Understanding Corporate Credit Spreads

Let us examine one useful indicator of investor sentiment and the economic climate – Credit Spreads. A credit spread, not to get confused with an options strategy, is the difference in yield offered between two debt securities of the same maturity but different credit quality. With the maturity of the debt security being the same, the difference in credit quality is the primary determinant of the size of the spread, alternatively the difference in yields. While wide credit spreads between debt instruments offer attractive returns to investors, it also serves as a proxy for the conditions of the market and the inherent risks. Credit spreads are likely to widen in times of economic hardship and narrow when the economy prospers. As such, a solid understanding of the mechanics of credit spreads is a very useful tool for investors.

Credit spreads were volatile in 2022, but generally widened for much of the year – an indication of reduced investor sentiment and weaker economic prospects in the near to medium term. The investment landscape during the year was influenced by inflation, severe geopolitical tensions, and continuing supply chain issues. Further, the Federal Reserve (Fed) has aggressively tightened monetary policy, primarily through interest rate hikes to fight record high inflation in the US, significantly affecting global financial market.

Corporate Credit Spreads Explained

Credit spreads are derived from the yields that bonds offer to investors which are also referred to as yield spreads. Bonds can be tailored in a variety of ways in terms of duration and classification. Credit spreads are calculated by finding the difference in the yield between two debt instruments of the same duration but different risk classifications or credit quality. Usually, this is calculated by finding the difference between treasury bonds and corporate bonds of the same maturity. Corporate bonds theoretically offer yields that are higher than that of treasury instruments, which are regarded as the ‘risk-free rate’ since investors would demand a premium because corporate bonds have a higher probability of defaulting than the government. This premium is known as the risk premium. For example, if the yield on a 10-year Treasury instrument is 3% and the yield on a corporate bond is 4.5% then the credit spread is 1.5%.

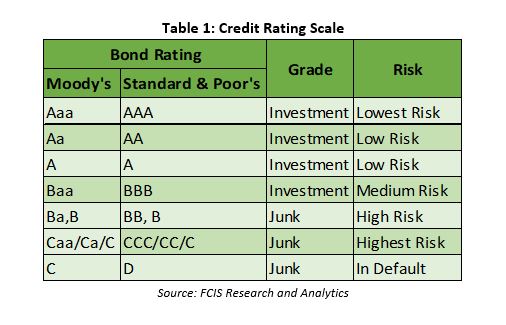

The probability of corporate bonds defaulting varies based on the perceived strength and viability of the company issuing the bond. A credit rating, which is issued by a ratings agency to assess the credit worthiness of a borrower, is one of the ways bonds can be classified. The better the rating issued on a company, the lower the yield given the perceived risk and vice-versa.

What Credit Spreads Say About the Economy

Credit spreads can be used as a barometer of the health of the economy and investor sentiment in the near and medium-term. When credit quality begins to deteriorate in an economy due to a general economic slowdown, investors would demand higher yields to fairly compensate for the additional risk they would be taking as the probability of borrowers defaulting on their debt obligations rise. The opposite is true when credit quality improves in an economy. Widening spreads signal economic downturns or some degree of turmoil while narrowing spreads indicate some degree of economic prosperity.

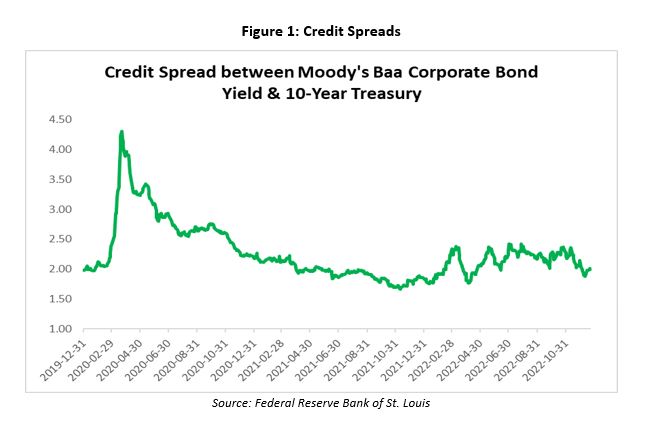

A recent example of marked widening credit spreads can be observed in 2020 when the covid-19 virus impacted markets worldwide. When the covid-19 pandemic forced many countries to implement stringent lockdown policies, the spread between 10-year corporate bonds rated ‘Baa’ by Moody’s and the US 10-year Treasury yield doubled from 1.98% at the beginning of 2020 to 4.31% by March 2020. This was the largest widening of the credit spread since 2009 which coincided with the financial crisis which began in 2007.

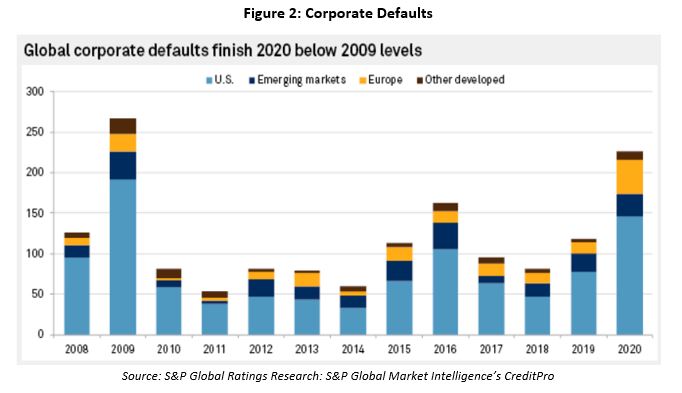

According to S&P Global, unsurprisingly, global corporate defaults surged, rising to an 11-year high in 2020 with the U.S. seeing 146 corporates rated by S&P, defaulting in 2020 up from 78 in 2019. This was the worse annual corporate default tally since the financial crisis in 2009.

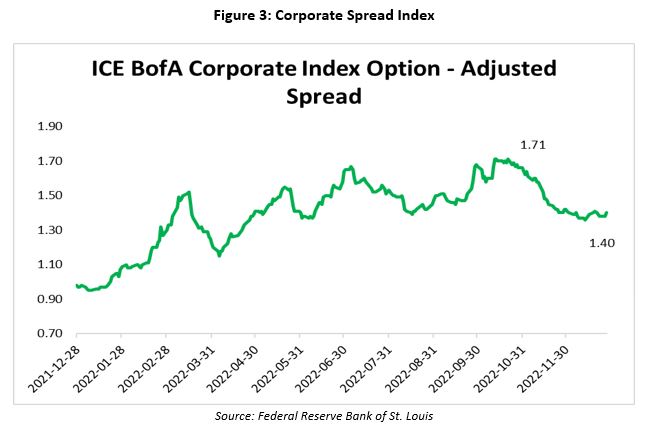

Credit spreads would have trended downwards and returned to pre-pandemic levels by mid-2021. At the turn of the year in 2022, volatility and widening of credit spreads coincided with mixed economic data and investor sentiment that seemed to see-saw as the year progressed. Even with mixed data, there seems to be emerging signs of a slowdown in inflation towards the end of 2022, as a result, credit spreads continued to narrow as the year came to an end as decelerating inflation increased speculation that the pace of interest rate hikes may slow. Since October 2022, the US BofA Corporate Spread Index showed spreads narrowed by 31 points from its 2022 peak on 12 Oct 2022 of 1.71 to 1.4 on 28 Dec 2022.

Credit Spreads Outlook in 2023

Although spreads began to narrow towards the end of 2022, it does not necessarily mean that this trend will continue in 2023. With further rate hikes of at least 75 basis points expected by the Fed in 2023 to a range of 5%-5.25%, the cost of borrowing will increase further. And as the cost of debt increases, companies which rely on debt could see their credit profile weaken as any debt refinancing or new debt altogether would now come at a substantially increased cost compared to a year ago. With the increased odds of a recession in the U.S., corporate earnings are likely to continue to suffer, which could also affect their ability to meet their existing debt obligations. Under these circumstances we can expect to see a widening of credit spreads as overall credit quality is negatively affected in a recessionary environment.

On the other hand, if supply chain issues and inflation subsides at a faster pace than expected, then this can could provide some needed headroom for corporates as the pace of rate hikes may slow. With China, the second largest economy in the world, starting to ease covid-19 restrictions, many market participants are optimistic that this will ease supply chain issues and help bring down global inflation. However, it is yet to be seen how soon the impact from China’s reopening would take effect. As China battles a surge in infections of the Omicron covid-19 variant, it is possible that there could be labour shortages which could slow manufacturing and shipments from China.

According to S&P Global’s “US Weekly Economic Commentary: 2023 Recession” published in December 2022, although financial conditions have been easing in the last few months in 2022 they still believe that a recession is more likely than not in 2023. S&P expects a mild recession to start early in 2023 with subsequent recovery beginning later in that year. As it stands, more evidence is pointing towards more economic hardships at the turn of the year in 2023 before meaningful relief in economic conditions is seen. While the fixed income market is expected to perform better in 2023 when rate hikes slow to a halt, we expect the headwinds previously highlighted will continue to affect corporates in 2023. Bond investors are expected to enjoy higher rates on bonds but it does not come without increased risks.

DISCLAIMER

First Citizens Bank Limited (hereinafter “the Bank”) has prepared this report which is provided for informational purposes only and without any obligation, whether contractual or otherwise. The content of the report is subject to change without any prior notice. All opinions and estimates in the report constitute the author’s own judgment as at the date of the report. All information contained in the report that has been obtained or arrived at from sources which the Bank believes to be reliable in good faith but the Bank disclaims any warranty, express or implied, as to the accuracy, timeliness, completeness of the information given or the assessments made in the report and opinions expressed in the report may change without notice. The Bank disclaims any and all warranties, express or implied, including without limitation warranties of satisfactory quality and fitness for a particular purpose with respect to the information contained in the report. This report does not constitute nor is it intended as a solicitation, an offer, a recommendation to buy, hold, or sell any securities, products, service, investment or a recommendation to participate in any particular trading scheme discussed herein. The securities discussed in this report may not be suitable to all investors, therefore Investors wishing to purchase any of the securities mentioned should consult an investment adviser. The information in this report is not intended, in part or in whole, as financial advice. The information in this report shall not be used as part of any prospectus, offering memorandum or other disclosure ascribable to any issuer of securities. The use of the information in this report for the purpose of or with the effect of incorporating any such information into any disclosure intended for any investor or potential investor is not authorized.

DISCLOSURE

We, First Citizens Bank Limited hereby state that (1) the views expressed in this Research report reflect our personal view about any or all of the subject securities or issuers referred to in this Research report, (2) we are a beneficial owner of securities of the issuer (3) no part of our compensation was, is or will be directly or indirectly related to the specific recommendations or views expressed in this Research report (4) we have acted as underwriter in the distribution of securities referred to in this Research report in the three years immediately preceding and (5) we do have a direct or indirect financial or other interest in the subject securities or issuers referred to in this Research report.