Trinidad and Tobago Economic Outlook: Brighter Days Ahead?

Commentary

The 2023 New Year address by the Prime Minister alluded to the possibility of more prosperous times for Trinidad and Tobago (T&T) in the upcoming year. Having suffered through the COVID-19 pandemic in 2020 and 2021 particularly, 2022 brought somewhat of a rebound in the country’s economic fortunes, bolstered by high energy prices especially in the wake of the war in Eastern Europe. The first month of 2023 concluded with some promising news for the local economy, namely the announcement that the United States Treasury Department granted T&T a two-year licence to develop the Dragon gas field, which is located in Venezuelan waters. This was followed soon after by an update from the Central Statistical Office (CSO), indicating that the country’s real GDP growth performance for the first quarter of 2022 was much better than initially estimated, while growth in the second quarter of 2022 stood at a robust 6.6% year-on-year. The following article will give an overview on the prospects for the domestic economy for 2023 and beyond.

Real GDP: 2022 Better than Expected, More Hoped for in 2023

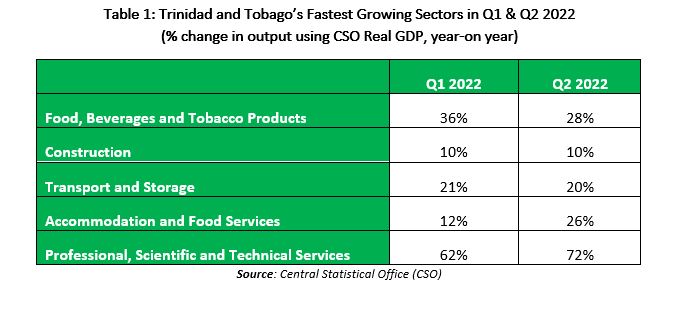

Although full-year data for 2022 is not yet available, the latest CSO data released in January 2023 shows that economic activity was clearly on the rebound in the first half of 2022, after the lows experienced in 2020 and 2021. Based on the CSO GDP data, the sectors experiencing the greatest revival in activity in H12022 were construction, food and beverage manufacturing, trade and repairs, transport and storage, and professional services. The growth rates of these sectors are illustrated in Table 1. The predominance of service-based sectors among the top performers can likely be attributed to the reopening of economic activity as the government gradually eased COVID-19 restrictions in the first half of 2022.

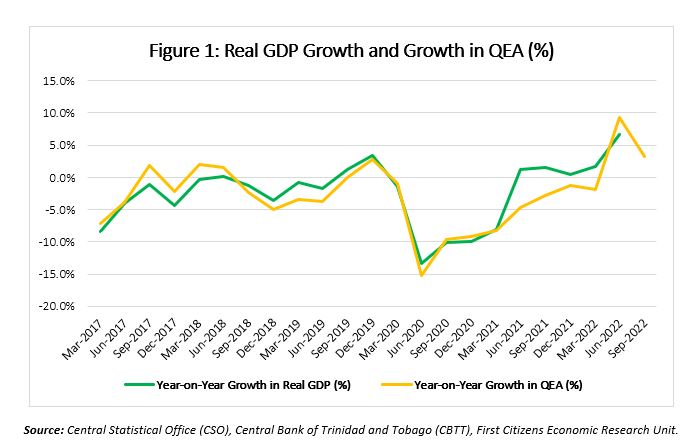

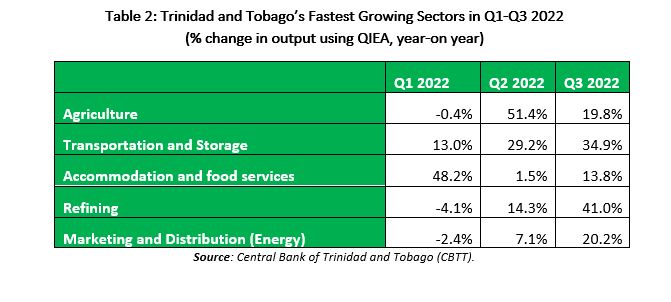

Based on the Central Bank of Trinidad and Tobago’s (CBTT) Quarterly Index of Real Economic Activity (QEA), after nine consecutive quarters of economic contraction between March 2020 and March 2022, economic activity grew by 9.3% year-on-year in June 2022 and 3.3% in September 2022, lending further support to the notion that the T&T economy began to recover throughout last year. Table 2 shows the five fastest-growing sectors based on the CBTT index, while Figure 2 illustrates the trajectory of real GDP along with the QEA in recent years.

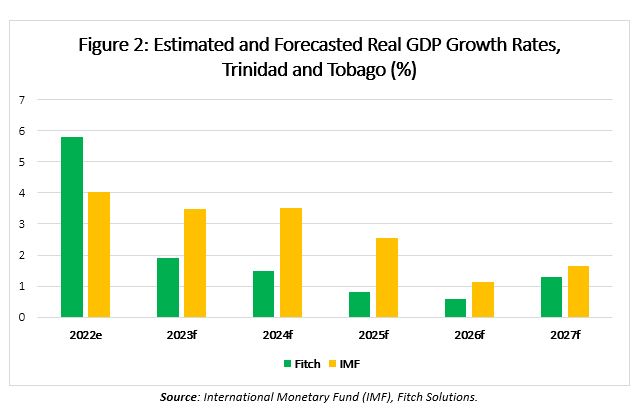

As Figure 2 shows, forecasts from international observers broadly suggest that economic growth will continue over the medium term. In its October 2022 World Economic Outlook, the IMF projected 3.5% growth for T&T in 2023, while a January 2023 report from Fitch Solutions forecasts 1.9% growth in 2023 after estimating that a 5.8% expansion took place in 2022. Because the key driver of the uptick in growth has been the upward trend in hydrocarbon commodity prices, Fitch in particular anticipates that growth will moderate further as prices return to historical levels.

Energy Sector: Dragon Impact Likely to be Longer-Term

The temporary waiver of sanctions on the Dragon gas field, which holds 4.2 trillion cubic feet (tcf) of reserves, has sparked much enthusiasm within the local business community. While most of its economic impact is likely to be felt over the longer term – as there are several legal, technical and commercial hurdles to be overcome before the gas can be extracted and monetised – it nevertheless represents a major fillip to the prospects of the country’s liquefied natural gas (LNG) sector.

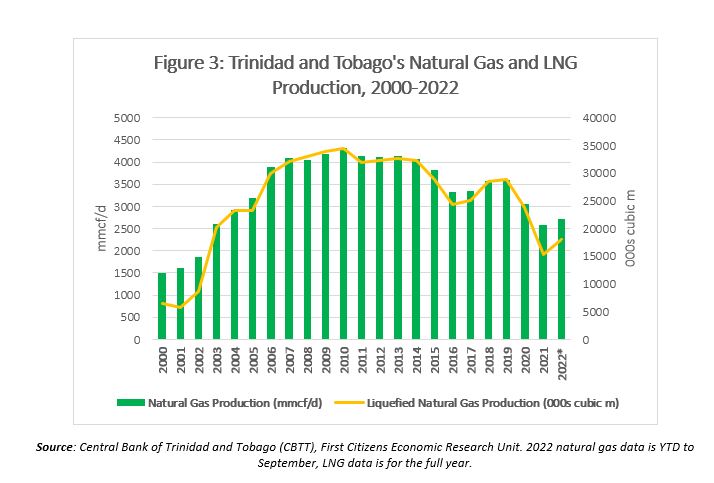

As Figure 3 illustrates, the LNG industry is highly dependent on a domestic supply of gas as a feedstock to its operations, however it has been constrained over the past decade by limited gas availability. Through Atlantic, the country has installed capacity to process 4.2 billion cubic feet per day (bcf/d) of gas into LNG, but T&T’s total gas production in recent years has fallen some way short of meeting this level of demand. 2022’s natural gas output is likely to have averaged well below 3bcf/d for the second consecutive year, meaning that while prices were strong the country was not fully able to capitalise on the opportunities presented in such an environment. Further, the Dragon deal is still subject to much uncertainty – as of the present date, the Venezuelan government has not yet commented on the approval of the licence.

Fiscal and Monetary Policy: Stable for Now But Risks Remain

Trinidad and Tobago’s fiscal situation improved in FY2022, coming close to a balanced budget, with the fiscal deficit for the year now recorded as TTD329Mn, representing 0.2% of GDP. For FY2023 the trend of relative fiscal consolidation is set to continue, with expenditure budgeted at TTD57.69Bn and revenue at TTD56.18Bn, for a deficit of TTD1.51Bn (0.8% of GDP). However, the budget is underpinned by a WTI oil price assumption of USD92.50/bbl and a Henry Hub gas price assumption of USD6/mmbtu, which are quite optimistic and predicated on the prolongation of the upward price pressures experienced in 2022. In contrast, Fitch forecasts that WTI will fall to USD81/bbl in 2023 and moderate to a long-term average of USD50/bbl by 2027, while it anticipates gas prices falling to USD5/mmbtu in 2023 and averaging USD2.75/mmbtu by 2027. So far in 2023, WTI has been trading within the USD70-80/bbl range, while the Henry Hub gas price has plunged by over 40% since the start of the year and is currently around USD2.50/mmbtu, well below the level assumed in the budget. The YTD fall in natural gas price is largely due to unseasonably warmer weather during the month of January, which typically is a month characterized by high demand for heating.

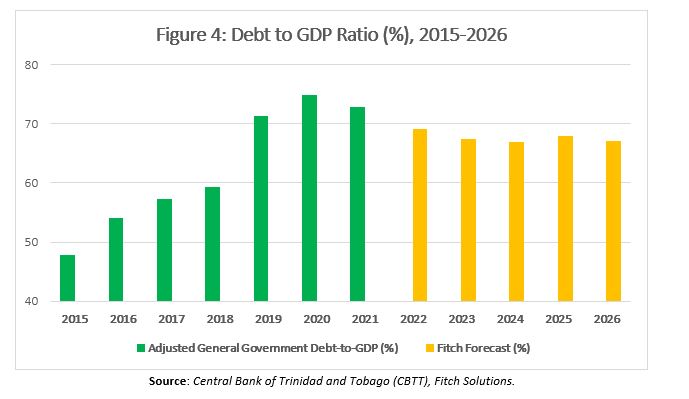

T&T’s debt position improved in 2022, with no significant increases in government borrowing taking place during the year. According to Ministry of Finance data, the adjusted general government debt outstanding was also projected to fall to 70% of GDP in 2022. The government is also adopting a soft debt-to-GDP ratio target of 75% for FY22/23 and FY23/24. Fitch expects the debt position to remain broadly stable in the coming years as it sees the present phase of fiscal consolidation as sustainable, especially if revenues remain strong and government continues to ease back on subsidies as it has done recently. After a significant build-up in debt up to and including the COVID pandemic – nominal debt increased from TTD76.5Bn in 2015 to TTD130.8Bn in 2021 – the latest forecasts from Fitch indicate that T&T’s debt ratio will stabilise in the 67-69% range over the next five years (see Figure 4).

With regard to monetary policy, the CBTT has taken a highly accommodative stance since the onset of the COVID-19 pandemic. Despite the uptick in inflation that began in mid-2021 and persisted throughout 2022, the CBTT has held the repo rate steady at 3.5%. In its Monetary Policy Announcements throughout 2022, the Central Bank justified these decisions by stating its intention to support the fragile economic recovery observed in 2022 and to maintain the momentum of the recovery in business and consumer lending, which became more evident in the second half of 2022. This stance contrasts with many neighbouring central banks, as well as those in the major economies such as the United States and United Kingdom, which raised interest rates multiple times throughout 2022 in an attempt to tamp down on inflationary pressures. Early indications in 2023 suggest that inflation may be moderating in the advanced economies, which may pass through to lower rates of domestic price increases in T&T.

Conclusion

Despite the favourable price trends for energy commodities, and the resultant improvements in the near-term outlook for T&T’s economy, a January 2023 Fitch report notes, “given T&T’s continuing dependence on its hydrocarbons sector, fluctuating energy prices will present persistent risks to growth.” While the short-term trends and recent developments are in the country’s favour, structural adjustments to break its traditional dependence on the energy sector have not yet manifested in a significant way. Energy prices, while expected to remain high in 2023, may not hit the levels upon which the Government has based the FY22/23 budget, meaning revenues may fall short of budget. Nevertheless, the performance of the non-energy sector in 2022 showed promising signs of a rebound, and forecasts suggest a trend of stable, positive real GDP growth in 2023 and over the coming few years.

DISCLAIMER

First Citizens Bank Limited (hereinafter “the Bank”) has prepared this report which is provided for informational purposes only and without any obligation, whether contractual or otherwise. The content of the report is subject to change without any prior notice. All opinions and estimates in the report constitute the author’s own judgment as at the date of the report. All information contained in the report that has been obtained or arrived at from sources which the Bank believes to be reliable in good faith but the Bank disclaims any warranty, express or implied, as to the accuracy, timeliness, completeness of the information given or the assessments made in the report and opinions expressed in the report may change without notice. The Bank disclaims any and all warranties, express or implied, including without limitation warranties of satisfactory quality and fitness for a particular purpose with respect to the information contained in the report. This report does not constitute nor is it intended as a solicitation, an offer, a recommendation to buy, hold, or sell any securities, products, service, investment or a recommendation to participate in any particular trading scheme discussed herein. The securities discussed in this report may not be suitable to all investors, therefore Investors wishing to purchase any of the securities mentioned should consult an investment adviser. The information in this report is not intended, in part or in whole, as financial advice. The information in this report shall not be used as part of any prospectus, offering memorandum or other disclosure ascribable to any issuer of securities. The use of the information in this report for the purpose of or with the effect of incorporating any such information into any disclosure intended for any investor or potential investor is not authorized.

DISCLOSURE

We, First Citizens Bank Limited hereby state that (1) the views expressed in this Research report reflect our personal view about any or all of the subject securities or issuers referred to in this Research report, (2) we are a beneficial owner of securities of the issuer (3) no part of our compensation was, is or will be directly or indirectly related to the specific recommendations or views expressed in this Research report (4) we have acted as underwriter in the distribution of securities referred to in this Research report in the three years immediately preceding and (5) we do have a direct or indirect financial or other interest in the subject securities or issuers referred to in this Research report.