Caribbean Debt

Commentary

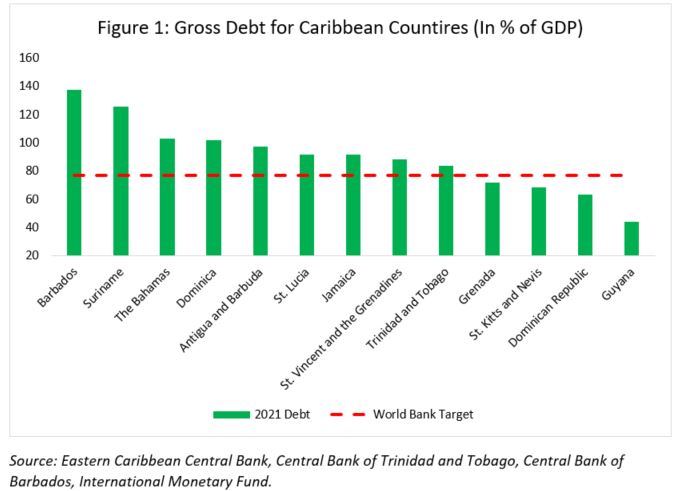

The Caribbean is among the most indebted regions in the world, with debt levels (excluding Haiti) averaging 90.1% of GDP since the onset of the pandemic according to IMF data. This puts the region significantly above the World Bank’s threshold for developing countries of 77% of GDP (after this level of debt, countries forego GDP growth if maintained for an extended period). However, high debt has been a long standing challenge for the Caribbean, with the COVID-19 pandemic only exacerbating the issue. Indeed, the average debt to GDP ratio in the Caribbean was 71.4% in 2018. As of 2021, the debt to GDP ratio of nine Caribbean countries exceeded the World Bank’s threshold, while only four countries fell below. The five most indebted countries in the region for 2021 were Barbados (137%), Suriname (125%), The Bahamas (102%), Dominica (101%), and Antigua and Barbuda (97%).

Historically High Debt Burden

The Caribbean’s onerous debt load stems from vulnerabilities that cannot be attributed to a single factor; instead the issue is multi-dimensional and covers economic, environmental, social, and political dynamics. Caribbean economies are small and highly open to international trade, and are heavily reliant on single sectors to drive economic activity, making them highly dependent on external demand and vulnerable to external shocks.

For most Caribbean countries, the primary economic driver is the tourism sector. The sector is highly dependent on international conditions as was painfully proven with the COVID-19 pandemic which brought economies to a virtual standstill as domestic and international lockdown measured were enforced. As tourism revenue dwindled, fiscal imbalances widened further. Added to this was the immediate need for substantial fiscal relief measures, which had to be financed through higher debt – thus worsening the debt profiles of many Caribbean countries.

The region also faces vulnerabilities in the form of environmental hazards. According to the OECD, the Caribbean is the second most environmental hazard-prone region in the world, with natural disasters and climate change causing major economic and infrastructural damages. Recent examples of natural disasters that have struck the region are Hurricane Dorian in 2019 that made landfall in The Bahamas, causing roughly USD3.4 billion (over 25% of GDP) in damages; Hurricane Maria in 2017 which ravaged Dominica, destroying roughly 90% of the island’s infrastructure and costing an estimated USD1.3 billion (226% of GDP).

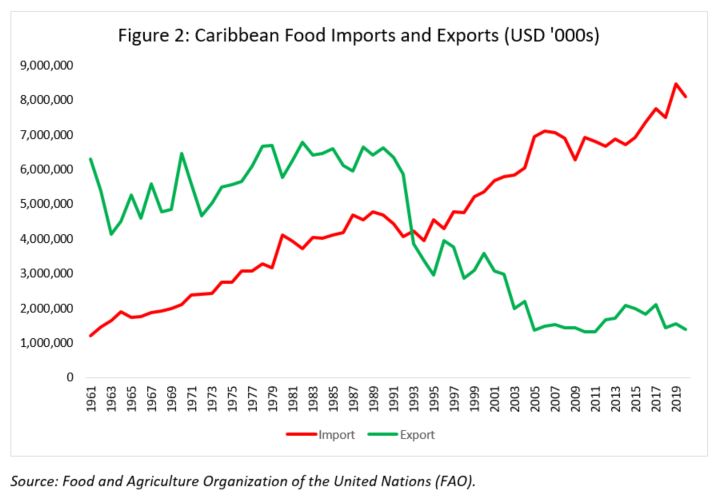

The Caribbean region is characterised by low growth and persistent current account deficits according to the Inter-American Development Bank (IADB). One of the main reasons for this is the region’s dependence on consumer commodity imports. The imbalance of Caribbean economies is noted by the IMF to have started in the early 1990s due to a loss in preferential trade agreements with European markets. In addition to this, there was also a “deterioration of the terms of trade, reduced fiscal space, and demographic trends, including emigration of skilled labour.”

The dependence on imports brings into question the relationship between food security and the debt burden for the region due to the ever expanding amount of foreign exchange required for the food import bill. During periods of severe economic downturns, the region has historically relied on multilateral borrowing in order to bolster international reserves and allow for imports. Most countries are net importers of food. According to the CARICOM Secretariat, between 2000 – 2018 the food import bill for the region jumped from USD2.08 billion to USD4.98 billion. Imported food represented approximately 60% of total food consumption, with the figure jumping to as high as 80% in some countries. This food import bill is estimated to have jumped to as high as USD10.8 billion in 2020. Only Guyana and Haiti produce about 50% of what they consume according to the Food and Agriculture Organization of the United Nations (FAO).

Debt Restructuring In The Caribbean

The Caribbean is no stranger debt restructuring programmes. Countries such as Barbados, Jamaica, and Grenada are some examples of more severe debt crises that have occurred, with Suriname being the most recent to enter into a restructuring exercise.

Jamaica’s experience with debt restructuring came as a result of the financial crisis of 2008/09. Jamaica found itself with an unsustainable debt to GDP ratio of 140%, owed mainly to domestic creditors. Interest payments averaged 52% of fiscal revenues during FY 2005/06 – FY 2008/09, severely squeezing fiscal space and leaving too few resources for addressing important social and infrastructure needs. Heavy public debt service obligations resulted in a large risk premium, periodic bouts of financial market instability, and a crowding out of bank credit to the private sector, all of which had contributed to a very low potential growth rate. Since the crisis, Jamaica has undergone two major restructuring exercises, the Jamaica Debt Exchange (JDX) in 2010 and National Debt Exchange (NDX) in 2013

Similar to Jamaica, the rise in public debt in Barbados came as a result of the financial crisis, steadily increasing from a 76.2% of GDP in 2009 to its highest level of 151.2% in 2016. In addition to this, government interest payments as a percentage of revenues steadily increased as well, costing over a quarter of all revenues (27%) by 2018. Many other structural imbalances in the Barbados economy such as low growth, and persistent fiscal and current account deficits led to Barbados defaulting on its debt obligations in FY 2018/19. Barbados entered into a 36-month long Barbados Economic Recovery and Transformation (BERT) programme under the EFF. Since then, though the COVID-19 pandemic has pushed back progress, Barbados has consistently met the fiscal targets set out by BERT.

Suriname is the most recent example of a Caribbean country that has to enter an EFF programme. In 2020 a severe economic crisis began in Suriname with a sharp contraction in GDP growth and rapid rise in inflation made worse by the COVID-19 pandemic. The IMF notes that upon taking office, President Chan Santokhi “inherited an economy in crisis with significant corruption problems and systemic economic and financial imbalances”. Government debt as of end 2020 stood at 147.7% of GDP, of which about one third was owed to external creditors. Government interest payments as a percentage of revenues reached a worrying 27.1% in 2020 according to S&P, limiting available resources. Suriname’s current arrangement under the EFF would see the economy undergo a 36-month reform plan with the IMF.

From these examples it is clear that along with high levels of debt, other indicators such as low growth, persistent deficits, and importantly a rise in government interest payments as a percentage of revenues are worrying indicators of an imminent debt crisis.

Conclusion – Debt Outlook for the Caribbean

The COVID-19 pandemic has exacerbated the long standing issue of high debt burdens in the Caribbean region. Many countries turned towards external financing in order to maintain some form of economic activity and implement relief measures, significantly increasing debt. Throughout 2021, as restrictions eased and economies restarted, regional debt fell marginally to 88.5% of GDP.

Economic activity for 2022 has slowed not only for the region, but also for the global economy, largely due to the ongoing Russia – Ukraine conflict and the recent surge in COVID-19 cases in China that has triggered strict lockdowns, further shocking already fragile commodity markets. Given the dependence on international commodity imports as well as foreign exchange, projections by the IMF place the average current account balance for the region at a deficit of 8.2% given the disruptions, with only Guyana, Trinidad and Tobago, and Haiti expected to post surpluses. Further to this, economic activity in the major tourist markets (USA, UK, Canada) is expected to slow and is expected to have a ripple effect on the regions, primarily tourism dependent economies. Interestingly, the countries which have undergone debt restructuring exercises have managed slightly better during the pandemic. Due to the fiscal surpluses accumulated in the recent years prior the pandemic, they were able to implement counter-cyclical policies when needed in 2020 and 2021. This was largely facilitated by sound fiscal management and the adoption of a fiscal framework with defined fiscal rules. These countries are likely to continue on a path of fiscal consolidation and primary surpluses which will sustainably reduce debt levels. However, there are many countries in the region which will continue to experience the vicious cycle of low growth and rising debt levels as they struggle to recoup the significant economic losses in the aftermath of the pandemic.

DISCLAIMER

First Citizens Bank Limited (hereinafter “the Bank”) has prepared this report which is provided for informational purposes only and without any obligation, whether contractual or otherwise. The content of the report is subject to change without any prior notice. All opinions and estimates in the report constitute the author’s own judgment as at the date of the report. All information contained in the report that has been obtained or arrived at from sources which the Bank believes to be reliable in good faith but the Bank disclaims any warranty, express or implied, as to the accuracy, timeliness, completeness of the information given or the assessments made in the report and opinions expressed in the report may change without notice. The Bank disclaims any and all warranties, express or implied, including without limitation warranties of satisfactory quality and fitness for a particular purpose with respect to the information contained in the report. This report does not constitute nor is it intended as a solicitation, an offer, a recommendation to buy, hold, or sell any securities, products, service, investment or a recommendation to participate in any particular trading scheme discussed herein. The securities discussed in this report may not be suitable to all investors, therefore Investors wishing to purchase any of the securities mentioned should consult an investment adviser. The information in this report is not intended, in part or in whole, as financial advice. The information in this report shall not be used as part of any prospectus, offering memorandum or other disclosure ascribable to any issuer of securities. The use of the information in this report for the purpose of or with the effect of incorporating any such information into any disclosure intended for any investor or potential investor is not authorized.

DISCLOSURE

We, First Citizens Bank Limited hereby state that (1) the views expressed in this Research report reflect our personal view about any or all of the subject securities or issuers referred to in this Research report, (2) we are a beneficial owner of securities of the issuer (3) no part of our compensation was, is or will be directly or indirectly related to the specific recommendations or views expressed in this Research report (4) we have acted as underwriter in the distribution of securities referred to in this Research report in the three years immediately preceding and (5) we do have a direct or indirect financial or other interest in the subject securities or issuers referred to in this Research report.