Year in Review and Outlook for 2023

Commentary

The upward momentum that characterized the financial market in 2021 was not evident in 2022 as markets were very volatile and turbulent, as the world economy faced unprecedented challenges including war, global monetary tightening and significant price increases. After initially deeming the rise in consumer prices as transitory for most of 2021, it was only at its December 2021 meeting that the US Federal Reserve (Fed) communicated its plan to effect three policy interest rate hikes during 2022 to tame inflationary pressures. However, just one month after, the Consumer Price Index (CPI) hit a 40-year high in January 2022, prompting the Fed to change its course of action, signaling a more aggressive stance of five interest rate hikes instead of three, with the first rate hike in March 2022.

A month later, markets around the world were rattled by Russia’s invasion of Ukraine that pushed energy and commodity prices higher. In response to this conflict, economic sanctions were imposed against Russian citizens and companies, prompting similar actions from Russia. Russia’s invasion occurred at a time when the Organization of Petroleum Exporting Countries (OPEC) curtailed its energy production, thus causing energy prices to rise at an accelerated pace. As the war continued unabated, food supplies were negatively impacted as Russia and Ukraine account for approximately a quarter of global exports of several key commodities. Food supplies were further disrupted by intense heat waves and droughts in several parts of Europe and Asia, contributing to rising inflationary pressures.

Moreover, during 2022 China maintained its strict COVID-19 restrictions for a third consecutive year that entailed mask usage, massive testing efforts, quarantining and wide-spread lockdowns that usually last for weeks or months at a time. The demanding quarantine and testing rules resulted in labour challenges and supply chain disruptions, further stoking rising prices.

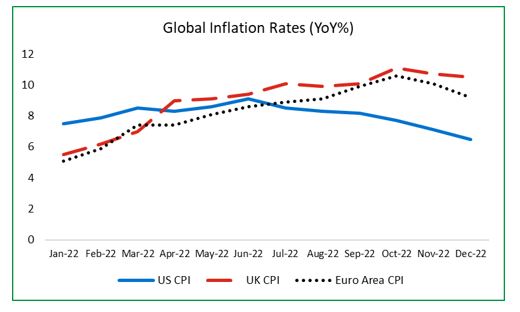

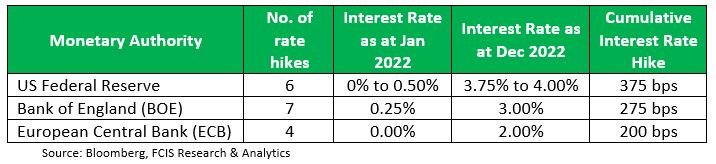

In response to decades-high inflation, several central banks including the US Fed, the European Central Bank (ECB) and the Bank of England (BOE), adopted a tighter monetary policy in 2022 with the aim of tempering demand.

Global Inflation Rates (YoY)

Interest Rate Hikes in 2022

As the year progressed, global geopolitical tensions intensified, with the second half of the year marred by political scandals, resignations and elections. In the month of July, Italy’s prime minister – Mr. Mario Draghi resigned due to his involvement with the appointment of a disgraced politician.

In the UK, chaos and turmoil tainted the political climate following the resignations of two prime ministers over a period of 7 weeks. In July, Mr. Boris Johnson resigned as prime minister owing to a vote of no confidence by the united parties after a series of scandals. Ms. Liz Truss was appointed as prime minister, however her term in office was very short, resigning after only 44 days in office, prompted by a lack of support for the “mini-budget” that included energy subsidies, unfunded tax cuts and no spending reductions.

The economic stimulus program sparked fear and concern of spiraling government debt and higher inflation and eroded investor confidence. As such, there was a significant sell-off in British financial assets in September. In an effort to restore financial stability, the Bank of England intervened to reassure investors and made a commitment to buy an unlimited quantity of government bonds.

Impact on Capital Markets

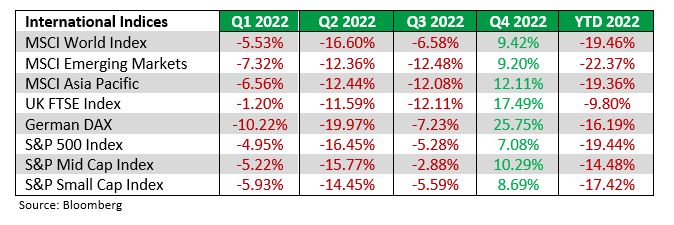

Against the backdrop of such uncertainty, equity markets sold off sharply as investor confidence waned and entered into bear market territory by June 2022, which occurs when a market has fallen roughly 20% from a recent high.

The losses continued up until the third quarter of 2022 but rebounded in the fourth quarter. The turnaround was fueled by the expectation that central banks may slow down the pace of increases in interest rates as consumer prices begin to cool.

Since peaking at 9.1% in June 2022, the US inflation rate eased materially thereafter, decelerating to 6.5% in December. While consumer prices are at a level that has not been seen since in 2021, it is still well above the Fed’s 2% target. This deceleration in the inflation rate suggested that the impact of a tighter monetary policy has started to take effect and a less aggressive stance by the US Fed in the near term may be warranted.

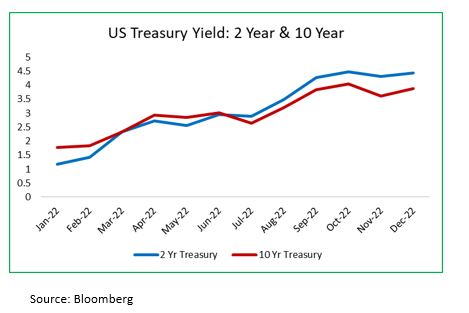

Fixed income markets were also in negative territory as bond yields hit highs not seen in a decade, fueled by elevated consumer prices and the tighter monetary conditions. The US 10 year yield peaked at 4.36% in November 2022, while UK’s 10-year note topped 4.53% in October 2022 and Germany’s 10 year rate climbed to 2.63% in December.

International Stock Indices

US Treasury Yields

US Sector Performance

From a sector perspective, the energy sector was the only industry to post positive returns in 2022. The defensive sector posted the least losses over the year, led by Utilities (1.4%), Consumer Staples (3.2%) and Health Care (3.6%). The worst performing sectors for the year were cyclical industries, led by Telecommunications (40.4%), Consumer Discretionary (37.6%) and Information Technology (28.9%).

Local Market Review

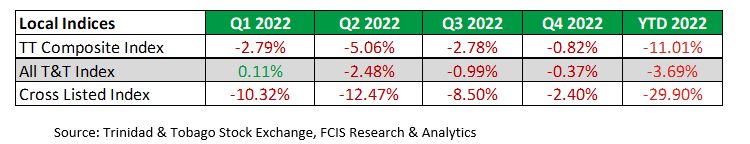

Similar to the international stock indices, the local stock market posted losses for 2022. The Cross Listed index led the decline, registering a loss of 29.90%, followed by the Composite Index with 11.01%. The All T&T index posted the smallest loss of 3.69% for the year.

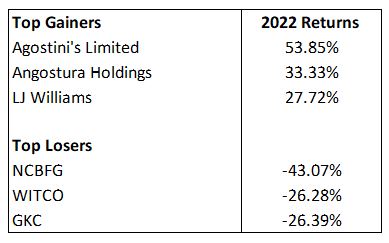

The stocks with the largest share price gains in 2022 were Agostini’s Limited (AGL), Angostura Holdings (AHL) and LJ Williams (LJW) with returns of 53.85%, 33.33% and 27.72% respectively. Leading the declines were NCB Financial Group Limited (NCBFG), GraceKennedy (GKC) and West Indies Tobacco Company (WCO) with losses of 43.07%, 26.39% and 26.28% respectively.

Local Stock Indices Returns 2022

Trinidad & Tobago Stock Exchange Largest Gains and Declines for 2022

Equity Markets Outlook

According to the World Bank, global economic growth is projected to slow from 3% in 2021 to 1.73% in 2023, led by the spillover effects of the rapid and synchronous global monetary policy tightening, worsening financial conditions and disruptions associated with the war in Ukraine.

Global inflationary pressures are anticipated to continue to ease in 2023 owing to slower economic growth, the subsequent fall in demand for goods and services and improvements in global supply chains as China eases its strict restrictive measures. Potential energy price shocks however remain a key risk and can be an impetus for price growth in 2023.

If the deceleration in inflation and current projections for economic weakness continue, central banks may reduce the pace of monetary tightening, which may support a recovery in both the stock and bond markets.

However, the recovery in the capital markets may be subdued owing to the sharp rise in borrowing costs. The higher interest rate environment may have an adverse impact on the demand for credit and corporate earnings, which may lead to a material reduction in discretionary spending and capital investments.

Locally, the Trinidad and Tobago economy is also expected to face headwinds as the global economy slows as it may lead to lower energy prices and lower revenues, which may create instability in domestic financial markets.

As such, volatility is expected to remain elevated for much of 2023 and having a sound investment strategy will prove beneficial to aid investors in navigating the anticipated turbulent times.

DISCLAIMER

First Citizens Bank Limited (hereinafter “the Bank”) has prepared this report which is provided for informational purposes only and without any obligation, whether contractual or otherwise. The content of the report is subject to change without any prior notice. All opinions and estimates in the report constitute the author’s own judgment as at the date of the report. All information contained in the report that has been obtained or arrived at from sources which the Bank believes to be reliable in good faith but the Bank disclaims any warranty, express or implied, as to the accuracy, timeliness, completeness of the information given or the assessments made in the report and opinions expressed in the report may change without notice. The Bank disclaims any and all warranties, express or implied, including without limitation warranties of satisfactory quality and fitness for a particular purpose with respect to the information contained in the report. This report does not constitute nor is it intended as a solicitation, an offer, a recommendation to buy, hold, or sell any securities, products, service, investment or a recommendation to participate in any particular trading scheme discussed herein. The securities discussed in this report may not be suitable to all investors, therefore Investors wishing to purchase any of the securities mentioned should consult an investment adviser. The information in this report is not intended, in part or in whole, as financial advice. The information in this report shall not be used as part of any prospectus, offering memorandum or other disclosure ascribable to any issuer of securities. The use of the information in this report for the purpose of or with the effect of incorporating any such information into any disclosure intended for any investor or potential investor is not authorized.

DISCLOSURE

We, First Citizens Bank Limited hereby state that (1) the views expressed in this Research report reflect our personal view about any or all of the subject securities or issuers referred to in this Research report, (2) we are a beneficial owner of securities of the issuer (3) no part of our compensation was, is or will be directly or indirectly related to the specific recommendations or views expressed in this Research report (4) we have acted as underwriter in the distribution of securities referred to in this Research report in the three years immediately preceding and (5) we do have a direct or indirect financial or other interest in the subject securities or issuers referred to in this Research report.