Market Review: First Quarter of 2024

Commentary

International Market Review

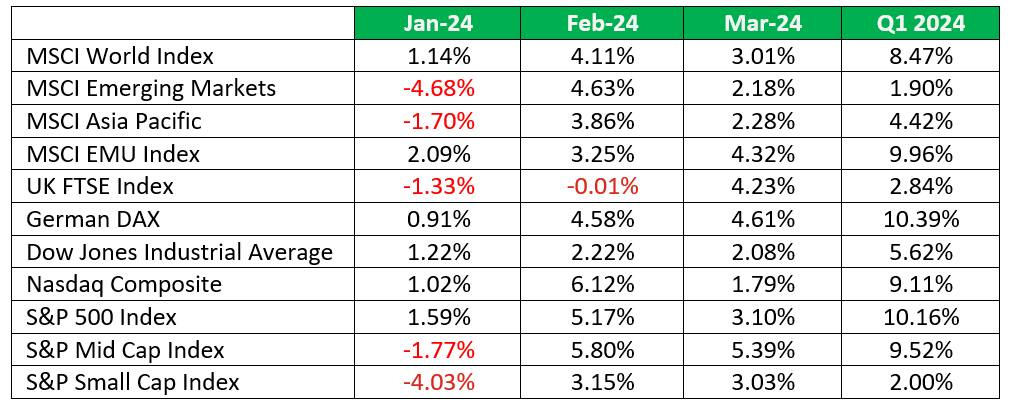

The robust momentum observed in equity markets throughout the final quarter of 2023 persisted into 2024, evident in the MSCI World Index recording a return of 8.47% in Q1 2024, primarily driven by developed markets. Emerging markets posted inferior returns as investor sentiment was negatively impacted by persistent weaknesses in China, Chile, and Brazil.

US Stocks

US stocks surged to record highs in the first quarter of 2024, with the S&P 500 Index leading the charge with a return of 10.16%, closely trailed by the Nasdaq Composite at 9.11% and the Dow Jones Industrial Average at 5.62%. The strong rally in US equities was buoyed by robust economic performance and strong corporate earnings. This suggests a smooth landing for the economy, characterized by moderated inflation and avoidance of a severe downturn. The US economy expanded at an annualized rate of 3.3% in Q4 2023, the strongest growth in two years, following a 2.9% rise in the previous quarter.

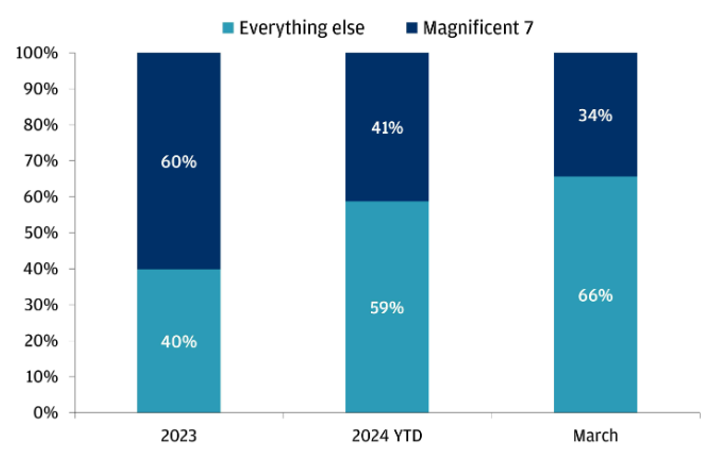

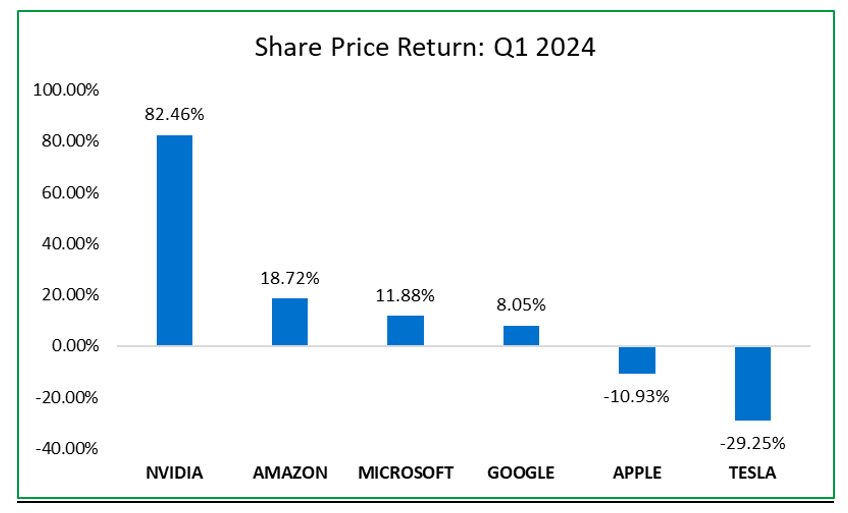

Although specific megacap companies continued to propel the US stock market, mirroring trends from 2023, the rally was more broad-based. In 2023, the top seven stocks (Apple, Alphabet (Google), Amazon, Meta Platforms (Facebook), Microsoft, Nvidia, and Tesla) contributed roughly 60% of the S&P 500’s annual gains. However, from January to March 2024, this percentage dropped to around 41%, primarily due to share price declines of Apple and Tesla by 10.93% and 29.25%, respectively. This was attributed to challenges in their China business, antitrust scrutiny, and concerns about electric vehicle demand.

In terms of market capitalization, small and medium cap stocks underperformed their larger counterparts in Q1 2024, with returns of 2.00% and 9.52%, respectively. Smaller companies, typically with weaker balance sheets, were more susceptible to inflationary headwinds and higher borrowing costs.

Europe and the United Kingdom

European stocks continued their upward trajectory, with several key indices including the CAC 40 and DAX, representing France and Germany respectively, reaching unprecedented highs in March. Investor confidence received a significant boost from diminishing inflationary pressures and a downward revision in the inflation forecast by the European Central Bank (ECB). The ECB now anticipates inflation to hover around 2% over the medium term, aligning with its target level, down from the previous forecast of 2.3%. In February 2024, Eurozone inflation eased to 2.6% year-on-year, marking its lowest point in three months and edging closer to the ECB’s 2% target, thereby reinforcing expectations for potential interest rate cuts in the near future.

Stocks in the United Kingdom fared less than their advanced peers, with the UK FTSE index posting a modest return of 2.56% for Q1 2024 due to weak economic fundamentals. The UK slipped into a technical recession in the fourth quarter of 2023 as GDP fell by 0.30% and followed a 0.10% contraction in Q3 2023. A recession is defined as two successive quarterly falls in gross domestic product.

Emerging Markets

Emerging equity markets faced a challenging start in 2024, marked by the MSCI Emerging Markets index recording a negative return of 4.68% in January. This downturn was attributed to various factors including China’s property market downturn, sluggish economic growth, and persistent deflationary pressures. However, momentum improved subsequently, with the index rebounding to a quarterly return of 1.52%. Investor confidence was bolstered by increased economic activity during China’s Lunar New Year holiday and supportive measures enacted by the Chinese government. These measures included the establishment of a stabilization fund, supported by offshore funds from Chinese State-Owned enterprises, aimed at purchasing stocks and imposing restrictions on short-selling. Short selling, a trading strategy where investors borrow securities from a broker and sell them on the market anticipating a price decline, was subject to limitations as part of these measures.

International Stock Indices Performance (Local Currency Returns)

Contribution to S&P 500 Returns (%)

Magnificent 7 Share Price Return: Q1 2024

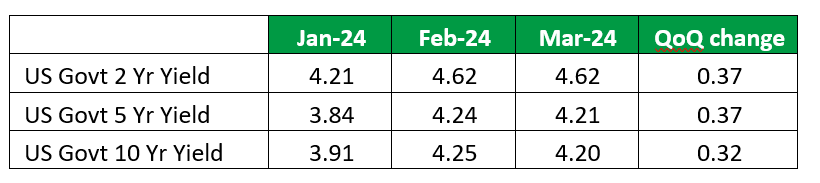

US Treasury Yields

The decline seen across various maturity levels in Q4 2023 did not recur in the following quarter, as US Treasury Yields rose from January to March 2024. This uptick in yields reflected investors’ concerns about the potential for prolonged higher interest rates, as the Federal Reserve anticipates both inflation and economic growth to be elevated in the near term. During the March 2024 meeting, the Federal Reserve revised its projections for Core Personal Consumption Expenditure (PCE), its preferred inflation metric, upward to 2.6% for 2024, compared to 2.4% in December 2023, and GDP growth to 2.1% from its previous estimate of 1.4%. Persistent inflation, alongside robust economic expansion, could impede the Federal Reserve’s plans to lower interest rates.

US Treasury Yields

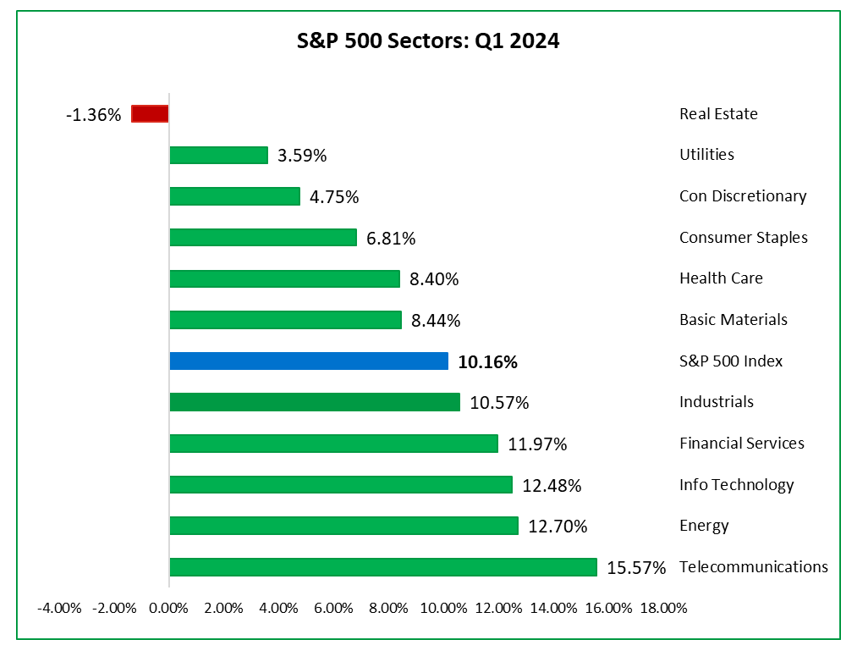

US Sector Performance

From a sector perspective, ten out of eleven sectors posted positive returns in Q1 2024, with five sectors achieving double-digit gains. The Telecommunication sector led the way as it increased by 15.57%, followed by Energy with a gain of 12.70%. The Telecommunications sector benefited from the solid gains in artificial intelligence (AI) stocks including Nvidia, Microsoft and META.

The energy sector rebounded strongly in the first quarter of 2024 after posting a loss of 7.80% in Q4 2023, with the notable upswing driven by rising oil prices, buffered by the Organization of the Petroleum Exporting Countries (OPEC+) supply cuts. The only sector that declined in the first quarter of 2024 was real estate that fell by 1.36% as the industry continues to be plagued by the elevated interest rate environment.

US Sector Performance: Q1 2024

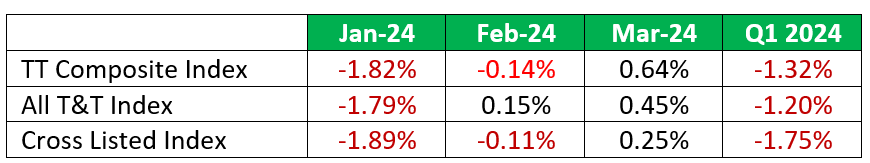

Local Market Review

After posting gains in Q4 2023, there was a pullback in the local stock market in Q1 2024, with the Composite Index down 1.32% compared with a gain of 0.37% in the prior quarter, led by losses in the cross listed stocks. The Cross Listed Index reversed its upward trend as it declined 1.75% in Q1 2024, down from gains of 0.75% in Q3 2023 and 10.48% in Q4 2023. The All T&T index remained on its downward trajectory, with a loss of 1.75% over Q1 2024 compared to a loss of 2.30% in Q4 2023.

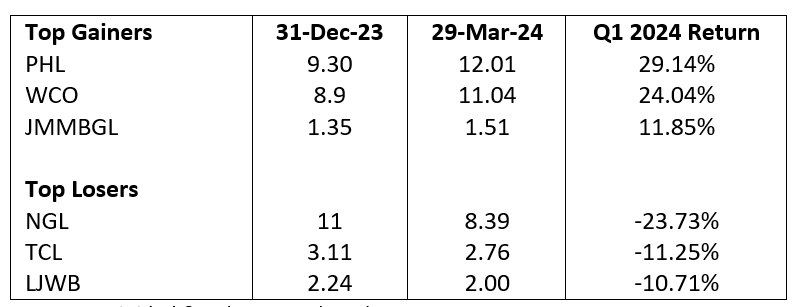

The stocks with the largest share price gains over the first quarter of 2024 were Prestige Holdings (PHL), West Indies Tobacco Company (WCO) and JMMBGL with returns of 29.14%, 24.04% and 11.85% respectively. Leading the declines were Trinidad & Tobago NGL Limited (NGL), Trinidad Cement Limited (TCL) and LJ Williams Limited (LJWB) with losses of 23.73%, 11.25% and 10.71% respectively.

Local Stock Indices Performance

Top Gainers and Losers

Equity Markets Outlook

Uncertainty is expected to continue given the elevated political dynamics, with a record-setting 76 elections slated for 2024, as reported by The Economist. Of utmost significance are the forthcoming US Presidential elections in November and the UK elections mandated to occur before January 2025 concludes.

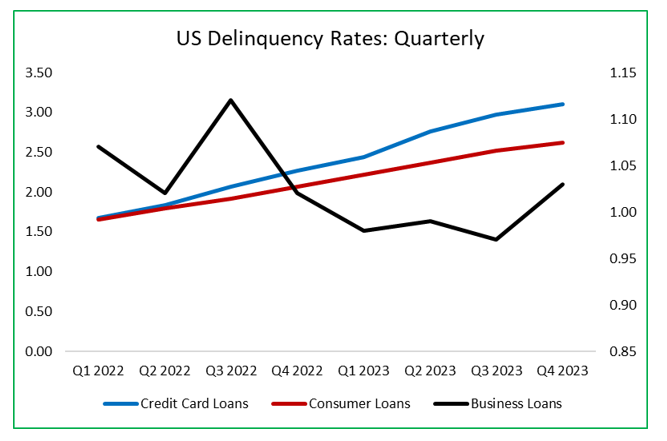

Maintaining interest rates at their highest level in 22 years for an extended period could adversely affect the growth prospects of the US economy, potentially derailing the soft landing and leading to a mild recession. Both consumers and businesses would face higher borrowing costs over a prolonged period, constraining future access to financing and increasing the burden of servicing existing debts. Delinquency rates on credit card loans, consumer loans, and business loans have been on an upward trend since the first quarter of 2023. The Federal Reserve faces a dilemma: delaying rate cuts and easing too slowly may heighten the risk of recession, while easing too rapidly could trigger inflationary pressures.

Continued assaults in the Red Sea, alongside a severe drought in the Panama Canal may exacerbate inflationary tendencies, given the substantial disruptions to global trade. In the initial two months of 2024, attacks on Red Sea vessels led to a 50% reduction in Suez Canal trade compared to the previous year, while the Panama Canal experienced a 32% decline due to the drought. The longer shipping times, along with higher fuel cost can cause upward pressure on inflation, due to higher shipping costs.

Given these challenges, volatility is likely to stay heightened in the upcoming quarter. Consequently, investors might view market pullbacks as chances to adjust portfolios by rebalancing or diversifying. Equities, known for their effectiveness in hedging against inflation, should assume a more significant role in portfolios. Historically, equity returns have surpassed inflation rates over the long haul. However, fixed income securities should not be disregarded as they can shield portfolios from substantial fluctuations in stock prices.

US Quarterly Delinquency Rates (%)

DISCLAIMER

First Citizens Bank Limited (hereinafter “the Bank”) has prepared this report which is provided for informational purposes only and without any obligation, whether contractual or otherwise. The content of the report is subject to change without any prior notice. All opinions and estimates in the report constitute the author’s own judgment as at the date of the report. All information contained in the report that has been obtained or arrived at from sources which the Bank believes to be reliable in good faith but the Bank disclaims any warranty, express or implied, as to the accuracy, timeliness, completeness of the information given or the assessments made in the report and opinions expressed in the report may change without notice. The Bank disclaims any and all warranties, express or implied, including without limitation warranties of satisfactory quality and fitness for a particular purpose with respect to the information contained in the report. This report does not constitute nor is it intended as a solicitation, an offer, a recommendation to buy, hold, or sell any securities, products, service, investment or a recommendation to participate in any particular trading scheme discussed herein. The securities discussed in this report may not be suitable to all investors, therefore Investors wishing to purchase any of the securities mentioned should consult an investment adviser. The information in this report is not intended, in part or in whole, as financial advice. The information in this report shall not be used as part of any prospectus, offering memorandum or other disclosure ascribable to any issuer of securities. The use of the information in this report for the purpose of or with the effect of incorporating any such information into any disclosure intended for any investor or potential investor is not authorized.

DISCLOSURE

We, First Citizens Bank Limited hereby state that (1) the views expressed in this Research report reflect our personal view about any or all of the subject securities or issuers referred to in this Research report, (2) we are a beneficial owner of securities of the issuer (3) no part of our compensation was, is or will be directly or indirectly related to the specific recommendations or views expressed in this Research report (4) we have acted as underwriter in the distribution of securities referred to in this Research report in the three years immediately preceding and (5) we do have a direct or indirect financial or other interest in the subject securities or issuers referred to in this Research report.