Caribbean Economic Outlook – Bright Spots but Downside Risks Weigh Heavily

By: Vangie Bhagoo-Ramrattan

Head, First Citizens Economic Research Unit

Commentary

The Caribbean has been one of the hardest hit regions with a culmination of exogenous factors, including the pandemic, the crisis in Eastern Europe and persistently high and rising inflation exacerbated by severe disruptions to supply. These challenges have added to the perennial issues that face the islands, including inherently small and open economies, high indebtedness and low economic growth. As the region now recoups the economic losses of the past two years especially, it now contends with the increasing prospect of a global economic downturn and persistently high inflation, alongside globally tighter financial conditions. Prior to the pandemic, many countries were making good strides in restraining growth in fiscal shortfalls and indebtedness with clear fiscal targets and while the pandemic disrupted plans to achieve these targets, there has been a return to fiscal consolidation efforts as the effects of COVID-19 fade. However, there is still much work to be done to sustainably reduce debt while at the same time, ensuring economic growth operates close to potential.

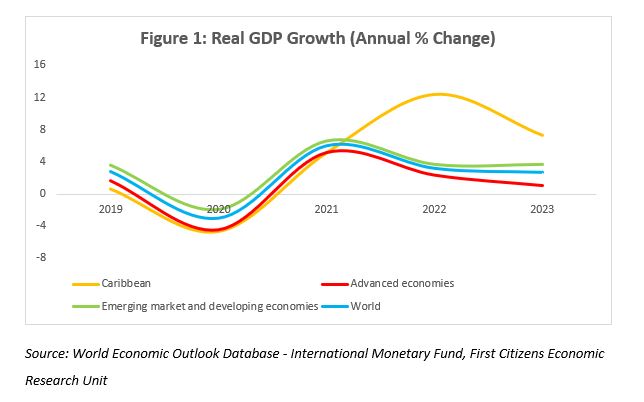

In its January 2023 World Economic Outlook, the International Monetary Fund (IMF) projected global economic growth at 2.9% for 2023 from 3.4% estimated for 2022. While the IMF’s 2023 forecast is more optimistic relative to its October 2022 forecast, it remains well below the preceding 20-year average growth rate of 3.8%. Many advanced economies have had their GDP growth projections cut based on a myriad of risks, including the persistently high inflation, aggressive pace of monetary tightening as well as the economic fallout from Russia’s invasion of Ukraine. Growth in the emerging markets is estimated to have bottomed out in 2022 according to the IMF and prospects for 2023 have [AS1] [BRV2] improved, largely because of the full reopening of the Chinese economy after relaxing its zero tolerance -COVID policies that were in place since the onset of the pandemic. Further, the IMF projects that about 84% of countries globally are expected to record lower headline inflation in 2023[AS3] [BRV4] , relative to 2022, with the average inflation rate expected to fall to 6.6% and 4.3% in 2023 and 2024, respectively, from 8.8% in 2022. The deceleration is likely to be driven by moderating commodity prices (both energy and non-energy) driven by weaker global demand.

While the global economic outlook is more optimistic, the risks remain elevated and are tilted to the downside. Based on the IMF’s report, the downside risks are:

- Stalled Chinese recovery

- Escalating war in Ukraine

- Debt distress largely amongst the emerging markets

- Persistent inflation

- Sudden repricing in financial markets

- Geopolitical fragmentation

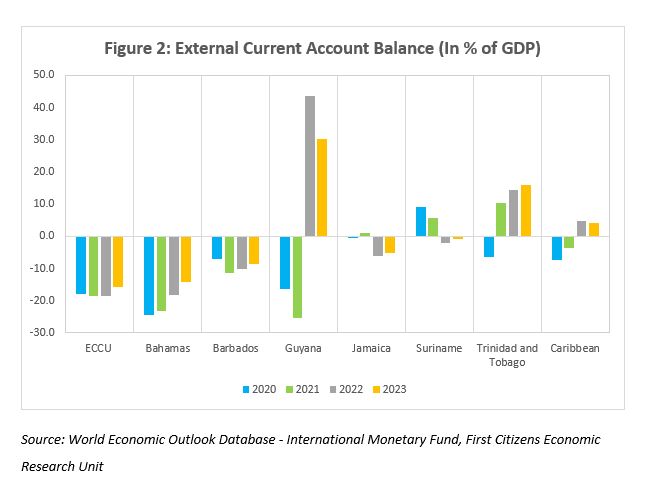

The Caribbean is highly susceptible to the vagaries of the external environment. We are heavily import dependent for critical resources, including food and fuel and [AS5] foreign exchange inflows from travel and tourism is critical. As such, the steady increase in commodity prices over the past 18 months or so placed a significant burden on countries which already grappled with significant imbalances on the external accounts. The impact was two-fold and simultaneous for islands that are greatly dependent on the tourism industry: the import bill increased sharply while tourism receipts dwindled with the uncertainty regarding international travel and COVID-19. During 2020, the region’s average external current account balance was equivalent to -7.3% of GDP, with most countries recording double digit deficits and Dominica, Bahamas and Grenada posting shortfalls of 29.3%, 24.5% and 21% of GDP respectively.

As COVID-related restrictions have been removed, some of the region’s current account deficits have moderated as travel and tourism demand has gradually resumed, but they remain elevated. For instance, in Dominica, the deficit is estimated to have increased to just over 30% of GDP in 2021 and 2022, before falling to around 21% of GDP by 2024. The commodity exporters of the region have benefitted greatly from higher international prices, with Guyana in particular estimated to have moved from a deficit of 25.5% of GDP in 2021 to a massive surplus of 43.5% of GDP in 2022, to persist in the medium term driven by surging energy exports. In the case of Trinidad and Tobago, the current account is estimated to have posted a surplus of 10.4% of GDP In 2021. This surplus position is projected to continue throughout the medium term. Consequently, the Caribbean region is expected to record average surpluses throughout the next few years, primarily driven by commodity exporters. Indeed, the tourism-dependent countries are expected to average a deficit of 12.1% of GDP in 2022 and 2023.

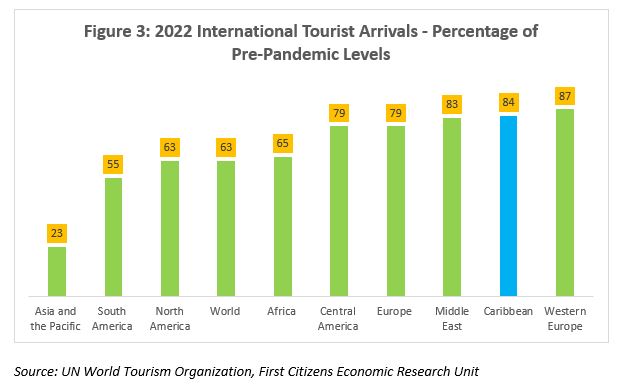

As the global economy weakens in 2023, the Caribbean is expected to feel the economic fallout. The region’s reliance on the advanced economies as major tourism source markets makes them extremely vulnerable. The US and UK remain the largest source of tourist arrivals into the region and shrinking disposable incomes caused by decades-high levels of inflation will ultimately affect demand for tourism. According to the UN World Tourism Organization (UNWTO), during 2022, international tourist arrivals significantly surpassed 2021 numbers, but only represents 63% of pre-pandemic levels from a global perspective. The UNWTO is also optimistic that tourism is set to return to pre-pandemic levels in 2023 supported by the return of Chinese tourists and stronger demand from the US backed by a stronger US dollar. Based on data compiled by the UNWTO, arrivals in the Caribbean reached 84% of pre-pandemic levels in 2022 and was among the best performing regions globally, only behind Western Europe.

Another consideration for the Caribbean tourism market is the strength of the US Dollar. Most of the region maintains an exchange rate that is fixed to the US dollar. Accordingly, as the US Federal Reserve continues to raise policy rates to combat inflation, the US dollar may likely remain strong, and the countries which operate under a fixed rate regime may become less competitive, relative to countries that operate a floating exchange rate against the US dollar. Simply, vacations in countries with fixed exchange rates against the US dollar will become relatively more expensive.

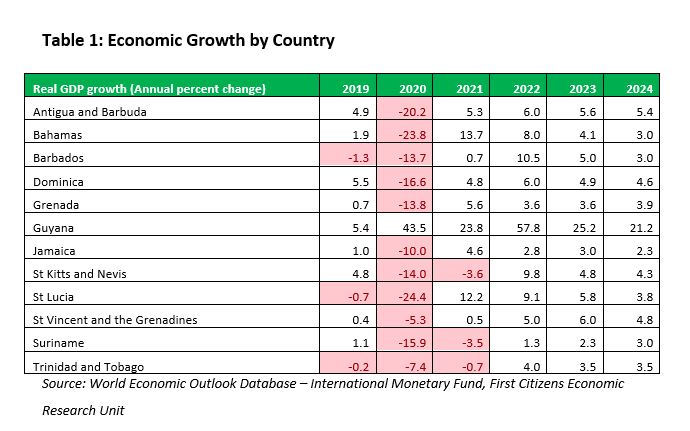

While still below pre-pandemic levels, increased tourism activity would have helped propelled strong economic growth in 2022 after a lackluster 2021 and a record low 2020. At the same time, the commodity-exporters of the region saw a return to positive GDP growth as energy markets remained buoyant with prices gradually increasing in 2021 and surging in 2022 due largely to the Eastern European crisis. Despite the dampening effect of a stronger dollar the overall outlook for economic growth for the region is relatively optimistic as seen below.

The Caribbean is estimated to have significantly outpaced global as well as emerging market growth in 2022 and is expected to continue this trend will continue in the medium term. The regional average is bolstered by significantly high growth rates forecasted for Guyana, as the country continues to reap tremendous benefits from its rapidly expanding energy sector. Indeed, the IMF estimates economic growth of 57.8% in 2022, while the Ministry of Finance estimates that the economy expanded by 62.3%. This puts Guyana as the world’s fastest growing economy in 2022, far outpacing the budgeted growth rate of 47.5%. The commodity exporters of the region are expected to expand at a rate of 12.8% in 2023 while expectations for the tourism-dependent economies are much more subdued at 3.6%.

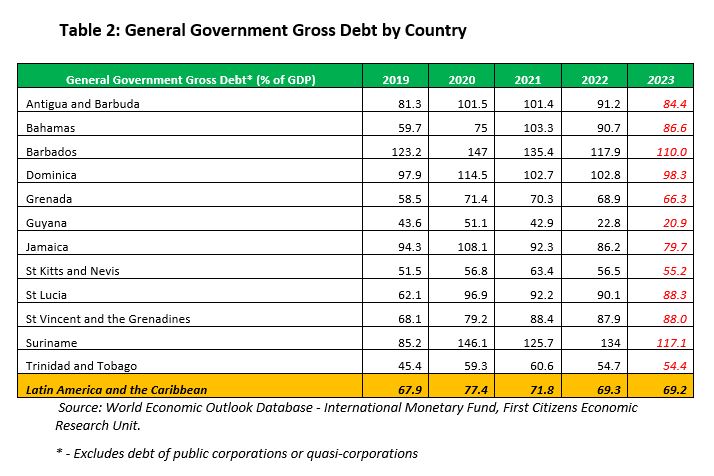

One of the concerns in the Caribbean is the historically high level of debt and limited fiscal flexibility. Persistent fiscal shortfalls precipitated by a very narrow revenue have caused an accumulation of debt over the years. During the pandemic, some members of the Eastern Caribbean Currency Union (ECCU), particularly Dominica and St Lucia expanded their capital expenditure program to help support economic activity and sustain jobs. This, added to the elevated pandemic-related spending, resulting in considerable widening of the fiscal deficit. In 2022, Suriname, Barbados and Dominica are all estimated to have recorded gross government debt of over 100% of GDP, while Antigua & Barbuda, Bahamas and St Lucia are in the 90% range. Several countries in the Eastern Caribbean have benefitted greatly from strong inflows of Citizenship by Investment Programs,[AS6] which helped to reduce the fiscal shortfalls and indebtedness. Further, several countries in the region operate under a fiscal responsibility framework, including Grenada, Barbados, St Vincent & the Grenadines and Jamaica, while a handful of sovereigns are under IMF programs[AS7] . This will ensure debt reduction and fiscal discipline well into the medium term barring any unforeseen shocks.

As the global economy faces significant economic headwinds in 2023, so too will the Caribbean. The region is home to very small and extremely open economies, with narrow economic and revenue bases, exacerbated by limited fiscal flexibility. As the worst effects of the pandemic fade, many of the islands have already started to rebuild – however, the progress is mixed and contingent on the discipline of policy response and the pace of implementation for the various economies in the region. As economic activity gradually returns, fiscal consolidation will be necessary to create flexibility to help build economic resilience. There is also a concern about the rising cost of living in the region, as global inflation remains elevated. Some countries, including Barbados have implemented policies to help cushion the impact of higher prices, but the larger issue of regional food security, in particular has to be prioritized.

DISCLAIMER

First Citizens Bank Limited (hereinafter “the Bank”) has prepared this report which is provided for informational purposes only and without any obligation, whether contractual or otherwise. The content of the report is subject to change without any prior notice. All opinions and estimates in the report constitute the author’s own judgment as at the date of the report. All information contained in the report that has been obtained or arrived at from sources which the Bank believes to be reliable in good faith but the Bank disclaims any warranty, express or implied, as to the accuracy, timeliness, completeness of the information given or the assessments made in the report and opinions expressed in the report may change without notice. The Bank disclaims any and all warranties, express or implied, including without limitation warranties of satisfactory quality and fitness for a particular purpose with respect to the information contained in the report. This report does not constitute nor is it intended as a solicitation, an offer, a recommendation to buy, hold, or sell any securities, products, service, investment or a recommendation to participate in any particular trading scheme discussed herein. The securities discussed in this report may not be suitable to all investors, therefore Investors wishing to purchase any of the securities mentioned should consult an investment adviser. The information in this report is not intended, in part or in whole, as financial advice. The information in this report shall not be used as part of any prospectus, offering memorandum or other disclosure ascribable to any issuer of securities. The use of the information in this report for the purpose of or with the effect of incorporating any such information into any disclosure intended for any investor or potential investor is not authorized.

DISCLOSURE

We, First Citizens Bank Limited hereby state that (1) the views expressed in this Research report reflect our personal view about any or all of the subject securities or issuers referred to in this Research report, (2) we are a beneficial owner of securities of the issuer (3) no part of our compensation was, is or will be directly or indirectly related to the specific recommendations or views expressed in this Research report (4) we have acted as underwriter in the distribution of securities referred to in this Research report in the three years immediately preceding and (5) we do have a direct or indirect financial or other interest in the subject securities or issuers referred to in this Research report.