Area are expected to grow marginally by 0.8% in 2024, compared to 0.4% in 2023. This comes as many economies, most notably Germany (Europe’s largest economy), continue to struggle. The German economy has been taking hits as a result of high interest rates, and shortages in skilled labour directly affecting the country’s large industrial sector. Latest data from Germany’s index of Industrial production showed an increase for the second consecutive month in February 2024 with monthly growth of 2.1%; while this indicates a good start for the year, production still remains 4.8% lower than February 2023.

The Chinese economy continues to struggle, with GDP growth expected to slow to 4.6% in 2024 from 5.2% in 2023. While this level of growth is above the global average, this is well below China’s historical double-digit figures. The Evergrande and subsequent property crisis is expected to have a continued effect on China’s pivotal property sector; this coupled with weak domestic demand as a result of years of pandemic related policies, have led the Chinese Communist Party (CCP) to implement fiscal stimulus measures in a bid to shore up activity. Preliminary estimates from China’s National Bureau of Statistics indicate a strong showing on Q1 2024, with year-on-year growth of 5.3%, and driven by property investment and industrial output, though household demand remains weak.

Global economic growth is expected to remain relatively stable in the medium-term averaging 3.2% until 2026. This is slower than historical standards according to the IMF, and is the result of the COVID-19 pandemic’s lingering effect, higher cost of borrowing due to high interest rates, and geopolitical tensions.

Inflation

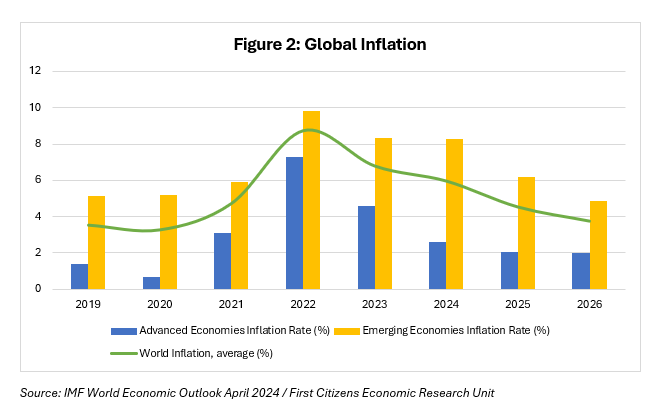

Global inflation has eased significantly from its peak of 9.9% in Q2 2022 to an estimated 2.3% as of Q4 2023. Prices eased through a combination of interest rates hikes aimed at limiting price pressures, and a pullback in commodity prices especially in energy. Though oil and gas prices peaked in 2022, when WTI oil price reached USD114.84 per barrel in June 2022 and the Henry Hub Natural Gas price hit USD8.81per MMBtu, price pressures have subsided primarily due to increased supply as non-OPEC countries ramped up production as well as demand concerns from large energy importers. OPEC and its allies (OPEC+) have continued its policy to limit oil production into Q2 2024. Based on these factors, energy prices are forecasted to remain fairly stable for 2024, with WTI expected to average USD82 per barrel and Henry Hub Natural Gas at USD2.20 per MMBtu. As of 26 April, WTI was trading at USD83 – USD84 per barrel, up 17% year to date, while Henry Hub natural gas price stood at USD1.60 per MMBtu, down 37% year to date.

Global inflation is expected to continue its decline throughout 2024 and the medium-term, forecasted to average 5.9% for 2024, further decelerating to 3.7% by 2026, with Advanced economies experiencing a quicker decline than Emerging Markets economies. This may allow economies to begin or continue with interest rate cutting cycles.

Inflation in the US remains above the Federal Reserve’s target of 2%. Latest data as of March 2024 shows inflation at 3.5% on an annual basis, the second consecutive monthly increase. Persistent inflation can result in US interest rates remaining at their current high levels for a longer period, with the chair of the Federal Reserve, Jerome Powell, open to keeping rates high as long as needed. While inflation is expected to moderate to an average of 2.9% in 2024, the strong labour market and consumer demand in the US economy, combined with ongoing global shocks may put upward pressure on prices.

Across the Euro Area, inflation has been on a downward trajectory, coming in at 2.6% in the 12 months to March 2024, lower that the 6.9% recorded a year prior and the third consecutive monthly decline. On a disaggregated basis, annual inflation fell in 13 Member States, remained stable in four and increased in 10, with the highest inflation level recorded in Romania at 6.7% and the lowest being Lithuania at 0.4%. The European Central Bank (ECB) has a target for inflation of 2%. Inflation is forecasted to decline to an average of 2.4% in 2024; this may allow the ECB space to begin their interest rate cutting cycle.

Caribbean

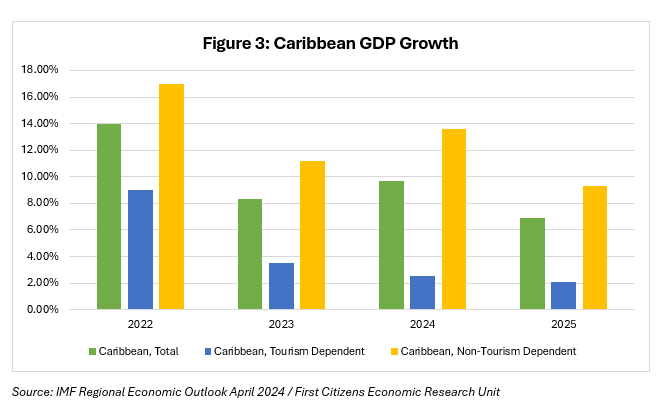

The Caribbean region is often faced with a more volatile economic climate as a result of persistent structural imbalances and climate related vulnerabilities. Following a strong showing post-pandemic, the economies of the Caribbean has seen moderating growth as economic activity continues to normalize. The region is estimated to have expanded by 8.3% in 2023, with growth of 3.5% expected in the tourism dependent economies, and 11.2% among the commodity-exporters, the latter being supported by Guyana, which is estimated to have grown by a significant 33%.

The IMF projects that economic growth in the Caribbean will accelerate to 9.7% in 2024, with non-tourism dependent nations (particularly Guyana) bolstering regional metrics. Tourism dependent nations are expected to see GDP growth slow to 2.5% in 2024, as pent-up demand in global tourism subsides and markets to their pre-pandemic levels, according to the United Nations World Tourism Organization (UNWTO).

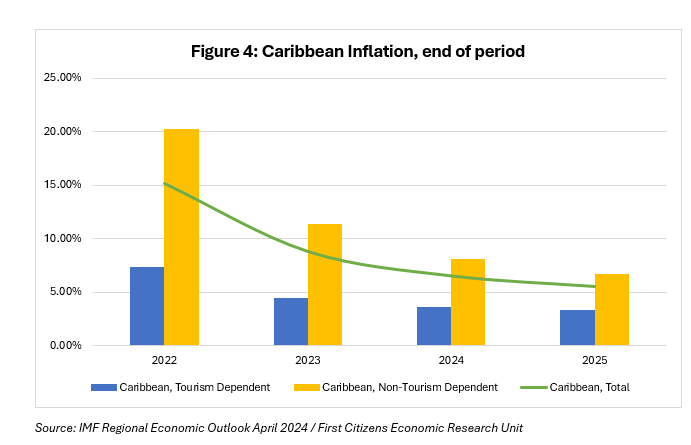

Inflation in the Caribbean is largely influenced by international commodity prices as a result of a dependence on imports. Food and energy prices play a significant part, with the region importing approximately 87% of petroleum used, according to the IMF, as well as 60% – 80% of all basic food items, according to the Food and Agriculture Organization.

Inflation is forecasted to close 2024 at 6.5%, down from 8.8% in 2023. Two outliers in the region exist in the form of Haiti and Suriname, where inflation is forecasted to close 2024 at 22.1% and 14.2% respectively. Ongoing disruptions in global supply channels such as the Panama Canal and Red Sea may exert upward pressures on global prices, which will result in higher imported inflation for the region.

Factors affecting Outlook

Risks to the global economic outlook are now balanced, according to the IMF. This represents a reversal from the downward tilted expectations in their October 2023 economic update. Nevertheless, downside risks remain, including ongoing and heightened geopolitical tensions, a struggling Chinese economy and stubborn inflation.

On the geopolitical front, ongoing tensions such as the Russia / Ukraine and Israel / Gaza conflicts still have the potential of flare ups, potentially affecting the respective wider regions. In addition to this, the continued attacks in the Red Sea could further disrupt global supply chains, directly affecting commodity prices.

While stimulus measures have been implemented in China, challenges persist within the economy and may require further stimulus measures to shore up activity. In addition to this, investment levels may drop in the absence of comprehensive reforms in the real estate sector.

The last major downside risk is inflation. While significant progress has been made on global scale, the threat of a resurgence still looms. Scenarios which may lead to a resurgence of inflation include tight labour markets, supply chain disruptions, and a rapid expansion in economic activity in the event of interest rate cuts.

On the upside, scenarios that can lead to better-than-expected economic growth include increased government spending, rapid monetary easing, and implementation of much needed structural reforms.

The first of these scenarios comes from increased government spending. The IMF dubs 2024 as a “Great Election Year” as many major countries are expected to undergo government elections. Fiscal consolidation efforts may be delayed as governments increase spending in transfers and infrastructure as elections approach.

The second possibility is policy rates easing quicker than anticipated. In the event of faster than expected disinflation, governments may have the space to begin or in some instances, continue with a cutting cycle, promoting medium-term growth. Key global markets such as the US and Europe’s decision to cut rates will also play a part in influencing the monetary stance of other global economies.

Finally, reforms geared towards reversing the lingering effects of the pandemic through boosting labour market conditions, and rebalancing economies may provide further stimulus to growth. This is especially relevant for Emerging Market economies where implementation of policy is typically more constrained.

Conclusion

Following a stronger than anticipated year in 2023, the global economy is expected to remain relatively stable and resilient throughout 2024, though below historical averages, reflecting the effects of interest rate hikes, and reduced fiscal support as well as global trade tensions and rising geoeconomic fragmentation. Advanced economies are expected to see a marginal increase in productivity, however, emerging markets are poised for stronger performance. Inflation is anticipated to continue its decline towards Central Bank targets, potentially allowing for a pullback in global rates and supporting medium term prospects.

DISCLAIMER

First Citizens Bank Limited (hereinafter “the Bank”) has prepared this report which is provided for informational purposes only and without any obligation, whether contractual or otherwise. The content of the report is subject to change without any prior notice. All opinions and estimates in the report constitute the author’s own judgment as at the date of the report. All information contained in the report that has been obtained or arrived at from sources which the Bank believes to be reliable in good faith but the Bank disclaims any warranty, express or implied, as to the accuracy, timeliness, completeness of the information given or the assessments made in the report and opinions expressed in the report may change without notice. The Bank disclaims any and all warranties, express or implied, including without limitation warranties of satisfactory quality and fitness for a particular purpose with respect to the information contained in the report. This report does not constitute nor is it intended as a solicitation, an offer, a recommendation to buy, hold, or sell any securities, products, service, investment or a recommendation to participate in any particular trading scheme discussed herein. The securities discussed in this report may not be suitable to all investors, therefore Investors wishing to purchase any of the securities mentioned should consult an investment adviser. The information in this report is not intended, in part or in whole, as financial advice. The information in this report shall not be used as part of any prospectus, offering memorandum or other disclosure ascribable to any issuer of securities. The use of the information in this report for the purpose of or with the effect of incorporating any such information into any disclosure intended for any investor or potential investor is not authorized.

DISCLOSURE

We, First Citizens Bank Limited hereby state that (1) the views expressed in this Research report reflect our personal view about any or all of the subject securities or issuers referred to in this Research report, (2) we are a beneficial owner of securities of the issuer (3) no part of our compensation was, is or will be directly or indirectly related to the specific recommendations or views expressed in this Research report (4) we have acted as underwriter in the distribution of securities referred to in this Research report in the three years immediately preceding and (5) we do have a direct or indirect financial or other interest in the subject securities or issuers referred to in this Research report.