Oil Markets–A recap of 2023 and a look ahead to 2024

Commentary

Review of 2023

The energy sector experienced a remarkable year in 2022, marked by unprecedented profits and increased dividends. The industry’s success was primarily driven by Russia’s invasion of Ukraine in February 2022 and the post-COVID-19 recovery, which propelled oil prices from USD100 per barrel to USD125 per barrel by June 2022. Consequently, with the surge in oil prices, the energy sector stood alone in ending the year with a positive performance, achieving a gain of 59%.

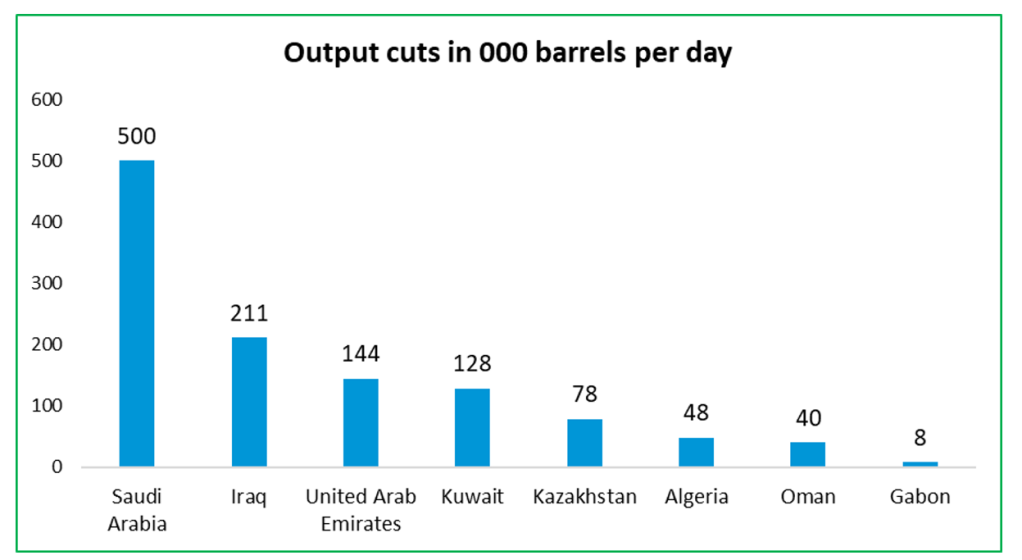

However, this positive momentum did not continue into 2023 as the energy sector ended the year down 4.80%. Several factors contributed to the sector’s dismal performance, including weakening macroeconomic conditions in numerous developed nations and record-breaking supply from non- Organization of the Petroleum Exporting Countries (OPEC) countries. Despite the extension of OPEC+ cuts throughout the year, oil market sentiment failed to improve.

The beginning of 2023 saw instability in the oil markets, with both Brent Crude (Brent) and West Texas Intermediate (WTI), global oil benchmarks, experiencing a decline of over 8%. Brent typically represents oil from the North Sea region, while WTI is associated with oil extracted from wells in the US, ranking as the second most popular benchmark.

Bearish global demand had an adverse effect on energy prices, driven by a lackluster economic recovery in China following the easing of COVID-19 restrictions. China’s economy faced challenges throughout the year, grappling with diminished exports and imports, an escalating property crisis and youth unemployment. Additionally, an environment of elevated interest rates, guided by a more stringent monetary policy aimed at curbing inflationary pressures, also contributed to a slowdown in growth across several advanced countries, including the US, Germany, France, and the UK.

In 2023, there was a notable increase in global oil supply, propelled by heightened production in the US, Brazil, Guyana, and Iran. The primary driver of this upsurge was the US, particularly the shale oil drillers in Texas and the Permian Basin of New Mexico. Factors such as drilling efficiencies, extended wells, and enhanced well productivity played a crucial role in this expansion. According to S&P, the US is now exporting an equivalent amount of crude oil, refined products, and natural gas liquids as Saudi Arabia and Russia. The record-high production levels in the US effectively countered the efforts by OPEC+ to elevate energy prices through production cuts.

Figure 1: OPEC Crude Oil Production Cuts from May 2023 to December 2023

Outlook 2024

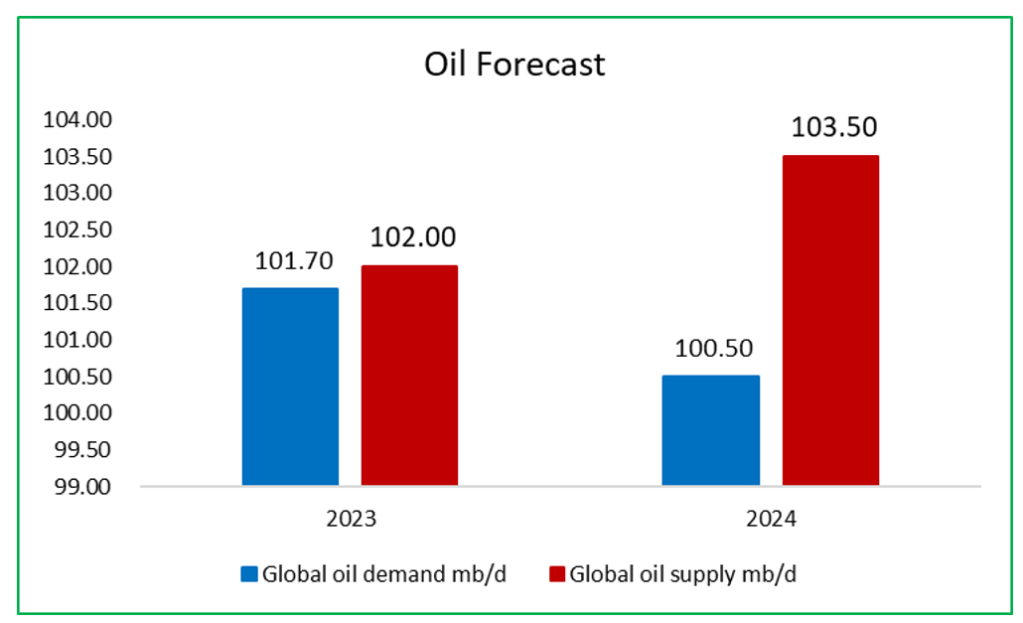

Energy prices are anticipated to remain stable in 2024 due to the ongoing deceleration in energy demand and an increase in supply levels. The projection for 2024 suggests that oil demand will continue its slow trajectory, influenced by the sluggish growth in demand in China amidst its property downturn and challenges in reviving manufacturing activity. Given that China constitutes approximately 24.6% of global oil consumption, any economic slowdown in the country is expected to have a cascading effect on oil markets. Prolonged higher interest rates than initially anticipated are also poised to negatively impact global growth, subsequently affecting oil consumption.

Anticipated high production levels may exert downward pressure on energy prices in 2024, with the International Energy Agency (IEA) forecasting a record world oil supply of 103.5 million barrels per day. Despite the potential for lower prices due to increased supply, escalating geopolitical tensions could lead to unplanned production disruptions, causing prices to surge. If the Israeli-Hamas conflict intensifies and involves major oil-producing nations like Saudi Arabia, Iraq, or Iran, or if there are heightened conflicts in the Red Sea, necessitating more tankers to take alternative and more costly routes, oil prices may be adversely affected.

Another potential factor that may impact the energy sector is a shift in OPEC’s strategies. Over the past year, OPEC and its allies have consistently implemented production cuts to support energy prices, and similar cuts are planned for 2024. Nevertheless, prices have remained stagnant due to the increase in non-OPEC production and subdued demand. There is a chance that OPEC and its allies might adopt a different approach by increasing their production levels, thereby lowering energy prices and reclaiming market share.

Investors should ready themselves for the shifts and obstacles in the energy sector by staying abreast of industry trends, diversifying their portfolios, and taking into account the potential influence of geopolitical tensions on energy prices. Through these proactive measures, investors can position their portfolios to seize investment opportunities and mitigate risks within the energy sector.

Figure 2: Oil Forecast 2024

DISCLAIMER

First Citizens Bank Limited (hereinafter “the Bank”) has prepared this report which is provided for informational purposes only and without any obligation, whether contractual or otherwise. The content of the report is subject to change without any prior notice. All opinions and estimates in the report constitute the author’s own judgment as at the date of the report. All information contained in the report that has been obtained or arrived at from sources which the Bank believes to be reliable in good faith but the Bank disclaims any warranty, express or implied, as to the accuracy, timeliness, completeness of the information given or the assessments made in the report and opinions expressed in the report may change without notice. The Bank disclaims any and all warranties, express or implied, including without limitation warranties of satisfactory quality and fitness for a particular purpose with respect to the information contained in the report. This report does not constitute nor is it intended as a solicitation, an offer, a recommendation to buy, hold, or sell any securities, products, service, investment or a recommendation to participate in any particular trading scheme discussed herein. The securities discussed in this report may not be suitable to all investors, therefore Investors wishing to purchase any of the securities mentioned should consult an investment adviser. The information in this report is not intended, in part or in whole, as financial advice. The information in this report shall not be used as part of any prospectus, offering memorandum or other disclosure ascribable to any issuer of securities. The use of the information in this report for the purpose of or with the effect of incorporating any such information into any disclosure intended for any investor or potential investor is not authorized.

DISCLOSURE

We, First Citizens Bank Limited hereby state that (1) the views expressed in this Research report reflect our personal view about any or all of the subject securities or issuers referred to in this Research report, (2) we are a beneficial owner of securities of the issuer (3) no part of our compensation was, is or will be directly or indirectly related to the specific recommendations or views expressed in this Research report (4) we have acted as underwriter in the distribution of securities referred to in this Research report in the three years immediately preceding and (5) we do have a direct or indirect financial or other interest in the subject securities or issuers referred to in this Research report.